PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911791

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911791

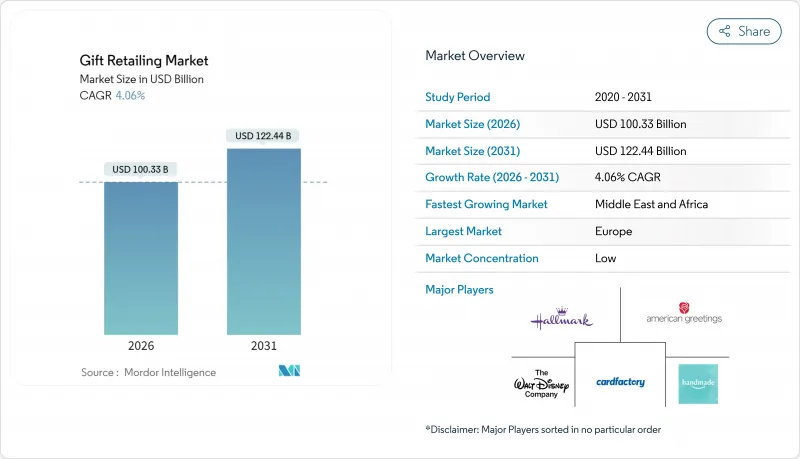

Gift Retailing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The gift retailing market is expected to grow from USD 96.42 billion in 2025 to USD 100.33 billion in 2026 and is forecast to reach USD 122.44 billion by 2031 at 4.06% CAGR over 2026-2031.

Merchandise aimed at travel shoppers, sustainability-certified corporate programs, and high-margin personalization technologies are reshaping revenue streams, while tariff shocks and digital substitutes test pricing power. Offline stores keep their relevance through sensory discovery zones and same-day take-away convenience, even as unified commerce tools make online discovery integral to the purchase path. Brands that integrate ESG messaging with novel production methods, such as small-batch 3-D printing, are capturing premium spending, whereas legacy greeting-card aisles face share loss to cash-transfer apps and digital greetings.

Global Gift Retailing Market Trends and Insights

Growth of Experiential Tourism Driving Souvenir Demand

International travel recovery boosts terminal retail receipts as passengers purchase location-specific keepsakes at premium price points. Dubai Duty Free logged USD 2.16 billion in sales in 2023 and reported perfumes alone generated USD 374 million, illustrating how airports have evolved into high-ticket gift corridors. Hainan's duty-free complex welcomed 5.683 million travellers who spent CNY 30.94 billion (USD 4.35 billion) on 33.082 million items in 2024, reinforcing the pull of exclusive merchandise for visiting shoppers. Authenticity remains a revenue lever; untreated gemstones now sell at two to three times pre-pandemic prices as buyers seek proof of provenance. Cruise lines mirror the trend by curating port-exclusive collections to convert shore excursions into retail events. Souvenir demand, therefore, anchors a tangible growth floor for the gift retailing market amid wider discretionary volatility.

Rising Disposable Income in Emerging Economies

Consumer wallets across the Gulf states expand on the back of young, tech-literate populations. Saudi Arabia's household outlays are projected to grow 6.4% annually through 2028, while 60% of citizens are under 30, supporting digital discovery journeys that culminate in premium gift purchases. An AlixPartners study found net spending intentions in the UAE rising 13% for 2025, the world's highest recorded confidence measure, with apparel and accessories ranking among the top beneficiary categories. Consumers continue to engage in price comparisons and monitor discounts online. However, the emphasis on value for money is increasingly accompanied by a rising preference for personalized experiences and ethically sourced products. Retailers that strategically implement click-and-collect services alongside innovative and immersive in-store displays are effectively capitalizing on this trend, converting youthful consumer enthusiasm into sustained repeat gifting revenue streams.

Volatile Raw-Material Costs for Decorative Items

Gemstone scarcity and rising freight rates squeeze margins across jewelry and seasonal decor lines. CaratX tracked sapphire and ruby prices at two to three times pre-2020 averages, while emerald buyers migrated from Colombian to costlier Zambian alternatives as supply tightened. The introduction of new U.S. tariffs has resulted in significant duty increases on Indian crafts and Chinese ornaments, compelling businesses to reassess product assortments and renegotiate supplier agreements. According to OpenBrand's consumer price index, the Recreation category experienced a price increase in January 2025, driven by a reduction in discounting practices among retailers. Companies are now faced with a strategic decision: either absorb the additional costs to protect sales volumes or pass these costs onto consumers, which could lead to a shift in customer preferences toward lower-priced competitors.

Other drivers and restraints analyzed in the detailed report include:

- Seasonal Promotional Campaigns by Retailers

- 3-D Printing Enabling Hyper-Personalized Gifts

- Rising Competition from Digital Greetings & Cash Apps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Souvenirs and Novelty Items will grow at a CAGR of 6.05% and Seasonal Decorations recorded an 8.61% CAGR outlook despite Souvenirs and Novelty Items holding the largest 2025 share. High-shine ornaments, driven by social-media aesthetics, capture impulse spending as consumers refresh home decor for photo backdrops. Retailers overlay rapid 3-D printing to launch micro-collections within days, meeting viral demand spikes without bloating inventory. Souvenirs retain relevance in tourist zones where location authenticity commands premiums, yet the category faces airport concession competition that compresses margins.

The gift retailing market size for Seasonal Decorations is projected to expand faster than the broader base, and retailers that pair eco-friendly materials with limited-edition drops defend price integrity. Greeting Cards maintain a niche through premium paper, embellishments, and embedded QR codes, though their volume stagnates. Giftware, especially home fragrance and tabletop items, benefits from corporate ESG sourcing rules, encouraging certified suppliers to capture institutional orders. The migration of fandom collectibles into decor, such as branded snow globes or themed light strings, fuses pop-culture licensing with traditional craft, supporting cross-category upselling.

The Gifts Retailing Market is Segmented by Product (Souvenirs and Novelty Items, Seasonal Decorations, Greeting Cards, Giftware, and Other Gift Items), by Distribution Channel (Offline and Online ), by Occasion (Birthday Gifts, Corporate Gifts, and Other) And, by Geography (North America, Europe, Asia-Pacific, Middle-East and Africa, and Latin America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe opened 2025 with the largest regional stake at 28.10% market share. Mature infrastructure, dense store networks, and long-standing gifting rituals sustain spend, yet economic headwinds and the rise of discount generalists cap growth. Sustainability concerns influence pre-purchase research, but final buying often tilts toward price rather than principle. Retailers counteract by labelling carbon footprints on shelf tags and running repair workshops that extend product life, framing value through durability. The increasing penetration of omnichannel strategies in categories such as electronics, souvenirs, and home fragrances is driving the adoption of experiential in-store pickups. These pickups not only enhance customer convenience but also function as strategic brand showcases, strengthening consumer engagement and brand visibility.

The Middle East & Africa region leads with an 8.23% CAGR outlook through 2031, powered by infrastructure megaprojects and youthful demographics. Dubai International Airport's expansion and Saudi Arabia's King Fahd upgrades are adding thousands of square meters of duty-free space where perfumes and confectionery dominate impulse gifting. UAE consumers posted the highest globally tracked net spending intentions at 13% for 2025, while high-income cohorts gravitate toward sustainable luxury goods. Local conglomerates co-invest with global brands to open experiential flagships that blend culture, cuisine, and curated gift corners. Mobile-first payment systems widen access for rural shoppers, supporting gift retail penetration beyond urban centres.

North America remains an innovation laboratory. Hallmark's NFL tie-ins bring sports-themed pop-ups to stadium concourses, converting fanfare into collectible sales. Yet the loss of the USD 800 de minimis import exemption injects cost and paperwork for cross-border online checkout, prompting some overseas merchants to suspend U.S. shipping. Asia-Pacific's recovery hinges on border reopening and restored outbound Chinese tourism; however, domestic travel and e-wallet penetration are cushioning retailers from international visitor volatility. South American markets such as Brazil and Chile see rising middle-class participation, though currency fluctuations require agile pricing strategies.

- Hallmark Cards Inc.

- American Greetings Corp.

- Card Factory PLC

- Walt Disney Co. (Disney Store)

- Spencer Gifts LLC

- Party City Holdco Inc.

- Etsy Inc.

- Amazon.com Inc. (Handmade & Gift)

- Walmart Inc.

- Target Corp.

- Dollar Tree Inc.

- Urban Outfitters Inc. (Anthropologie)

- Things Remembered

- Paper Source Inc.

- Archie McPhee

- Moonpig Group PLC

- Zazzle Inc.

- Shutterfly LLC

- Miniso Group Holding Ltd.

- Muji (Ryohin Keikaku Co.)

- Carrefour SA (Fnac Darty Gift Shops)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of experiential tourism driving souvenir demand

- 4.2.2 Rising disposable income in emerging economies

- 4.2.3 Seasonal promotional campaigns by retailers

- 4.2.4 3-D printing enabling hyper-personalised gifts

- 4.2.5 Corporate ESG gifting mandates favouring sustainable products

- 4.2.6 Growth of fandom culture & licensed collectibles

- 4.3 Market Restraints

- 4.3.1 Volatile raw-material costs for decorative items

- 4.3.2 Rising competition from digital greetings & cash apps

- 4.3.3 Anti-clutter consumer movements (e.g., minimalism)

- 4.3.4 Geopolitical tariffs on novelty imports

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product

- 5.1.1 Souvenirs and Novelty Items

- 5.1.2 Seasonal Decorations

- 5.1.3 Greeting Cards

- 5.1.4 Giftware

- 5.1.5 Other Gift Items

- 5.2 By Distribution Channel

- 5.2.1 Offline

- 5.2.2 Online

- 5.3 By Occasion

- 5.3.1 Birthday Gifts

- 5.3.2 Wedding & Anniversary Gifts

- 5.3.3 Corporate Gifts

- 5.3.4 Baby & Kids Gifts

- 5.3.5 Festive & Holiday Gifts

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.4.3.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 India

- 5.4.4.2 China

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 South-East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Hallmark Cards Inc.

- 6.4.2 American Greetings Corp.

- 6.4.3 Card Factory PLC

- 6.4.4 Walt Disney Co. (Disney Store)

- 6.4.5 Spencer Gifts LLC

- 6.4.6 Party City Holdco Inc.

- 6.4.7 Etsy Inc.

- 6.4.8 Amazon.com Inc. (Handmade & Gift)

- 6.4.9 Walmart Inc.

- 6.4.10 Target Corp.

- 6.4.11 Dollar Tree Inc.

- 6.4.12 Urban Outfitters Inc. (Anthropologie)

- 6.4.13 Things Remembered

- 6.4.14 Paper Source Inc.

- 6.4.15 Archie McPhee

- 6.4.16 Moonpig Group PLC

- 6.4.17 Zazzle Inc.

- 6.4.18 Shutterfly LLC

- 6.4.19 Miniso Group Holding Ltd.

- 6.4.20 Muji (Ryohin Keikaku Co.)

- 6.4.21 Carrefour SA (Fnac Darty Gift Shops)

7 Market Opportunities & Future Outlook

- 7.1 AI-powered predictive gifting platforms

- 7.2 Circular gifting & rental subscription services