PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911822

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911822

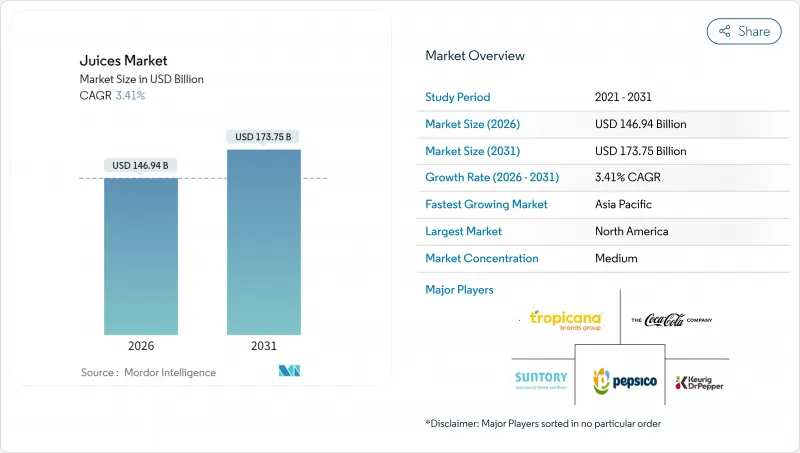

Juices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The global juices market is expected to grow from USD 142.10 billion in 2025 to USD 146.94 billion in 2026 and is forecast to reach USD 173.75 billion by 2031 at 3.41% CAGR over 2026-2031.

Growth in the market is driven by strong demand for premium, minimally processed products, counterbalanced by the expansion of sugar taxes in over 45 jurisdictions and climate-related challenges affecting citrus and apple harvests. Factors such as functional fortification, the rapid development of cold-chain infrastructure in the Asia-Pacific region, and the adoption of aseptic cartons, which reduce lifecycle carbon emissions by 30%, are contributing to value creation. Additionally, sugar-conscious consumers are driving the transition to 100% juice and not-from-concentrate (NFC) options, while organic-certified products are commanding higher price premiums in North America and Europe. Competitive dynamics are shifting toward smaller, high-margin segments, including direct-to-consumer cold-pressed shots, probiotic blends, and blockchain-verified provenance, which align with ESG-focused procurement trends.

Global Juices Market Trends and Insights

Product innovation and functional fortification

Product innovation and functional fortification are significantly influencing the global juices market, transforming traditional fruit and vegetable juices into beverages designed to provide specific health benefits beyond hydration and taste. In response to growing consumer demand for wellness-oriented products, manufacturers are incorporating ingredients such as probiotics, adaptogens, turmeric, collagen peptides, vitamins, and antioxidants into juice formulations. These additions aim to address consumer needs related to digestive health, immunity, stress management, skin health, and overall well-being. Innovation in fortified juice products is reflected in the diverse range of functional ingredients being utilized and the strategic initiatives of major brands to differentiate through health-focused offerings. Functional juice blends featuring probiotics, adaptogens, turmeric, and collagen peptides are being positioned as lifestyle beverages that cater to specific health objectives and promote daily wellness. For instance, PepsiCo's Tropicana Essentials Probiotics line, introduced in North America, combines Lactobacillus strains with 100% orange juice to appeal to gut-health-conscious millennials. This example highlights how leading companies are leveraging functional fortification to reshape consumer expectations within the juice category.

Sugar-averse shift to 100% and NFC juices

The global juices market is experiencing a notable shift due to increasing consumer aversion to sugar, which is influencing purchasing behavior and product expectations. As health awareness grows globally, consumers are paying closer attention to the sugar content in beverages, including juices that were traditionally considered healthy. This trend has led to a rising demand for 100% juices, produced solely from fruit or vegetable juice without added sugars, and NFC (Not From Concentrate) juices, which undergo minimal processing to retain natural flavor and perceived nutritional value. Health concerns and epidemiological trends are further driving this preference for low-sugar options. According to the International Diabetes Federation, Portugal recorded the highest adult diabetes prevalence in Europe at 14.3% in 2024, followed by Croatia at 13.7% . These figures underscore the public health challenges posed by metabolic diseases and are contributing to the growing demand for low-sugar beverage alternatives in the region. Similar patterns of health risk awareness are evident globally, encouraging consumers to choose juices that provide natural fruit nutrition without added sugars.

Sugar-tax expansion in more than 45 countries

The implementation of sugar taxes in over 45 countries is increasingly restricting growth in the global juices market, particularly for products with higher levels of natural or added sugar. Although juices are often promoted as nutritious beverages, many contain inherent sugars that fall under these regulatory measures. This has resulted in price increases for sugar-rich juices, potentially reducing demand among price-sensitive consumers and limiting volume growth in impacted markets. Additionally, the expansion of sugar taxation requires manufacturers to reformulate products, invest in sugar-reduction technologies, or develop low- and no-sugar alternatives. These efforts add to production complexity and costs. In regions such as Europe and Latin America, where sugar taxes are becoming integral to public health strategies, juice brands face the dual challenge of preserving flavor and nutritional value while adhering to tax regulations.

Other drivers and restraints analyzed in the detailed report include:

- Sustainable and recyclable beverage-carton adoption

- Rapid cold-chain and HPP capacity build-out in Asia-Pacific

- Climate-driven citrus and apple supply volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Juice drinks (up to 24% juice) accounted for 47.62% of 2025 revenue, supported by affordability and widespread distribution. However, the segment's growth is slowing due to the impact of sugar taxes and increasing health awareness, which are diminishing its value proposition. The 100% juice segment is projected to grow at a CAGR of 3.94% through 2031, driven by premiumization and the rising demand for not-from-concentrate (NFC) products. Brands such as Coca-Cola's Simply and PepsiCo's Tropicana Pure Premium are gaining market share by eliminating flavor packs and emphasizing single-origin sourcing. Juice concentrates, which were previously dominant in foodservice and industrial applications, are facing challenges from tariff fluctuations and a shift toward ready-to-drink formats. Despite this, they maintain cost advantages in bulk catering and export markets where reconstitution infrastructure is available.

Regulatory frameworks are significantly influencing segment trends. The EU Fruit Juice Directive mandates clear labeling of juice content percentages and prohibits misleading "natural" claims on diluted drinks. Similar standards are being adopted by food regulatory agencies in Australia and Canada. The segment's development highlights a clear divergence: volume-driven juice drinks are defending market share through private-label collaborations, while 100% juice and nectars are focusing on higher margins by leveraging wellness narratives and ingredient transparency.

PET bottles accounted for 38.78% of the packaging market share in 2025, driven by consumer familiarity, resealability, and transparency, which conveys freshness. However, aseptic packaging is growing at a compound annual growth rate (CAGR) of 4.31% through 2031, supported by sustainability mandates and the cost advantages of ambient distribution. Tetra Pak's Tetra Evero Aseptic, incorporating a paper-based barrier and plant-derived polymers, achieved 12% adoption among European juice brands in 2025. This packaging reduced carbon footprints by 30% compared to virgin PET and aligned with EU Extended Producer Responsibility targets.

The packaging market is increasingly segmented by use cases. PET bottles dominate take-home and refrigerated retail due to their clarity and resealability. Aseptic cartons are preferred for ambient distribution and rural markets where cold chain infrastructure is limited. Glass packaging is positioned in premium organic and artisanal segments, while cans are favored for impulse purchases and on-the-go consumption. Technological advancements are driving hybrid solutions, such as PET bottles with 50% recycled content and cartons with bio-based caps, which aim to balance sustainability, functionality, and cost. These developments often benefit larger players with the resources to navigate complex certification processes and invest in research and development.

The Global Juices Market Report is Segmented by Product Type (100% Juice, Juice Drinks (up To 24% Juice), Juice Concentrates, and Nectars), Packaging Type (PET Bottles, Aseptic Packages, Glass Bottles, Metal Can, and Disposable Cups and Pouches), Category (Conventional and Organic), Distribution Channel (Off-Trade, On-Trade), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 27.94% of the 2025 turnover, driven by established breakfast habits and widespread access to refrigerated products. However, market maturity and increasing consumer awareness of sugar content have slowed overall growth. Traditional leaders such as Tropicana and Simply Orange have lost market share to emerging cold-pressed brands like Suja and Evolution Fresh. In Canada, the demand for organic products is growing rapidly, supported by consumer preferences for healthier options and stricter labeling regulations. Meanwhile, Mexico's sugar tax continues to influence product reformulations, favoring alternatives like stevia and agave nectar, as manufacturers adapt to shifting consumer preferences and regulatory pressures.

The Asia-Pacific region is experiencing the fastest growth, with a 5.18% compound annual growth rate (CAGR), supported by rising urban incomes and investments in high-pressure processing (HPP) and cold-chain infrastructure. Nongfu Spring's entry into the not-from-concentrate (NFC) segment has positioned juice as a lifestyle product in China, appealing to health-conscious urban consumers. In India, the popularity of mango juice is fueled by regional varietal preferences, with brands leveraging local sourcing to enhance authenticity and appeal. Japan's functional beverage market has expanded to include electrolyte-rich hybrids, catering to an aging population and a growing focus on wellness. However, regulatory fragmentation poses challenges, complicating the standardization of stock-keeping units (SKUs) across borders within the global juice market, which limits the scalability of certain product lines.

Europe represents a mature but evolving market influenced by sustainability regulations and reduced-sugar initiatives. Southern Europe capitalizes on its abundant stone-fruit crops for nectars, though irrigation challenges linked to climate change present risks to long-term production. Producers are increasingly adopting water-efficient practices and exploring alternative crop varieties to mitigate these challenges. In South America, Brazil remains a focal point as the leading exporter of orange juice, benefiting from its extensive citrus plantations and established export networks. However, domestic consumption is limited by affordability issues, with lower-income households opting for cheaper alternatives. Meanwhile, Argentina's high inflation rates have significantly reduced 2025 volumes, underscoring the region's vulnerability to macroeconomic risks and the need for producers to adopt cost-effective strategies to maintain competitiveness.

- The Coca-Cola Company

- PepsiCo Inc.

- Tropicana Brands Group

- Keurig Dr Pepper Inc.

- Suntory Holdings Ltd.

- Nongfu Spring Co. Ltd.

- Britvic plc

- Eckes-Granini Group GmbH

- Thai Beverage PCL

- Uni-President Enterprises Corp.

- Rauch Fruchtsafte GmbH & Co OG

- The Kraft Heinz Company

- Tingyi (Cayman Islands) Holding Corp.

- Ocean Spray Cranberries Inc.

- Del Monte Pacific Ltd.

- Nestle S.A.

- Suja Life LLC

- Bolthouse Farms Inc.

- Welch Foods Inc.

- Campbell Soup Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Product innovation and functional fortification

- 4.2.2 Sugar-averse shift to 100 % and NFC juices

- 4.2.3 Sustainable and recyclable beverage-carton adoption

- 4.2.4 Digital D2C subscription platforms for juice shots

- 4.2.5 Rapid cold-chain and HPP capacity build-out in Asia-Paific

- 4.2.6 Growth in portion control and single-serve packaging

- 4.3 Market Restraints

- 4.3.1 Geopolitical tariff swings on juice concentrates

- 4.3.2 Loss of nutritional value due to processing for extended shelf life

- 4.3.3 Sugar-tax expansion in more than 45 countries

- 4.3.4 Climate-driven citrus and apple supply volatility

- 4.4 Supply Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECATS (VALUE)

- 5.1 By Product Type

- 5.1.1 100% Juice

- 5.1.2 Juice Drinks (up to 24% Juice)

- 5.1.3 Juice Concentrates

- 5.1.4 Nectars

- 5.2 By Packaging Type

- 5.2.1 Aseptic packages

- 5.2.2 Glass Bottles

- 5.2.3 Metal Can

- 5.2.4 PET Bottles

- 5.2.5 Disposable Cups and Pouches

- 5.3 By Category

- 5.3.1 Conventional

- 5.3.2 Organic

- 5.4 By Distribution Channel

- 5.4.1 Off-Trade

- 5.4.1.1 Supermarkets/Hypermarkets

- 5.4.1.2 Convenience Stores

- 5.4.1.3 Online Retail

- 5.4.1.4 Other Distribution Channels

- 5.4.2 On-Trade

- 5.4.1 Off-Trade

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 The Coca-Cola Company

- 6.4.2 PepsiCo Inc.

- 6.4.3 Tropicana Brands Group

- 6.4.4 Keurig Dr Pepper Inc.

- 6.4.5 Suntory Holdings Ltd.

- 6.4.6 Nongfu Spring Co. Ltd.

- 6.4.7 Britvic plc

- 6.4.8 Eckes-Granini Group GmbH

- 6.4.9 Thai Beverage PCL

- 6.4.10 Uni-President Enterprises Corp.

- 6.4.11 Rauch Fruchtsafte GmbH & Co OG

- 6.4.12 The Kraft Heinz Company

- 6.4.13 Tingyi (Cayman Islands) Holding Corp.

- 6.4.14 Ocean Spray Cranberries Inc.

- 6.4.15 Del Monte Pacific Ltd.

- 6.4.16 Nestle S.A.

- 6.4.17 Suja Life LLC

- 6.4.18 Bolthouse Farms Inc.

- 6.4.19 Welch Foods Inc.

- 6.4.20 Campbell Soup Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK