PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911717

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911717

Military Transport Aircraft - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

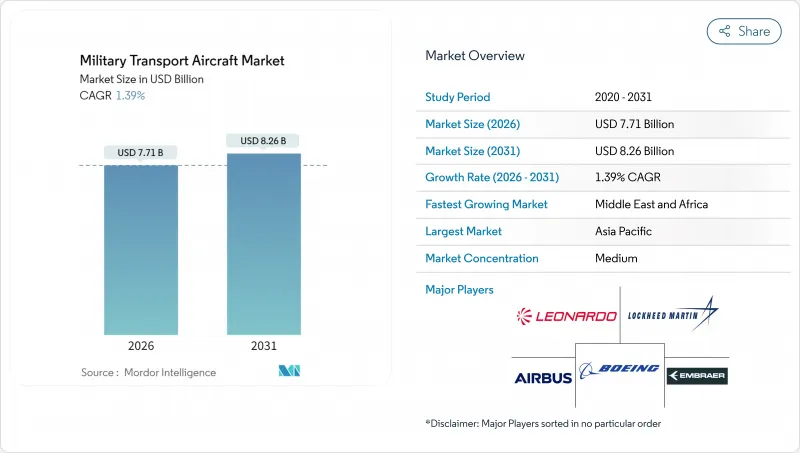

The military transport aircraft market was valued at USD 7.60 billion in 2025 and estimated to grow from USD 7.71 billion in 2026 to reach USD 8.26 billion by 2031, at a CAGR of 1.39% during the forecast period (2026-2031).

Current expansion stems from heightened geopolitical tensions, urgent humanitarian operations, and programmed fleet renewal cycles. Asia-Pacific defense ministries continue to order heavy strategic platforms while smaller nations favor light and medium airlifters that require lower infrastructure investment. Modernization programs increasingly specify open-architecture avionics, digital-thread maintenance suites, and multi-role reconfigurability, enabling operators to reduce downtime and expand mission sets. Although procurement budgets remain sound, supply-chain bottlenecks for composite structures and aero-engines restrain annual deliveries, causing manufacturers to negotiate longer lead times and activate additional Tier-2 suppliers. Competitive dynamics now feature indigenous entrants from China, India, and South Korea contesting the traditional dominance of Airbus, Boeing, and Lockheed Martin, an evolution likely to reshape export patterns through 2030.

Global Military Transport Aircraft Market Trends and Insights

Escalating Defense Budgets in Asia-Pacific and the Middle East

Defense outlays rose sharply in 2024, with China allocating USD 296 billion and the United Arab Emirates lifting aviation procurement by 18%. These higher budgets are funneled into new heavy airlift programs, life-extension packages, and local industrial partnerships that include technology transfer clauses. Sustained spending also underpins research into digital logistics suites that cut lifecycle costs and speed mission readiness. Countries in the Gulf Cooperation Council continue to diversify their fleets toward modular A400M and C-130J variants, ensuring interoperability with coalition partners for coalition operations.

Fleet-modernization Programs Replacing Aging C-130/L-100 and AN-26 Classes

Over 60% of legacy C-130A/B and An-26 airframes have exceeded 40 years in service, prompting operators to fast-track competitive tenders that favor new-build C-390, C-295, and KC-390 Millennium models. Sweden's 2024 order for four C-390 aircraft marks a shift toward higher-throughput airframes with fly-by-wire controls and lower fuel consumption. Eastern European users are simultaneously retiring Soviet-era transport systems to reduce their dependence on Russian supply chains, creating a steady replacement funnel through 2035.

Supply-chain Constraints for Widebody Composite Structures and Aero-engines

Pratt & Whitney's TP400 line and Toray's carbon-fiber feedstocks reached 18-month backlogs in 2024, delaying A400M handovers and forcing original equipment manufacturers to resequence production slots. The scarcity raises unit pricing and compels air forces to accept interim capability gaps or pay premium "surge" fees for supplemental charter lift.

Other drivers and restraints analyzed in the detailed report include:

- Geopolitical Flashpoints Spurring Urgent Lift Capability

- Expansion of Humanitarian and Disaster-relief Missions Requiring Dual-role Airlifters

- High Total-ownership Cost Versus Potential Leased Cargo Conversions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fixed-wing transports captured 61.12% of the 2025 military transport aircraft market size, anchored by dependable performers such as the C-130J Super Hercules and A400M Atlas. Continuous block upgrades raise payload-range productivity while preserving interoperability certifications. At the same time, rotorcraft benefit from doctrinal shifts toward point-to-point lift in denied environments, driving a 4.20% CAGR that outpaces the broader military transport aircraft market. The widespread use of composite blades and improved transmission designs raises lift-to-weight ratios, expanding external-sling capacities for the Chinook and CH-53K fleets.

Rotorcraft share gains also reflect special-operations demand for low-signature infiltration, where tilt-rotor platforms like the CV-22 offer jet-class speed combined with vertical takeoff and landing (VTOL) capabilities. However, fixed-wing aircraft remain irreplaceable for inter-theater moves; the C-390 Millennium's fly-by-wire controls provide civil-certified Category IIIb autoland, allowing entry to fog-prone forward locations. Through 2030, fixed-wing deliveries are expected to stabilize at around 95 aircraft annually, whereas rotary procurement could peak at 140 units as new FLRAA entrants mature.

Troop and cargo airlifting generated the largest slice of the 2025 military transport aircraft market size, at USD 3.41 billion, equivalent to 44.85% of the total value, and is forecasted to track closely to the overall 1.39% CAGR as nations sustain their strategic lift requirements. The sub-segment benefits from fixed-wing workhorses such as the C-130J and A400M, which together accounted for more than 60% of troop-movement sorties in 2024. Fleet planners prioritize payload-range improvements and rapid re-role configurations, ensuring the segment defends its scale even as growth plateaus. Procurement pipelines in the Asia-Pacific and Europe remain steady. At the same time, North American operators focus on avionics refreshes and service-life extensions, which anchor aftermarket spending within the military transport aircraft market.

The Global Military Transport Aircraft Market Report is Segmented by Aircraft Type (Fixed-Wing Transport Aircraft, Rotary-Wing Transport Aircraft), Application (Troop and Cargo Airlifting, and More), End-User Service (Air Force, Army Aviation, and More), Propulsion Type (Turboprop, Turboshaft, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region accounted for 39.05% of 2025 revenue, solidifying its regional leadership in the military transport aircraft market. Volume comes from continuous Y-20 production, India's indigenous C-295 line, and Japan's expanded C-2 build rate. The regional CAGR is forecasted at 1.75%, driven by annual defense budget growth averaging 8.5% across major economies. Capability cooperatives, such as the Quad-spur interoperability requirements, further stimulate joint crew-training contracts.

North America held a 28.50% share, primarily through US Air Force programs, which saw a 12% increase in C-130J flight hours in 2024. Canada's CC-330 Husky tanker-transport initiative and Mexico's CN-235 expansion underscore the growing continental demand. Across the Atlantic, Europe accounted for 22.05%, though supply-chain snarls limited A400M outputs to eight units. NATO's Strategic Airlift Capability rotates C-17s from Papa Air Base, underscoring the alliance's reliance on pooled assets.

The Middle East and Africa emerge as the fastest-growing slice with a 3.60% CAGR. Nigeria's four-unit C-295 order and South Africa's C-130BZ modernization illustrate how peacekeeping and humanitarian mandates override tight budgets. Gulf states blend Middle East and Africa statistics; the UAE's fresh C-130J-30s and Qatar's pending A400M purchase underpin a 2.32% regional CAGR. Shared infrastructure under the African Union mobilizes cross-border airlift operations, easing regulatory hurdles and encouraging cooperative maintenance depots.

- Airbus SE

- Lockheed Martin Corporation

- The Boeing Company

- Leonardo S.p.A.

- Embraer S.A.

- ANTONOV COMPANY (Ukroboronprom)

- Rostec

- Kawasaki Heavy Industries, Ltd.

- Korea Aerospace Industries Ltd.

- Aviation Industry Corporation of China (AVIC)

- PT Dirgantara Indonesia

- De Havilland Aircraft of Canada Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 KEY INDUSTRY TRENDS

- 4.1 Gross Domestic Product

- 4.1.1 North America

- 4.1.2 Europe

- 4.1.3 Asia-Pacific

- 4.1.4 South America

- 4.1.5 Middle East and Africa

- 4.2 Active Fleet Data

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia-Pacific

- 4.2.4 South America

- 4.2.5 Middle East and Africa

- 4.3 Defense Spending

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia-Pacific

- 4.3.4 South America

- 4.3.5 Middle East and Africa

5 MARKET LANDSCAPE

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Escalating defense budgets in Asia-Pacific and the Middle East

- 5.2.2 Fleet-modernization programs replacing aging C-130/L-100 and An-26 classes

- 5.2.3 Geopolitical flashpoints spurring urgent lift capability

- 5.2.4 Expansion of humanitarian and disaster-relief missions requiring dual-role airlifters

- 5.2.5 Digital-thread MRO reducing downtime and enlarging aftermarket revenue pools

- 5.2.6 Emerging eVTOL logistics aircraft for agile last-mile resupply

- 5.3 Market Restraints

- 5.3.1 Supply-chain constraints for widebody composite structures and aero-engines

- 5.3.2 High total-ownership cost versus potential leased cargo conversions

- 5.3.3 Export-control and ITAR barriers limiting platform addressable markets

- 5.3.4 Runway-availability risk in dispersed operations limiting heavy-lift utility

- 5.4 Value Chain Analysis

- 5.5 Regulatory Landscape

- 5.6 Technological Outlook

- 5.7 Porter's Five Forces Analysis

- 5.7.1 Bargaining Power of Suppliers

- 5.7.2 Bargaining Power of Buyers

- 5.7.3 Threat of New Entrants

- 5.7.4 Threat of Substitutes

- 5.7.5 Intensity of Competitive Rivalry

6 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 6.1 By Aircraft Type

- 6.1.1 Fixed-wing Transport Aircraft

- 6.1.2 Rotary-wing Transport Aircraft

- 6.2 By Application

- 6.2.1 Troop and Cargo Airlifting

- 6.2.2 Humanitarian and Disaster Relief

- 6.2.3 Special Missions (MEDEVAC, SAR, VIP)

- 6.3 By End-User Service

- 6.3.1 Air Force

- 6.3.2 Army Aviation

- 6.3.3 Naval/Marine Corps Aviation

- 6.3.4 Joint/Special Operations

- 6.3.5 Paramilitary and Coast Guard

- 6.4 By Propulsion Type

- 6.4.1 Turboprop

- 6.4.2 Turboshaft

- 6.4.3 Turbofan

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.1.3 Mexico

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 France

- 6.5.2.3 Germany

- 6.5.2.4 Spain

- 6.5.2.5 Italy

- 6.5.2.6 Russia

- 6.5.2.7 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 South Korea

- 6.5.3.5 Australia

- 6.5.3.6 Indonesia

- 6.5.3.7 Rest of Asia-Pacific

- 6.5.4 South America

- 6.5.4.1 Brazil

- 6.5.4.2 Rest of South America

- 6.5.5 Middle East and Africa

- 6.5.5.1 Middle East

- 6.5.5.1.1 Saudi Arabia

- 6.5.5.1.2 United Arab Emirates

- 6.5.5.1.3 Qatar

- 6.5.5.1.4 Rest of Middle East

- 6.5.5.2 Africa

- 6.5.5.2.1 South Africa

- 6.5.5.2.2 Nigeria

- 6.5.5.2.3 Rest of Africa

- 6.5.5.1 Middle East

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 7.4.1 Airbus SE

- 7.4.2 Lockheed Martin Corporation

- 7.4.3 The Boeing Company

- 7.4.4 Leonardo S.p.A.

- 7.4.5 Embraer S.A.

- 7.4.6 ANTONOV COMPANY (Ukroboronprom)

- 7.4.7 Rostec

- 7.4.8 Kawasaki Heavy Industries, Ltd.

- 7.4.9 Korea Aerospace Industries Ltd.

- 7.4.10 Aviation Industry Corporation of China (AVIC)

- 7.4.11 PT Dirgantara Indonesia

- 7.4.12 De Havilland Aircraft of Canada Limited

8 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 8.1 White-space and Unmet-need Assessment

9 KEY STRATEGIC QUESTIONS FOR MILITARY TRANSPORT AIRCRAFT CEOS