PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911818

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911818

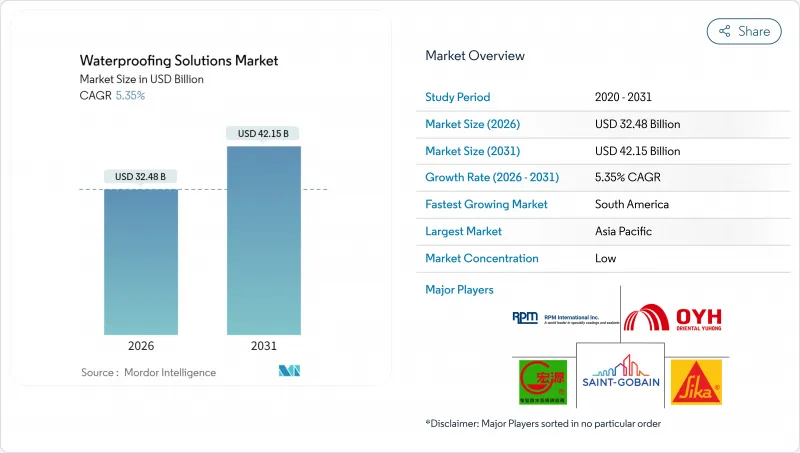

Waterproofing Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Waterproofing Solutions market is expected to grow from USD 30.83 billion in 2025 to USD 32.48 billion in 2026 and is forecast to reach USD 42.15 billion by 2031 at 5.35% CAGR over 2026-2031.

The current expansion reflects a decisive pivot from reactive repairs to proactive building-envelope protection, as green-building mandates, infrastructure resilience goals, and labor-saving construction methods converge. Liquid-applied membranes, which cure seamlessly and require fewer skilled installers, are replacing many sheet-based systems in both new-build and retrofit settings. Tighter VOC regulations have accelerated the reformulation of chemical coatings toward water-borne and bio-based chemistries, while public-sector procurement now values total life-cycle performance over initial cost. Finally, data-center cooling intensity, tunnel rehabilitation, and climate-adaptation projects are broadening the application base, keeping pricing power relatively stable despite volatility in raw materials.

Global Waterproofing Solutions Market Trends and Insights

Surge in Green-Building Low-VOC Mandates

Regulators now limit VOC content to 50 g/L or lower for many waterproofing categories, pushing solvent-based coatings off specifications in public housing and commercial projects. Manufacturers with advanced emulsion-polymer chemistry are capturing premium positions by delivering water-based membranes that match or surpass the durability of solvent-borne membranes. Contractors embrace these products because reduced on-site odors shorten re-occupancy cycles and cut worker-exposure risks. Labels indicating LEED-compatible or EU Ecolabel compliance have become critical purchasing cues for architects. In parallel, emerging bio-based resins enable firms to advertise carbon footprint reductions, offering differentiation beyond simple VOC compliance.

Rapid Urbanization and Infrastructure Build-Out

Megacity expansion is adding millions of square feet of roof, podium, and below-grade surfaces each year across Asia and South America. Large dams, subways, and flood-control tunnels require specialized membranes that perform under sustained hydrostatic pressure. High-rise construction heightens the consequence of failure, so design teams specify multi-layer liquid-applied systems backed by long warranties. Modular-prefab apartment blocks further favor factory-applied waterproof coatings that arrive onsite fully cured, shrinking labor hours. As governments bundle climate-resilience clauses into tenders, suppliers with track records on landmark infrastructure quickly climb bid shortlists.

Volatile Petro-Resin Input Prices

Epoxy, polyurethane, and PVC feedstocks track crude oil fluctuations, which in turn affect finished goods prices every quarter. Natural-rubber shortfalls lifted raw-material costs by 15-20% between 2024 and 2025, forcing manufacturers to hedge inventory and issue rapid surcharge notices. Smaller formulators with limited purchasing power struggled to secure supplies, conceding market share to integrated majors. Some contractors substituted cementitious coatings where feasible, but performance gaps limit wholesale migration. Continuous volatility encourages research and development into bio-sourced or recycled polymers to buffer price risk, although industrial-scale volumes remain nascent.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Hyperscale Data Centers

- Rapid Growth in Public Infrastructure Projects

- Specialist-Installer Labor Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Membranes accounted for 73.42% of the revenue in 2025, reflecting the waterproofing solutions market share dominance of sheet and liquid systems, which deliver uniform thickness and rapid installation. At the segment level, membranes are projected to command the highest 5.69% CAGR to 2031, meaning their share of the waterproofing solutions market size is forecasted to widen steadily. Demand aligns with the growth of modular buildings, where cold-liquid-applied polyurethanes form seamless skins around volumetric modules. Hot-spray polyureas remain favored on civil structures because instant curing allows traffic reopening within hours, even in humid climates. Fully adhered sheets continue to lead the way in low-slope roofing, thanks to their well-documented ASTM test pedigree, while loose-laid assemblies find ecological niches in green-roof and plaza-deck designs that require root-resistant yet reversible layers.

Manufacturers are engineering primers that bond across dissimilar substrates to simplify transitions from concrete to metal or thermoplastic. Integrated QA platforms using RFID-tagged rolls now log batch, spread-rate, and ambient-condition data, assuring specifiers of performance consistency. Meanwhile, industry collaboration on ISO 22114 testing harmonizes outcomes across domestic codes, easing cross-border project approvals. Overall, membranes' materials evolution and job-site efficiencies keep them the go-to solution for value-driven owners seeking low life-cycle costs within the waterproofing solutions market.

The Global Waterproofing Solutions Market Report is Segmented by Product (Chemicals Including Epoxy-Based, Polyurethane-Based, Water-Based, and Other Technologies; Membranes Including Cold Liquid Applied, Hot Liquid Applied, Fully Adhered Sheet, and Loose-Laid Sheet), End-Use Sector (Commercial, Residential, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region retained a commanding 36.70% of 2025 revenue as China, India, and Southeast Asia continued to drive housing, expressway, and hydropower projects. Large public-private partnerships underpin volume commitments that reward suppliers who can establish regional warehouses and technical crews near project hubs. Japan and South Korea, with stringent building codes, adopted high-spec liquid membranes early, setting benchmarks that were later emulated in emerging neighbors. Growth accelerates when governments integrate waterproofing line items into broader climate-adaptation programs, channeling stimulus toward flood protection and elevated rail structures.

South America is projected to deliver the strongest 6.22% CAGR through 2031, as Brazil reinstates urban-mobility funding and Colombia completes cross-Andean tunnels. Exchange-rate swings encourage local manufacturing of polymer resins, creating joint-venture openings for multinationals. Argentina's gradual recovery drives pent-up residential demand, prompting distributors to stock fast-curing acrylic membranes suitable for labor-constrained sites. Regional climate, with heavy rainfall and high UV, favors elastomeric systems that stay flexible, and government tenders increasingly list ASTM C836 or EN 14891 as mandatory standards.

North America and Europe exhibit mature, low-single-digit growth, yet set the global technology pace. The U.S. Infrastructure Investment and Jobs Act steers billions into bridge-deck overlays and stormwater tunnels, maintaining a resilient base for premium suppliers. Europe's Green Deal shifts specifications toward fully recyclable or bio-based layers, pressuring petrochemical-heavy formulations. The Middle East and Africa markets concentrate demand in Gulf megaprojects, where extreme heat drives the uptake of UV-stable polyureas. Meanwhile, South Africa's urban renewal allocates funds to low-income housing waterproofing, financed by development banks.

- Ardex Group

- Arkema (Bostik)

- Asian Paints Ltd.

- Beijing Oriental Yuhong Waterproof Technology Co., Ltd.

- Hongyuan Waterproof Technology Group Co., Ltd.

- Keshun Waterproof Technology Co., Ltd.

- Kingspan Group

- Minerals Technologies Inc.

- Nippon Paint Holdings Co., Ltd.

- Pidilite Industries Ltd.

- RPM International Inc.

- Saint-Gobain

- Sika AG

- Soprema

- Thermax Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in green-building low-VOC mandates

- 4.2.2 Rapid urbanisation and infrastructure build-out

- 4.2.3 Expansion of hyperscale data centres

- 4.2.4 Rapid growth in public infrastructure projects

- 4.2.5 Robust shift towards liquid-applied membranes in modular construction

- 4.3 Market Restraints

- 4.3.1 Volatile petro-resin input prices

- 4.3.2 Specialist-installer labour shortage

- 4.3.3 Microplastic compliance burden

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Industry Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Chemicals

- 5.1.1.1 Epoxy-based

- 5.1.1.2 Polyurethane-based

- 5.1.1.3 Water-based

- 5.1.1.4 Other Technologies

- 5.1.2 Membranes

- 5.1.2.1 Cold Liquid Applied

- 5.1.2.2 Hot Liquid Applied

- 5.1.2.3 Fully Adhered Sheet

- 5.1.2.4 Loose-Laid Sheet

- 5.1.1 Chemicals

- 5.2 By End-Use Sector

- 5.2.1 Commercial

- 5.2.2 Industrial and Institutional

- 5.2.3 Infrastructure

- 5.2.4 Residential

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 Australia

- 5.3.1.2 China

- 5.3.1.3 India

- 5.3.1.4 Indonesia

- 5.3.1.5 Japan

- 5.3.1.6 Malaysia

- 5.3.1.7 South Korea

- 5.3.1.8 Thailand

- 5.3.1.9 Vietnam

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 Canada

- 5.3.2.2 Mexico

- 5.3.2.3 United States

- 5.3.3 Europe

- 5.3.3.1 France

- 5.3.3.2 Germany

- 5.3.3.3 Italy

- 5.3.3.4 Russia

- 5.3.3.5 Spain

- 5.3.3.6 United Kingdom

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Argentina

- 5.3.4.2 Brazil

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ardex Group

- 6.4.2 Arkema (Bostik)

- 6.4.3 Asian Paints Ltd.

- 6.4.4 Beijing Oriental Yuhong Waterproof Technology Co., Ltd.

- 6.4.5 Hongyuan Waterproof Technology Group Co., Ltd.

- 6.4.6 Keshun Waterproof Technology Co., Ltd.

- 6.4.7 Kingspan Group

- 6.4.8 Minerals Technologies Inc.

- 6.4.9 Nippon Paint Holdings Co., Ltd.

- 6.4.10 Pidilite Industries Ltd.

- 6.4.11 RPM International Inc.

- 6.4.12 Saint-Gobain

- 6.4.13 Sika AG

- 6.4.14 Soprema

- 6.4.15 Thermax Limited

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

8 Key Strategic Questions for CEOS