PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934583

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934583

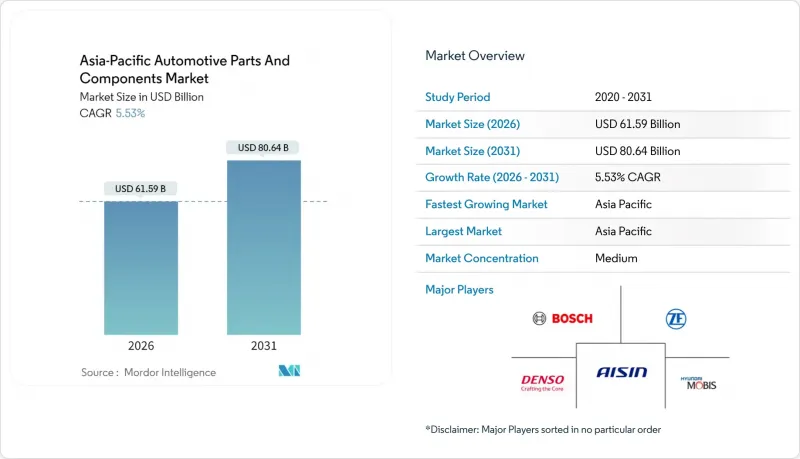

Asia-Pacific Automotive Parts And Components - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Asia-Pacific automotive components market size in 2026 is estimated at USD 61.59 billion, growing from 2025 value of USD 58.36 billion with 2031 projections showing USD 80.64 billion, growing at 5.53% CAGR over 2026-2031.

Robust electrification policies, new vehicle-production lines in China and India, and broader deployment of advanced driver-assistance systems shape this growth path. Automakers accelerate battery-electric rollouts, driving demand for lightweight alloys and high-value electronics, while additive manufacturing shortens product-development cycles and trims tooling costs. Localization mandates across ASEAN economies spur regional supply-chain realignment, and aging fleets in mature markets bolster the replacement-parts business. Nevertheless, raw-material cost swings, semiconductor shortages, and fragmented regulatory frameworks restrain near-term momentum. The Asia-Pacific automotive components market continues to reward suppliers that pair scale with software expertise and resilient sourcing strategies.

Asia-Pacific Automotive Parts And Components Market Trends and Insights

Expansion of Vehicle-Production Capacity in China and India

China produced 31.28 million vehicles in 2024, including more than 10 million new-energy models, reinforcing its position as the primary demand engine for precision powertrain and electronic-control units . India follows with multi-billion-dollar green-field plants geared toward global exports, prompting tier-one suppliers to localize advanced casting, forging, and semiconductor packaging lines. Both markets target higher export ratios, compelling component makers to align with international homologation standards while safeguarding cost advantages. The Asia-Pacific automotive components market benefits from this volume surge, yet suppliers must diversify sourcing to hedge against single-country slowdowns and comply with divergent local-content rules.

Rising Adoption of Advanced Automotive Electronics / ADAS

Chinese suppliers control half of global LiDAR output, and new regulations mandate Level 3 autonomy readiness of new cars by 2025 . Semiconductor content per battery electric vehicle averages twice that of internal combustion models, encouraging vertically integrated chip-to-software stacks. Suppliers must pair functional safety firmware with over-the-air update architectures and invest in cyber-resilience testing. The Asia-Pacific automotive components market tilts toward electronics specialists, raising the entry barrier for purely mechanical vendors.

Raw-Material Price Volatility

Aluminum, copper, and nickel prices trend upward through 2026 as energy-transition demand collides with mining-permit delay . China supplies roughly 85% of rare-earth oxides, underscoring concentration risk for magnet-driven traction motors. Component manufacturers engage in hedging contracts and closed-loop scrap recycling to buffer cost shocks. Insert-molded composite parts and high-strength steel grades also gain favor for cost-to-weight advantages. Still, sudden commodity price spikes squeeze margins and slow capacity expansion in the Asia-Pacific automotive components market.

Other drivers and restraints analyzed in the detailed report include:

- Accelerated EV-Friendly Incentives Across Asia-Pacific

- ASEAN Localization Mandates for EV Supply-Chain Vendors

- OEM Shift to Captive Software-Defined Platforms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Driveline & Powertrain retained the leading 34.72% slice of the Asia-Pacific automotive components market share in 2025, anchored by universal fitment across ICE, hybrid, and battery-electric platforms. Electronics, however, is growing at a 7.29% CAGR, propelled by embedded ADAS sensors, zonal controllers, and high-voltage conversion units. Passenger-car OEMs increasingly adopt centralized domain architectures that funnel multiple functions through consolidated chips, intensifying the electronics bill of materials. Component makers must also comply with evolving cybersecurity regulations, such as UNECE R155, which add software overhead but favor established tier-ones equipped with in-house encryption expertise.

Interiors and exteriors benefit from cabin premiumization trends, including augmented-reality head-up displays and sustainable trim substrates. Body and chassis suppliers pivot toward giga-casting-friendly aluminum grades that curtail weld points and improve structural rigidity. Wheel and tire vendors roll out low rolling-resistance compounds optimized for heavier EV curb weights. Filtration businesses expand into cabin HEPA systems and dielectric-fluid filters tailored for battery-electric powertrains. The net result is a portfolio shift toward electrification-ready designs, with electronics shouldering the lion's share of incremental value capture within the Asia-Pacific automotive components market.

Passenger cars continued to generate 63.05% of component demand in 2025, yet two-wheelers chart the fastest 8.12% CAGR on the back of favorable tax breaks, low-cost battery-swap networks, and urban congestion policies. Electric scooter sales are expected to climb by 2030, raising requirements for compact traction motors and solid-state controllers. Commercial vehicles adopt battery-electric drivelines for last-mile logistics, with Japan's mandatory zero-emission freight zones slated for 2028. Off-highway OEMs test autonomous and hybrid loaders for mining and construction, embedding ruggedized sensors and telematics.

Component suppliers navigate contrasting bill-of-material profiles: passenger cars demand sophisticated driver-assistance electronics, whereas low-voltage two-wheelers prioritize cost-optimized power modules and robust charging connectors. Firms with modular product families can cater to both ends of the spectrum, sustaining volume scale while capturing higher margins on premium passenger-car lines. Consequently, the Asia-Pacific automotive components market rewards flexible manufacturing footprints and agile engineering teams.

The Asia-Pacific Automotive Components Market Report is Segmented by Type (Driveline and Powertrain, and More), Vehicle Type (Passenger Cars, and More), Propulsion (Internal Combustion Engine, and More), Sales Channel (Original Equipment Manufacturers, and More), Material (Steel, and More), Manufacturing Process (Stamping and Forging, Casting, and More), and by Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- DENSO Corporation

- Robert Bosch GmbH

- Aisin Corporation

- ZF Friedrichshafen AG

- Continental AG

- Hyundai Mobis Co., Ltd.

- Magna International Inc.

- Mitsubishi Electric Corporation

- Hitachi Astemo, Ltd.

- Panasonic Automotive Systems Co., Ltd.

- Magneti Marelli S.p.A.

- HELLA GmbH & Co. KGaA

- Lear Corporation

- Valeo SA

- Faurecia SE (FORVIA)

- Nidec Corporation

- Cummins Inc.

- Motherson Sumi Systems Ltd.

- Yazaki Corporation

- Toyota Boshoku Corporation

- GKN Automotive

- NSK Ltd.

- NTN Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Vehicle-Production Capacity in China and India

- 4.2.2 Accelerated EV-Friendly Incentives Across APAC

- 4.2.3 Rising Adoption of Advanced Automotive Electronics / ADAS

- 4.2.4 Ageing Fleet Spurring High-Value Aftermarket Demand.

- 4.2.5 Rapid Giga casting Deployment Driving Lightweight-Alloy Demand

- 4.2.6 ASEAN Localization Mandates for EV Supply-Chain Vendors

- 4.3 Market Restraints

- 4.3.1 Raw-Material Price Volatility (Steel, Aluminum, Rare Earths)

- 4.3.2 Persistent Semiconductor and Logistics Bottlenecks

- 4.3.3 OEM Shift to Captive Software-Defined Platforms

- 4.3.4 Fragmented Cross-Border Compliance Costs Inside APAC

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Key Suppliers Mapping Across the Region

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Type

- 5.1.1 Driveline & Powertrain

- 5.1.2 Interiors & Exteriors

- 5.1.3 Electronics

- 5.1.4 Bodies & Chassis

- 5.1.5 Wheels & Tires

- 5.1.6 Other Components (Filtration, Fluids, etc.)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.2.3 Two-Wheelers

- 5.2.4 Off-Highway Vehicles

- 5.3 By Propulsion

- 5.3.1 Internal Combustion Engine (ICE)

- 5.3.2 Battery Electric Vehicles (BEV)

- 5.3.3 Hybrid Electric Vehicles (HEV)

- 5.3.4 Plug-in Hybrid Electric Vehicles (PHEV)

- 5.3.5 Fuel Cell Electric Vehicles (FCEV)

- 5.3.6 Alternative Fuels (CNG, LPG, Biofuels)

- 5.4 By Sales Channel

- 5.4.1 Original Equipment Manufacturers (OEM)

- 5.4.2 Aftermarket

- 5.4.2.1 Original Equipment Service (OES)

- 5.4.2.2 Independent Aftermarket and E-Commerce Aftermarket

- 5.5 By Material

- 5.5.1 Steel

- 5.5.2 Aluminium

- 5.5.3 Composites

- 5.5.4 Plastics & Polymers

- 5.5.5 Others (Magnesium, Carbon Fibre)

- 5.6 By Manufacturing Process

- 5.6.1 Stamping & Forging

- 5.6.2 Casting (Die, Sand, Investment)

- 5.6.3 Machining

- 5.6.4 Additive Manufacturing

- 5.7 By Country

- 5.7.1 China

- 5.7.2 India

- 5.7.3 Japan

- 5.7.4 South Korea

- 5.7.5 Thailand

- 5.7.6 Indonesia

- 5.7.7 Vietnam

- 5.7.8 Australia & New Zealand

- 5.7.9 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 DENSO Corporation

- 6.4.2 Robert Bosch GmbH

- 6.4.3 Aisin Corporation

- 6.4.4 ZF Friedrichshafen AG

- 6.4.5 Continental AG

- 6.4.6 Hyundai Mobis Co., Ltd.

- 6.4.7 Magna International Inc.

- 6.4.8 Mitsubishi Electric Corporation

- 6.4.9 Hitachi Astemo, Ltd.

- 6.4.10 Panasonic Automotive Systems Co., Ltd.

- 6.4.11 Magneti Marelli S.p.A.

- 6.4.12 HELLA GmbH & Co. KGaA

- 6.4.13 Lear Corporation

- 6.4.14 Valeo SA

- 6.4.15 Faurecia SE (FORVIA)

- 6.4.16 Nidec Corporation

- 6.4.17 Cummins Inc.

- 6.4.18 Motherson Sumi Systems Ltd.

- 6.4.19 Yazaki Corporation

- 6.4.20 Toyota Boshoku Corporation

- 6.4.21 GKN Automotive

- 6.4.22 NSK Ltd.

- 6.4.23 NTN Corporation

7 Market Opportunities & Future Outlook