PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934594

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934594

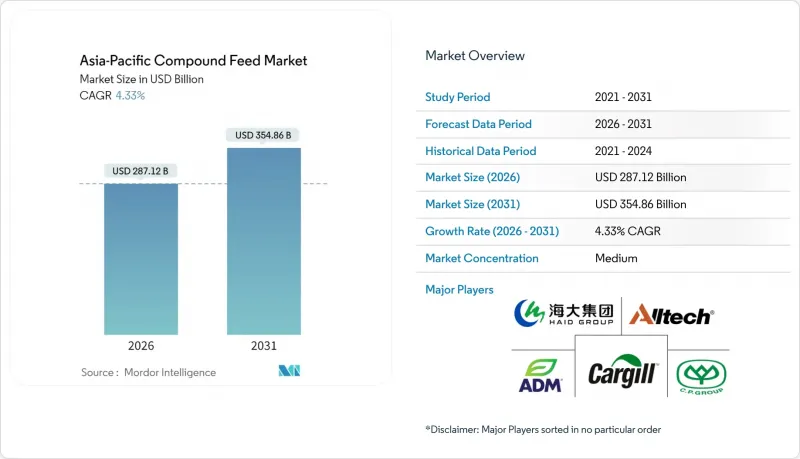

Asia-Pacific Compound Feed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Asia-Pacific compound feed market is expected to grow from USD 275.21 billion in 2025 to USD 287.12 billion in 2026 and is forecast to reach USD 354.86 billion by 2031 at 4.33% CAGR over 2026-2031.

Robust demand for animal protein, especially among rapidly urbanizing middle-class households, reinforces the need for precision-formulated feed that maximizes feed-to-meat conversion efficiency. Large integrated producers accelerate adoption of automated feed mills and real-time quality systems, allowing them to lock in raw-material margins and comply with emerging antibiotic-free regulations. Innovative oilseed and single-cell protein offerings diversify ingredient baskets, tempering exposure to volatile corn and soybean prices while improving amino-acid profiles in aqua and swine rations. At the same time, e-commerce platforms shorten supply chains, giving smaller feed mills access to premium additives once controlled by large distributors, thereby enhancing competitive intensity across the region.

Asia-Pacific Compound Feed Market Trends and Insights

Rising Demand for Animal Protein

Urban household diets continue to shift toward meat, eggs, and dairy, pushing per-capita meat consumption in China during 2024. Higher disposable incomes likewise lifted Vietnam's protein intake year-over-year. Producers consequently demand feeds with superior digestibility and balanced amino-acid ratios so poultry feed conversion stays under 1.8. Synthetic lysine and methionine volumes rise because they deliver consistent quality while minimizing pathogen risk. The protein transition also spurs installation of precision-feeding controllers that meter nutrients to genetic potential, reducing waste and emission intensity.

Expansion of Commercial Aquaculture

Intensive shrimp and finfish farms across Southeast Asia increasingly rely on extruded pellets fortified with marine proteins, functional binders, and water-stable coatings. Vietnam's shrimp capacity rose 15% in 2024, underscoring strong downstream pull for species-specific diets. Sophisticated extrusion lines now handle alternative oils and single-cell proteins, improving pellet water stability and nutrient retention. Equipment vendors report stronger sales of twin-screw extruders and inline vacuum coaters, enabling formulators to load heat-sensitive enzymes post-pellet without performance loss. These enhancements sharpen feed conversion and support export-oriented producers chasing eco-label certifications.

Volatile Corn and Soybean Prices

Spot corn swung between USD 200 and USD 280 per metric ton in 2024, while soybean meal ranged USD 350-450. Such swings stress mills lacking hedging lines, leading to hurried reformulations that impair consistency. Least-cost formulation software adoption surged as nutritionists sought real-time recalculations. Mid-tier mills increasingly substitute rice bran, cassava chips, and wheat middlings, moderating exposure yet complicating nutrient-profile management.

Other drivers and restraints analyzed in the detailed report include:

- Government Subsidies for Feed Mills

- Growth of E-commerce Feed Ingredient Trade

- Surge in Fermented Single-Cell Proteins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cereals retained 42.60% of the Asia-Pacific compound feed market share in 2025 as corn and wheat underpin energy requirements across poultry, swine, and ruminant diets. Higher inclusion limits stem from predictable nutrient profiles, established logistics, and advanced mycotoxin-control routines. Oilseeds are forecast to log a 5.55% CAGR, driven by soybean meal's superior amino-acid balance and growing preference for canola meal in shrimp and tilapia diets. The Asia-Pacific compound feed market size in cereals was substantially larger than all other ingredient pools combined in 2025, yet oilseed volumes are closing the gap as fishmeal substitution accelerates.

Rice-bran fermentation pilots in Vietnam convert high-fiber by-products into protein-rich concentrates, signaling future value-addition of local crops. The oil segment serves high-energy rations for fast-growing broilers and nursery pigs, while molasses remains essential for pelleting and palatability in ruminant cubes. Local processors also valorize food-processing by-products such as rice polish and coconut cake, diversifying the Asia-Pacific compound feed market and cushioning import exposure.

The Asia-Pacific Compound Feed Market Report is Segmented by Ingredients (Cereals, Oilseeds, Oils, Molasses, and More), by Supplements (Vitamins, Amino Acids, Antibiotics, Enzymes, and More), by Animal Type (Ruminant Feed, Swine Feed, Poultry Feed, Aquatic Feed, and Other Animal Types), and by Geography (China, India, Japan, Thailand, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Charoen Pokphand Group

- Cargill, Incorporated

- New Hope Liuhe Group

- Archer Daniels Midland(ADM)

- Alltech Inc

- Nutreco (SHV Holdings)

- Land O'Lakes Inc

- De Heus Animal Nutrition B.V.

- Kyodo Shiryo Company (Feed One Co., Ltd.)

- Japfa Ltd.

- Zheng DA International Group

- Ballance Agri-Nutrients Ltd.

- Weston Milling Animal Nutrition (George Weston Foods)

- Kent Nutrition Group

- Guangdong Haid Group

- Ridley Corp Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for animal protein

- 4.2.2 Expansion of commercial aquaculture

- 4.2.3 Government subsidies for feed mills

- 4.2.4 Growth of e-commerce feed ingredient trade

- 4.2.5 Enzymatic feed additive cost reductions

- 4.2.6 Genomic breeding driving precision nutrition

- 4.3 Market Restraints

- 4.3.1 Volatile corn and soybean prices

- 4.3.2 Surge in fermented single-cell proteins

- 4.3.3 Stricter antibiotic-free regulations

- 4.3.4 Logistics bottlenecks at regional ports

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Ingredients

- 5.1.1 Cereals

- 5.1.2 Oilseeds

- 5.1.3 Oils

- 5.1.4 Molasses

- 5.1.5 Supplements

- 5.1.6 Other Ingredients

- 5.2 By Supplements

- 5.2.1 Vitamins

- 5.2.2 Amino Acids

- 5.2.3 Antibiotics

- 5.2.4 Enzymes

- 5.2.5 Antioxidants

- 5.2.6 Acidifiers

- 5.2.7 Prebiotics and Probiotics

- 5.2.8 Other Supplements

- 5.3 By Animal Type

- 5.3.1 Ruminant Feed

- 5.3.2 Swine Feed

- 5.3.3 Poultry Feed

- 5.3.4 Aquatic Feed

- 5.3.5 Other Animal Types

- 5.4 By Geography

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 Thailand

- 5.4.5 Vietnam

- 5.4.6 Australia

- 5.4.7 Rest of Asia Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Charoen Pokphand Group

- 6.4.2 Cargill, Incorporated

- 6.4.3 New Hope Liuhe Group

- 6.4.4 Archer Daniels Midland(ADM)

- 6.4.5 Alltech Inc

- 6.4.6 Nutreco (SHV Holdings)

- 6.4.7 Land O'Lakes Inc

- 6.4.8 De Heus Animal Nutrition B.V.

- 6.4.9 Kyodo Shiryo Company (Feed One Co., Ltd.)

- 6.4.10 Japfa Ltd.

- 6.4.11 Zheng DA International Group

- 6.4.12 Ballance Agri-Nutrients Ltd.

- 6.4.13 Weston Milling Animal Nutrition (George Weston Foods)

- 6.4.14 Kent Nutrition Group

- 6.4.15 Guangdong Haid Group

- 6.4.16 Ridley Corp Ltd.

7 Market Opportunities and Future Outlook