PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911756

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911756

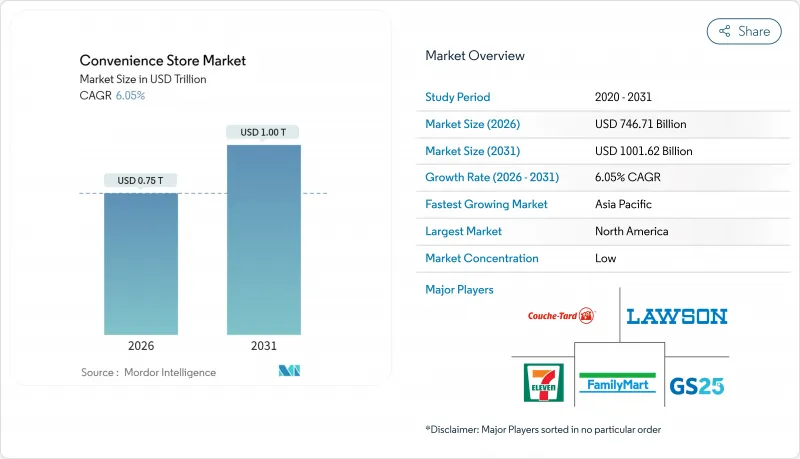

Convenience Store - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The convenience store market was valued at USD 704.11 billion in 2025 and estimated to grow from USD 746.71 billion in 2026 to reach USD 1001.62 billion by 2031, at a CAGR of 6.05% during the forecast period (2026-2031).

Momentum comes from urban migration, rising demand for instant-gratification shopping, and the digital integration of ordering, loyalty, and payment tools across formats. Operators are enlarging prepared-food menus, embedding electric-vehicle charging, and applying real-time analytics to shorten replenishment cycles, all of which lift basket value even when fuel volumes soften. Private-equity roll-ups and corporate M&A remain active because the sector delivers predictable cash flows and resilient customer footfall, while regulatory incentives for alternative-energy infrastructure open fresh revenue streams. The competitive intensity within the market remains moderate, as the top chains account for only a limited portion of global revenue. This scenario creates opportunities for mid-tier and regional players to establish a competitive edge by focusing on localization strategies, expanding their product portfolios, and leveraging data-driven promotional activities to attract and retain customers.

Global Convenience Store Market Trends and Insights

Urban Micro-Fulfilment Demand Spike

Dense city cores increasingly rely on convenience stores as last-mile hubs for two-hour and same-day delivery services, allowing operators to serve both walk-in and digital orders from the same shelf location. In 2024, Casey's completed the acquisition of a Star Food Store located in Texas, strategically enhancing its presence in delivery-friendly zones. This acquisition is expected to generate incremental revenue while maintaining minimal growth in fixed costs, reflecting a calculated approach to operational expansion and resource optimization. Wawa's 70-store Southeast expansion follows a similar logic, ensuring enough nodes to guarantee 15-minute delivery windows. Real-time planogram tools feed demand signals directly to distribution centres, keeping high-velocity SKUs in stock and trimming spoilage. Municipal zoning rules increasingly reserve curb-space permits for companies that maintain brick-and-mortar sites, tilting competitive advantage toward established convenience brands.

Cash-Rich Private-Equity Roll-Ups

First Reserve has explored a USD 1.5 billion sale of Refuel, underscoring how financial sponsors view the category as defensive, cash-generative, and exit-ready. Arko Corp.'s decision to divest its company-operated stores, valued at USD 2 billion, reflects significant opportunities for both strategic acquirers and private equity sponsors. Casey's recent acquisition of CEFCO sites demonstrates how corporations strategically utilize debt financing to compete with private capital, achieving operational efficiencies in areas such as fuel procurement and prepared-food logistics. These developments collectively drive the professionalization of operations, enhance data standardization, and improve access to capital within the convenience store market, fostering a more competitive and streamlined industry landscape.

Rising Urban Lease Renewals

In the fourth quarter of 2024, the average rental rate for shopping centres in the United States reached USD 24.76 per square foot, reflecting the ongoing demand for retail spaces and the resilience of the commercial real estate market CBRE.COM. Cap-rate compression continues to sustain elevated property valuations, which, in turn, drive significant increases in renewal rates. This trend emerges at a time when macroeconomic challenges are exerting pressure on discretionary consumer spending. 7-Eleven shuttered 400 under-performing North American sites in late 2024, chiefly in rent-intensive metros, to recycle capital into high-return formats. Zoning laws often block relocation to cheaper districts without fuel-tank re-permitting, locking operators into escalators that compress margins.

Other drivers and restraints analyzed in the detailed report include:

- Digital Lottery & Gaming Commissions

- EV-Charger Foot-Traffic Boost

- Labour Shortage & Minimum-Wage Escalation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Staple products controlled 56.12% of 2025 revenue within the convenience store market share, underscoring consumer dependence on beverages, snacks, and daily necessities. Emergency products, although smaller in absolute terms, are slated to expand at a 9.38% CAGR, capitalizing on weather disruptions and supply shocks that redirect shoppers from supermarkets to nearby stores. The COVID-19 crisis proved the format's resilience as a quasi-public-service node when larger outlets faced curfews. Prepared foods sharpen differentiation: Casey's lifted prepared-food and dispensed-beverage revenue 11.4% year-over-year to USD 349 million in Q3 2024, illustrating margin accretion from hot food lines. Impulse products sit between the two, fuelled by strategic end-cap placement and promotional bundling that exploit immediate-consumption psychology.

Shoppers increasingly expect crisis-responsive assortments, portable chargers, bottled water, and OTC medication, driving SKU rationalization around high-turn, high-margin emergency items. Operators rely on real-time demand sensing to pre-stage these goods ahead of hurricanes or heat waves, protecting against stockouts and reinforcing brand trust. As climate volatility intensifies, emergency products could capture a larger slice of the convenience store market, especially in regions prone to extreme weather.

The Convenience Store Market Report Segments the Industry Into by Product Types (Staple Products, Impulse Products, Emergency Products), by Store Types (Kiosks, Mini Convenience Stores, and Other), by Ownership Model (Independent Stores, and Other) and by Region (North America, Latin America, Europe, Middle East and Africa, Asia-Pacific). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, North America contributed 38.10% to the total turnover, primarily driven by well-established fuel integration strategies and a high prevalence of household car ownership. During Q3 2025, U.S.-based chains such as Casey's reported robust fuel margins while strategically increasing the proportion of inside sales attributed to high-margin prepared food offerings. Concurrently, Canada emerged as a leader in sustainability initiatives, exemplified by 7-Eleven Canada's 2023 collaboration with a food-waste app, which successfully prevented 130,000 meals from being wasted. This initiative also laid the groundwork for similar implementations in the U.S. market. On the consolidation front, Alimentation Couche-Tard's USD 47.2 billion acquisition bid for Seven & i is anticipated to necessitate the divestiture of certain stores to comply with regulatory requirements, a move that could significantly alter the competitive dynamics within the region.

Asia-Pacific is poised for the highest growth at an 8.22% CAGR, led by compressed living spaces and rising disposable income that favour quick trips. Lawson plans to double overseas units to 14,000, and FamilyMart is reorganizing its China network while entering the U.S., underscoring cross-border ambitions. Japanese pioneers focus on proprietary hot foods and cashier-less tech; South Korea's GS25 drives loyalty via super-app ecosystems that integrate payments, delivery, and media. The Middle East remains nascent yet promising: Saudi Arabia's AL Sulaiman Group will ramp Circle K from 40 to 300 sites within five years, targeting hospitals, universities, and offices.

Europe presents maturity tempered by regulatory rigor. HFSS product caps push chains to reformulate snack lines and market better-for-you ranges, supplying a template later exported worldwide. Switzerland's Coop Pronto optimizes small-box assortments and energy-efficient refrigeration to meet both profitability and environmental goals. Latin America, particularly Brazil's 8,100-store network with 60% franchise penetration, showcases rising middle-class demand and provides strategic adjacency for North American majors expanding southward.

- 7-Eleven

- Alimentation Couche-Tard (Circle K)

- FamilyMart

- Lawson

- GS25 (GS Retail)

- Wawa

- Casey's General Stores

- Speedway

- QuikTrip

- Sheetz

- Cumberland Farms

- Alfamart

- Oxxo (FEMSA)

- Coop (Switzerland)

- Reitangruppen (Narvesen, 7-Eleven Nordics)

- SPAR International

- Reliance Smart Point

- CP All (7-Eleven Thailand)

- Indomaret

- Lulu Express Fresh Market

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urban Micro-Fulfilment Demand Spike

- 4.2.2 Cash-Rich Private-Equity Roll-Ups

- 4.2.3 Digital Lottery & Gaming Commissions

- 4.2.4 EV-Charger Foot-Traffic Boost

- 4.2.5 Subscription-Based Meal-Kits Pick-Up

- 4.2.6 Real-Time Planogram Analytics

- 4.3 Market Restraints

- 4.3.1 Rising Urban Lease Renewals

- 4.3.2 Stricter HFSS* Product Limits (*High-Fat-Salt-Sugar)

- 4.3.3 Labour Shortage & Minimum-Wage Escalation

- 4.3.4 Cyber-Security Liability for Self-Checkout

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Pricing Analysis

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Staple Products

- 5.1.2 Impulse Products

- 5.1.3 Emergency Products

- 5.2 By Store Type

- 5.2.1 Kiosks

- 5.2.2 Mini Convenience Stores

- 5.2.3 Limited Selection Convenience Stores

- 5.2.4 Traditional Convenience Stores

- 5.2.5 Expanded Convenience Stores

- 5.2.6 Hyper Convenience Stores

- 5.3 By Ownership Model

- 5.3.1 Independent Stores

- 5.3.2 Franchise Stores

- 5.3.3 Corporate-Owned Chains

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Chile

- 5.4.2.4 Peru

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX

- 5.4.3.6.1 Belgium

- 5.4.3.6.2 Netherlands

- 5.4.3.6.3 Luxembourg

- 5.4.3.7 NORDICS

- 5.4.3.7.1 Denmark

- 5.4.3.7.2 Finland

- 5.4.3.7.3 Iceland

- 5.4.3.7.4 Norway

- 5.4.3.7.5 Sweden

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Australia

- 5.4.4.6 South-East Asia

- 5.4.4.6.1 Singapore

- 5.4.4.6.2 Malaysia

- 5.4.4.6.3 Thailand

- 5.4.4.6.4 Indonesia

- 5.4.4.6.5 Vietnam

- 5.4.4.6.6 Philippines

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 7-Eleven

- 6.4.2 Alimentation Couche-Tard (Circle K)

- 6.4.3 FamilyMart

- 6.4.4 Lawson

- 6.4.5 GS25 (GS Retail)

- 6.4.6 Wawa

- 6.4.7 Casey's General Stores

- 6.4.8 Speedway

- 6.4.9 QuikTrip

- 6.4.10 Sheetz

- 6.4.11 Cumberland Farms

- 6.4.12 Alfamart

- 6.4.13 Oxxo (FEMSA)

- 6.4.14 Coop (Switzerland)

- 6.4.15 Reitangruppen (Narvesen, 7-Eleven Nordics)

- 6.4.16 SPAR International

- 6.4.17 Reliance Smart Point

- 6.4.18 CP All (7-Eleven Thailand)

- 6.4.19 Indomaret

- 6.4.20 Lulu Express Fresh Market

7 Market Opportunities & Future Outlook

- 7.1 Emerging Quick-Commerce Integration

- 7.2 AI-Enabled Inventory Optimization