PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911819

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911819

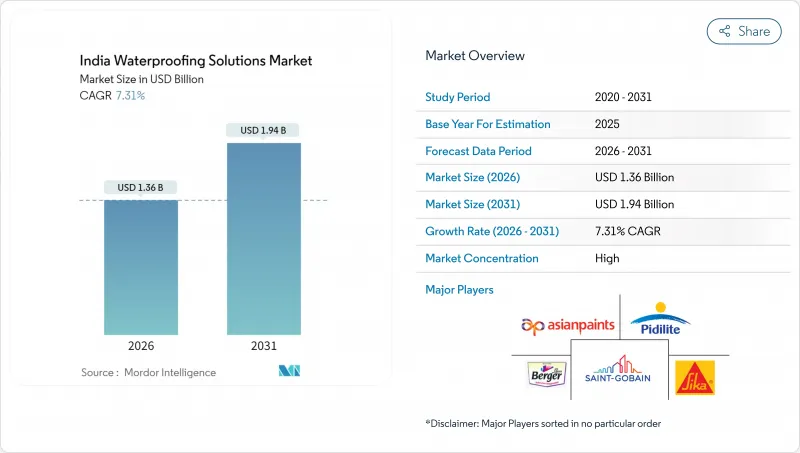

India Waterproofing Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The India Waterproofing Solutions Market is expected to grow from USD 1.27 billion in 2025 to USD 1.36 billion in 2026 and is forecast to reach USD 1.94 billion by 2031 at 7.31% CAGR over 2026-2031.

Robust public spending under the National Infrastructure Pipeline, stricter building codes focused on climate resilience, and a clear customer pivot toward preventive maintenance keep the India Waterproofing Solutions market on a stable growth path despite raw-material cost swings. Membranes remain the favored technology because they combine proven performance in aggressive monsoon conditions with the extended warranties demanded by developers and affluent homeowners. Residential construction drives premiumization, while commercial, industrial, and infrastructure projects create scale for advanced systems such as heat-reflective hybrid membranes. Competitive intensity is high as diversified paint majors and specialized chemical suppliers race to improve reseaarch and development, strengthen applicator networks, and comply with the Bureau of Indian Standards' upgraded waterproofing specifications.

India Waterproofing Solutions Market Trends and Insights

Rapid Urbanization and Affordable-Housing Stimulus

India adds more than 10 million urban residents each year, and the Pradhan Mantri Awas Yojana alone targets 20 million new affordable units by 2025. Developers increasingly specify preventive waterproofing at the design stage because retrofits cost up to five times more than original installation. Budget 2024-25 earmarked USD 144 billion for climate-resilient infrastructure, a move that directly links funding to BIS-compliant waterproofing. Smart-City projects in 100 municipalities have elevated demand for membranes that perform in underground metro stations, multilevel parking structures, and mixed-use towers. Vertical construction in dense urban cores favors cold liquid applied membranes, which adapt to complex geometries without joints that could fail under differential settlement.

Adoption of Hybrid Liquid Membranes with Heat-Reflectivity

Hybrid liquid membranes that combine waterproofing with near-infrared reflectance reduce rooftop temperatures by as much as 15 °C during peak summer, lowering HVAC energy loads and helping buildings qualify for IGBC and LEED points. Asian Paints and Sika AG have scaled polymer research and development to address durability and color-fastness concerns in India's ultraviolet-intense climate. Early adopters include data centers and manufacturing plants where energy savings compound quickly across large roof areas. The technology has begun penetrating residential high-rise projects, where reduced heat gain adds marketing value for developers targeting mid-premium buyers. Over the long term, broader rollout depends on lowering product cost through local raw-material sourcing and higher manufacturing volumes.

Fragmented Applicator Base Driving Workmanship Failures

Small contractors with limited formal training install about 80% of waterproofing systems nationwide, leading to inconsistent workmanship and premature failures.Urban developers increasingly mandate OEM-certified applicators, yet reaching India's sprawling construction market remains challenging. Manufacturers fund regional training centers, but retention of skilled labor is low because workers migrate between short-term projects. In the immediate term, workmanship failures erode end-user confidence and slow the shift toward premium membranes that require meticulous installation.

Other drivers and restraints analyzed in the detailed report include:

- Intensifying Monsoons Prompting Climate-Resilient Codes

- Shift Toward Low-VOC Nano-Penetrating Technologies

- Limited Tier-3/Rural Awareness for Preventive Waterproofing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Membranes represented 65.62% of the India Waterproofing Solutions market share in 2025 and will maintain a 7.46% CAGR to 2031, reinforcing their status as the functional benchmark for demanding applications. Cold liquid applied membranes attract residential builders because they form seamless barriers over complex roof lines and cure without torches, enhancing job-site safety. Fully adhered sheet systems dominate large-format commercial roofs and podium slabs where proven 20-year field performance matters. Hot liquid variants address chemical plants and refineries, while loose-laid sheets support fast-track infrastructure projects by enabling pre-fabricated installation sequences.

Advanced elastomeric chemistry helps membranes bridge cracks up to 2 mm, a critical advantage in high-rise structures subject to differential movement. Warranties now extend to 12 years in premium residential segments, and digital inspection tools allow manufacturers to audit installations before issuing coverage. While chemicals retain relevance for localized repairs and niche substrates, the India Waterproofing Solutions market size for membranes keeps increasing as cost per square meter falls with scale. Strategic raw-material backward integration by major suppliers further cushions membrane pricing against crude-driven volatility.

The India Waterproofing Solutions Report is Segmented by Sub Product (Chemicals and Membranes), and End-Use Sector (Commercial, Industrial and Institutional, Infrastructure, and Residential). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Ardex Group

- Asian Paints

- Berger Paints India Limited

- Bostik (Arkema)

- Choksey FixGuruu

- CICO Group

- Kryton International Inc.

- MAPEI S.p.A.

- MC-Bauchemie

- Pidilite Industries Ltd.

- Saint-Gobain

- Sika AG

- Soprema Group

- STP Limited, India

- Ultratech Cement Ltd.

- Xypex Chemical Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid urbanization and affordable-housing stimulus

- 4.2.2 Adoption of hybrid liquid membranes that add heat-reflectivity

- 4.2.3 Intensifying monsoons prompting climate-resilient codes

- 4.2.4 Home-owner premiumization and 10-year warranty demand

- 4.2.5 Shift toward low-VOC nano-penetrating technologies

- 4.3 Market Restraints

- 4.3.1 Fragmented applicator base driving workmanship failures

- 4.3.2 Crude-linked raw-material volatility hitting PU and bitumen

- 4.3.3 Limited tier-3 / rural awareness for preventive waterproofing

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Sub Product

- 5.1.1 Chemicals

- 5.1.1.1 Epoxy-based

- 5.1.1.2 Polyurethane-based

- 5.1.1.3 Water-based

- 5.1.1.4 Other Technologies

- 5.1.2 Membranes

- 5.1.2.1 Cold Liquid Applied

- 5.1.2.2 Fully Adhered Sheet

- 5.1.2.3 Hot Liquid Applied

- 5.1.2.4 Loose-Laid Sheet

- 5.1.1 Chemicals

- 5.2 By End-Use Sector

- 5.2.1 Commercial

- 5.2.2 Industrial and Institutional

- 5.2.3 Infrastructure

- 5.2.4 Residential

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Ardex Group

- 6.4.2 Asian Paints

- 6.4.3 Berger Paints India Limited

- 6.4.4 Bostik (Arkema)

- 6.4.5 Choksey FixGuruu

- 6.4.6 CICO Group

- 6.4.7 Kryton International Inc.

- 6.4.8 MAPEI S.p.A.

- 6.4.9 MC-Bauchemie

- 6.4.10 Pidilite Industries Ltd.

- 6.4.11 Saint-Gobain

- 6.4.12 Sika AG

- 6.4.13 Soprema Group

- 6.4.14 STP Limited, India

- 6.4.15 Ultratech Cement Ltd.

- 6.4.16 Xypex Chemical Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment