PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911816

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911816

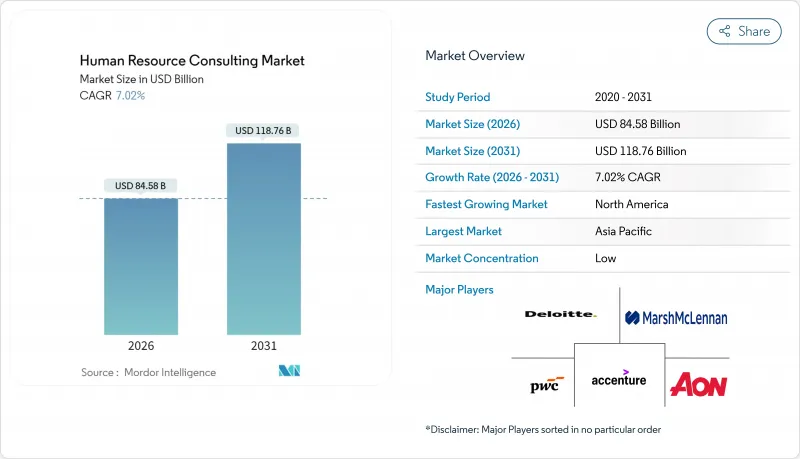

Human Resource Consulting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Human Resource Consulting market is expected to grow from USD 79.03 billion in 2025 to USD 84.58 billion in 2026 and is forecast to reach USD 118.76 billion by 2031 at 7.02% CAGR over 2026-2031.

The human resource consulting market is benefiting from rapid digital HR-tech adoption, stricter global compliance demands, and the urgent need to redesign work for hybrid models. North America presently anchors the human resource consulting market, yet Asia-Pacific is closing the gap quickly as SMEs digitize HR processes and regional regulators harmonize employment rules. Intensifying M&A activity, deeper analytics penetration, and immersive up-skilling technologies are widening advisory scopes, while commoditization of routine tasks pushes firms toward higher-value engagements. Competition remains moderate because the top-five firms command just one-fourth of the combined revenue, leaving ample white space for niche specialists.

Global Human Resource Consulting Market Trends and Insights

Digital HR-tech Adoption & Analytics Integration

Companies worldwide are embedding AI, machine learning, and predictive analytics in people processes, which raises the bar for data-driven workforce decisions. Advisory demand spikes when leadership teams lack internal capability to translate data signals into actionable talent strategies, a gap that only 21% of HR heads believe they have bridged . The shift from on-premises suites to cloud HCM and point-solution ecosystems is generating sizeable implementation and change-management opportunities for consultancies. In the Asia-Pacific region, first-time buyers among SMEs accelerate platform rollouts, extending the human resource consulting market footprint in tier-two cities. Consultants increasingly bundle managed analytics services with training so clients can self-serve dashboards, yet still buy strategic insight. Organizations that have leveraged analytics to enhance retention times demonstrate measurable financial gains while reinforcing enduring advisory relationships. These success stories underscore the strategic value of data-driven decision-making in fostering customer loyalty and driving sustainable business growth.

Regulatory Complexity (DEI, Pay Transparency, ESG)

A fast-evolving rulebook covering equal pay, inclusive hiring, and sustainability disclosure is reshaping the human resource consulting market across mature and emerging economies. The EU Pay Transparency Directive obliges companies to publish gender pay-gap metrics, while several U.S. states enforce salary-range postings, nudging global multinationals toward rigorous audit programs. Heightened scrutiny by investors and regulators on human-capital metrics in 10-K filings fuels consulting around data collection and narrative design. HR teams must also align with the EU AI Act's human-in-the-loop safeguards for algorithmic hiring, a requirement propelling demand for specialized risk reviews . Because legislatures revise statutes frequently, forward-looking clients engage external partners on ongoing retainer models rather than one-off gap assessments.

Commoditization of Routine HR Advisory Tasks

AI-driven workflow engines now draft policies, draft proposals, and prepare dashboards that junior consultants once produced manually. This automation lowers perceived differentiation for standard deliverables and exerts downward pricing pressure across the human resource consulting market. Established firms respond by pivoting toward premium domains such as AI ethics, climate workforce planning, and cross-border regulatory orchestration. Boutique providers counter by embedding domain IP into subscription software, locking in annuity revenue despite lower ticket sizes. Although strategic work remains insulated, the volume of commoditized tasks reduces the sector CAGR by 1.3% in medium-term forecasts.

Other drivers and restraints analyzed in the detailed report include:

- Hybrid/Remote Work Transformation Needs

- M&A-led Organizational Restructuring Wave

- In-house HR Analytics Capabilities Rising

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, talent management held the largest slice of the human resource consulting market at 26.02%, reflecting organizations' urgent need to secure scarce skills and craft succession pipelines. HR Analytics, although representing a smaller base, is on course to expand at a 12.18% CAGR, indicating outsized appetite for data-backed talent strategies. The human resource consulting market size for analytics-related engagements is projected to climb steadily, propelled by clients' recognition that robust insights cut turnover costs and lift engagement metrics. Compensation & Benefits work is undergoing a redesign as pay-transparency rules force firms into real-time benchmarking, prompting cross-border harmonization projects. Advisory demand in Learning & Development tilts toward immersive formats that capitalize on XR and adaptive learning to shorten skill cycles.

Organizations that integrated predictive models into hiring processes reported time-to-fill reductions of 30%, underscoring analytics' strategic relevance. Talent Management services remain resilient because evolving skills taxonomies and gig-style labour models complicate workforce planning for even sophisticated HR departments. Meanwhile, Human Capital Strategy projects rise in prominence as clients pursue boundaryless HR operating models that break down silos across finance, IT, and line leadership. Mid-cycle reviews show that only 8% of enterprises rate their analytics muscle as "strong," unlocking a sizeable advisory backlog. Consequently, service providers that couple domain expertise with scalable tech playbooks is positioned to capture disproportionate value in the human resource consulting market.

The Human Resource Consulting Market Segments by Service (Human Capital Strategy, Compensation and Benefits, Talent Management, Organizational Change, Learning and Development, HR Function, HR Analytics), by End User (IT and Telecom, BFSI, Healthcare, and Other), and by Geography (Asia-Pacific, North America, Europe, South America, Middle East & Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 39.88% human resource consulting market share in 2025 underscores its status as the sector's most mature region, supported by advanced analytics adoption and comprehensive pay-transparency statutes. Advisory pipelines focus on AI governance, sustainability workforce planning, and total-rewards personalization, although federal budget tightening has tempered short-term growth. Canadian and Mexican demand rises on the back of cross-border labour-mobility programs under USMCA, adding regional nuance to talent-strategy projects. Providers are differentiating through proprietary AI accelerators targeted at regulated industries, reinforcing North America's premium-pricing profile. Despite near-term softness, the region's high client sophistication ensures sustained long-run relevance for the human resource consulting market.

Europe represents a multifaceted opportunity, buoyed by sweeping regulatory changes such as the EU AI Act and Pay Transparency Directive that generate consistent compliance work. In 2025, several countries introduced fresh protections, from Germany's whistle-blower reforms to the Netherlands' disability-hiring incentives, intensifying localization needs. Nordic and BENELUX clients emphasize ESG-linked pay, driving sophisticated reward-strategy projects, while Southern Europe prioritizes digital workforce transformation for mid-cap firms. M&A activity rebounded sharply, sparking post-deal integration assignments centred on cultural harmonization and leadership retention. Aging demographics across Western Europe further boost succession-planning mandates, reinforcing the human resource consulting market outlook.

Asia-Pacific, projected to register an 8.78% CAGR, remains the engine of future expansion for the human resource consulting market, propelled by MSME digitalization programs and rising cross-border trade. Southeast Asia's HCM software boom leads to strong implementation and managed-services contracts for local and global advisers . China and India anchor scale projects, ranging from AI-enabled recruitment to regulatory remediation, while Australia and Japan invest heavily in analytics centers of excellence. Government funds targeting SME capability building spread advisory demand into second-tier cities, creating new client pools. These dynamics position Asia-Pacific to challenge Western dominance and redefine global revenue shares before 2030.

- Deloitte

- PwC

- KPMG

- EY

- McKinsey & Company

- Boston Consulting Group

- Bain & Company

- Accenture

- Mercer

- Aon

- Willis Towers Watson

- Korn Ferry

- Randstad

- Adecco

- Hay Group

- Oliver Wyman

- IBM Consulting

- SAP SuccessFactors Services

- Workday Advisory Services

- Tata Consultancy Services

- Infosys

- Capgemini

- HCLTech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digital HR-tech adoption & analytics integration

- 4.2.2 Hybrid/remote work transformation needs

- 4.2.3 Regulatory complexity (DEI, pay transparency, ESG)

- 4.2.4 M&A-led organizational restructuring wave

- 4.2.5 Immersive XR-based workforce up-skilling demand

- 4.2.6 SME accelerator programs in emerging markets

- 4.3 Market Restraints

- 4.3.1 Commoditization of routine HR advisory tasks

- 4.3.2 Client budget compression during downturns

- 4.3.3 In-house HR analytics capabilities rising

- 4.3.4 Data-privacy / AI-ethics compliance hurdles

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service

- 5.1.1 Human Capital Strategy

- 5.1.2 Compensation & Benefits

- 5.1.3 Talent Management

- 5.1.4 Organizational Change

- 5.1.5 Learning & Development

- 5.1.6 HR Function

- 5.1.7 HR Analytics

- 5.2 By End-User

- 5.2.1 IT & Telecom

- 5.2.2 BFSI

- 5.2.3 Healthcare

- 5.2.4 Retail and E-Commerce

- 5.2.5 Other End-Users

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Medium Enterprises

- 5.3.3 Small Enterprises

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 Canada

- 5.4.1.2 United States

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX

- 5.4.3.7 NORDICS

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 India

- 5.4.4.2 China

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 South-East Asia

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East & Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Deloitte

- 6.4.2 PwC

- 6.4.3 KPMG

- 6.4.4 EY

- 6.4.5 McKinsey & Company

- 6.4.6 Boston Consulting Group

- 6.4.7 Bain & Company

- 6.4.8 Accenture

- 6.4.9 Mercer

- 6.4.10 Aon

- 6.4.11 Willis Towers Watson

- 6.4.12 Korn Ferry

- 6.4.13 Randstad

- 6.4.14 Adecco

- 6.4.15 Hay Group

- 6.4.16 Oliver Wyman

- 6.4.17 IBM Consulting

- 6.4.18 SAP SuccessFactors Services

- 6.4.19 Workday Advisory Services

- 6.4.20 Tata Consultancy Services

- 6.4.21 Infosys

- 6.4.22 Capgemini

- 6.4.23 HCLTech

7 Market Opportunities & Future Outlook

- 7.1 Generative-AI talent-intelligence advisory

- 7.2 Climate-transition workforce planning services