PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937265

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937265

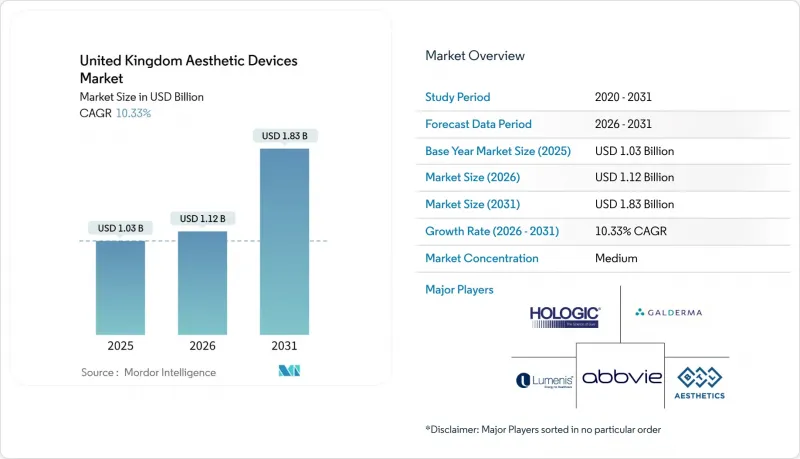

United Kingdom Aesthetic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United Kingdom Aesthetic Devices Market size is projected to expand from USD 1.03 billion in 2025 and USD 1.12 billion in 2026 to USD 1.83 billion by 2031, registering a CAGR of 10.33% between 2026 to 2031.

A sustained pivot toward minimally- and non-invasive procedures, rapid upgrades that bundle laser, radiofrequency and ultrasound modalities into a single console, and the emergence of at-home LED and microcurrent tools keep the United Kingdom aesthetic devices market on a double-digit growth path. Regulatory clarity-through Medicines and Healthcare products Regulatory Agency (MHRA) approvals and impending non-surgical licensing rules-has reduced gray-market imports, giving fully compliant manufacturers clearer access to clinics and medical spas. Private operators also benefit from the National Health Service (NHS) Provider Selection Regime, which outsources selected laser treatments and supplies a predictable patient pipeline during traditionally slow summer quarters. Meanwhile, rising wait lists for gender-affirming care and medical-tourism complications have heightened consumer awareness around MHRA-registered devices, encouraging domestic spend.

United Kingdom Aesthetic Devices Market Trends and Insights

Rising Demand for Minimally-Invasive Cosmetic Procedures

Consumers continue to favor treatments that avoid general anesthesia, produce little to no scarring and allow same-day discharge. BAAPS reported a 5% rise in non-surgical volumes in 2024, driven by protocols that pair radiofrequency microneedling with platelet-rich plasma for collagen remodeling without incisions. Thread-lift technology typifies this shift; Care Quality Commission guidelines now require surgical registration, weeding out poorly trained providers and boosting public confidence. Since 2016, the Association of PDO Thread Practitioners has certified more than 640 clinicians, standardizing technique and lowering complication rates. Combination plans that blend absorbable sutures with fillers or polynucleotides can extend visible results beyond 30 months, improving clinic retention rates.

Aging Population with Higher Discretionary Income

Individuals aged 50-64 hold median household wealth topping GBP 500,000, positioning them as the financial engine behind the United Kingdom aesthetic devices market. Many prefer in-office radiofrequency or high-intensity focused ultrasound sessions over one-time surgery, valuing minimal downtime and natural-looking outcomes. Cynosure's ELITE iQ PRO, introduced in 2024, cuts session length by a third yet delivers higher fluence, appealing to busy professionals. Real-time melanin-reader adjustments broaden suitability to Fitzpatrick IV-VI skin types, enlarging the market's demographic base.

Stringent MHRA & EU-MDR Compliance Costs

Manufacturers and importers must now appoint UK Responsible Persons, submit exhaustive technical files and undertake annual post-market surveillance to satisfy MHRA and EU-MDR rules. Smaller suppliers face yearly compliance bills between GBP 50,000 and GBP 150,000, often prompting portfolio cuts or market exits. New sustainability guidance adds environmental-impact assessments for single-use applicators, stretching approval timelines by up to a year.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Technology Upgrades in Energy-Based Devices

- Expansion of Cosmetic Clinics & Medical Spas

- High Treatment Cost to Consumers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Energy-based platforms controlled 41.32% of 2025 revenue, highlighting continued preference for laser hair removal, intense-pulsed-light photofacials and radiofrequency skin-tightening. The United Kingdom aesthetic devices market share for energy-based systems stems from their versatility and short learning curves, letting clinics amortize capital quicker than implant or injectable devices. Cynosure's ELITE iQ PRO illustrates the arms race for higher power and larger spot sizes, shaving treatment times and lifting margin per staff hour.

Thread-lift kits are the breakout category, forecast to rise at 12.52% CAGR thanks to polydioxanone and poly-L-lactic sutures that suspend tissue without general anesthesia. The Care Quality Commission's ruling that thread placement requires surgical registration removed unqualified operators and lifted consumer trust. As a result, the United Kingdom aesthetic devices market size for thread-lift systems is projected to expand from USD 48 million in 2026 to USD 87 million by 2031. Breast and facial implants face headwinds as patients favor autologous fat transfer, yet Allergan's 2025 acquisition of Northwood Medical and its earFold implant shows niche hardware can still thrive when it addresses specific aesthetic pain points.

Facial contouring and skin-rejuvenation represented 36.64% of 2025 turnover, reflecting demand for collagen-boosting lasers, fractional RF and injectables that postpone surgical facelifts. Tattoo and scar removal is the fastest accelerator, set for 13.24% CAGR as picosecond lasers slash session counts by 75% versus older Q-switched systems.

Body-contouring maintains double-digit growth through radiofrequency-assisted lipolysis, cryolipolysis and high-intensity EM muscle stimulation, but competes with surgical liposuction for dramatic fat-loss seekers. Hair removal remains the United Kingdom aesthetic devices market workhorse by volume, yet commoditization pressures per-session prices. Breast-enhancement devices battle textured-implant scrutiny, while port-wine-stain laser therapies gain stability from NHS outsourcing agreements.

The United Kingdom Aesthetic Devices Market Report is Segmented by Product (Energy-Based Aesthetic Devices, Breast Implants, Facial Implants, Dermal Filler/Injectable Delivery Devices, Microdermabrasion Devices, and More), Application (Facial Contouring & Skin Rejuvenation, and More), Procedure Invasiveness (Non-Invasive Devices, and More), End-User (Hospitals, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Abbvie

- Alma Lasers

- Apyx Medical

- BTL

- Candela Medical

- Classys

- Cutera

- Fotona

- Galderma

- Hologic (Cynosure)

- InMode

- Johnson & Johnson (Mentor)

- Lumenis

- Lutronic

- Merz Pharma

- Quanta System

- Sientra

- Bausch Health(Solta)

- Venus Concept

- Zimmer Biomet (A&E)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Minimally-Invasive Cosmetic Procedures

- 4.2.2 Aging Population with Higher Discretionary Income

- 4.2.3 Rapid Technology Upgrades in Energy-Based Devices

- 4.2.4 Expansion of Cosmetic Clinics & Medical Spas

- 4.2.5 NHS Outsourcing of Aesthetic Laser Services

- 4.2.6 Growth in Gender-Affirming Body-Contouring Needs

- 4.3 Market Restraints

- 4.3.1 Stringent MHRA & EU-MDR Compliance Costs

- 4.3.2 High Treatment Cost to Consumers

- 4.3.3 Sustainability & Re-Processing Scrutiny

- 4.3.4 "Natural Look" Social-Media Backlash

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Energy-based Aesthetic Devices

- 5.1.2 Breast Implants

- 5.1.3 Facial Implants

- 5.1.4 Dermal Filler/Injectable Delivery Devices

- 5.1.5 Microdermabrasion Devices

- 5.1.6 Thread-lift Devices

- 5.1.7 Other Products

- 5.2 By Application

- 5.2.1 Facial Contouring & Skin Rejuvenation

- 5.2.2 Body Contouring & Cellulite Reduction

- 5.2.3 Hair Removal

- 5.2.4 Breast Enhancement

- 5.2.5 Tattoo & Scar Removal

- 5.2.6 Other Applications

- 5.3 By Procedure Invasiveness

- 5.3.1 Non-invasive Devices

- 5.3.2 Minimally-invasive Devices

- 5.3.3 Invasive / Implantable Devices

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Dermatology & Cosmetic Clinics

- 5.4.3 Medical Spas

- 5.4.4 Home-use Settings

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 AbbVie

- 6.3.2 Alma Lasers

- 6.3.3 Apyx Medical

- 6.3.4 BTL Aesthetics

- 6.3.5 Candela Medical

- 6.3.6 Classys

- 6.3.7 Cutera

- 6.3.8 Fotona

- 6.3.9 Galderma

- 6.3.10 Hologic (Cynosure)

- 6.3.11 InMode

- 6.3.12 Johnson & Johnson (Mentor)

- 6.3.13 Lumenis

- 6.3.14 Lutronic

- 6.3.15 Merz Pharma

- 6.3.16 Quanta System

- 6.3.17 Sientra

- 6.3.18 Bausch Health(Solta)

- 6.3.19 Venus Concept

- 6.3.20 Zimmer Biomet (A&E)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment