PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911500

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911500

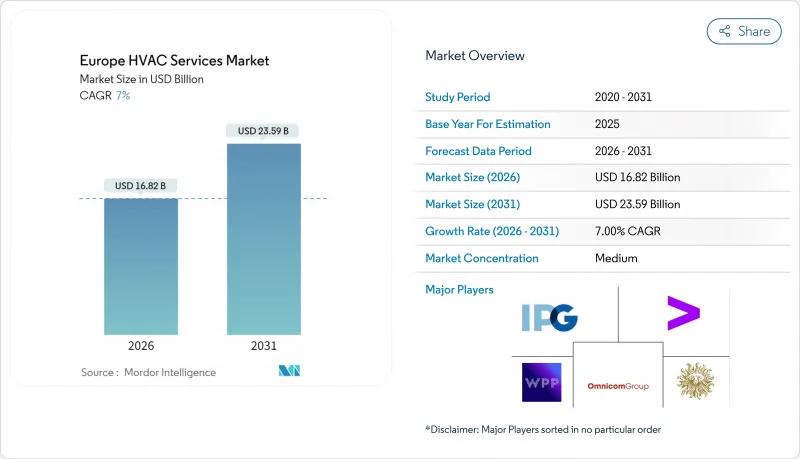

Europe HVAC Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe HVAC services market is expected to grow from USD 15.72 billion in 2025 to USD 16.82 billion in 2026 and is forecast to reach USD 23.59 billion by 2031 at 7.0% CAGR over 2026-2031.

Momentum comes from binding decarbonization laws, widespread heat-pump rollouts, and growing demand for predictive maintenance that lowers both energy use and service downtime. Tightening F-gas regulations, record copper prices, and regional labour shortages add cost pressure, yet they simultaneously accelerate digital service uptake as asset owners look for ways to stretch operating budgets. Competitive intensity keeps rising after Bosch's USD 8.1 billion purchase of the Johnson Controls-Hitachi JV, which reshapes residential and light-commercial service networks across the continent. Growth opportunities concentrate in retrofit packages tied to the EU Renovation Wave, district-heating upgrades in the Nordics, and precision-cooling contracts for hyperscale data centers that value guaranteed uptime over cost minimization.

Europe HVAC Services Market Trends and Insights

EU Renovation Wave mandates drive service demand acceleration

The Renovation Wave compels member states to refurbish the worst-performing 16% of non-residential buildings by 2030 and to install building-automation controls in sites above 290 kW by December 2024. Compliance pushes owners to shift from reactive maintenance toward outcome-based service contracts that guarantee energy savings. Contractors that layer energy audits, financing support, and digital performance tracking onto routine HVAC tasks lock in long multiyear deals. Early adopters in Germany and the Netherlands report higher margins because clients value turnkey compliance more than low hourly rates.

Heat-pump replacement boom reshapes service portfolio requirements

Europe's installed base surpassed 21.5 million units in 2024, and each replacement calls for technicians trained on A2L refrigerants and smart-home integration. Service visits shift from combustion safety checks to refrigerant leak detection and firmware updates. Sweden's 95% cut in building-heating emissions since the 1990s shows how widespread heat-pump adoption can transform service patterns for decades. Vendors now bundle remote monitoring and five-year warranties to differentiate, raising per-customer lifetime value.

Shortage of F-gas-certified technicians constrains capacity

New 2025 rules force every field technician who handles R-454B or R-32 to carry updated certification, yet 80,000 vacancies remain unfilled across the bloc. Backlogs push labour rates up 15-20% in hot spots such as the Netherlands, and some projects stall for weeks until a licensed crew becomes available. Companies including Bosch now sponsor accelerated courses and mobile training labs, but the skills gap is unlikely to close before 2027.

Other drivers and restraints analyzed in the detailed report include:

- Growing demand for energy-efficient retrofits transforms business models

- Data-center cooling surge creates a specialized service niche

- High IoT retrofit costs limit smart-service adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Maintenance and repair held 53.55% of Europe HVAC services market share in 2025, anchored by mandatory inspections on systems above specified capacity thresholds. The stable installed base delivers recurring revenue, yet profit pools shift toward software-enabled platforms that dispatch technicians only when sensor analytics flag performance drift. Smart-connected operations and maintenance, expanding at 10.38% CAGR, leverages edge devices that predict faults days in advance and trims labour truck rolls by up to 25%. Vendors invest in digital twins to visualize airflow and energy loads so they can offer uptime guarantees that boost margins far above traditional service rates. While the legacy maintenance cohort remains sizable, its growth lags inflation, nudging providers to bundle remote monitoring, parts logistics, and compliance reporting.

Predictive maintenance also changes workforce composition. Field teams now include data analysts who interpret anomaly alerts before dispatching mechanical specialists. The new model increases wallet share per client because a single provider manages software licenses, on-site visits, and regulatory paperwork. As subscription arrangements deepen, customer churn rates fall, locking revenue streams and raising enterprise valuations for service firms that master connectivity. Conversely, companies that cling to break-fix models face eroding prices and potential acquisition by digitally enabled rivals eager to consolidate the Europe HVAC services market.

The Europe HVAC Services Market Report is Segmented by Type of Service (Maintenance and Repair, Installation, Smart-Connected OandM), Implementation Type (New Construction, Retrofit Buildings), End-User Industry (Residential, Non-Residential Including Commercial, Industrial, Public and Institutional), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Johnson Controls International PLC

- Carrier Corporation

- Daikin Industries Ltd

- Vaillant Group

- Aggreko PLC

- Aermec SpA

- Trane Technologies plc

- Bosch Thermotechnology GmbH

- Siemens Building Technologies

- Honeywell International Inc.

- BDR Thermea Group

- Ingersoll Rand PLC

- Crystal Air Holdings Limited

- Klima Venta

- IAC Vestcold AS

- Airedale International Air Conditioning Ltd

- Envirotec Limited

- Kospel SA

- Spectrum Engineering Limited

- Pentair Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Renovation Wave mandates

- 4.2.2 Heat-pump replacement boom

- 4.2.3 Growing demand for energy-efficient retrofits

- 4.2.4 Data-center cooling demand surge

- 4.2.5 Carbon-linked financing schemes

- 4.2.6 Digital twin-driven predictive maintenance

- 4.3 Market Restraints

- 4.3.1 Shortage of F-gas-certified technicians

- 4.3.2 High IoT retrofit costs for legacy systems

- 4.3.3 Refrigerant supply-chain volatility

- 4.3.4 Cyber-security concerns in connected HVAC

- 4.4 Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type of Service

- 5.1.1 Maintenance and Repair

- 5.1.2 Installation

- 5.1.3 Smart-connected OandM

- 5.2 By Implementation Type

- 5.2.1 New Construction

- 5.2.2 Retrofit Buildings

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Non-residential

- 5.3.2.1 Commercial

- 5.3.2.2 Industrial

- 5.3.2.3 Public and Institutional

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Nordic

- 5.4.6.1 Denmark

- 5.4.6.2 Norway

- 5.4.6.3 Sweden

- 5.4.6.4 Finland

- 5.4.6.5 Iceland

- 5.4.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Johnson Controls International PLC

- 6.4.2 Carrier Corporation

- 6.4.3 Daikin Industries Ltd

- 6.4.4 Vaillant Group

- 6.4.5 Aggreko PLC

- 6.4.6 Aermec SpA

- 6.4.7 Trane Technologies plc

- 6.4.8 Bosch Thermotechnology GmbH

- 6.4.9 Siemens Building Technologies

- 6.4.10 Honeywell International Inc.

- 6.4.11 BDR Thermea Group

- 6.4.12 Ingersoll Rand PLC

- 6.4.13 Crystal Air Holdings Limited

- 6.4.14 Klima Venta

- 6.4.15 IAC Vestcold AS

- 6.4.16 Airedale International Air Conditioning Ltd

- 6.4.17 Envirotec Limited

- 6.4.18 Kospel SA

- 6.4.19 Spectrum Engineering Limited

- 6.4.20 Pentair Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment