PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937261

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937261

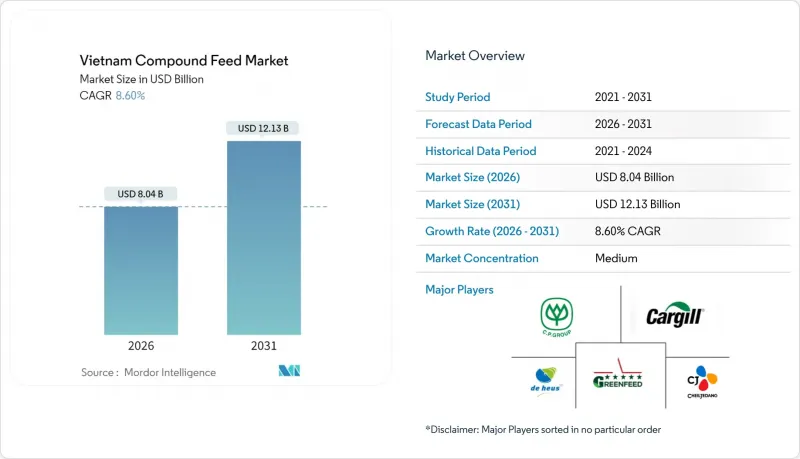

Vietnam Compound Feed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Vietnam compound feed market is expected to grow from USD 7.40 billion in 2025 to USD 8.04 billion in 2026 and is forecast to reach USD 12.13 billion by 2031 at 8.6% CAGR over 2026-2031.

Vietnam has emerged as Southeast Asia's fastest-growing feed market, supported by its recovery from African Swine Fever and its development as a regional aquaculture export center. The market demonstrates strength through the adoption of integrated farming models and government initiatives to decrease reliance on imported feed ingredients, which currently represent 80% of raw material requirements. The industry consists of 265 feed manufacturing facilities, including 85 foreign-invested enterprises and 180 domestic producers, creating a distinct two-tier competitive landscape. The gap between large-scale producers and smaller mills continues to widen due to integrated farming models, increased contract farming adoption, and digital nutrition platforms. Additionally, the introduction of functional additives and specialized aquafeeds has increased average selling prices and profit margins as farmers recognize that investments in animal health reduce disease risks.

Vietnam Compound Feed Market Trends and Insights

Rising Meat and Seafood Consumption

Vietnam per capita meat consumption reached 58.4 kg in 2024, representing a 12% increase from pre-African Swine Fever (ASF) levels in 2020. The seafood consumption remained stable at 32.1 kg per capita annually. Feed conversion ratios indicate that one kilogram of pork requires 3.2 kg of feed, and one kilogram of farmed fish needs 1.8 kg of aquafeed, creating a multiplier effect on compound feed consumption. Urban households in Ho Chi Minh City and Hanoi consume 15-20% more animal protein than rural households, which concentrates premium feed demand near logistics hubs. The introduction of antibiotic-free meat products by retailers has encouraged farmers to implement certified nutrition programs, driving the adoption of value-added feed formulations and increasing production volumes for specialty feed mills in the Vietnam compound feed market.

Emphasis on Animal Health and Functional Nutrition

After the African Swine Fever (ASF) recovery, Vietnamese farmers changed their approach to animal nutrition, with functional feed additives increasing to 8.2% of total feed costs in 2024 from 4.1% in 2019 . Farmers nowadays regularly include probiotics, prebiotics, and immune-boosting compounds in feed formulations, recognizing that preventing diseases is more cost-effective than treating them. The Ministry of Health's 2024 regulations on stricter antibiotic limits prompted large farms to adopt functional feed blends for regulatory compliance . Feed manufacturers nowadays provide on-farm advisory services alongside their products, which increases customer retention. These developments strengthen the revenue stability of major players in the Vietnam compound feed market.

Price Volatility of Corn, Soybean, and Fishmeal

Vietnam imports 80% of its corn and soybean meal requirements, so world-price swings significantly impact cost structures . Corn prices fluctuated between USD 180 and USD 240 per metric ton in 2024, forcing four mid-size mills to suspend production for two months due to negative margins. Fishmeal traded as high as USD 1,800 per metric ton, eroding profitability in shrimp feed lines. Larger mills hedge through futures and diversified supply, but smaller operators lack capital access, amplifying consolidation pressures in the Vietnam compound feed market.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Integrated Mega-Farms and Contract Farming Models

- Growth of Vietnam Aquaculture Export Corridor

- Tighter Limits on Antimicrobial Growth Promoters

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Grains and cereals maintained 45.60% of the Vietnam compound feed market share in 2025, reflecting Vietnam's traditional reliance on corn and rice-based feed formulations, while the segment maintains steady growth aligned with overall market expansion. The ingredient landscape reveals Vietnam's strategic vulnerability and emerging opportunities simultaneously. Domestic grain production covers only 20% of feed industry requirements, creating import dependency that exposes manufacturers to global price volatility and supply chain disruptions. This challenge drives innovation in alternative ingredients, with black soldier fly larvae production facilities expanding rapidly and algae-based proteins gaining traction in aquaculture applications.

The Supplements segment demonstrates the highest growth trajectory at 9.1% CAGR through 2031, reflecting the industry's shift toward functional nutrition and health-focused formulations. The regulatory environment increasingly favors sustainable and traceable ingredients, positioning domestic alternative protein producers for accelerated market penetration as environmental compliance requirements tighten across the value chain.

The Vietnam Compound Feed Market is Segmented by Ingredient (Grains and Cereals, Oilseeds and Derivatives, Fish Meal and Fish Oil, Supplements, and Other Ingredients) and by Animal Type (Ruminants, Swine, Poultry, Aquaculture, and Other Animal Types). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Charoen Pokphand Group Co., Ltd

- Cargill Incorporated

- Royal De Heus Group B.V.

- GreenFeed Group JSC

- CJ CheilJedang Corp

- Masan Group Corporation

- Tongwei Co., Ltd.

- Japfa Ltd.

- Harim Group Co., Ltd.

- Vinh Hoan Corporation

- Alltech Inc.

- Land O Lakes, Inc.

- New Hope Liuhe Co., Ltd.

- Archer Daniels Midland Company

- Nutreco N.V.

- Heracles Feed

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising meat and seafood consumption

- 4.2.2 Emphasis on animal health and functional nutrition

- 4.2.3 Expansion of integrated mega-farms and contract farming models

- 4.2.4 Growth of Vietnam aquaculture export corridor

- 4.2.5 Adoption of insect meal and other novel proteins

- 4.2.6 Digital feed-formulation platforms improving farm ROI

- 4.3 Market Restraints

- 4.3.1 Price volatility of corn, soybean, and fishmeal

- 4.3.2 Tighter limits on antimicrobial growth promoters

- 4.3.3 Recurring livestock epidemics

- 4.3.4 Stricter environmental and wastewater compliance for mills

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Ingredient Type

- 5.1.1 Grains and Cereals

- 5.1.2 Oilseeds and Derivatives

- 5.1.3 Fish Meal and Fish Oil

- 5.1.4 Supplements

- 5.1.5 Other Ingredient Types

- 5.2 By Animal Type

- 5.2.1 Ruminants

- 5.2.2 Swine

- 5.2.3 Poultry

- 5.2.4 Aquaculture

- 5.2.5 Other Animal Types

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Charoen Pokphand Group Co., Ltd

- 6.4.2 Cargill Incorporated

- 6.4.3 Royal De Heus Group B.V.

- 6.4.4 GreenFeed Group JSC

- 6.4.5 CJ CheilJedang Corp

- 6.4.6 Masan Group Corporation

- 6.4.7 Tongwei Co., Ltd.

- 6.4.8 Japfa Ltd.

- 6.4.9 Harim Group Co., Ltd.

- 6.4.10 Vinh Hoan Corporation

- 6.4.11 Alltech Inc.

- 6.4.12 Land O Lakes, Inc.

- 6.4.13 New Hope Liuhe Co., Ltd.

- 6.4.14 Archer Daniels Midland Company

- 6.4.15 Nutreco N.V.

- 6.4.16 Heracles Feed

7 Market Opportunities and Future Outlook