PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911778

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911778

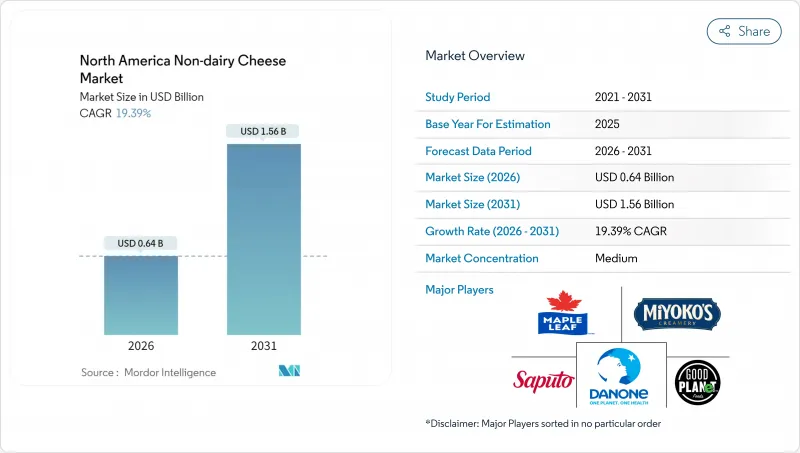

North America Non-dairy Cheese - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The North America non-dairy cheese market is expected to grow from USD 0.54 billion in 2025 to USD 0.64 billion in 2026 and is forecast to reach USD 1.56 billion by 2031 at 19.39% CAGR over 2026-2031.

This growth represents a strong CAGR of 19.71% during the forecast period. The market's expansion is primarily attributed to several key factors. The increasing prevalence of lactose intolerance in diverse urban populations has heightened the demand for dairy alternatives. Additionally, the rising popularity of flexitarian diets, particularly among millennials and Generation Z consumers, has further fueled the adoption of non-dairy cheese products. Rapid advancements in product formulations, particularly those enhancing meltability, have also played a crucial role in driving demand. Technological innovations, such as precision-fermentation casein, are narrowing the performance gap between non-dairy and traditional dairy cheese. These advancements enable pizza and sandwich chains to experiment with plant-based options without compromising on texture or quality. Retailers are also adapting to this growing demand. Supermarkets are allocating more refrigerated shelf space to plant-based offerings, while online retailers are leveraging targeted promotions to attract and convert curious shoppers. The competitive landscape is evolving as well. Pure-play startups are focusing on artisan niches, offering unique and high-quality products to cater to specific consumer preferences. Meanwhile, established dairy processors are utilizing their extensive distribution networks to expand their reach and capture a larger market share. This dynamic has created an environment of intense competition, with players vying to establish dominance in the rapidly growing non-dairy cheese market.

North America Non-dairy Cheese Market Trends and Insights

Rising lactose intolerance prevalence pushes consumers toward dairy-free options

In 2024, Medline Plus stated that approximately 30 million American adults experience some degree of lactose intolerance by the age of 20 . This condition is particularly common among African American, Hispanic, Asian American, and Native American communities. Consequently, grocers in diverse metropolitan areas are allocating more shelf space to non-dairy alternatives. The FDA's 2024 guidance has further supported this shift. By permitting "plant-based cheese" labeling, provided products are clearly differentiated from dairy, the FDA has reduced regulatory barriers. This change allows brands to emphasize product functionality without risking enforcement actions. Enzyme-deficiency testing is also becoming a standard practice in pediatric care, fostering early awareness that leads to a lifelong preference for lactose-free products. Retailers have noted that non-dairy cheese sales in regions with higher Hispanic and Asian populations exceed those in predominantly white neighborhoods by 40 to 60 percentage points. This trend indicates that targeted distribution strategies can enhance market penetration. As demographic changes continue and lactose intolerance screenings become more common in healthcare, this growth is expected to sustain in the medium term.

Expanding vegan and flexitarian populations, especially millennials and gen Z

Health-conscious consumers are increasingly adopting plant-based diets, fueling the market's growth. The Good Food Institute reported that in 2024, 59% of U.S. households purchased plant-based foods . These consumers are notably reducing their consumption of animal products without fully eliminating them. Millennials and Generation Z, who collectively hold over half of the grocery purchasing power in urban areas, demonstrate significantly higher trial rates for plant-based cheese compared to older generations. The popularity of plant-based eating has been amplified by social media, with celebrity endorsements and influencer marketing playing key roles in shifting these products from niche to mainstream. In 2025, PETA recognized Chicago as the most vegan-friendly city in the U.S., citing its extensive range of plant-based options . Quick-service restaurants like Chipotle and Panera Bread, which target younger demographics, have introduced non-dairy cheese options to address unmet demand. Brands are rapidly adapting by utilizing digital marketing strategies to capture the attention of this demographic and convert initial interest into repeat purchases.

Taste-texture skepticism among omnivores

Research on consumer perception indicates that taste is the primary obstacle to the adoption of non-dairy cheese. Omnivores frequently describe the texture as "plasticky," the aftertaste as "sour," and note a "lack of creaminess," which leads them to dismiss plant-based alternatives after initial trials. Blind taste tests conducted by food science researchers show that even formulations preferred by vegans receive lukewarm responses from omnivores accustomed to the complex flavors and mouthfeel of dairy cheese. This skepticism is particularly prevalent in the Midwest and Southern U.S., where dairy consumption is deeply rooted in culture, and plant-based diets are often viewed as a coastal trend. Quick-service restaurants testing non-dairy cheese report that customer satisfaction scores trail dairy options by 15 to 20 percentage points, discouraging broader menu inclusion. Medium-term improvements rely on narrowing the sensory gap through precision fermentation casein and advanced flavor-masking technologies. However, consumer education campaigns are equally essential to reset expectations and highlight that plant-based cheese offers unique attributes rather than replicating dairy exactly.

Other drivers and restraints analyzed in the detailed report include:

- Health consciousness favors non-dairy cheese for its perceived benefits

- Foodservice demand from pizza and QSR chains upgrading meltability

- Lack of awareness among older demographics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, cashew-based cheese accounted for a 36.24% market share, attributed to its neutral flavor, creamy texture, and versatility in shredded, sliced, and block forms. These qualities appeal to both committed vegans and flexitarians exploring plant-based options. Almond-based cheeses are expected to grow at a 20.02% CAGR through 2031, driven by California processors diversifying crops due to water scarcity and a saturated almond butter market, while seeking higher-margin opportunities. Soy-based cheese has lost market share to nut-based alternatives, as consumers associate soy with genetic modification and hormonal disruption, despite scientific evidence affirming its safety. Other bases, such as oat, coconut, and pea protein, collectively hold the remaining market share and are attracting investments as brands develop allergen-free formulations that avoid tree nuts and soy. Precision fermentation technologies, which produce animal-free casein, are anticipated to disrupt this segmentation. Patent filings from New Culture and Perfect Day indicate that casein-fortified formulations can incorporate any plant base while delivering dairy-like functionality.

Cashew sourcing, concentrated in Vietnam and India, presents geopolitical and climate-related risks. In contrast, almond-based brands mitigate these risks by relying on California's domestic supply, highlighting supply chain resilience as a competitive advantage. Brands like Miyoko's Creamery and Kite Hill have established strong market positions by emphasizing artisan-crafted cashew formulations and adopting premium pricing strategies, even as mass-market consumers remain price-sensitive. Soy-based cheese continues to appeal to budget-conscious vegans and institutional foodservice operators prioritizing cost over taste, but its growth is limited by flavor challenges and its inability to command premium pricing. Oat-based cheese, introduced to North America by European brands, is gaining popularity among consumers seeking nut-free options due to allergy concerns, although texture issues persist. The FDA's GRAS approval process for novel proteins, including those derived from precision fermentation, will play a critical role. If casein-fortified formulations achieve commercial scalability before 2027, the focus may shift from base ingredients to functional performance.

In 2025, shredded cheese captured a dominant 32.84% market share, bolstered by strong demand from foodservice sectors, particularly pizzerias and taco chains. Here, meltability and portion control play pivotal roles in format preference. Meanwhile, cheese slices are on track to witness a robust growth rate of 20.51% CAGR through 2031. This surge is largely attributed to quick-service restaurants, such as Subway and Panera Bread, reshaping their menus to cater to the rising flexitarian demand for previously overlooked dairy-free options. Blocks and cubes, often linked to charcuterie boards and snacking, are experiencing sluggish growth. This is primarily due to texture challenges, making plant-based cheese less favorable for standalone consumption, in contrast to its melted counterparts. Other variations, like spreads and cream cheese substitutes, cater to niche breakfast and appetizer markets. However, they grapple with fierce competition from well-established dairy brands that dominate the refrigerated deli sections.

The growth of sliced cheese underscores its operational benefits for quick-service restaurants. Pre-portioned slices not only cut down labor costs but also reduce food waste, a challenge often faced with shredded cheese that requires precise measuring and is prone to clumping during storage. While pizza chains are open to experimenting with plant-based toppings, the premium pricing of shredded formats confines their use to limited-time offers, rather than a permanent fixture on the menu. Blocks of cheese encounter the most significant hurdles in adoption. Consumers anticipate cheese blocks to provide a rich flavor profile and a firm texture ideal for slicing. These are qualities that plant-based versions find challenging to emulate without costly and time-consuming aging processes. On the other hand, cream cheese alternatives, spearheaded by brands like Kite Hill and Miyoko's, have seamlessly integrated into the mainstream. Their simpler flavor profiles and spreadable textures effectively mask any functional shortcomings. This indicates that targeted innovation strategies in specific forms could pave the way for growth in segments that remain relatively untapped.

The North America Non-Dairy Cheese Market Report is Segmented by Type (Cashew-Based, Soy-Based, Almond-Based, Others), Form (Shredded, Blocks, Cubes, Slices, Others), Packaging Type (Tubs, Tins, Cans), Distribution Channel (On-Trade, Off-Trade), and Geography (United States, Canada, Mexico, Rest of North America). Market Forecasts are Provided in Terms of Value (USD) and Volume (Tons).

List of Companies Covered in this Report:

- Danone SA

- Good Planet Foods LLC

- GreenSpace Brands (Galaxy Nutritional Foods Inc.)

- Maple Leaf Foods Inc.

- Miyoko's Creamery

- Otsuka Holdings Co. Ltd (Daiya Foods)

- Saputo Inc.

- Tofutti Brands Inc.

- Upfield Group (Violife)

- Treeline Cheese

- Follow Your Heart

- Parmela Creamery

- Dr-Cow Tree Nut Cheese

- WayFare Foods

- Vtopian Artisan Cheeses

- Nush Foods

- Field Roast Grain Meat Co. (Chao)

- Heidi Ho Foods

- The Kraft Heinz Co. (NotCheese)

- Bute Island Foods Ltd. (Sheese)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising lactose intolerance prevalence pushes consumers toward dairy-free options

- 4.2.2 Expanding vegan and flexitarian populations, especially millennials and Gen Z

- 4.2.3 Health consciousness favors non-dairy cheese for its perceived benefits

- 4.2.4 Food-service demand from pizza/QSR chains upgrading meltability

- 4.2.5 Product innovations improve meltability, texture, and flavor

- 4.2.6 Sustainability concerns over dairy farming's environmental impact

- 4.3 Market Restraints

- 4.3.1 Premium pricing versus dairy cheese persists

- 4.3.2 Taste-texture scepticism among omnivores

- 4.3.3 Lack of awareness among older demographics

- 4.3.4 Nut-supply price volatility and climate risks

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Product Type

- 5.1.1 Cashew-Based Cheese

- 5.1.2 Soy-Based Cheese

- 5.1.3 Almond-Based Cheese

- 5.1.4 Others

- 5.2 Form

- 5.2.1 Shredded

- 5.2.2 Blocks

- 5.2.3 Cubes

- 5.2.4 Slices

- 5.2.5 Others

- 5.3 Packaging Type

- 5.3.1 Tubs

- 5.3.2 Tins

- 5.3.3 Cans

- 5.4 Distribution Channel

- 5.4.1 On-trade

- 5.4.2 Off-trade

- 5.4.2.1 Convenience Stores

- 5.4.2.2 Specialist Retailers

- 5.4.2.3 Supermarkets and Hypermarkets

- 5.4.2.4 On-line Retail

- 5.4.2.5 Others (Warehouse clubs, gas stations, etc.)

- 5.5 Conutry

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Danone SA

- 6.4.2 Good Planet Foods LLC

- 6.4.3 GreenSpace Brands (Galaxy Nutritional Foods Inc.)

- 6.4.4 Maple Leaf Foods Inc.

- 6.4.5 Miyoko's Creamery

- 6.4.6 Otsuka Holdings Co. Ltd (Daiya Foods)

- 6.4.7 Saputo Inc.

- 6.4.8 Tofutti Brands Inc.

- 6.4.9 Upfield Group (Violife)

- 6.4.10 Treeline Cheese

- 6.4.11 Follow Your Heart

- 6.4.12 Parmela Creamery

- 6.4.13 Dr-Cow Tree Nut Cheese

- 6.4.14 WayFare Foods

- 6.4.15 Vtopian Artisan Cheeses

- 6.4.16 Nush Foods

- 6.4.17 Field Roast Grain Meat Co. (Chao)

- 6.4.18 Heidi Ho Foods

- 6.4.19 The Kraft Heinz Co. (NotCheese)

- 6.4.20 Bute Island Foods Ltd. (Sheese)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK