PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911810

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911810

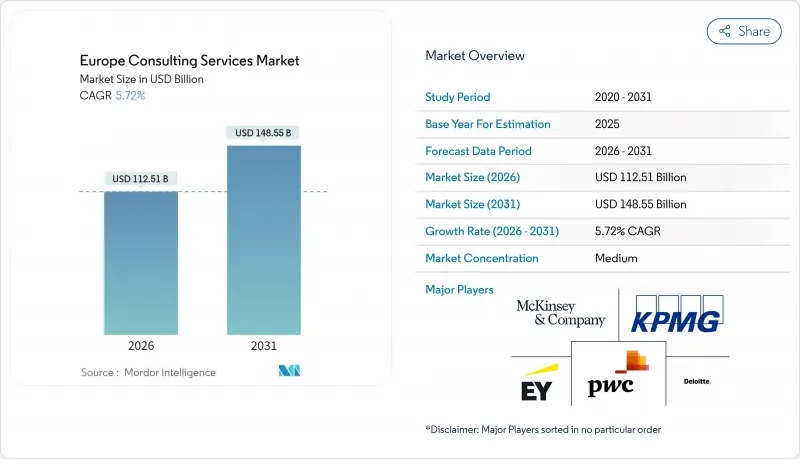

Europe Consulting Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe Consulting Services Market is expected to grow from USD 106.42 billion in 2025 to USD 112.51 billion in 2026 and is forecast to reach USD 148.55 billion by 2031 at 5.72% CAGR over 2026-2031.

This steady climb underscores how professional services firms have adapted to economic uncertainty, digital-first mandates, and tightening sustainability rules. Demand strengthens as the European Commission's Digital Europe Programme channels EUR 7.9 billion toward technology adoption, allowing service providers to expand cross-border engagements. Geopolitical supply-chain stress keeps operational excellence projects at the top of client agendas, while heavy AI investment by leading firms converts emerging technology into day-to-day consulting deliverables. Funding from the EU Recovery and Resilience Facility (RRF) accelerates small-business adoption of external expertise, widening the customer base and reducing dependence on large-enterprise budgets. Competitive intensity rises as the Big Four plough more than USD 4 billion into AI capabilities, reshaping service delivery economics and pushing mid-tier players toward niche specialisms.

Europe Consulting Services Market Trends and Insights

Regulatory Convergence for Cross-Border Services

The European Union is reducing administrative friction by aligning digital regulations, letting consulting firms replicate solutions across borders with fewer compliance checks. Germany and France formalized cooperation on interoperable public-sector software in 2024, giving early movers a chance to develop reusable playbooks that cut project lead times. Mid-sized providers gain new reach because they no longer need full legal teams for each country. While complete harmonization will not occur until 2027, firms that invest now in multilingual regulatory expertise stand to win multiyear frameworks as governments scale joint services.

Accelerated Client Demand for AI-Enabled Productivity Consulting

C-suites view artificial intelligence as an essential lever for cost containment and growth, translating into sizeable advisory pipelines. Germany's AI market alone is growing 15% annually and could add EUR 430 billion to GDP by 2030, underpinning a surge in AI strategy, data engineering, and change-management engagements. Deloitte's new Zora platform and EY's fleet of 150 AI agents illustrate how the largest firms are productizing intellectual property to deliver 25-40% productivity gains for clients. Smaller consultancies must pivot to hyper-specialized AI applications or risk margin squeeze as basic automation becomes commoditized.

Persistent Talent Deficit in Advanced Analytics

European consultancies cannot hire data scientists fast enough. CEDEFOP's Labour and Skills Shortage Index flags analytics and AI roles as high-pressure occupations through 2035. German and French governments report persistent gaps despite record tech job creation, forcing firms to pay premiums or offshore work. Scarcity inflates project costs and slows delivery, reducing the addressable volume for advanced analytics engagements. Smaller providers feel the pinch hardest because they struggle to match Big Four compensation packages, thereby intensifying market consolidation risks.

Other drivers and restraints analyzed in the detailed report include:

- EU Green Deal and CSRD Compliance Pressures

- SME Digital-Maturity Funding via EU RRF Grants

- Fee-Compression from Procurement-Led Negotiations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Operations consulting generated the largest revenue slice, capturing 28.12% of the European consulting services market share in 2025 as companies sought supply-chain resilience and cost savings amid geopolitical strains. The European consulting services market continues to prioritise lean manufacturing, process re-engineering, and working-capital optimization, anchoring steady fee streams for specialists. In parallel, digital transformation consulting is growing at a 7.49% CAGR, the fastest among all segments, powered by AI, cloud migration, and sustainability dashboards.

Strategy, financial advisory, and HR/change management retain essential roles, yet demand increasingly converges around integrated transformation offerings blending technology, risk management, and workforce enablement. Technology advisory enjoys heightened relevance because cyber threats multiply and cloud architectures fragment. Sustainability and ESG consulting now overlap with core operational mandates as firms embed carbon accounting into process flows. Service providers that create multidisciplinary squads around sector-specific playbooks will defend relevance as the European consulting services market shifts from siloed engagements toward platform-based, outcome-linked programmes.

The ICT and Media sector contributed 29.56% of 2025 revenue, reflecting constant technology refresh cycles and heavy software innovation. This client group continues to pilot generative AI, 5G monetization, and edge computing projects, sustaining robust demand within the European consulting services market. Consumer and Retail, however, is registering a 7.41% CAGR to 2031 as omnichannel investment, last-mile logistics, and data-driven merchandising accelerate.

Financial services keep consulting spend elevated on account of capital adequacy regulations and digital banking competition, while manufacturing turns to Industry 4.0 roadmaps and energy-efficient plant retrofits. Healthcare clients ramp up electronic-medical-record consolidation and cloud-hosted ERP migrations such as Asklepios Kliniken's SAP S/4HANA rollout, which required 18 months of external support. Energy and Utilities look for grid digitization and hydrogen-ready infrastructure planning, creating niche opportunities for sustainability-focused advisers.

Europe Consulting Services Market is Segmented by Service Type (Operations Consulting, Strategy Consulting, Financial Advisory, and More), Client Industry (BFSI, Manufacturing and Industrials, and More), Enterprise Size (Large Enterprises and Small and Medium Enterprises), Delivery Model (On-Site Engagement, Remote/Virtual, and Hybrid Model), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Deloitte Touche Tohmatsu Limited

- Ernst & Young Global Limited

- KPMG International

- PricewaterhouseCoopers LLP

- McKinsey & Company

- Boston Consulting Group

- Bain & Company

- Accenture PLC

- Kearney

- Roland Berger

- Capgemini Invent

- BearingPoint

- Oliver Wyman

- L.E.K. Consulting

- Alvarez & Marsal

- Grant Thornton International

- BDO Advisory

- PA Consulting Group

- IBM Consulting

- Infosys Consulting

- Atos Consulting

- Wipro Consulting Services

- NTT DATA Business Solutions

- CGI Inc.

- Tata Consultancy Services (TCS) Consulting

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Regulatory convergence for cross-border services

- 4.2.2 Accelerated client demand for AI-enabled productivity consulting

- 4.2.3 EU Green Deal and CSRD compliance pressures

- 4.2.4 SME digital-maturity funding via EU RRF grants

- 4.2.5 Shift to outcome-based pricing models

- 4.2.6 Near-shoring driven by geopolitical risk in supply chains

- 4.3 Market Restraints

- 4.3.1 Persistent talent deficit in advanced analytics

- 4.3.2 Fee-compression from procurement-led negotiations

- 4.3.3 Generative-AI DIY toolkits reducing entry-level work

- 4.3.4 Regulatory scrutiny on large integrator-consultant M&A

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Service Type

- 5.1.1 Operations Consulting

- 5.1.2 Strategy Consulting

- 5.1.3 Financial Advisory

- 5.1.4 Technology Advisory

- 5.1.5 HR and Change Management

- 5.1.6 Sustainability and ESG Consulting

- 5.1.7 Digital Transformation Consulting

- 5.2 By Client Industry

- 5.2.1 BFSI

- 5.2.2 Manufacturing and Industrials

- 5.2.3 Healthcare and Life Sciences

- 5.2.4 Energy and Utilities

- 5.2.5 ICT and Media

- 5.2.6 Consumer and Retail

- 5.2.7 Other Client Industries

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Delivery Model

- 5.4.1 On-site Engagement

- 5.4.2 Remote/Virtual

- 5.4.3 Hybrid Model

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Benelux

- 5.5.5 Italy

- 5.5.6 Nordics

- 5.5.7 Spain

- 5.5.8 Central and Eastern Europe (incl. Poland)

- 5.5.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Deloitte Touche Tohmatsu Limited

- 6.4.2 Ernst & Young Global Limited

- 6.4.3 KPMG International

- 6.4.4 PricewaterhouseCoopers LLP

- 6.4.5 McKinsey & Company

- 6.4.6 Boston Consulting Group

- 6.4.7 Bain & Company

- 6.4.8 Accenture PLC

- 6.4.9 Kearney

- 6.4.10 Roland Berger

- 6.4.11 Capgemini Invent

- 6.4.12 BearingPoint

- 6.4.13 Oliver Wyman

- 6.4.14 L.E.K. Consulting

- 6.4.15 Alvarez & Marsal

- 6.4.16 Grant Thornton International

- 6.4.17 BDO Advisory

- 6.4.18 PA Consulting Group

- 6.4.19 IBM Consulting

- 6.4.20 Infosys Consulting

- 6.4.21 Atos Consulting

- 6.4.22 Wipro Consulting Services

- 6.4.23 NTT DATA Business Solutions

- 6.4.24 CGI Inc.

- 6.4.25 Tata Consultancy Services (TCS) Consulting

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment