PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911490

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911490

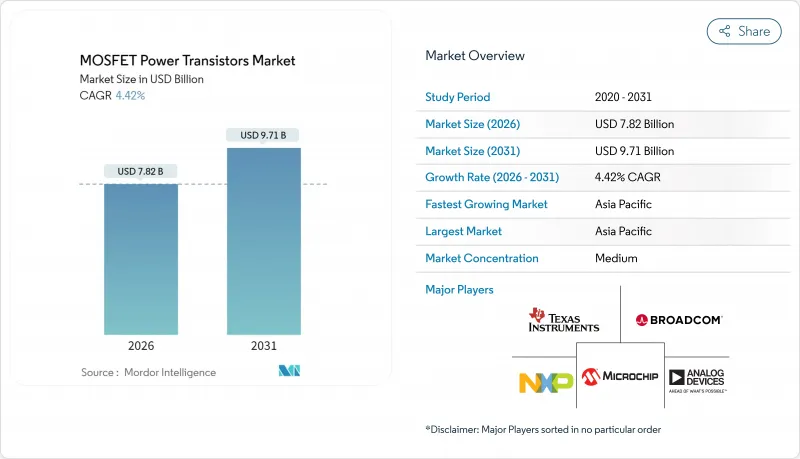

MOSFET Power Transistors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

MOSFET power transistors market size in 2026 is estimated at USD 7.82 billion, growing from 2025 value of USD 7.49 billion with 2031 projections showing USD 9.71 billion, growing at 4.42% CAGR over 2026-2031.

This measured expansion reflects escalating electrification in transportation, renewable-energy build-outs, and AI-centric data-center upgrades, even as supply bottlenecks and manufacturing constraints temper near-term momentum. Demand concentrates in high-growth end-user arenas-electric vehicles, solar and wind inverters, and AI servers-where wide-bandgap materials, high-voltage architectures, and advanced packaging provide measurable efficiency gains. Competitive intensity remains moderate; top suppliers leverage vertically integrated fabrication, automotive-grade quality systems, and platform portfolios to defend share while nimble entrants exploit niche capacity and wide-bandgap specialization. Government "fab-on-shore" incentives, most prominently the U.S. CHIPS Act and comparable Asian and European programs, reshape sourcing considerations toward supply resilience, nudging procurement decisions away from pure cost-optimization.

Global MOSFET Power Transistors Market Trends and Insights

EV Production Surge Accelerates Traction MOSFET Adoption

Electric-vehicle output scaling propels high-current traction inverter requirements, lifting automotive semiconductor content toward USD 600-800 per car from roughly USD 400 in combustion models. Silicon-carbide MOSFETs enable 800 V drivetrains that trim 80%-charge times to 15 minutes versus 45 minutes on 400 V systems, justifying 3-4 X material premiums. Infineon's OptiMOS 7 family, introduced in December 2024, cuts switching losses by 30% to meet next-generation inverter thermal envelopes. Automotive-grade qualification under AEC-Q101 standards extends design cycles but entrenches incumbent suppliers with proven reliability records.

Government Semiconductor Incentives Reshape Manufacturing Geography

The USD 53 billion CHIPS and Science Act subsidizes domestic U.S. fabrication, shifting sourcing decisions toward resiliency over lowest cost. TSMC's Arizona site, backed by USD 6.6 billion in grants, will commence power semiconductor output in 2028, while Intel's Ohio fabs target automotive-grade MOSFET nodes. Parallel programs in South Korea, Japan, and the European Union foster localized clusters that shorten lead-times for regional automakers and renewable-energy integrators, though meaningful capacity only arrives post-2027.

Wide-Bandgap Cost Premiums Limit Mass-Market Penetration

SiC and GaN dies command 3-10 X silicon prices, with 150 mm SiC wafers selling for USD 1,500-2,000 versus USD 50 slices of silicon. Yields linger around 60-80%, and specialized high-voltage packages add USD 2-5 per device. Cost curves improve with 200 mm adoption, yet material properties and capital intensity keep absolute pricing well above legacy silicon through the forecast window.

Other drivers and restraints analyzed in the detailed report include:

- AI Server Power Architecture Migration Drives SiC Adoption

- Renewable-Energy Inverter Scaling Expands Grid-Tied Applications

- Supply Chain Bottlenecks Extend Lead-Times

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

N-channel devices represented 72.55% of 2025 revenue, underscoring their lower on-resistance and higher electron mobility advantages that remain decisive in high-frequency converters. This share equates to a dominant MOSFET power transistors market position across traction inverters, solar MPPTs, and server VRMs. Complementary/dual devices, while smaller, unlock synchronous rectification benefits that shave 2-3 percentage-point converter losses, propelling a forecast-leading 5.48% CAGR.

Designers pair complementary MOSFETs in half-bridge topologies for DC-DC converters, optimizing conduction during dead-time and trimming shoot-through risk. Adoption scales with AI server and telecom rectifiers, where every watt saved converts to lower cooling loads. Although P-channel devices retain niche high-side roles, their higher on-resistance cedes most growth to dual-channel implementations that balance performance and cost efficiency.

Silicon accounts for 68.75% of 2025 revenue on the back of mature 200 mm fabs, ample supply, and USD 0.05-0.15 per die economics that lock silicon into sub-600 V sockets. Here, the MOSFET power transistors market share for silicon remains sticky despite SiC enthusiasm. Silicon-carbide's 5.65% CAGR reflects 800 V EV drivetrains, 1,500 V solar strings, and industrial drives demanding >200 °C junction capability.

Higher thermal conductivity and three-fold critical electric field tolerance grant SiC MOSFETs lower switching and conduction losses at elevated voltages. GaN occupies the 650 V, 1-2 MHz switching sweet spot, coveted by quick-charge AC adapters and LIDAR pulser stages, yet wafer scaling and substrate availability restrain mass volumes through 2031. Other compound semiconductors remain specialty plays with minimal revenue contribution.

The MOSFET Power Transistors Market Report is Segmented by Channel Type (N-Channel, P-Channel, and Complementary/Dual), Material Technology (Silicon, Silicon-Carbide, Gallium-Nitride, and More), Package Type (Discrete, Surface-Mount, Power Modules, and More), End-User Industry (Automotive, Consumer Electronics, Industrial and Manufacturing, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led with 45.20% of 2025 revenue and a 7.25% forecast CAGR. China, Taiwan, and South Korea combine mature foundry nodes with downstream electronics assembly clusters, sustaining localized demand loops. Japan rejuvenates its semiconductor footprint with government subsidies topping USD 13 billion for power device and advanced-packaging lines. India's production-linked incentive (PLI) schemes tap into domestic EV and solar markets, albeit from a small base.

North America benefits from data-center buildouts and accelerating EV adoption. The MOSFET power transistors market size for North America is poised to expand as Intel, Wolfspeed, and onsemi add 200 mm SiC capacity in the Carolinas and Arizona, reducing import reliance. The CHIPS Act tilts sourcing toward domestic nodes, especially for defense-critical and automotive qualification streams.

Europe commands close to 17.80% share, anchored by Germany's automotive giants and Italy's analog specialist fabs. Stricter eco-regulations spur demand for high-efficiency 1,200 V SiC devices in renewable-energy inverters and fast-chargers. Meanwhile, Saudi Arabia and the United Arab Emirates steer Middle East demand toward utility-scale solar farms and industrial drives, yet capacity remains import-oriented. Latin American growth tracks regional EV incentives in Brazil and renewable-energy tenders in Chile, though volume remains modest relative to APAC or NA.

- Infineon Technologies AG

- STMicroelectronics N.V.

- ON Semiconductor Corporation

- Texas Instruments Incorporated

- Toshiba Corporation

- Renesas Electronics Corporation

- Mitsubishi Electric Corporation

- Vishay Intertechnology Inc.

- NXP Semiconductors N.V.

- Analog Devices, Inc.

- Broadcom Inc.

- Microchip Technology Incorporated

- ROHM Co., Ltd.

- Wolfspeed, Inc.

- Alpha and Omega Semiconductor Ltd.

- Littelfuse, Inc.

- Diodes Incorporated

- Nexperia B.V.

- Fuji Electric Co., Ltd.

- Power Integrations, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV-production boom elevating demand for traction and onboard-charger MOSFETs

- 4.2.2 Renewable-energy inverter build-outs in solar and wind

- 4.2.3 Explosive smartphone and wearable shipments needing low-power MOSFETs

- 4.2.4 Government "fab-on-shore" incentives spawning niche foundry capacity deals

- 4.2.5 AI-server power-supply migration to high-voltage SiC/GaN stages

- 4.2.6 Cost collapse from 200 mm SiC wafers unlocking 1200 V design wins

- 4.3 Market Restraints

- 4.3.1 Wide-bandgap MOSFETs' high die and packaging costs

- 4.3.2 Wafer-capacity shortages and long lead-times

- 4.3.3 Lack of gate-driver interface standard slows design cycles

- 4.3.4 Eco-taxes on fluorinated-gas etching raise production costs

- 4.4 Industry Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

- 4.8 Assessment of Macroeconomic Impact

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Channel Type

- 5.1.1 N-channel

- 5.1.2 P-channel

- 5.1.3 Complementary / Dual

- 5.2 By Material

- 5.2.1 Silicon

- 5.2.2 Silicon-Carbide (SiC)

- 5.2.3 Gallium-Nitride (GaN)

- 5.2.4 Other Materials (GaAs, etc.)

- 5.3 By Package Type

- 5.3.1 Discrete (TO-247/TO-220)

- 5.3.2 Surface-Mount (DPAK, QFN)

- 5.3.3 Power Modules

- 5.3.4 Wafer-Level CSP

- 5.3.5 Other Package Types

- 5.4 By End-user Industry

- 5.4.1 Automotive and Transportation

- 5.4.2 Consumer Electronics

- 5.4.3 Industrial and Manufacturing

- 5.4.4 Healthcare

- 5.4.5 Aerospace and Defense

- 5.4.6 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Infineon Technologies AG

- 6.4.2 STMicroelectronics N.V.

- 6.4.3 ON Semiconductor Corporation

- 6.4.4 Texas Instruments Incorporated

- 6.4.5 Toshiba Corporation

- 6.4.6 Renesas Electronics Corporation

- 6.4.7 Mitsubishi Electric Corporation

- 6.4.8 Vishay Intertechnology Inc.

- 6.4.9 NXP Semiconductors N.V.

- 6.4.10 Analog Devices, Inc.

- 6.4.11 Broadcom Inc.

- 6.4.12 Microchip Technology Incorporated

- 6.4.13 ROHM Co., Ltd.

- 6.4.14 Wolfspeed, Inc.

- 6.4.15 Alpha and Omega Semiconductor Ltd.

- 6.4.16 Littelfuse, Inc.

- 6.4.17 Diodes Incorporated

- 6.4.18 Nexperia B.V.

- 6.4.19 Fuji Electric Co., Ltd.

- 6.4.20 Power Integrations, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment