PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911737

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911737

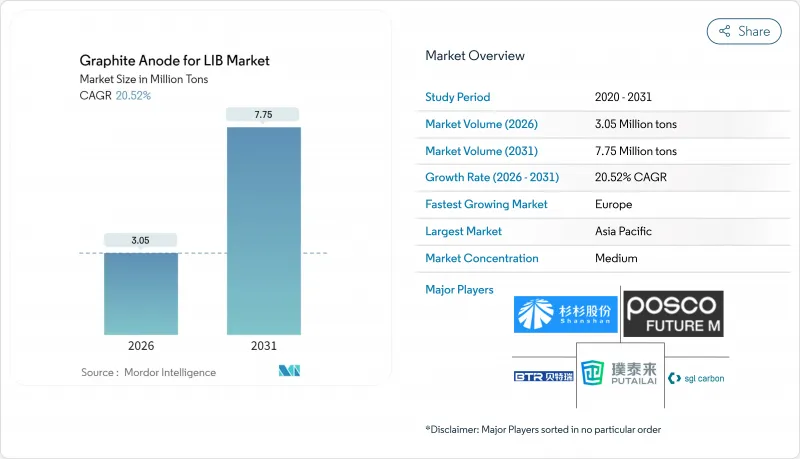

Graphite Anode For LIB - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Graphite Anode for LIB Market was valued at 2.53 million tons in 2025 and estimated to grow from 3.05 million tons in 2026 to reach 7.75 million tons by 2031, at a CAGR of 20.52% during the forecast period (2026-2031).

Rising electric-vehicle (EV) cell capacity, expanding stationary storage projects, and localization mandates that reward domestic content are collectively accelerating adoption. Synthetic graphite retains its volume leadership because its engineered microstructure tolerates fast-charge demands; however, cost-sensitive natural graphite is closing the performance gap as purification routes reach automotive-grade purity at a lower cost. Regional incentive packages-from the U.S. Inflation Reduction Act to India's Production-Linked Incentive scheme-are fragmenting supply chains into local clusters located near gigafactories, a shift that compresses logistics costs while improving compliance with origin rules. Competitive intensity remains high as Chinese incumbents extend vertical integration into precursor coke, Japanese and Korean specialists differentiate through proprietary coating chemistries, and Western newcomers attract government loans to build low-carbon facilities. Simultaneously, export-control risks, emissions regulations, and the impending arrival of silicon-rich anodes are prompting cell makers to dual-source synthetic and natural feedstocks, further reshaping procurement strategies for the graphite anode in the LIB market.

Global Graphite Anode For LIB Market Trends and Insights

Surging EV-Driven Li-ion Cell Capacity Expansions

Between January 2024 and October 2025, announced gigafactory projects led to an incremental anode requirement at standard graphite loadings. By 2027, CATL's Debrecen and BYD's Rayong projects are expected to contribute additional capacity. Meanwhile, Tesla's Texas facility has secured a significant portion of Syrah Resources' Louisiana output through a decade-long offtake agreement. To meet the content thresholds set by the U.S. Inflation Reduction Act and EU Battery Regulation, cell manufacturers are now required to position anode lines within 200 km of their final assembly points. This strategy not only ensures compliance but also secures upstream volumes from local suppliers. As commissioning struggles to keep pace with demand, this widespread expansion is set to create a structural deficit in the graphite anode market for lithium-ion batteries (LIB) until 2027.

Cost Decline of Synthetic Graphite from Chinese Scale-Ups

In 2024, unit prices for Chinese synthetic graphite experienced a significant decline, a shift attributed to the activation of new furnaces in Inner Mongolia and Sichuan. Integrated producers, leveraging Sinopec contracts, procure petroleum needle-coke at discounted rates. They operate Acheson furnaces at a high utilization rate, subsequently passing these savings on to their cell customers. While this price drop gives an edge over Japanese and Korean competitors in the entry-level EV and two-wheeler markets, provisional EU anti-dumping duties now moderate this advantage within the European market. As a result, this cost-driven substitution not only propels volume growth but also heightens geopolitical tensions in the graphite anode market for lithium-ion batteries.

Natural Graphite Supply Concentration and Export Controls

In 2024, China dominated the world's mined natural graphite production and global spheroidization capacity. Following an expansion of export licenses in December 2023, Beijing now oversees all battery-grade flake exports, causing delays for shipments outside China. In early 2024, LG Energy Solution faced a shutdown at its Wroclaw plant due to permit delays, while Samsung SDI opted for a pricier synthetic feedstock. Despite scaling operations at Mozambique's Balama and Madagascar's Molo mines, the total supply from non-Chinese sources is projected to fall short until 2026, leading to heightened volatility in the graphite anode market for lithium-ion batteries (LIBs).

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Domestic Battery Supply Chains

- High-Energy Consumer-Electronics Demand Spike

- Emissions Scrutiny on Graphitization Furnaces

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Synthetic graphite captured 56.78% of 2025 volume, thanks to its unmatched cycle life in NMC and NCA chemistries, as well as its compatibility with ultra-fast charging protocols. Meanwhile, natural graphite found its niche in entry-level LFP batteries. These batteries, although they accept a lower first-cycle efficiency, offer a cost advantage. This cost efficiency is driving robust growth, forecasted to propel a 24.10% CAGR forecast to 2031. As a result, the market for natural graphite products used in graphite anodes for LIBs is set to surge significantly. In contrast, synthetic volumes are anticipated to grow at a more modest rate. Advanced purification techniques, which achieve metallic impurities below 10 ppm and carbon purity of 99.95%, have bridged the performance gap. This newfound confidence is evident as BYD's Blade Battery opts for a high percentage of natural feedstock in its sub-USD 25,000 EV line.

Coating technologies are evolving, with both materials now utilizing pitch-derived carbon or carbon-nanotube layers to boost initial coulombic efficiency. Despite this convergence, synthetic graphite maintains an edge in calendar-life retention. This advantage is pivotal for automakers providing 150,000-mile warranties. While EU carbon regulations may steer standard-range models towards natural graphite, U.S. domestic-content credits are incentivizing premium vehicles to lean back towards synthetic graphite. This dynamic is creating a regional, rather than a global, pattern of material substitution in the graphite anode for the LIB market. Consequently, the industry is splitting into two distinct segments: a high-volume, price-sensitive natural-graphite sector and a premium, engineered synthetic niche.

The Graphite Anode for LIB Market Report is Segmented by Anode Material Type (Synthetic Graphite and Natural Graphite), End-Use Application (Electric Vehicles, Energy Storage Systems, Consumer Electronics, and Others), and Geography (Asia-Pacific, North America, Europe, and Rest of the World). The Market Forecasts are Provided in Terms of Volume (Tons) and Value (USD).

Geography Analysis

Asia-Pacific supplied 73.85% of 2025 shipments, largely driven by China's significant manufacturing capacity. This capacity seamlessly integrates processes like refinery coke calcination, graphitization, spheroidization, and cell assembly within single provincial clusters. China's edge comes from low-cost electricity, provincial land discounts, and expedited permitting, solidifying its cost leadership. Meanwhile, Japan and South Korea are pivoting towards high-margin synthetics, enhanced with proprietary coatings. Notably, Mitsubishi Chemical's MAGE-M series commands a premium for its sub-3 nm coatings, boasting high full-depth cycles, highlighting a performance-centric niche in the graphite anode market for lithium-ion batteries (LIB).

Europe is expected to exhibit the steepest regional growth, at a 28.05% CAGR, to 2031, driven by automakers' efforts to align with the EU Battery Regulation, which mandates a regional content threshold by 2027. Northvolt's site in Sweden is already ahead of the curve, recycling graphite through a hydrometallurgical loop with significant output and plans for expansion. Concurrently, BASF's Schwarzheide facility produces synthetic graphite annually, harnessing renewable energy to reduce its cradle-to-gate carbon intensity. Further bolstering the region, France's Verkor and Italy's Italvolt have initiated joint ventures aimed at increasing annual production. However, challenges loom as European cash costs are still significantly higher than those in the Asia-Pacific region, making carbon-border adjustments crucial for competitiveness in the graphite anode market for LIBs.

North America, which accounted for a smaller share of the 2024 volume, is poised to more than double its share by 2030, driven by Section 45X credits that offer subsidies. Syrah's Vidalia plant achieved a notable run-rate in 2025, directly supplying Tesla's Texas gigafactory, capitalizing on a premium for domestic origin. In Tennessee, Novonix, with backing from a Department of Energy loan guarantee, is set to launch synthetic capacity by 2026, catering to Ford and GM within a close radius. While Canada's Quebec mines are ramping up natural-flake supply, they're grappling with extended federal permitting, pushing their significant impact to post-2027. Mexico stands out for its cost-effective electrode coating and pack assembly, yet the absence of major graphitization assets keeps the North American supply constrained in the short term.

- Beterui New Materials Group Co. Ltd

- Guangdong Kaijin New Energy Technology Co. Ltd

- Hunan Zhongke Electric Co. Ltd (Hunan Zhongke Xingcheng Graphite Co. Ltd)

- JFE Chemical Corporation

- Mitsubishi Chemical Corporation

- Nippon Carbon Co. Ltd

- POSCO CHEMICAL

- SGL Carbon

- Shanghai Putailai New Energy Technology Co. Ltd

- Shangtai Technology

- Shanshan Co. Ltd

- Shenzhen Sinuo Industrial Development Co. Ltd

- Shenzhen Xiangfenghua Technology Co. Ltd

- Showa Denko KK

- Tokai Carbon Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging EV-driven Li-ion cell capacity expansions

- 4.2.2 Cost decline of synthetic graphite from Chinese scale-ups

- 4.2.3 Government incentives for domestic battery supply chains

- 4.2.4 High-energy consumer electronics demand spike

- 4.2.5 Fast-charge architectures needing high-rate anodes

- 4.3 Market Restraints

- 4.3.1 Natural graphite supply concentration and export controls

- 4.3.2 Emissions scrutiny on graphitisation furnaces

- 4.3.3 Shift toward Si-rich and Li-metal anodes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Anode Material Type

- 5.1.1 Synthetic Graphite

- 5.1.2 Natural Graphite

- 5.2 By End-use Application

- 5.2.1 Electric Vehicles

- 5.2.2 Energy Storage Systems

- 5.2.3 Consumer Electronics

- 5.2.4 Others (Power Tools and e-Mobility)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 South Korea

- 5.3.1.4 India

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Beterui New Materials Group Co. Ltd

- 6.4.2 Guangdong Kaijin New Energy Technology Co. Ltd

- 6.4.3 Hunan Zhongke Electric Co. Ltd (Hunan Zhongke Xingcheng Graphite Co. Ltd)

- 6.4.4 JFE Chemical Corporation

- 6.4.5 Mitsubishi Chemical Corporation

- 6.4.6 Nippon Carbon Co. Ltd

- 6.4.7 POSCO CHEMICAL

- 6.4.8 SGL Carbon

- 6.4.9 Shanghai Putailai New Energy Technology Co. Ltd

- 6.4.10 Shangtai Technology

- 6.4.11 Shanshan Co. Ltd

- 6.4.12 Shenzhen Sinuo Industrial Development Co. Ltd

- 6.4.13 Shenzhen Xiangfenghua Technology Co. Ltd

- 6.4.14 Showa Denko KK

- 6.4.15 Tokai Carbon Co. Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment