PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911769

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911769

GCC Digital Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

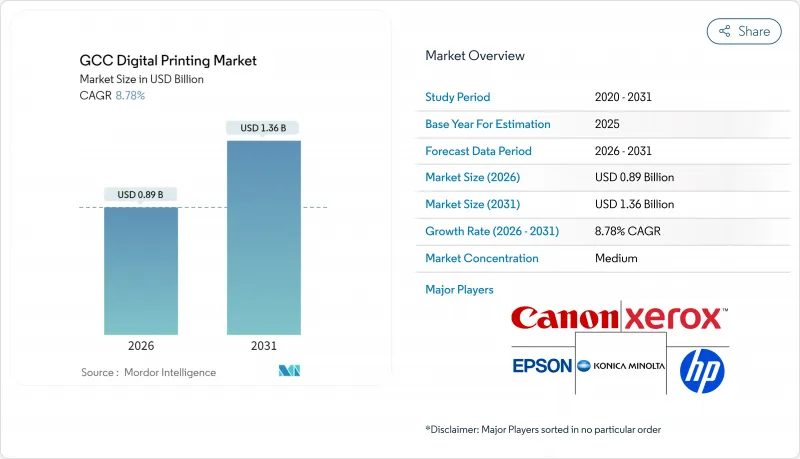

The GCC Digital Printing Market is expected to grow from USD 0.82 billion in 2025 to USD 0.89 billion in 2026 and is forecast to reach USD 1.36 billion by 2031 at 8.78% CAGR over 2026-2031.

This robust trajectory reflects the Gulf states' decisive shift toward localized manufacturing, rising e-commerce volumes, and pro-diversification policies such as Saudi Arabia's Vision 2030 and the UAE's Operation 300 billion. Inkjet systems capture demand for shorter runs and rapid versioning, while UV-curable inks gain favor amid low-VOC mandates. Government-backed infrastructure spending, stringent Arabic-labeling rules, and expanding non-oil GDP reinforce growth, even as high press acquisition costs and skills shortages temper adoption. Competitive intensity is increasing as global OEMs establish regional production hubs, as illustrated by HP's planned Riyadh facility, slated to open by 2027.

GCC Digital Printing Market Trends and Insights

Growth of Packaging and Textile Industries and Rising Demand for Digital Advertisements

Industrial diversification is expected to accelerate packaging demand as the UAE's Operation 300bn targets an industrial output of AED 300 billion (USD 81.6 billion) by 2031, up from AED 133 billion (USD 36.2 billion) in 2021. Digital presses capitalize on SKU proliferation by removing plate-making and minimum-order constraints. Simultaneously, the expansion of technical textiles and fashion production drives the uptake of variable-data printing for mass customization. Advertisers are increasingly leveraging personalized packaging as a brand touchpoint, prompting converters to adopt on-press data integration capabilities. The convergence of industrial scaling and digital marketing thus sustains double-digit demand for agile inkjet and electrophotographic solutions.

Rapid Inkjet Adoption for Short-Run and Variable-Data Jobs

Converters across the Gulf recognize the strategic value of inkjet beyond cost-per-page metrics. Eliminating plates cuts setup to minutes, enabling profitable runs of 50-100 units. Variable-data functions extend from basic serialization to embedded QR codes supporting real-time consumer engagement and anti-counterfeiting. Supply-chain disruptions expose the cost of analog rigidity, making inkjet the default contingency option for urgent localized production. Retrofitting inkjet heads onto existing flexo lines furthers adoption by maximizing the utilization of legacy assets while layering digital capabilities.

High Capital Expenditure for Presses and R&D

Full-production digital presses cost upwards of USD 2 million, a burden magnified by ancillary workflow upgrades and specialized ink contracts. Operating expenses can reach 60% of annual budgets once printheads and service agreements are included. Although Gulf sovereign wealth funds hold USD 4.4 trillion in assets, SMEs struggle to navigate the financing options. Equipment vendors are mitigating this through operating leases and click-charge models that convert capex into opex, yet adoption remains cautious until converters gain confidence in utilization rates.

Other drivers and restraints analyzed in the detailed report include:

- Government Diversification Programs Fueling Industrial and Packaging Capacity

- E-Commerce Arabic-Labeling Rules Driving Short-Run Packaging

- Limited Skilled Digital-Press Workforce

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Inkjet captured 60.05% GCC digital printing for the packaging market share in 2025, supported by its ability to print on coated, uncoated, and heat-sensitive substrates without primer layers. The segment's 9.12% CAGR benefits from UV-LED curing that lowers energy use by 40% compared with mercury lamps. The integration of inkjet bars into flexo lines maximizes asset uptime, enabling converters to toggle between analog and digital processes within a single shift. Electrophotography remains relevant for standardized, high-coverage label work; however, its slower format flexibility limits its growth. Cross-border regulatory variation favors the variable-data strengths of inkjet, making it the default choice for fast-moving consumer goods that require frequent artwork updates.

Inkjet's ecosystem maturity accelerates as consumables suppliers introduce food-safe, low-migration inks and as workflow vendors release cloud-based job management suites. Predictive maintenance algorithms extend printhead life, reducing the total cost of ownership. Rising adoption in pharmaceutical and personal care applications underscores the fine-text resolution and micro-code accuracy of inkjet. Given these advantages, inkjet is expected to maintain a market share of over 60% in the GCC digital printing market for packaging throughout the forecast horizon.

Labels accounted for 34.78% of GCC digital printing for the packaging market size in 2025 due to mandatory barcode, excise-stamp, and nutrition declarations on imported goods. Brand owners prefer pressure-sensitive labels for their speed-to-market and potential for product differentiation. Flexible packaging, however, is growing at a 9.85% CAGR as online grocery and meal-kit services demand lightweight, durable pouches capable of vivid graphics. The transition toward mono-material laminates to meet recyclability targets further boosts digital's advantage, since cured UV inks bond effectively to polyethylene and polypropylene films.

Corrugated boxes are gaining market share as Saudi electronics and appliance assembly plants localize outer-packaging production, while cartons experience premiumization driven by the cosmetics industry. Direct-to-metal printing presents opportunities in beverage cans, promising to reduce label waste and enhance recycling. Rigid plastics face substrate compatibility challenges with conventional UV inks; however, dual-cure chemistries are expanding material options. Across formats, converters leverage digital to offer lot-sized production, enabling brand owners to test market new SKUs without inventory risk.

The GCC Digital Printing Market Report is Segmented by Printing Process (Electrophotography, and Inkjet), Packaging Format (Labels, Corrugated Packaging, Cartons, Flexible Packaging, Rigid Packaging, and Metal Packaging), End-User Industry (Food and Beverage, and More), Ink Type (UV-Curable, and More), and Geography (Saudi Arabia, United Arab Emirates, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- HP Inc.

- Canon Inc.

- Xerox Holdings Corporation

- Konica Minolta Inc.

- Seiko Epson Corporation

- Durst Group AG

- Xeikon NV

- Koenig & Bauer AG

- BOBST Group SA

- Landa Corporation Ltd.

- Domino Printing Sciences plc

- Agfa-Gevaert NV

- Mimaki Engineering Co., Ltd.

- Ricoh Company Ltd.

- Heidelberger Druckmaschinen AG

- Fujifilm Holdings Corporation

- Screen Holdings Co., Ltd.

- Oki Electric Industry Co., Ltd.

- Brother Industries Ltd.

- ePac Holdings LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Market Drivers

- 4.3.1 Growth of Packaging and Textile Industries and Rising Demand for Digital Advertisements

- 4.3.2 Rapid Inkjet Adoption for Short-Run and Variable-Data Jobs

- 4.3.3 Government Diversification Programs Fueling Industrial and Packaging Capacity

- 4.3.4 E-commerce Arabic-Labeling Rules Driving Short-Run Packaging

- 4.3.5 Mandatory Excise Tax Stamps and Track-and-Trace Systems

- 4.3.6 Mega-Events Generating On-Demand Signage and Display Work

- 4.4 Market Restraints

- 4.4.1 High Capital Expenditure for Presses and R&D

- 4.4.2 Limited Skilled Digital-Press Workforce

- 4.4.3 Import Dependency for Inks and Substrates Exposed to Logistics Shocks

- 4.4.4 GCC Single-Use-Plastics Bans Forcing Substrate Migration

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitute Products

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Printing Process

- 5.1.1 Electrophotography

- 5.1.2 Inkjet

- 5.2 By Packaging Format

- 5.2.1 Labels

- 5.2.2 Corrugated Packaging

- 5.2.3 Cartons

- 5.2.4 Flexible Packaging

- 5.2.5 Rigid Packaging

- 5.2.6 Metal Packaging

- 5.3 By End-User Industry

- 5.3.1 Food and Beverage

- 5.3.2 Personal Care and Cosmetics

- 5.3.3 Pharmaceuticals

- 5.3.4 Industrial and Chemical

- 5.4 By Ink Type

- 5.4.1 UV-Curable

- 5.4.2 Water-Based

- 5.4.3 Solvent

- 5.4.4 Latex

- 5.5 By Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Qatar

- 5.5.4 Kuwait

- 5.5.5 Oman

- 5.5.6 Bahrain

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 HP Inc.

- 6.4.2 Canon Inc.

- 6.4.3 Xerox Holdings Corporation

- 6.4.4 Konica Minolta Inc.

- 6.4.5 Seiko Epson Corporation

- 6.4.6 Durst Group AG

- 6.4.7 Xeikon NV

- 6.4.8 Koenig & Bauer AG

- 6.4.9 BOBST Group SA

- 6.4.10 Landa Corporation Ltd.

- 6.4.11 Domino Printing Sciences plc

- 6.4.12 Agfa-Gevaert NV

- 6.4.13 Mimaki Engineering Co., Ltd.

- 6.4.14 Ricoh Company Ltd.

- 6.4.15 Heidelberger Druckmaschinen AG

- 6.4.16 Fujifilm Holdings Corporation

- 6.4.17 Screen Holdings Co., Ltd.

- 6.4.18 Oki Electric Industry Co., Ltd.

- 6.4.19 Brother Industries Ltd.

- 6.4.20 ePac Holdings LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment