PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934633

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934633

Asia-Pacific Ice Cream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

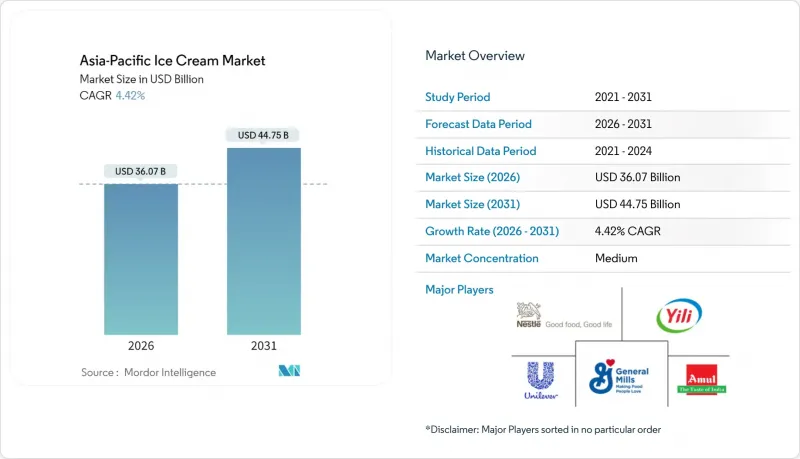

The Asia-Pacific ice cream market was valued at USD 34.54 billion in 2025 and estimated to grow from USD 36.07 billion in 2026 to reach USD 44.75 billion by 2031, at a CAGR of 4.42% during the forecast period (2026-2031).

The steady growth of the market is underpinned by the increasing urban population, the expansion of the middle class, and the broadening of distribution networks. This growth trajectory remains resilient despite challenges such as raw-material price volatility and infrastructure deficiencies. The category continues to attract both multinational corporations and local specialists, driven by key trends including premiumization, innovative flavor experimentation, and the growing popularity of vegan and low-calorie recipes. China plays a pivotal role in anchoring regional revenue, leveraging its well-established mass-production capabilities. In contrast, India is emerging as a significant growth driver, experiencing the fastest increase in household consumption, which contributes to incremental volume growth. Furthermore, investments in technology-enabled cold-chain infrastructure, along with regulatory initiatives promoting halal certification and clean-label compliance, are shaping the evolution of product design, logistics frameworks, and export strategies within the market.

Asia-Pacific Ice Cream Market Trends and Insights

Rising urbanization and changing lifetsyles

Urbanization across Asia-Pacific fundamentally reshapes ice cream consumption patterns, with city dwellers demonstrating higher per-capita consumption rates and preference for convenience-oriented products. According to a UN-Habitat report, Asia accounts for 54% of the world's urban population, equating to over 2.2 billion people. Projections suggest that by 2050, the region's urban population will grow by an additional 1.2 billion, representing a 50% increase . In both India and China, the rapid expansion of metropolitan areas has led to a concentration of consumers with growing disposable incomes. This shift has paved the way for premium ice cream products to penetrate the market, with consumers making purchases more frequently. Urban lifestyle changes have spurred a demand for quick-consumption formats. This trend has particularly bolstered the impulse ice cream segment, thanks to the proliferation of retail touchpoints like convenience stores and vending machines. Moreover, a noticeable shift from traditional desserts to Western-style frozen treats underscores a cultural adaptation in urban settings. Here, the influx of international brands and flavors has significantly sped up the adoption of these treats. Manufacturers boasting robust distribution networks in these metropolitan areas stand to gain the most from this urbanization trend.

Increasing consumer preference for low-calorie, low-sugar, and vegan options

Health-conscious consumers across developed Asia-Pacific markets are increasingly seeking alternatives that align with their dietary restrictions and wellness goals. In Thailand, YenYen has collaborated with Nestle La Frutta to develop a 60-calorie ice cream variant. This innovative product combines traditional cooling properties with fruity flavors, demonstrating how manufacturers actively respond to evolving health trends while maintaining cultural relevance. By addressing consumer demand for low-calorie and culturally resonant options, YenYen and Nestle La Frutta are setting a benchmark for health-focused product development in the region. Similarly, Pulmuone in South Korea has introduced a plant-based dessert line under the '2FREE 1ADD' concept. This product line eliminates milk and eggs while incorporating dietary fiber, reflecting a systematic and deliberate approach to creating healthier formulations. These innovations not only create significant growth opportunities for specialized manufacturers but also place pressure on traditional dairy-focused companies. The shift towards health-oriented consumption is reshaping the market landscape, driving manufacturers to innovate and adapt to changing consumer preferences.

Rising awareness and concerns over sugar and fat content affecting sales

Health consciousness increasingly constrains traditional ice cream consumption as consumers become more aware of nutritional content and its health implications, particularly in developed Asia-Pacific markets where obesity rates and diabetes prevalence drive dietary behavior changes. In 2024, the International Diabetes Federation reports that approximately 107 million individuals in Southeast Asia are grappling with diabetes , further driving dietary behavior changes. For instance, Singapore's Nutri-Grade initiative, which tightens regulations on sodium and fat content, underscores the significant role of government interventions in reshaping product formulations and marketing strategies. Such heightened health awareness has led to a market divide: on one side, traditional full-fat products, and on the other, their reformulated counterparts. This divide has spurred manufacturers to channel investments into Research and Development, focusing on sugar reduction technologies and alternative sweetening systems. Furthermore, as consumer education campaigns shed light on nutritional content, there's a marked increase in scrutiny of ingredient lists. This scrutiny has nudged brands towards transparent labeling strategies and healthier formulations, all in a bid to retain market access. Notably, this trend is reshaping impulse purchase decisions.

Other drivers and restraints analyzed in the detailed report include:

- Continuous flavor innovation and introduction of novel textures and formats

- Rising demand for premium, high-end, and artisan ice cream products

- Limited cold storage/accessibility in rural areas

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, impulse ice cream accounted for the largest share of the Asia-Pacific ice cream market, capturing 45.62% of total industry sales. This strong performance reflects consumer demand for convenience-oriented products that can be easily purchased and consumed on the go. Widely available through convenience stores, vending machines, supermarkets, and street vendors, impulse ice cream remains deeply integrated into daily consumption habits across the region. The popularity of single-serve formats also resonates with portion-conscious consumers, balancing indulgence with manageable serving sizes. Its accessibility across both urban and rural markets ensures mass appeal, making it the go-to choice for spontaneous consumption. These factors collectively reinforce impulse ice cream's dominance as the largest segment, underpinned by affordability, convenience, and broad distribution networks.

In contrast, artisanal ice cream is emerging as the fastest-growing category, projected to expand at a CAGR of 5.02% through 2031. This surge reflects evolving consumer preferences toward premiumization, with affluent buyers increasingly seeking unique, high-quality ice cream experiences. Artisanal ice cream stands out for its innovative flavors, natural ingredients, and handcrafted production methods that deliver authenticity and distinctiveness. Rising health awareness across the Asia-Pacific market has also played a role, as consumers perceive artisanal options as cleaner, more transparent, and less processed compared to mass-market offerings. Moreover, the influence of global culinary trends and social media-driven demand for novelty is boosting the appeal of artisanal concepts, particularly among younger, trend-sensitive demographics.

The Asia-Pacific Ice Cream Market Report is Segmented by Product Type (Artisanal Ice Cream, Impulse Ice Cream, and Take-Home Ice Cream), Category (Dairy and Non-Dairy), Distribution Channel (On-Trade, and Off-Trade), and Geography (China, India, Japan, South Korea, Australia, New Zealand, Indonesia, Thailand, Vietnam, Malaysia, Philippines, Rest of Asia-Pacific). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Unilever PLC

- Nestle S.A.

- Gujarat Co-operative Milk Marketing Fed. (Amul)

- Yili Group

- General Mills Inc.

- Lotte Confectionery

- Morinaga & Co. Ltd

- Meiji Holdings

- Mengniu Dairy

- Wells Enterprises Inc.

- Bulla Dairy Foods

- Peters Ice-Cream

- Ezaki Glico

- Bright Dairy & Food

- Lotte Foods

- Froneri Ltd

- Dairy Classic Ice-Cream Pvt

- Food Empire Holdings

- Pacific Ice-Cream Co.

- Aurora Ice-Cream Indonesia

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising urbanization and changing lifetsyles

- 4.2.2 Increasing consumer preference for low-calorie, low-sugar, and vegan options

- 4.2.3 Continuous flavor innovation and introduction of novel textures and formats

- 4.2.4 Rising demand for premium, high-end, and artisan ice cream products

- 4.2.5 Seasonal demand peaks in warmer months enhancing sales

- 4.2.6 Growing emphasis on eco-friendly and sustainable packaging

- 4.3 Market Restraints

- 4.3.1 Rising awareness and concerns over sugar and fat content affecting sales

- 4.3.2 Limited cold storage/accessibility in rural areas

- 4.3.3 Supply chain disruptions affecting raw material availability and costs

- 4.3.4 Price sensitivity in emerging markets

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Artisanal Ice Cream

- 5.1.2 Impulse Ice Cream

- 5.1.3 Take-home Ice Cream

- 5.2 By Category

- 5.2.1 Dairy

- 5.2.2 Non-Dairy

- 5.3 Distribution Channel

- 5.3.1 On-Trade

- 5.3.2 Off-Trade

- 5.3.2.1 Supermarkets/Hypermarkets

- 5.3.2.2 Specialist Retailers

- 5.3.2.3 Convenience Stores

- 5.3.2.4 Online Retail Stores

- 5.3.2.5 Other Distribution Channels

- 5.4 By Geography

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Australia

- 5.4.6 New Zealand

- 5.4.7 Indonesia

- 5.4.8 Thailand

- 5.4.9 Vietnam

- 5.4.10 Malaysia

- 5.4.11 Philippines

- 5.4.12 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Unilever PLC

- 6.4.2 Nestle S.A.

- 6.4.3 Gujarat Co-operative Milk Marketing Fed. (Amul)

- 6.4.4 Yili Group

- 6.4.5 General Mills Inc.

- 6.4.6 Lotte Confectionery

- 6.4.7 Morinaga & Co. Ltd

- 6.4.8 Meiji Holdings

- 6.4.9 Mengniu Dairy

- 6.4.10 Wells Enterprises Inc.

- 6.4.11 Bulla Dairy Foods

- 6.4.12 Peters Ice-Cream

- 6.4.13 Ezaki Glico

- 6.4.14 Bright Dairy & Food

- 6.4.15 Lotte Foods

- 6.4.16 Froneri Ltd

- 6.4.17 Dairy Classic Ice-Cream Pvt

- 6.4.18 Food Empire Holdings

- 6.4.19 Pacific Ice-Cream Co.

- 6.4.20 Aurora Ice-Cream Indonesia

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK