PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934640

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934640

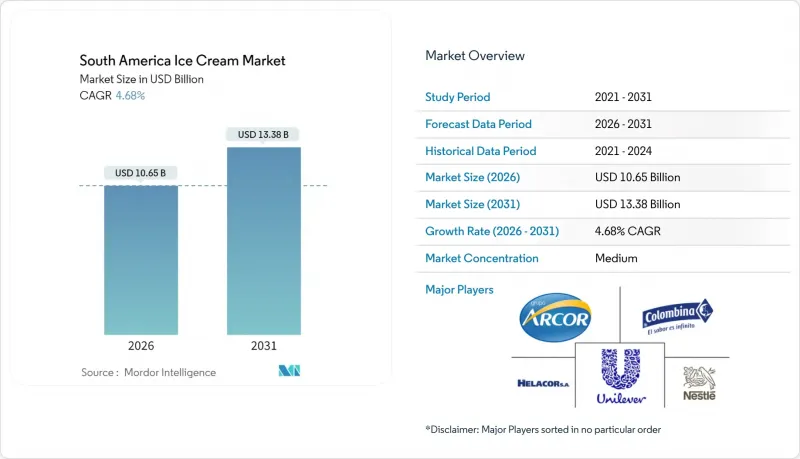

South America Ice Cream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

South America ice cream market size in 2026 is estimated at USD 10.65 billion, growing from 2025 value of USD 10.17 billion with 2031 projections showing USD 13.38 billion, growing at 4.68% CAGR over 2026-2031.

This growth is supported by factors such as rapid urbanization, increased household freezer ownership, premiumization trends, and the expansion of cold-chain-enabled retail formats, which enhance the accessibility of frozen desserts as convenient snack options. The rise of e-commerce and on-demand delivery services is transforming distribution strategies, enabling manufacturers to offer higher-priced pints and multipacks without the limitations of physical retail freezer space. Competition in the market remains moderate but structured, with multinational companies focusing on protecting their core stock-keeping units (SKUs) while local artisans establish premium niches by leveraging regional ingredients and unique narratives. Challenges such as macroeconomic instability in Argentina, inconsistent logistics outside coastal regions, and growing health concerns related to sugar and calorie content pose constraints on market growth. However, the expanding consumer base continues to drive volume growth across both mass-market and premium segments. Additionally, structural trends such as the shift toward plant-based diets, low-sugar formulations, and functional ingredient fortification are expected to support the sustained growth of the South America ice cream market through 2030.

South America Ice Cream Market Trends and Insights

Rising urbanization shifts lifestyles toward convenience snacking

Urban population density in Brazil's southeastern corridor has reached a critical level, reducing household meal preparation time and increasing demand for grab-and-go frozen desserts. This demographic shift has led to a significant rise in impulse ice cream sales through convenience stores and gas stations, as commuters and students prioritize portability over traditional sit-down consumption. A similar trend is observed in Argentina, where economic instability has increased snacking frequency, with consumers choosing affordable indulgences as substitutes for full meals. In response, manufacturers have adapted by offering smaller pack sizes and introducing resealable multi-serve tubs to accommodate urban apartment living and limited freezer space. This urbanization-driven growth is not limited to major metropolitan areas; secondary cities such as Curitiba and Medellin are also experiencing modern retail expansion. Improved cold-chain infrastructure in these areas is further driving volume growth in previously underserved markets.

Demand for premium artisanal flavors like tropical fruits

Fruit and tropical flavors are increasingly appealing to consumers by drawing on regional biodiversity and evoking nostalgia for native ingredients. Acai-based ice creams, which were once limited to Brazil's northern states, have now reached premium supermarket shelves in Sao Paulo and Buenos Aires, commanding significant price premiums compared to vanilla varieties. Similarly, maracuya (passion fruit) and guanabana (soursop) flavors are gaining popularity in Chile, where artisanal parlors report these variants achieving notably higher gross margins than chocolate or strawberry. The strategic insight is that brands forming direct sourcing relationships with Amazonian cooperatives or Andean smallholders can stand out through authenticity while reducing exposure to fluctuations in commodity prices. Unilever's Kibon division introduced a limited-edition cupuacu line in the second quarter of 2024, highlighting that multinational companies are recognizing the competitive advantage of local artisans, who control provenance narratives and can adapt flavor offerings more quickly than global research and development cycles allow.

Health concerns over high sugar and calories

Public health campaigns addressing childhood obesity have brought frozen desserts under increased scrutiny, particularly in Chile, where per-capita ice cream consumption exceeds five liters annually. The Chilean Ministry of Health's dietary guidelines for the year 2024 recommend limiting frozen dessert consumption to once a week, creating challenges for impulse formats sold near schools . In Brazil, the Ministry of Health reported in early 2025 that nearly twenty-two percent of adults actively avoid high-sugar snacks, an increase from sixteen percent in 2022, indicating growing awareness of metabolic syndrome risks. This shift in behavior is reducing purchase frequency rather than eliminating the category entirely. Consumers are opting for smaller portion sizes or substituting with frozen yogurt and sorbet alternatives that have lower caloric content. Manufacturers face a reformulation challenge, as reducing sugar often necessitates adjustments to fat or stabilizers, which can alter the product's mouthfeel and risk consumer rejection if sensory profiles deviate significantly from established expectations.

Other drivers and restraints analyzed in the detailed report include:

- Growth in e-commerce and food delivery platforms

- Health trends boost low-sugar and functional ice creams

- Supply chain disruptions in cold chain logistics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vanilla accounted for 33.12% of South American ice cream sales in 2025, driven by its versatility as a base for mix-ins and its widespread appeal across various age groups and income levels. Chocolate ranked as the second-largest flavor, supported by cocoa's cultural significance in the region and its adaptability to both impulse stick formats and premium pint packaging. However, the most notable growth is observed in fruit and tropical flavors, which are projected to expand at a Compound Annual Growth Rate (CAGR) of 5.72% through 2031. Manufacturers are leveraging the region's biodiversity to differentiate their offerings, with flavors such as acai, maracuya, and lucuma transitioning from artisanal parlors to supermarket freezers. This shift is facilitated by advancements in freeze-drying techniques that retain volatile aromatics and vibrant pigments without relying on synthetic additives.

The "Others" category, which includes nut-based, coffee, and novelty flavors, is growing steadily but remains fragmented, with no single Stock Keeping Unit (SKU) achieving significant scale to rival the top three flavors. Unilever's launch of a dulce de leche-coconut hybrid in Argentina in late 2024 exemplifies how global companies are integrating regional taste preferences with tropical ingredients to meet premiumization demand while optimizing manufacturing efficiencies across multiple markets.

Take-home ice cream accounted for 45.78% of the market share in 2025, driven by the popularity of family-sized tubs and multi-serve formats that cater to in-home consumption and bulk-purchase preferences. Impulse ice cream, typically sold as single-serve sticks or cones through kiosks and convenience stores, holds a significant but smaller share, supported by spontaneous purchasing behavior and seasonal demand during hot weather.

Artisanal ice cream, while representing a smaller portion of the market, is growing at a Compound Annual Growth Rate (CAGR) of 5.71% through 2031, as consumers increasingly value experiential eating and unique, craft-focused offerings over mass-market convenience. This growth is primarily concentrated in affluent neighborhoods of Chile and Brazil, where independent parlors charge USD 4 to 6 per scoop, approximately double the price of supermarket alternatives. These parlors justify the premium pricing through live churning demonstrations, the use of exotic ingredients such as Peruvian pink salt or Colombian coffee nibs, and visually appealing, Instagram-friendly presentations.

The South America Ice Cream Market Report is Segmented by Flavor (Vanilla, Chocolate and More), Product Type (Artisanal Ice Cream, Impulse Ice Cream, and Take-Home Ice Cream), Category (Dairy and Non-Dairy), Distribution Channel (On-Trade and Off-Trade), and Geography (Brazil, Argentina, Chile, and Rest of South America). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Unilever PLC

- Nestle S.A.

- Arcor S.A.I.C.

- Helacor S.A.

- Colombina S.A.

- Frutos do Brasil

- Sorvetes Jundia

- Froneri

- Chiquinho Sorvetes

- Grupo Nutresa

- Diletto

- Los Paleteros

- Creme Mel Sorvetes

- General Mills

- Mars Inc.

- Cacau Show

- Emporio La Rosa

- Savory

- Danone

- Grupo Bimbo

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising urbanization shifts lifestyles toward convenience snacking

- 4.2.2 Demand for premium artisanal flavors like tropical fruits

- 4.2.3 Growth in e-commerce and food delivery platforms

- 4.2.4 Health trends boost low-sugar and functional ice creams

- 4.2.5 Popularity of plant-based dairy-free alternatives

- 4.2.6 Lactose intolerance awareness drives non-dairy options

- 4.3 Market Restraints

- 4.3.1 Health concerns over high sugar and calories

- 4.3.2 Supply chain disruptions in cold chain logistics

- 4.3.3 Raw material price volatility for dairy and sugar

- 4.3.4 Intense competition from multinationals and locals

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Flavor

- 5.1.1 Vanilla

- 5.1.2 Chocolate

- 5.1.3 Fruit and Tropical

- 5.1.4 Others

- 5.2 By Product Type

- 5.2.1 Artisanal Ice Cream

- 5.2.2 Impulse Ice Cream

- 5.2.3 Take-home Ice Cream

- 5.3 By Category

- 5.3.1 Dairy

- 5.3.2 Non-Dairy

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.4.2.1 Supermarkets/Hypermarkets

- 5.4.2.2 Specialist Retailers

- 5.4.2.3 Convenience Stores

- 5.4.2.4 Online Retail Stores

- 5.4.2.5 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 Brazil

- 5.5.2 Argentina

- 5.5.3 Chile

- 5.5.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Unilever PLC

- 6.4.2 Nestle S.A.

- 6.4.3 Arcor S.A.I.C.

- 6.4.4 Helacor S.A.

- 6.4.5 Colombina S.A.

- 6.4.6 Frutos do Brasil

- 6.4.7 Sorvetes Jundia

- 6.4.8 Froneri

- 6.4.9 Chiquinho Sorvetes

- 6.4.10 Grupo Nutresa

- 6.4.11 Diletto

- 6.4.12 Los Paleteros

- 6.4.13 Creme Mel Sorvetes

- 6.4.14 General Mills

- 6.4.15 Mars Inc.

- 6.4.16 Cacau Show

- 6.4.17 Emporio La Rosa

- 6.4.18 Savory

- 6.4.19 Danone

- 6.4.20 Grupo Bimbo

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK