PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911801

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911801

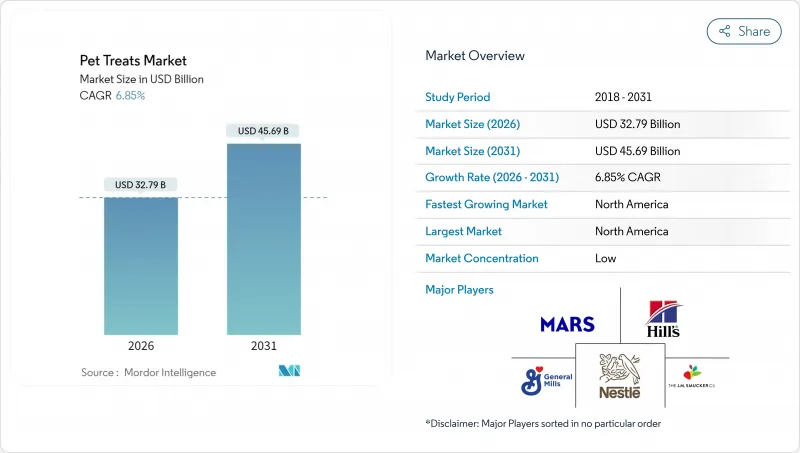

Pet Treats - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

pet treats market size in 2026 is estimated at USD 32.79 billion, growing from 2025 value of USD 30.69 billion with 2031 projections showing USD 45.69 billion, growing at 6.85% CAGR over 2026-2031.

Strong growth stems from the deepening humanization of companion animals, durable demand for functional nutrition, and the emotional attachment owners have to reward rituals that persist even when discretionary spending is tight. Within the broader pet care economy, the pet treats market represents a unique blend of essential wellness products and affordable luxury, enabling manufacturers to maintain volumes despite rising price elasticity elsewhere. Premium-positioned treats centered on dental health, single-source proteins, and gut-health additives establish the tone for competitive differentiation, while digital subscriptions enhance lifetime value and enable data-driven personalization of formulations.

Global Pet Treats Market Trends and Insights

Humanization of Pets and Premiumization of Treats

Pet owners increasingly treat companion animals as family members, driving demand for human-grade ingredients and artisanal formulations that mirror premium food trends. This behavioral shift transforms treats from simple rewards into wellness investments, with owners willing to pay premiums for organic certification, single-source proteins, and transparent supply chains. General Mills' USD 1.45 billion acquisition of Whitebridge Pet Brands in November 2024 specifically targeted the premium cat feeding and treat segments, recognizing their combined USD 24 billion retail value within the broader USD 52 billion United States pet food market. The humanization trend creates sustainable competitive advantages for brands that successfully communicate ingredient provenance and transparency in their manufacturing processes .

Accelerated Dental-Health Focus in Companion Animals

Veterinary professionals increasingly recommend daily dental chews as a preventive measure, transforming oral health treats from occasional purchases into a routine part of healthcare. This clinical endorsement drives consistent demand patterns that resist economic downturns, as pet owners prioritize veterinarian-recommended products over discretionary treats. The Veterinary Oral Health Council's seal of approval has become a critical differentiator, with VOHC-certified products commanding premium pricing and preferred shelf placement in specialty retail channels. Regulatory frameworks, such as those established by the Association of American Feed Control Officials (AAFCO), provide nutritional adequacy standards that support veterinary recommendations and foster consumer confidence in dental-specific treat formulations.

Price Inflation in Key Animal-Protein Inputs

Rising costs for poultry, beef, and fish proteins create margin pressure across all treat categories, with manufacturers facing difficult choices between price increases and reformulation strategies. Protein ingredients typically account for 40-60% of treat production costs, making input price volatility a critical factor affecting profitability and influencing investment decisions and capacity expansion plans. European markets experienced price increases of 14.8% in the pet category in Germany and 12.1% in the United Kingdom during 2023, prompting consumers to shift toward private-label alternatives and value-oriented formulations .

Other drivers and restraints analyzed in the detailed report include:

- Expansion of DTC Subscription Models for Treats

- Functional Treats with Probiotic and CBD Infusion

- Regulatory Scrutiny of Novel Functional Ingredients

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Crunchy treats maintain market leadership with 22.85% share in 2025, benefiting from established consumer preferences and manufacturing cost advantages that enable competitive pricing across all retail channels. These treats have gained significant traction among pet owners due to their versatility in training and rewarding purposes, especially with younger pets. Dogs hold the largest share within the crunchy treats segment, accounting for nearly 54% of consumption, followed by cats and other animals, highlighting the widespread appeal across different pet categories. The segment's growth is further supported by specialty stores and supermarkets/hypermarkets, which serve as major distribution channels, offering convenience and a wide range of products to consumers.

Soft and chewy treats emerge as the fastest-growing segment, with an 7.98% CAGR through 2031, driven by their superior capacity for incorporating functional ingredients and palatability advantages that support premium positioning. Soft and chewy treats offer a different texture profile that appeals to pets with specific preferences or dental sensitivities, making them particularly popular among cat owners. These segments are complemented by various other treat types, including lickable treats, cakes, catnips, and mineral blocks, which cater to diverse pet preferences and functional needs. Each segment contributes to the market's diversity by offering specialized solutions for different pet ages, sizes, and health requirements.

The Pet Treats Market Report is Segmented by Sub Product (Crunchy Treats, Dental Treats, Freeze-Dried and Jerky Treats, and More), by Pets (Cats, Dogs, and More), by Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, and More), and by Geography (Africa, Asia-Pacific, Europe, North America, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

North America maintains its position as the largest regional market, with a 39.35% share in 2025, with a CAGR of 7.58% through 2031, supported by mature pet ownership patterns, where over 70% of households own pets, and the average annual spending per pet-owning household reaches USD 938 . The region's growth trajectory reflects premiumization trends and the adoption of functional ingredients, with veterinary-recommended dental treats and subscription-based delivery models driving consistent demand patterns that are resilient to economic volatility.

The Asia-Pacific region emerges as the fastest-growing, driven by China's expanding pet ownership and South Korea's advanced e-commerce infrastructure, which enables sophisticated subscription models and personalized nutrition services. India's pet food market shows particular promise, driven by growing urban populations and increasing disposable income. Cultural preferences and price sensitivity necessitate the development and distribution of localized products.

Europe exhibits sophisticated demand patterns, with a strong emphasis on sustainability and organic certification, driving innovation in upcycled ingredients and carbon-neutral packaging solutions that shape global industry standards. The region's regulatory framework under European Pet Food Industry Federation (FEDIAF) guidelines creates compliance requirements that favor established players while ensuring product safety and quality standards that support premium positioning.

- Mars, Incorporated

- Nestle (Purina)

- Colgate-Palmolive Company (Hill's Pet Nutrition, Inc.)

- General Mills Inc.

- Schell & Kampeter, Inc. (Diamond Pet Foods)

- PLB International

- Clearlake Capital Group, L.P. (Wellness Pet Company, Inc.)

- Alltech

- Heristo aktiengesellschaft

- Affinity Petcare S.A

- Natural Balance

- Rayne Nutrition

- Unicharm

- Champion Petfoods

- Farmina Pet Foods

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 EXECUTIVE SUMMARY & KEY FINDINGS

3 REPORT OFFERS

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Consumer Trends

5 SUPPLY AND PRODUCTION DYNAMICS

- 5.1 Trade Analysis

- 5.2 Ingredient Trends

- 5.3 Value Chain and Distribution Channel Analysis

- 5.4 Regulatory Framework

- 5.5 Market Drivers

- 5.5.1 Humanization of Pets and Premiumization of Treats

- 5.5.2 Accelerated Dental-Health Focus in Companion Animals

- 5.5.3 Expansion of DTC Subscription Models for Treats

- 5.5.4 Functional Treats with Probiotic and CBD Infusion

- 5.5.5 Up-Cycling of Meat By-Products into Sustainable Treats

- 5.5.6 AI-Driven Personalized Treat Formulations

- 5.6 Market Restraints

- 5.6.1 Price Inflation in Key Animal-Protein Inputs

- 5.6.2 Regulatory Scrutiny of Novel Functional Ingredients

- 5.6.3 Carbon-Labeling Pressure from ESG-Minded Retailers

- 5.6.4 Rising Competition from Homemade Treat Communities

6 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 6.1 Sub Product

- 6.1.1 Crunchy Treats

- 6.1.2 Dental Treats

- 6.1.3 Freeze-dried and Jerky Treats

- 6.1.4 Soft and Chewy Treats

- 6.1.5 Other Treats

- 6.2 Pets

- 6.2.1 Cats

- 6.2.2 Dogs

- 6.2.3 Other Pets

- 6.3 Distribution Channel

- 6.3.1 Convenience Stores

- 6.3.2 Online Channel

- 6.3.3 Specialty Stores

- 6.3.4 Supermarkets/Hypermarkets

- 6.3.5 Other Channels

- 6.4 Geography

- 6.4.1 Africa

- 6.4.1.1 By Country

- 6.4.1.1.1 South Africa

- 6.4.1.1.2 Rest of Africa

- 6.4.1.1 By Country

- 6.4.2 Asia-Pacific

- 6.4.2.1 By Country

- 6.4.2.1.1 Australia

- 6.4.2.1.2 China

- 6.4.2.1.3 India

- 6.4.2.1.4 Indonesia

- 6.4.2.1.5 Japan

- 6.4.2.1.6 Malaysia

- 6.4.2.1.7 Philippines

- 6.4.2.1.8 Taiwan

- 6.4.2.1.9 Thailand

- 6.4.2.1.10 Vietnam

- 6.4.2.1.11 Rest of Asia-Pacific

- 6.4.2.1 By Country

- 6.4.3 Europe

- 6.4.3.1 By Country

- 6.4.3.1.1 France

- 6.4.3.1.2 Germany

- 6.4.3.1.3 Italy

- 6.4.3.1.4 Netherlands

- 6.4.3.1.5 Poland

- 6.4.3.1.6 Russia

- 6.4.3.1.7 Spain

- 6.4.3.1.8 United Kingdom

- 6.4.3.1.9 Rest of Europe

- 6.4.3.1 By Country

- 6.4.4 North America

- 6.4.4.1 By Country

- 6.4.4.1.1 Canada

- 6.4.4.1.2 Mexico

- 6.4.4.1.3 United States

- 6.4.4.1.4 Rest of North America

- 6.4.4.1 By Country

- 6.4.5 South America

- 6.4.5.1 By Country

- 6.4.5.1.1 Argentina

- 6.4.5.1.2 Brazil

- 6.4.5.1.3 Rest of South America

- 6.4.5.1 By Country

- 6.4.1 Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Brand Positioning Matrix

- 7.4 Market Claim Analysis

- 7.5 Company Landscape

- 7.6 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments)

- 7.6.1 Mars, Incorporated

- 7.6.2 Nestle (Purina)

- 7.6.3 Colgate-Palmolive Company (Hill's Pet Nutrition, Inc.)

- 7.6.4 General Mills Inc.

- 7.6.5 Schell & Kampeter, Inc. (Diamond Pet Foods)

- 7.6.6 PLB International

- 7.6.7 Clearlake Capital Group, L.P. (Wellness Pet Company, Inc.)

- 7.6.8 Alltech

- 7.6.9 Heristo aktiengesellschaft

- 7.6.10 Affinity Petcare S.A

- 7.6.11 Natural Balance

- 7.6.12 Rayne Nutrition

- 7.6.13 Unicharm

- 7.6.14 Champion Petfoods

- 7.6.15 Farmina Pet Foods

8 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS