PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911770

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911770

Middle East And Africa Transformer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

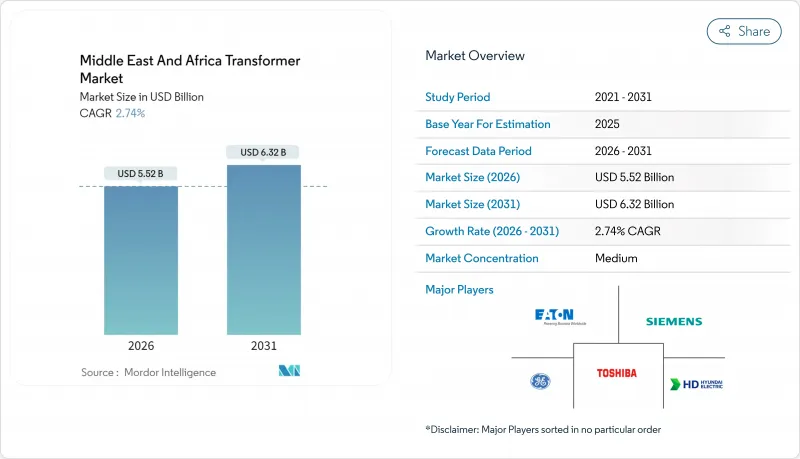

The Middle East And Africa Transformer Market was valued at USD 5.37 billion in 2025 and estimated to grow from USD 5.52 billion in 2026 to reach USD 6.32 billion by 2031, at a CAGR of 2.74% during the forecast period (2026-2031).

Measured growth conceals structural shifts as sovereign wealth funds steer capital toward grid-modernization megaprojects, while utility budgets remain sensitive to fluctuations in oil prices. Specialized high-voltage demand rises sharply around marquee investments such as Saudi Arabia's NEOM, where converter stations and HVDC links supersede conventional distribution additions. Supply-chain challenges intensify this dynamic; Hitachi Energy cautions that new power-class units now command three-year lead times, prompting utilities to over-order and regional players to localize production. At the same time, air-cooled designs gain traction in dense urban districts and hyperscale data centers, reflecting both tightening environmental regulations and the need for compact equipment.

Middle East And Africa Transformer Market Trends and Insights

Utility-Scale Renewables Driving Grid Expansion

National clean-energy targets fundamentally reshape procurement. Saudi Arabia aims for 50% renewable capacity by 2030, obligating collector circuits that rely on multiple 33/132 kV step-up transformers per wind farm.Egypt's Gulf of Suez project follows suit at a continental scale, while Morocco's 52% renewables objective boosts demand for distribution units tied to rooftop solar. Because intermittent output stresses voltage stability, utilities increasingly specify power electronic-integrated transformers that provide harmonic filtering. Manufacturers with digital-ready portfolios, therefore, command premium pricing. The enduring pivot toward active grid management cements a higher value mix for the Middle East Africa Transformer market.

Rising Urban Electricity Demand

Rapid city growth strains legacy networks. Dubai's USD 2.31 billion underground upgrade program prioritizes compact units rated for high ambient heat. Lagos and Abuja illustrate the same capacity crunch, fueling micro-grid adoption. Urban planners also impose stricter noise and spill-prevention rules, which favor dry-type cores over oil-filled tanks. NEOM sets the benchmark by integrating IoT sensors from day one, embedding predictive maintenance into municipal control rooms. Such urban-centric spending concentrates shipments geographically, enabling suppliers to optimize service hubs yet exposing them to localized logistics disruptions.

Oil-Price Driven Utility CAPEX Cuts

Budget correlations to crude receipts can freeze tenders in a matter of minutes. Nigeria delayed multiple grid projects when Brent oil prices fell below USD 70 per barrel in 2024, extending the lifespan of aging fleets beyond their optimal replacement windows. Saudi Arabia dampened approvals for secondary substations during similar troughs, even as flagship projects continued. Volatile cycles complicate inventory planning for manufacturers, favoring firms with diversified geographic exposure and lean production models. Although pent-up replacement needs accumulate, yearly order swings distort cash flows across the Middle East Africa Transformer market.

Other drivers and restraints analyzed in the detailed report include:

- State-Funded Grid Modernisation Programmes

- Desalination Plant Electrification

- Low-Cost Asian Imports Intensifying Price Pressure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large transformers above 100 MVA are expected to capture the fastest 4.62% CAGR outlook, mirroring utility investment in 400 kV and 500 kV corridors designed to shuttle renewable energy flows across long distances. In value terms, these units contributed a significant portion to the Middle East Africa Transformer market size, despite a smaller shipment count. Medium-rating equipment retained 64.35% share in 2025, anchoring most substation extensions and industrial builds. Utility pre-booking helps counter multi-year lead times, keeping order books healthy; however, suppliers face capital intensity and stringent test-bay requirements that limit new entrants.

The demand mix skews towards high-voltage areas where interconnection projects proliferate; examples include the Morocco-Spain HVDC and GCC power-trading pilots. Conversely, small units serve rural electrification and commercial rooftop solar, providing steady but modest growth. Combined, these trends cement the premiumization trajectory of the Middle East Africa Transformer market, steering R&D toward high-voltage insulation systems and digital-native control interfaces.

Oil-filled units held 83.95 of % Middle East Africa Transformer market share in 2025, as their thermal headroom suits Gulf climates. Nonetheless, air-cooled designs are forecasted to grow at a 4.92% CAGR, driven by hyperscale data centers and mixed-use high-rises that require fire-safe equipment. Adoption accelerates further where municipal bylaws restrict oil pits and containment berms. Suppliers tout amorphous-core innovations that cut no-load losses by up to 30%, offsetting historically higher upfront costs.

While dry-type capex remains steeper, reduced maintenance and insurance premiums narrow lifecycle gaps. As IEC 60076-11:2022 migrates into national codes, technical clarity removes specification ambiguity, unlocking pent-up demand. Consequently, the cooling-type choice becomes application-centric rather than climate-driven, adding granularity to the Middle East Africa Transformer industry sales mix.

The Middle East and Africa Transformer Market Report is Segmented by Power Rating (Large, Medium, and Small), Cooling Type (Air-Cooled and Oil-Cooled), Phase (Single-Phase and Three-Phase), Transformer Type (Power and Distribution), End-User (Power Utilities, Industrial, Commercial, and Residential), and Geography (Saudi Arabia, United Arab Emirates, Qatar, South Africa, Egypt, Nigeria, Rest of Middle East and Africa).

List of Companies Covered in this Report:

- Hitachi Energy Ltd.

- Siemens AG

- General Electric Co.

- Schneider Electric SE

- Eaton Corporation plc

- Mitsubishi Electric Corp.

- Toshiba Corp.

- HD Hyundai Electric Co., Ltd.

- Hyosung Heavy Industries

- Bharat Heavy Electricals Ltd.

- ABB Saudi Arabia

- Elsewedy Electric

- CG Power & Industrial

- Wilson Transformer (South Africa)

- Aktif Elektroteknik

- Voltamp Oman

- Arteche

- Alfanar

- Saudi Power Transformers Co.

- ZTR

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Utility-scale renewables driving grid expansion

- 4.2.2 Rising urban electricity demand

- 4.2.3 State-funded grid modernisation programmes

- 4.2.4 Mining-led micro-grid investments

- 4.2.5 Desalination plant electrification

- 4.2.6 Cross-border HVDC links

- 4.3 Market Restraints

- 4.3.1 Oil-price driven utility CAPEX cuts

- 4.3.2 Low-cost Asian imports intensifying price pressure

- 4.3.3 Skilled maintenance-labour shortage

- 4.3.4 Resin supply bottlenecks for dry-type units

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Power Rating

- 5.1.1 Large (Above 100 MVA)

- 5.1.2 Medium (10 to 100 MVA)

- 5.1.3 Small (Up to 10 MVA)

- 5.2 By Cooling Type

- 5.2.1 Air-cooled

- 5.2.2 Oil-cooled

- 5.3 By Phase

- 5.3.1 Single-Phase

- 5.3.2 Three-Phase

- 5.4 By Transformer Type

- 5.4.1 Power

- 5.4.2 Distribution

- 5.5 By End-User

- 5.5.1 Power Utilities (includes, Renewables, Non-renewables, and T&D)

- 5.5.2 Industrial

- 5.5.3 Commercial

- 5.5.4 Residential

- 5.6 By Geography

- 5.6.1 Saudi Arabia

- 5.6.2 United Arab Emirates

- 5.6.3 Qatar

- 5.6.4 South Africa

- 5.6.5 Egypt

- 5.6.6 Nigeria

- 5.6.7 Rest of Middle East and Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Hitachi Energy Ltd.

- 6.4.2 Siemens AG

- 6.4.3 General Electric Co.

- 6.4.4 Schneider Electric SE

- 6.4.5 Eaton Corporation plc

- 6.4.6 Mitsubishi Electric Corp.

- 6.4.7 Toshiba Corp.

- 6.4.8 HD Hyundai Electric Co., Ltd.

- 6.4.9 Hyosung Heavy Industries

- 6.4.10 Bharat Heavy Electricals Ltd.

- 6.4.11 ABB Saudi Arabia

- 6.4.12 Elsewedy Electric

- 6.4.13 CG Power & Industrial

- 6.4.14 Wilson Transformer (South Africa)

- 6.4.15 Aktif Elektroteknik

- 6.4.16 Voltamp Oman

- 6.4.17 Arteche

- 6.4.18 Alfanar

- 6.4.19 Saudi Power Transformers Co.

- 6.4.20 ZTR

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment