PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934663

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934663

Asia-Pacific Medical Aesthetic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

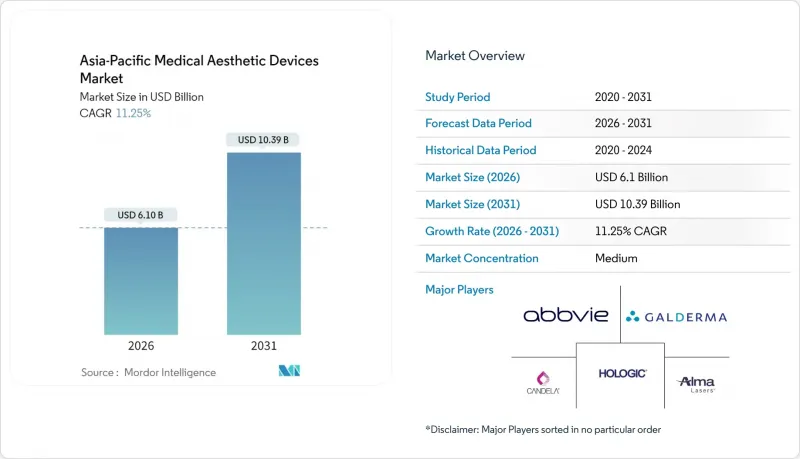

Asia-Pacific medical aesthetic devices market size in 2026 is estimated at USD 6.1 billion, growing from 2025 value of USD 5.48 billion with 2031 projections showing USD 10.39 billion, growing at 11.25% CAGR over 2026-2031.

This brisk trajectory is powered by digitalized care delivery, growing medical tourism networks, and consumer migration toward minimally invasive solutions. Energy-based platforms still anchor revenues, but injectable-centric alternatives are scaling faster as practitioners favor procedures that shorten downtime. China remains the spending heavyweight, yet India's momentum signals a profound east-to-west rebalancing in demand patterns. Consolidation-for example, the Cynosure-Lutronic tie-up that forged a USD 1 billion powerhouse-keeps competitive intensity moderate while stimulating platform innovation.

Asia-Pacific Medical Aesthetic Devices Market Trends and Insights

Technological Innovations In Aesthetic Device Platforms

Platform convergence is reshaping therapeutic algorithms as vendors merge radiofrequency, ultrasound, and laser technologies within single chassis. The EXION system integrates monopolar radiofrequency with ultrasound, reducing treatment time by 40% without compromising outcomes. Intelliview-enabled imaging inside the MIRIA Skin Treatment System offers real-time depth visualization that minimizes adverse events in Fitzpatrick IV-VI patients. Predictive analytics modules now set energy parameters by mining prior clinical outcomes, shifting decision-making from operator skill to algorithmic guidance. These advances justify premium pricing while broadening the eligible patient base through safer profiles. The U.S. FDA cleared 23% more next-generation devices in 2024 than in 2023, underscoring compressed innovation cycles that favor early adopters.

Expansion of Regional Medical Tourism Networks

Dedicated aesthetic corridors capitalize on currency arbitrage and liberal regulations to lure international clients. South Korea logged an 80% jump in foreign spend on dermatology and cosmetic procedures between December 2024 and March 2025, hitting KRW 489 billion, with dermatology alone drawing 55% of visits. Thailand's aesthetic surgery receipts are projected to touch THB 76.5 billion in 2025, with tourism accounting for up to 12% of hospital revenue. Teleconsultations now enable pre-arrival planning, maximizing on-site efficiency, while cross-border regulatory harmonization trims time-to-market for device makers entering tourist hubs.

Cultural Stigma and Ethical Reservations Toward Cosmetic Procedures

Conservative mores still assign vanity labels to aesthetic enhancements. Half of older East Asian respondents deem minimally invasive procedures acceptable, yet familial expectations rooted in Confucian ideals often suppress uptake. Philosophical emphasis on inner virtue heightens cognitive dissonance in rural segments. The concept of "pretty privilege," acknowledged by 60% of Southeast Asian participants, reveals awareness of appearance-linked advantages but does not fully neutralize stigma. Youth adoption is chipping away at resistance, aided by educational messaging that frames treatments as self-care rather than vanity.

Other drivers and restraints analyzed in the detailed report include:

- Rising Incidence of Obesity and Age-Related Skin Conditions

- Heightened Beauty Awareness Via Social Media Influence

- Absence Of Robust Insurance Reimbursement Frameworks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Energy-based modalities held a 52.04% stake in 2025 revenues, reinforcing their role as the backbone of the Asia-Pacific medical aesthetic devices market. Lasers now employ fractional beams at the 1,726 nm wavelength to target sebaceous glands while real-time thermal feedback curbs epidermal damage. Radiofrequency systems, exemplified by the XERF platform with Spider Pattern Technology, sharpen depth control for Fitzpatrick IV-VI skin types. Ultrasound devices add microfocused imaging to tailor energy deposit across facial planes.

Non-energy categories, chiefly injectables, are climbing at a 13.45% CAGR as localized hyaluronic-acid production in China narrows price differentials with imports. AI-aligned dispensing pens standardize dose, enhancing outcomes and patient confidence. Together, hybrid protocols weave energy and non-energy tools, underpinning personalized regimens that enlarge the Asia-Pacific medical aesthetic devices market.

Minimally invasive options captured 55.42% of 2025 spending as social downtime became a non-negotiable constraint for urban professionals. Botulinum toxin, dermal fillers, and micro-coring deliver quick wins, fueling repeat-visit business models. The ellacor Micro-Coring system secured fresh approvals across Canada and Saudi Arabia in 2025, underscoring global appetite for scar-less outcomes.

Conversely, surgical volumes are slated for a 13.28% CAGR because procedures like the "Mini-V lift" match Asian craniofacial dimensions while limiting incision length. Robotics and AI-guided imaging curtail operative times and refine symmetry, reducing historical hesitancy. Multi-modality care-combining endoscopic lifts with injectable finishing touches-expands therapeutic repertoires and retains clients inside the Asia-Pacific medical aesthetic devices market ecosystem.

The Asia-Pacific Medical Aesthetic Devices Market Report is Segmented by Type of Device (Energy-Based Aesthetic Devices and Non-Energy-Based Aesthetic Devices), Procedure Type (Non-Surgical/Minimally Invasive and Surgical), Application (Skin Resurfacing and Tightening, and More), End User (Hospitals, and More), and Geography (China, Japan, India, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Abbvie

- Alma Lasers

- Cutera

- Bausch Health

- Galderma

- Hologic

- Boston Scientific (Lumenis)

- Lutronic

- Sanuwave Health

- WonTech

- Candela Medical

- Venus Concept

- Sciton

- Merz Pharma

- Fotona

- Classys

- Jeisys Medical

- Sensus Healthcare

- Zimmer Aesthetics

- Huadong Sisram

- Sharplight Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Technological Innovations in Aesthetic Device Platforms

- 4.2.2 Expansion of Regional Medical Tourism Networks

- 4.2.3 Rising Incidence of Obesity and Age-Related Skin Conditions

- 4.2.4 Heightened Beauty Awareness Via Social Media Influence

- 4.2.5 Localization of Injectable Manufacturing and Pricing Advantages

- 4.2.6 Adoption of At-Home And Digital Aesthetic Solutions

- 4.3 Market Restraints

- 4.3.1 Cultural Stigma and Ethical Reservations Toward Cosmetic Procedures

- 4.3.2 Absence of Robust Insurance Reimbursement Frameworks

- 4.3.3 Regulatory Complexity and High Market Entry Barriers

- 4.3.4 Shortage of Skilled and Certified Aesthetic Professionals

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Type Of Device

- 5.1.1 Energy-Based Aesthetic Devices

- 5.1.1.1 Laser-Based Aesthetic Device

- 5.1.1.2 Radiofrequency (RF)-Based Aesthetic Device

- 5.1.1.3 Light-Based Aesthetic Device

- 5.1.1.4 Ultrasound Aesthetic Device

- 5.1.2 Non-Energy-Based Aesthetic Devices

- 5.1.2.1 Botulinum Toxin

- 5.1.2.2 Dermal Fillers & Aesthetic Threads

- 5.1.2.3 Chemical Peels

- 5.1.2.4 Microdermabrasion

- 5.1.2.5 Implants

- 5.1.1 Energy-Based Aesthetic Devices

- 5.2 By Procedure Type

- 5.2.1 Non-Surgical / Minimally Invasive

- 5.2.2 Surgical

- 5.3 By Application

- 5.3.1 Skin Resurfacing And Tightening

- 5.3.2 Body Contouring And Cellulite Reduction

- 5.3.3 Hair Removal

- 5.3.4 Facial Aesthetic Procedures

- 5.3.5 Breast Augmentation

- 5.3.6 Other Applications

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Clinics And Dermatology Offices

- 5.4.3 Medical Spas

- 5.4.4 Home Settings

- 5.5 By Country

- 5.5.1 China

- 5.5.2 Japan

- 5.5.3 India

- 5.5.4 Australia

- 5.5.5 South Korea

- 5.5.6 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 AbbVie (Allergan)

- 6.3.2 Alma Lasers

- 6.3.3 Cutera

- 6.3.4 Bausch Health

- 6.3.5 Galderma SA

- 6.3.6 Hologic Inc. (Cynosure)

- 6.3.7 Boston Scientific (Lumenis)

- 6.3.8 Lutronic

- 6.3.9 Sanuwave Health

- 6.3.10 WonTech

- 6.3.11 Candela Medical

- 6.3.12 Venus Concept

- 6.3.13 Sciton

- 6.3.14 Merz Pharma

- 6.3.15 Fotona

- 6.3.16 Classys

- 6.3.17 Jeisys Medical

- 6.3.18 Sensus Healthcare

- 6.3.19 Zimmer Aesthetics

- 6.3.20 Huadong Sisram

- 6.3.21 Sharplight Technologies

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment