PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934604

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934604

Asia-Pacific Probiotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

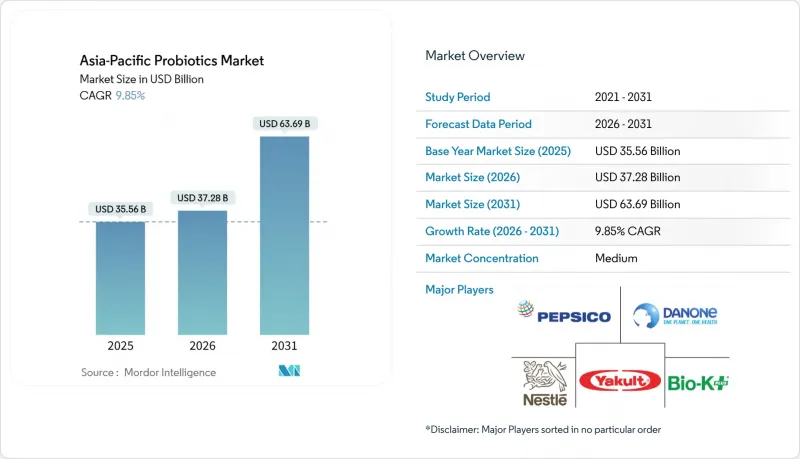

Asia Pacific probiotics market size in 2026 is estimated at USD 38.96 billion, growing from 2025 value of USD 35.56 billion with 2031 projections showing USD 61.43 billion, growing at 9.56% CAGR over 2026-2031.

This expansion rests on the region's transition to preventive nutrition, rapid urbanization that lifts disposable income, and policy environments that increasingly validate probiotic health claims. Rising clinical evidence underpins consumer trust, while e-commerce and cold-chain logistics broaden access to strain-specific products. Leading producers emphasize proprietary research, moving the competitive focus from volume sales to scientifically differentiated formulations. Simultaneously, emerging start-ups leverage niche strains and digital channels, signaling an ecosystem where incumbent scale and agile innovation coexist. Regulatory harmonization efforts-from Japan's Foods with Function Claims framework to Indonesia's new biotic regulation-further legitimize probiotics, catalyzing investment in localized manufacturing and R&D capacity across key economies.

Asia-Pacific Probiotics Market Trends and Insights

Rising Demand for Functional Foods & Beverages

Consumers in the Asia Pacific are increasingly adopting functional foods as they perceive nutrition as a means of preventive healthcare. By September 2023, Japan's regulatory framework had recorded 7,473 Foods with Function Claims (FFC), highlighting the growing acceptance of health benefits supported by science. The region's cultural heritage of fermented foods provides a natural avenue for probiotic integration. Additionally, rising disposable incomes are driving the trend toward premium product offerings. Research indicates that nearly 50% of consumers in the Asia Pacific and Middle East Africa (APMEA) prioritize cognitive health, boosting the demand for multifunctional probiotic products that support digestion, immunity, and neurological health. This combination of traditional familiarity and modern health awareness is transforming functional probiotics into essential wellness products.

Growing Incidence of Digestive Disorders Drives Market Growth

In 2024, approximately 180,000 Australians were reported to suffer from irritable bowel syndrome, reflecting the significant digestive disease burden across Asia and driving the increasing adoption of probiotics, according to the Australian Broadcasting Corporation. Scientific Reports highlighted findings from recent randomized controlled trials, which demonstrated the efficacy of probiotics in managing irritable bowel syndrome, chronic constipation, and various inflammatory conditions across multiple Asian populations. The growing prevalence of digestive diseases, coupled with robust clinical evidence, positions probiotics as essential tools for both preventive healthcare and therapeutic interventions, addressing a wide range of gastrointestinal health challenges.

High Cost of Research and Development

Probiotic product development requires significant investments in strain identification, clinical validation, and regulatory compliance, posing substantial challenges for smaller companies and new entrants in emerging markets. Strain-specific efficacy necessitates dedicated clinical trials, with recent studies highlighting the complexities involved in obtaining regulatory approvals across various APAC regions. Manufacturing complexities further escalate R&D costs, as companies must ensure viable cell counts are maintained throughout production, distribution, and shelf life while preserving strain stability and purity. The regulatory framework adds to these expenses, with countries like Japan requiring extensive documentation for Foods with Function Claims, while others mandate novel food assessments for innovative strains. Companies with limited R&D budgets often depend on generic probiotic blends instead of developing proprietary strains, restricting opportunities for product differentiation and premium positioning.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Natural, Organic, and Non-GMO Probiotics

- Expansion of Retail & E-commerce Distribution

- Regulatory Challenges and Product Claims Restrictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, probiotic foods hold a 52.10% market share, highlighting the strong cultural integration of fermented products in Asian cuisines and the established consumer confidence in dairy-based formats. Yogurt remains the leading segment within probiotic foods, supported by daily consumption patterns and its perceived nutritional advantages. At the same time, bakery products and breakfast cereals are gaining traction due to increasing demand for convenient, functional nutrition. Infant formulas and baby foods, though niche, are experiencing rapid growth, driven by parental focus on early-life microbiome development and recent regulatory approvals for pediatric probiotic strains. Snacks and confectionery products present emerging opportunities for probiotic inclusion, but technical difficulties in maintaining viable cells in low-moisture formats currently limit their market penetration.

Dietary supplements are the fastest-growing product category, with a projected 10.02% CAGR through 2031. This growth is primarily driven by consumer preferences for concentrated dosing and strain-specific therapeutic benefits. The market is shifting from food-based probiotics to pharmaceutical-grade formulations that offer higher colony-forming unit counts and targeted health advantages. Supporting this trend, recent clinical studies confirm the effectiveness of these supplements, showcasing the superior outcomes of encapsulated multi-strain formulations compared to traditional dairy-based options. Although animal feed and nutrition applications represent a smaller segment in the consumer market, they exhibit significant growth potential. Livestock producers are increasingly adopting probiotics as alternatives to antibiotic growth promoters, reflecting a broader shift. This evolution underscores the growing perception of probiotics as targeted health solutions rather than mere food ingredients.

The Asia Pacific Probiotics Market Report is Segmented by Product Type (Probiotic Foods, Probiotic Drinks, and More), Distribution Channels (Supermarket/Hypermarkets, Pharmacies and Drug Stores, Convenience/Grocery Stores, Online Stores, Others), and Geography (China, India, Japan, Australia, Indonesia, Thailand, Malaysia, South Korea, Rest of Asia Pacific). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Danone SA

- Nestle SA

- Yakult Honsha Co. Ltd

- BioGaia AB

- PepsiCo Inc.

- DSM-Firmenich

- Morinaga Milk Industry Co., Ltd.

- Probi AB

- Chr. Hansen Holding A/S

- Shanghai Dongsheng Health Industry Co., Ltd.

- Zhejiang Hisun Pharmaceuticals Co., Ltd.

- Sanzyme Biologics Pvt. Ltd.

- H&H Group

- Jiangzhong Pharmaceutical

- Probiotech International

- Winclove Probiotics

- By-Health Co., Ltd.

- SYNBIO Technologies

- Nutraceutix

- Shanghai SINE Pharmaceutical Laboratories Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for functional foods & beverages

- 4.2.2 Growing Incidence of Digestive Disorders Drives Market Growth

- 4.2.3 Demand for natural, organic, and non-GMO probiotics

- 4.2.4 Expansion of retail & e-commerce distribution

- 4.2.5 Growing Research and Clinical Validation

- 4.2.6 Microbiome-based personalised nutrition programs

- 4.3 Market Restraints

- 4.3.1 High cost of research and development

- 4.3.2 Competition from Alternative Health Products

- 4.3.3 Lack of consumer awareness in some regions

- 4.3.4 Regulatory challenges and product claims restrictions

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECAST

- 5.1 By Product Type

- 5.1.1 Probiotic Foods

- 5.1.1.1 Yogurt

- 5.1.1.2 Bakery & Breakfast Cereals

- 5.1.1.3 Infant Formula & Baby Foods

- 5.1.1.4 Snacks & Confectionery

- 5.1.1.5 Others

- 5.1.2 Probiotic Drinks

- 5.1.2.1 Dairy-based

- 5.1.2.2 Non-dairy

- 5.1.3 Dietary Supplements

- 5.1.4 Animal Feed and Nutrition

- 5.1.1 Probiotic Foods

- 5.2 By Distribution Channels

- 5.2.1 Supermarket/Hypermarkets

- 5.2.2 Pharmacies and Drug Stores

- 5.2.3 Convinience/Grocery Stores

- 5.2.4 Online Stores

- 5.2.5 Others

- 5.3 By Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 Australia

- 5.3.5 Indonesia

- 5.3.6 Thailand

- 5.3.7 Malaysia

- 5.3.8 South Korea

- 5.3.9 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Danone SA

- 6.4.2 Nestle SA

- 6.4.3 Yakult Honsha Co. Ltd

- 6.4.4 BioGaia AB

- 6.4.5 PepsiCo Inc.

- 6.4.6 DSM-Firmenich

- 6.4.7 Morinaga Milk Industry Co., Ltd.

- 6.4.8 Probi AB

- 6.4.9 Chr. Hansen Holding A/S

- 6.4.10 Shanghai Dongsheng Health Industry Co., Ltd.

- 6.4.11 Zhejiang Hisun Pharmaceuticals Co., Ltd.

- 6.4.12 Sanzyme Biologics Pvt. Ltd.

- 6.4.13 H&H Group

- 6.4.14 Jiangzhong Pharmaceutical

- 6.4.15 Probiotech International

- 6.4.16 Winclove Probiotics

- 6.4.17 By-Health Co., Ltd.

- 6.4.18 SYNBIO Technologies

- 6.4.19 Nutraceutix

- 6.4.20 Shanghai SINE Pharmaceutical Laboratories Co., Ltd.

7 MARKET OPPORTUNITITES AND FUTURE OUTLOOK