PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911459

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911459

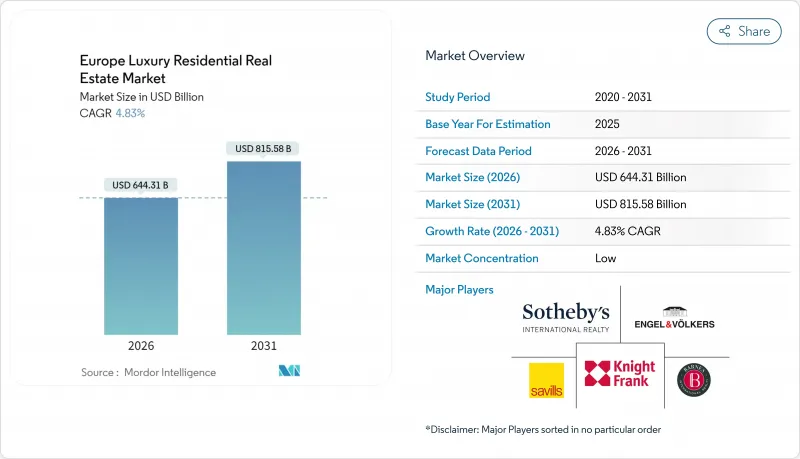

Europe Luxury Residential Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe luxury residential real estate market was valued at USD 614.63 billion in 2025 and estimated to grow from USD 644.31 billion in 2026 to reach USD 815.58 billion by 2031, at a CAGR of 4.83% during the forecast period (2026-2031).

Robust wealth creation among ultra-high-net-worth individuals, limited developable land in historic cores, and currency arbitrage opportunities keep prime home values firm despite changing monetary policy. Supply restrictions are intensifying because new luxury housing permits in top European cities fell 27% from their recent peak, which has triggered scarcity premiums that shield prices when broader housing slows. Currency divergences sustain foreign demand: American buyers alone are expected to deploy USD 13 billion in London in 2024, taking advantage of a weakened pound and attractive post-Brexit valuations. Investors treating bricks as bonds also buoy pricing; prime gross yields hold between 3.5% and 4.5%, while total returns are guided at 7.7% annually through 2029, dominated by rental income growth instead of pure capital gains. Secondary capitals such as Madrid rank ahead of London and Paris in BARNES' 2025 City Index, proving that quality-of-life factors and relative affordability now carry greater weight when allocating capital across the Europe luxury residential real estate market.

Europe Luxury Residential Real Estate Market Trends and Insights

Strong Demand from Global High-Net-Worth Individuals for Prime Cities

Capital inflows from ultra-wealthy households continue to cluster in financial centers where legal transparency and global connectivity converge. London's luxury apartment segment generated GBP 1.3 billion (USD 1.6 billion) in transactions above GBP 15 million (USD 18.75 million) during 2023, a 24% jump in value even though unit volumes rose only 10%. In Knightsbridge and Mayfair, average prices reached GBP 4,306 per square foot (USD 5,382.5), far above GBP 3,011 (USD 3,763.8) for full houses, underscoring an amenities premium tied to concierge services and fortified security. Zurich and Geneva draw centi-millionaires relocating from stricter tax jurisdictions, aided by Switzerland's plan to reduce income taxes for top brackets. A post-Olympics infrastructure uplift and euro softness have simultaneously widened Paris' buyer catchment to North American investors seeking a euro hedge. Concentrated wealth brings more luxury retailers and services, reinforcing each city's desirability flywheel.

Stable Investment Environment Positioning Luxury Real Estate as a Safe-Haven Asset

Institutional allocators now treat luxury dwellings as bond-like holdings that confer diversification and inflation protection. Residential allocations in European investment portfolios jumped from 8% in 2008 to 21% in 2024, aided by nearly USD 44 billion in capital deployment last year. Expected total returns of 7.7% per year through 2029 mostly emanate from rent growth, not mark-to-market gains, making luxury homes attractive substitutes for low-yield fixed income. Legal robustness in England and Switzerland simplifies title assurance, while currency exposure offers additional hedging lines for dollar-based investors. A 3.2% compound annual rent rise outlook further cushions against real price erosion under higher inflation regimes.

High Acquisition and Transaction Costs Due to Taxes and Regulatory Charges

Fiscal drag remains the most immediate hurdle for cross-border buyers. France's combined notary, registration, and agency costs near 8% of the ticket price, eroding returns for leverage-light investors. Germany layers a real estate transfer tax of 3.5%-6.5% depending on the state, followed by due diligence legal fees around 2% that elongate break-even horizons. Spain's legislature has even floated a 100% surcharge on non-EU purchases to cool affordability pressures, a move that highlights how political optics can interrupt otherwise rational capital flows. The fragmented EU tax mosaic complicates comparisons and raises advisory expenses, leaving potential buyers to weigh net yield against bureaucratic drag.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for Branded Residences and Heritage Properties with Modern Upgrades

- Rise of Lifestyle-Driven Projects Integrating Wellness, Sustainability, and Smart Home Technologies

- Regulatory Restrictions on Foreign Ownership in Certain Countries Limit the Buyer Base

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The rental arm of the Europe luxury residential real estate market is advancing at a 5.18% CAGR, outperforming the dominant sales model even though the latter still commands 73.40% of revenue. Prime rents are increasing 3.2% per year against sticky inflation, protecting real income streams that pension funds and insurers prize. In 2024, institutional deployment into luxury rentals touched USD 44 billion, featuring Savills Investment Management teaming with Greystar in a USD 165 million forward-funded Madrid community. The Europe luxury residential real estate market size for rental stock is therefore scaling faster than for transaction-driven turnover, particularly as prospective homebuyers delay ownership while mortgage costs stay high.

Sales pipelines, however, remain substantial. In London alone, purchases topping USD 18.75 million continue to close above guide price, reinforcing the prestige cachet attached to holding trophy assets in West End boroughs. Build-to-rent platforms are also proliferating, but many new developments retain dual-track models, offering bulk sale exits to family offices next to stabilized rental blocks. The Europe luxury residential real estate industry consequently enjoys diversified cash-flow profiles that aid risk management across economic cycles.

The Europe Luxury Residential Real Estate Market Report is Segmented by Business Model (Sales, Rental), by Property Type (Apartments & Condominiums, Villas & Landed Houses), by Mode of Sale (Primary (New-Build), Secondary (Existing-Home Resale)), and by Country (United Kingdom, Germany, France, Italy, Spain, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Sotheby's International Realty Affiliates LLC

- Knight Frank LLP

- Savills plc

- Engel & Volkers AG

- Barnes International Realty

- Proprietes Le Figaro

- Mansion Global

- John Taylor

- Luxury Places SA

- Christie's International Real Estate

- Coldwell Banker Global Luxury

- Quintessentially Estates

- Fine & Country

- Strutt & Parker

- Foxtons Prime Services

- Keller Williams Luxury International

- Cain International

- Battersea Power Station Development Co.

- Lodha UK

- Emaar Europe Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Insights and Dynamics

- 4.1 Market Overview

- 4.2 Residential Real Estate Buying Trends - Socio-economic & Demographic Insights

- 4.3 Rental Yield Analysis

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Insights into Existing and Upcoming Projects

- 4.7 Market Drivers

- 4.7.1 Strong demand from global high-net-worth individuals for prime cities like London, Paris, and Zurich

- 4.7.2 Stable investment environment positioning luxury real estate as a safe-haven asset

- 4.7.3 Growing demand for branded residences and heritage properties with modern upgrades

- 4.7.4 Rise of lifestyle-driven projects integrating wellness, sustainability, and smart home technologies

- 4.7.5 Cross-border investment flows are supported by favorable visa and residency-by-investment programs

- 4.8 Market Restraints

- 4.8.1 High acquisition and transaction costs due to taxes and regulatory charges

- 4.8.2 Regulatory restrictions on foreign ownership in certain countries limit the buyer base

- 4.8.3 Geopolitical and economic uncertainties are impacting foreign investor sentiment

- 4.9 Value / Supply-Chain Analysis

- 4.9.1 Overview

- 4.9.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.9.3 Real Estate Brokers and Agents - Key Quantitative and Qualitative Insights

- 4.9.4 Property Management Companies - Key Quantitative and Qualitative Insights

- 4.9.5 Insights on Valuation Advisory and Other Real Estate Services

- 4.9.6 State of the Building Materials Industry and Partnerships with Key Developers

- 4.9.7 Insights on Key Strategic Real Estate Investors/Buyers in the Market

- 4.10 Porter's Five Forces

- 4.10.1 Threat of New Entrants

- 4.10.2 Bargaining Power of Buyers

- 4.10.3 Bargaining Power of Suppliers

- 4.10.4 Threat of Substitutes

- 4.10.5 Competitive Rivalry Intensity

5 Residential Real Estate Market Size & Growth Forecasts (Value USD billion)

- 5.1 By Business Model

- 5.1.1 Sales

- 5.1.2 Rental

6 Residential Real Estate Market (Sales Model) Size & Growth Forecasts (Value USD billion)

- 6.1 By Property Type

- 6.1.1 Apartments & Condominiums

- 6.1.2 Villas & Landed Houses

- 6.2 By Mode of Sale

- 6.2.1 Primary (New-Build)

- 6.2.2 Secondary (Existing-Home Resale)

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Spain

- 6.3.6 Rest of Europe

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves (M&A, Joint Ventures, etc)

- 7.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, Recent Developments)}

- 7.3.1 Sotheby's International Realty Affiliates LLC

- 7.3.2 Knight Frank LLP

- 7.3.3 Savills plc

- 7.3.4 Engel & Volkers AG

- 7.3.5 Barnes International Realty

- 7.3.6 Proprietes Le Figaro

- 7.3.7 Mansion Global

- 7.3.8 John Taylor

- 7.3.9 Luxury Places SA

- 7.3.10 Christie's International Real Estate

- 7.3.11 Coldwell Banker Global Luxury

- 7.3.12 Quintessentially Estates

- 7.3.13 Fine & Country

- 7.3.14 Strutt & Parker

- 7.3.15 Foxtons Prime Services

- 7.3.16 Keller Williams Luxury International

- 7.3.17 Cain International

- 7.3.18 Battersea Power Station Development Co.

- 7.3.19 Lodha UK

- 7.3.20 Emaar Europe Ltd.

8 Market Opportunities & Future Outlook

- 8.1 White-Space & Unmet-Need Assessment