PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911460

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911460

Middle East Gift Card And Incentive Card - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

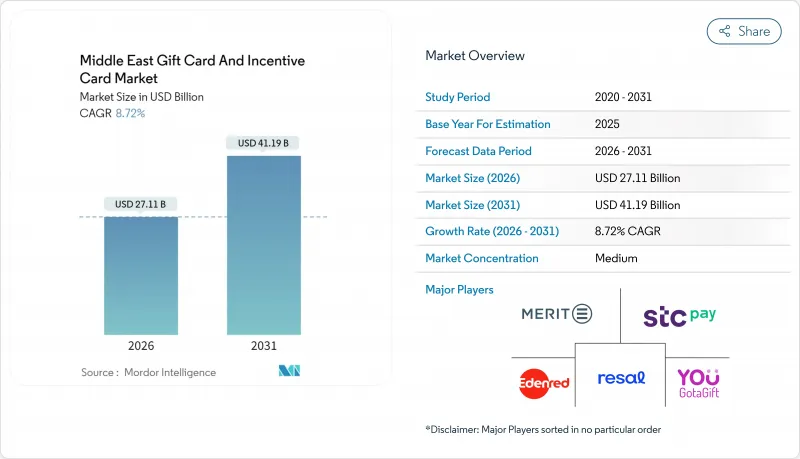

Middle East gift card and incentive card market size in 2026 is estimated at USD 27.11 billion, growing from 2025 value of USD 24.94 billion with 2031 projections showing USD 41.19 billion, growing at 8.72% CAGR over 2026-2031.

This expansion mirrors the region's rapid digital-payment adoption, underpinned by Saudi Vision 2030 and parallel cash-lite agendas in the United Arab Emirates and Qatar. Online spending, mobile-wallet usage, and API-based embedded-finance models continue to reshape distribution economics, lowering issuance costs while deepening merchant acceptance. Corporate digitization of employee-reward programs, along with rising millennial and expatriate demand for instant digital gifting, further accelerates growth. Moderate market concentration still leaves room for fintech newcomers to capture unserved niches through white-label issuance, fraud mitigation, and cross-border redemption services.

Middle East Gift Card And Incentive Card Market Trends and Insights

Explosive e-commerce and digital-payment penetration

Rising smartphone ownership, improved logistics, and competitive delivery pricing have lifted regional e-commerce to double-digit growth. Mobile wallets already process almost one-fifth of GCC point-of-sale value, and network effects inside super-apps amplify gift-card discoverability at checkout. Players such as STC Pay and Tabby embed stored-value rails directly within their ecosystems, allowing real-time issuance, split payments, and cashback promotions. Repetitive online grocery orders cultivate habitual digital-payment behaviour, which favours instant stored-value solutions over cash. As checkout friction declines, e-gift cards convert impulse buying into immediately redeemable credit, expanding the Middle East gift card market.

Government cash-lite agendas (Saudi Vision 2030)

Saudi Arabia is focusing on strategic investments in network infrastructure and open-banking frameworks to meet its goal of achieving 70% digital-payment penetration by 2030. These initiatives are designed to enhance the efficiency of payment systems by reducing issuance costs and enabling near-instant transaction processing. By prioritizing these advancements, the country aims to strengthen its digital economy, improve financial inclusion, and support the broader objectives of its Vision 2030 framework. SAMA's Counter-Fraud Framework elevates security standards, boosting consumer confidence in prepaid instruments. Parallel initiatives undertaken in the UAE and Qatar are strategically aimed at improving the interoperability of instant-payment infrastructures. This development is expected to drive a substantial expansion in the number of acceptance points at retail terminals, with significant progress anticipated by 2030. Regulatory backing translates into predictable breakage rules and clearer KYC obligations, spurring issuer participation and sustaining the Middle East gift card market's momentum.

High fraud and charge-back risk in cross-border digital cards

LexisNexis reports that 52% of Saudi digital-payment fraud originates online, spotlighting liability concerns for issuers and merchants. Divergent KYC standards across MENA enable account takeovers and bulk purchase of anonymous cards for resale. Charge-back disputes inflate program costs and erode small-merchant appetite to accept stored value. Money-laundering fears prompt some regulators to cap transaction size, dampening higher-ticket corporate gift use cases. While machine-learning fraud tools help, false positives can reduce approval rates, undermining user experience.

Other drivers and restraints analyzed in the detailed report include:

- Corporate digitization of employee rewards

- Growing expatriate and millennial population with a gifting culture

- Fragmented consumer-protection / e-money regulation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The corporate segment generated 38.88% of value in 2025, yet its 14.32% CAGR positions it as the most dynamic contributor to the Middle East gift card market. SMEs gravitate toward prepaid rewards because they simplify multi-national payroll obligations and minimize petty-cash leakages. API connectors from issuers such as NymCard integrate seamlessly with HR software, enabling click-through issuance and spend reconciliation. Merit Incentives' bank-partnership model processed millions in employee rewards across 5,000 brands in 2025, highlighting scale potential. Tax advantages in several GCC jurisdictions, where modest prepaid limits remain exempt from income levies, further encourage substitution of cash bonuses with digital cards.

Growing platform interoperability fosters use beyond staff perks into channel incentives, reseller commissions, and customer-loyalty schemes. Real-time analytics provide SMEs with redemption insights that guide campaign fine-tuning. As government diversification schemes unlock credit lines for small businesses, the addressable user base for corporate gift solutions expands, reinforcing the trajectory of the Middle East gift card market.

The Middle East Gift Card and Incentive Card Market Report Segments the Industry Into by Consumer (Individual and Corporate), by Distribution Channel (Online and Offline), by Product (E-Gift Card and Physical Card), and by Geography (Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Bahrain, and Oman). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Edenred

- YouGotaGift

- Resal

- Merit Incentives

- STC Pay

- Giftit.me

- NymCard

- Blackhawk Network ME

- Carrefour Gift Cards KSA

- Alshaya Group eGift

- Talabat Rewards

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive e-commerce & digital-payment penetration

- 4.2.2 Government cash-lite agendas (e.g., Saudi Vision 2030)

- 4.2.3 Corporate digitisation of employee rewards & perks

- 4.2.4 Growing expat & millennial population with gifting culture

- 4.2.5 Rise of Sharia-compliant prepaid gifting products

- 4.2.6 API-driven fintech platforms enabling embedded gift cards

- 4.3 Market Restraints

- 4.3.1 High fraud & charge-back risk in cross-border digital cards

- 4.3.2 Fragmented consumer-protection / e-money regulation

- 4.3.3 Cultural reliance on cash in non-GCC markets

- 4.3.4 Dormancy-balance escheat rules squeezing breakage revenue

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Consumer

- 5.1.1 Individual

- 5.1.2 Corporate

- 5.1.2.1 Small-scale Enterprises

- 5.1.2.2 Mid-tier Enterprises

- 5.1.2.3 Large Enterprises

- 5.2 By Distribution Channel

- 5.2.1 Online

- 5.2.2 Offline

- 5.3 By Product

- 5.3.1 E-gift Card

- 5.3.2 Physical Card

- 5.4 By Geography

- 5.4.1 Saudi Arabia

- 5.4.2 United Arab Emirates

- 5.4.3 Qatar

- 5.4.4 Kuwait

- 5.4.5 Bahrain

- 5.4.6 Oman

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Edenred

- 6.4.2 YouGotaGift

- 6.4.3 Resal

- 6.4.4 Merit Incentives

- 6.4.5 STC Pay

- 6.4.6 Giftit.me

- 6.4.7 NymCard

- 6.4.8 Blackhawk Network ME

- 6.4.9 Carrefour Gift Cards KSA

- 6.4.10 Alshaya Group eGift

- 6.4.11 Talabat Rewards

7 Market Opportunities & Future Outlook

- 7.1 API-ready loyalty-as-a-service for regional SMEs

- 7.2 Pilgrim-season travel gift bundles (Hajj/Umrah)