PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911739

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911739

Precision Turned Product Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

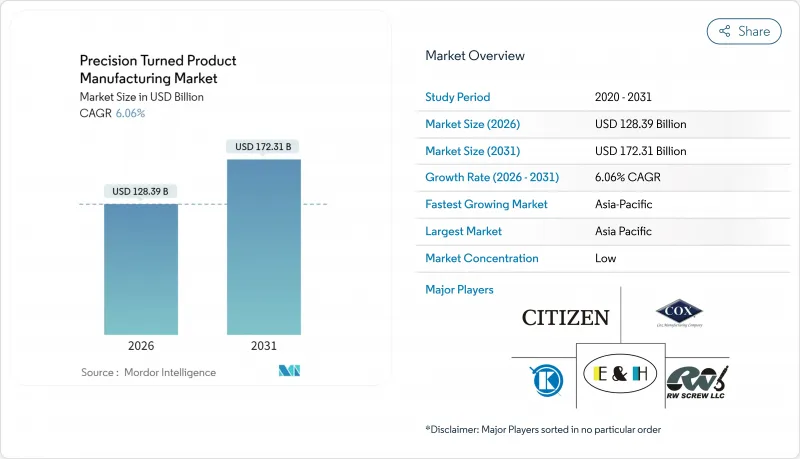

The Precision Turned Product Manufacturing market is expected to grow from USD 121.05 billion in 2025 to USD 128.39 billion in 2026 and is forecast to reach USD 172.31 billion by 2031 at 6.06% CAGR over 2026-2031.

The expansion marks an ongoing shift from volume-based machining toward precision-engineered parts that support aerospace recovery, electric-vehicle (EV) drivetrain complexity, and the miniaturization of implantable medical devices. Demand resilience also stems from automated manufacturing cells that require ultra-precise components with repeatable tolerances. Competitive opportunity centers on suppliers that combine multi-axis CNC capability with lights-out operations, allowing them to capture reshored programs in North America and Europe. Material strategy is evolving as titanium and super-alloys gain share in engines, implants, and high-temperature systems, even while steel remains the volume foundation. Strategic capital investments by machine tool builders and OEMs bolster localized, higher-margin production runs that protect intellectual property and ensure supply-chain certainty.

Global Precision Turned Product Manufacturing Market Trends and Insights

Reshoring of Precision-Machining Supply Chains

North American and European OEMs are bringing machining programs home to mitigate geopolitical and logistics risks, backed by more than USD 100 billion in combined incentives under the U.S. CHIPS Act and the EU Sovereignty Fund. GKN Aerospace's upgrade of its Trollhattan, Sweden, cell shows how automation enables cost-competitive local production while shrinking lead times. Customers reward domestic suppliers with price premiums because secure access to mission-critical parts outweighs pure cost concerns. Defense contracts intensify the movement by requiring domestic or allied sourcing. Haas Automation's USD 300 million Nevada plant is a case in point, adding regional spindle production to shield customers from shipping delays.

Proliferation of EV Drivetrain Parts

EV architectures replace thousands of mechanical parts with a smaller set of highly accurate, thermally stable components, pushing the Precision Turned Product Manufacturing market toward micron-level tolerances. Chinese brands such as BYD and NIO specify precision-turned stator housings and coolant junctions that demand multi-axis Swiss-type machining backed by on-machine probing. European and U.S. automakers follow suit, yet domestic-content rules in both regions divert a rising share of the spend to local job shops. As global EV adoption climbs, the market gains a multi-regional demand base rather than a single-country concentration, underwriting long-term order stability for qualified suppliers.

Persistent Skilled-Machinist Shortage

The U.S. faces a projected 2.1 million manufacturing-role deficit by 2030, and precision machining tops the hard-to-hire list because toolmakers require up to five years of on-the-job mentoring. German and Japanese firms report similar talent gaps that inflate wages and constrain throughput. Apprenticeship programs and high-school outreach help, yet the lag between intake and productivity keeps the labor market tight. Small and medium-sized enterprises (SMEs) feel the squeeze most, often losing workers to large multinationals that can pay premiums and offer robotics training.

Other drivers and restraints analyzed in the detailed report include:

- Miniaturization of Medical Implants & Devices

- Aerospace OEM Ramp-ups Post-B737 MAX & A320neo

- Volatility in Specialty Alloy Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

CNC processes own 65.98% of the Precision Turned Product Manufacturing market share in 2025 and are projected to expand at an 8.41% CAGR to 2031, adding roughly USD 42.2 billion in incremental Precision Turned Product Manufacturing market size during the period. Automated pallet pools, tool presetters, and on-machine gauging turn individual spindles into unattended production cells that counterbalance the skilled-labor deficit. FANUC demonstrates 24/7 lights-out cells that log spindle uptimes above 90%, cutting unit labor minutes by half. Manual lathes persist for prototyping and micro-volume heritage parts, yet their share shrinks every year as a series of multi-axis CNC machines replace sequential setups.

Machine analytics platforms now feed predictive maintenance dashboards that alert technicians to spindle bearing wear or ball-screw backlash before dimensional drift occurs. Early adopters report scrap reductions of 20% without adding inspection headcount. Integrators are bundling robots with vision systems to automate secondary deburr and wash cycles, thereby extending the single-setup advantage deeper into the downstream flow. Such end-to-end automation underpins the next leap in traceability, positioning digital CNC lines as the core production model across aerospace, EV, and medical programs.

Swiss-type lathes captured 36.20% of the 2025 Precision Turned Product Manufacturing market size and are pacing a 9.92% CAGR through 2031 as new servo architectures deliver five- and seven-axis simultaneous cutting. Tsugami's SS207-II-5AX integrates a B-axis cross-drill module, allowing complete machining of bone screws and catheter components in one clamp. Citizen's LFV cutting function synchronizes servo-driven oscillation with spindle rotation to break chips in sticky alloys, extending tool life by up to 30% and slashing downtime on exotic metals.

Conventional cam-based screw machines remain relevant for commodity shafts and fittings, yet pricing pressure and tighter surface-finish specs push converters to migrate toward CNC models. Hybrid mill-turn centers blur category lines by integrating opposing spindles and Y-axis milling within a horizontal platform, effectively amplifying part complexity without increasing floor space. Forward-looking shops evaluate machine-tool purchases not only on cycle time but also on MTConnect-enabled data interoperability that powers closed-loop quality controls.

The Precision Turned Product Manufacturing Market Report is Segmented by Operation (Manual Operation, CNC Operation), by Machine Type (Automatic Screw Machines, CNC Swiss-Type and More), by Material Type (Steel, Aluminum and More), by End-User Industry (Automotive & EV, Aerospace & Defense and More), and by Geography (North America, South America and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the Precision Turned Product Manufacturing market in 2025 with 38.60% share and a 7.33% CAGR toward 2031, anchored by China's unrivaled EV production scale and India's Make-in-India policy incentives. Chinese OEMs such as BYD place rolling forecasts on domestic machine shops for motor housings and refrigerant valve bodies, keeping spindle utilization high even amid price competition. India lures foreign investment with 15-year tax holidays for green-field machinery assets, and Endo's FDA-approved Indore site validates the country's ascent in regulated products Japan, still the birthplace of high-precision machine tools, focuses on low-volume, high-value components for satellites, surgical robots, and microfluidics. Southeast Asian states attract mid-tier outsourcing for cost-sensitive parts like compressor fittings and gaming-device shafts, diversifying the regional output mix.

North America follows with accelerating demand fueled by aerospace rebound and federal reshoring credits. Boeing's exacting delivery targets translate into expanded blanket orders for compliant turn-part suppliers across Washington, Texas, and Ontario. Haas Automation's Nevada spindle plant shortens lead times for domestic job shops switching to higher-spec CNCs. Mexico amplifies the continental network under USMCA, offering cost-effective assembly and favorable duty structures that keep complex parts within a two-to-three-day logistics radius of U.S. final-assembly centers.

Europe leverages stringent machinery and medical regulations to maintain a competitive moat. Germany's Mittelstand specializes in mill-turn prototyping for luxury vehicles, while Sweden's roboticized aerospace cells showcase lights-out repeatability in titanium fan blades. EU Regulation 2023/1230 mandates risk assessments and CE marking that widen compliance gaps versus imports, steering OEMs toward audited European suppliers. Sustainability targets push plants to certify CO2 footprints, and early adopters integrate solar-powered coolant chillers and closed-loop chip briquetting to score procurement points under new green-deal frameworks.

- Cox Manufacturing Co.

- Citizen FINEDEVICE (Citizen Group)

- Zhejiang Ronnie Precision

- R W Screw Products

- E&H Precision

- KDK Finish-Turning

- Astro Machine Works

- Melling Tool Co.

- E. J. Basler Co.

- Hall Industries Incorporated

- Supreme Machined Products Company

- Alpha Grainger Mfg

- C & M Machine Products

- Alger Precision Machining

- Tompkins Products Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Government Regulations and Initiatives

- 4.3 Technological Trends in the Industry

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth of the Aerospace Industry is Driving the Market

- 5.1.2 Automotive Industry is Driving the Market

- 5.2 Market Restraints

- 5.2.1 Skilled Labor Shortage

- 5.3 Market Opportunities

- 5.3.1 Industry 4.0 Revolutionizing the Manufacturing Industry By 2025

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Operation

- 6.1.1 Manual Operation

- 6.1.2 CNC Operation

- 6.2 By Machine Types

- 6.2.1 Automatic Screw Machines

- 6.2.2 Rotary Transfer Machines

- 6.2.3 Computer Numerically Controlled (CNC)

- 6.2.4 Lathes or Turning centers

- 6.3 By Material Type

- 6.3.1 Plastic

- 6.3.2 Steel

- 6.3.3 Other Material Types

- 6.4 By End-user Industry

- 6.4.1 Automobile

- 6.4.2 Electronics

- 6.4.3 Defense

- 6.4.4 Healthcare

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.1.3 Mexico

- 6.5.2 Europe

- 6.5.2.1 Germany

- 6.5.2.2 France

- 6.5.2.3 United Kingdom

- 6.5.2.4 Italy

- 6.5.2.5 Spain

- 6.5.2.6 Russia

- 6.5.2.7 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 Japan

- 6.5.3.3 India

- 6.5.3.4 Bangladesh

- 6.5.3.5 Turkey

- 6.5.3.6 South Korea

- 6.5.3.7 Australia

- 6.5.3.8 Indonesia

- 6.5.3.9 Rest of Asia-Pacific

- 6.5.4 Middle East and Africa

- 6.5.4.1 Egypt

- 6.5.4.2 South Africa

- 6.5.4.3 Saudi Arabia

- 6.5.4.4 Rest of Middle East and Africa

- 6.5.5 Rest of the World

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Cox Manufacturing Co.

- 7.2.2 Citizen FINEDEVICE (Citizen Group)

- 7.2.3 Zhejiang Ronnie Precision

- 7.2.4 R W Screw Products

- 7.2.5 E&H Precision

- 7.2.6 KDK Finish-Turning

- 7.2.7 Astro Machine Works

- 7.2.8 Melling Tool Co.

- 7.2.9 E. J. Basler Co.

- 7.2.10 Hall Industries Incorporated

- 7.2.11 Supreme Machined Products Company

- 7.2.12 Alpha Grainger Mfg

- 7.2.13 C & M Machine Products

- 7.2.14 Alger Precision Machining

- 7.2.15 Tompkins Products Inc.

- 7.3 Other Companies

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX