PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934668

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934668

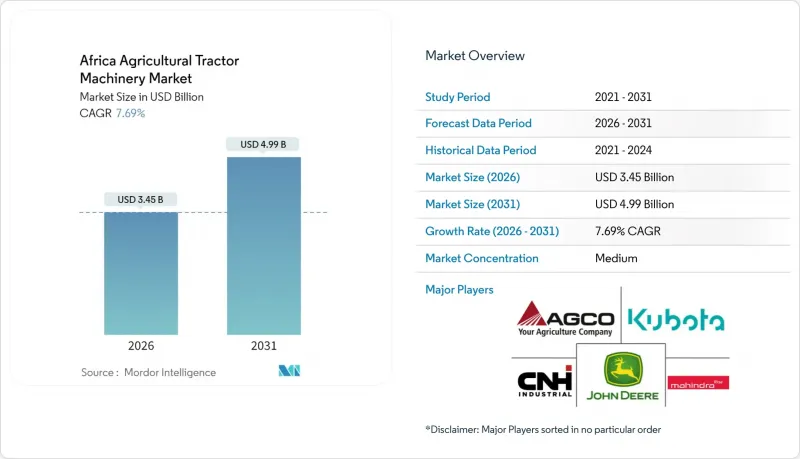

Africa Agricultural Tractor Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Africa agricultural tractor machinery market is expected to grow from USD 3.20 billion in 2025 to USD 3.45 billion in 2026 and is forecast to reach USD 4.99 billion by 2031 at 7.69% CAGR over 2026-2031.

This expansion reflects widening mechanization gaps being closed through targeted subsidies, growing digital hiring platforms, and the rise of climate-smart implements that make tractors indispensable across a variety of African production systems. Governments continue to anchor credit lines in local currencies, while donor-backed projects create new demand for precision sprayers, planters, and GPS-enabled tractors capable of conserving fuel and inputs. Despite structural headwinds such as currency depreciation and customs delays, pay-per-use business models combined with lower-cost CKD (Completely Knocked Down) assembly have begun easing the affordability barrier that long constrained mechanization adoption. Large-scale commercial farms are simultaneously pushing horsepower requirements higher, creating a bifurcated product mix that ranges from sub-90 horsepower units for smallholders to 450 horsepower machines for export-oriented estates. Original equipment manufacturers are responding with localized assembly, fleet-financing packages, and after-sales service hubs that tighten brand loyalty while improving uptime across the continent.

Africa Agricultural Tractor Machinery Market Trends and Insights

Government Mechanization Subsidies and Tractor Financing Schemes

Pan-African subsidy programs and concessional credit lines have rapidly lowered purchase barriers for tractor ownership, stimulating demand across the Africa agricultural tractor machinery market. Nigeria's Anchor Borrowers' Programme disbursed ₦1.12 trillion (USD 1.5 billion) to 4.8 million farmers cultivating 5.3 million hectares since 2015, while the Agricultural Credit Guarantee Scheme Fund covers 75% of loan defaults, mitigating lender risk. Kenya reinforced a similar approach in its 2024/25 budget, allocating KES 68.3 billion (USD 520 million) for agriculture, including tractor fleets operated by agripreneurs and the distribution of 230 milk coolers that integrate dairy value chains. Average tractor density remains just 0.27 horsepower per hectare versus 1.5 horsepower per hectare in Asia, underscoring the scope for mechanization gains. Although high nominal interest rates between 18% and 30% limit credit uptake, the growing presence of local-currency instruments and partial-risk guarantees is easing access in rural areas. These programs thereby underpin the projected growth trajectory of the Africa agricultural tractor machinery market.

Expansion of Large-Scale Commercial Farming Across Africa

Consolidation of farmland is shifting demand toward larger horsepower models and sophisticated implements. Egypt's desert agriculture projects operate corporate holdings of 7,500 to 9,000 acres, using center-pivot irrigation and machine harvesting that call for GPS-guided 120-450 horsepower units. Institutional capital has already deployed USD 45 billion into global farm acquisitions, a portion of which targets African estates where scale efficiencies justify premium equipment. Emerging carbon-credit programs that reward no-till and cover crops further accelerate mechanization, because large farms must track input use and yields precisely to earn additional revenue streams. As a result, the Africa agricultural tractor machinery market is witnessing a gradual tilt toward high-end models with advanced telematics, boosting average selling prices. The trend is long-term in nature and resilient to cyclical commodity swings, given the multi-decade land-development horizons of private equity, pension funds, and sovereign wealth investors.

High Import Tariffs and Complex Customs Procedures for CKD Kits

Despite low nominal tariffs on assembled tractors, documentation hurdles, port congestion, and varied inspection regimes keep effective landed costs up to 25% above invoice prices in several African markets. Nigeria's clearance cycle stretches 60-90 days for CKD consignments, immobilizing working capital for local assemblers. Kenya's Mombasa port faces similar backlogs, with demurrage charges increasing total costs. While AfCFTA promises to harmonize trade processes, implementation remains uneven, and the digitization of customs paperwork is still in early stages. Until clearance times normalize, manufacturers face elongated cash conversion cycles that weigh on inventory planning and deter new entrants in the Africa agricultural tractor machinery market.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of Pay-Per-Use Tractor Hiring Digital Platforms

- Climate-Smart Agriculture Programs Driving Demand for Precision Implements

- Fragmented After-Sales Service Networks Limiting Machinery Uptime

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The plowing and cultivating category held a 30.68% revenue share of the Africa agricultural tractor machinery market in 2025, driven by rotovators, cultivators, and harrows that prepare fragmented plots for planting. Contract mechanization services priced between USD 19-28 per hectare in Zambia and USD 51-69 per hectare in Zimbabwe underline the persistent need for tillage operations. Nonetheless, animal draft power still covers up to 57% of tillage in parts of Malawi and Zambia, indicating that full transition to tractor-based systems is incomplete. Conservation agriculture programs promote no-till practices, but uptake remains limited because specialized planters are expensive and weed management requires additional knowledge. Over the forecast horizon, the segment is likely to cede relative share to precision implements, yet absolute volumes will still grow on the back of rising food output.

Sprayers form the fastest-growing product line, advancing at a 9.67% CAGR through 2031 and reshaping the Africa agricultural tractor machinery market. The Middle East and Africa region registered 0.95 million sprayer units in 2024, with Nigeria and South Africa jointly accounting for 0.34 million. Tractor-mounted configurations now capture 34-38% of global demand, replacing manual knapsack units and cutting labor hours while improving coverage uniformity. Solar-powered sprayers offer emissions-free operation for off-grid farms, although battery costs and charging gaps postpone mainstream adoption. Precision chemistry, variable-rate nozzles, and IoT sensors are also entering the field, aligning with donor mandates for climate-smart agriculture. Given that 51% of African farmers still share or rent sprayers, leasing pools and digital booking platforms will remain pivotal in unlocking further penetration.

The Africa Agricultural Tractor Machinery Market Report is Segmented by Product Type ( Plowing and Cultivating Machinery, Planting Machinery, Sprayers, Haying and Forage Machinery, and Other Types) and by Geography (Nigeria, South Africa, Kenya, and Rest of Africa). The Report Offers the Market Size and Forecasts in Terms of Value (USD).

List of Companies Covered in this Report:

- Deere and Company

- CNH Industrial

- AGCO Corporation

- Mahindra and Mahindra

- Kubota Corporation

- Tractors and Farm Equipment Ltd (Amalgamations Group)

- Yanmar Holdings Co., Ltd.

- International Tractors Ltd -Sonalika

- CLAAS KGaA mbH

- Weichai Lovol Intelligent Agriculture (Weichai Group)

- LS Mtron Ltd (LS Group)

- SDF Group - Same Deutz-Fahr

- Tumosan Motor ve Traktor Sanayi A.S.

- Dongfeng Agricultural Machinery Group

- Zetor Tractors a.s. (HTC Holding)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government mechanization subsidies and tractor financing schemes

- 4.2.2 Expansion of large-scale commercial farming across Africa

- 4.2.3 Proliferation of pay-per-use tractor hiring digital platforms

- 4.2.4 Climate-smart agriculture programs driving demand for precision implements

- 4.2.5 Rising adoption of renewable-powered autonomous tractors

- 4.2.6 China-Africa industrial parks enabling low-cost CKD tractor assembly

- 4.3 Market Restraints

- 4.3.1 High import tariffs and complex customs procedures for CKD kits

- 4.3.2 Fragmented after-sales service networks limiting machinery uptime

- 4.3.3 Currency depreciation increasing the cost of imported components

- 4.3.4 Land tenure uncertainties discouraging long-term machinery investment

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Plowing and Cultivating Machinery

- 5.1.1.1 Plows

- 5.1.1.2 Harrows

- 5.1.1.3 Rotovators and Cultivators

- 5.1.1.4 Other Equipment

- 5.1.2 Planting Machinery

- 5.1.2.1 Seed Drills

- 5.1.2.2 Planters

- 5.1.2.3 Spreaders

- 5.1.2.4 Other Planting Machinery

- 5.1.3 Sprayers

- 5.1.4 Haying and Forage Machinery

- 5.1.4.1 Mowers and Conditioners

- 5.1.4.2 Balers

- 5.1.4.3 Other Haying and Forage Machinery

- 5.1.5 Other Types

- 5.1.1 Plowing and Cultivating Machinery

- 5.2 By Geography

- 5.2.1 Nigeria

- 5.2.2 South Africa

- 5.2.3 Kenya

- 5.2.4 Rest of Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Deere and Company

- 6.4.2 CNH Industrial

- 6.4.3 AGCO Corporation

- 6.4.4 Mahindra and Mahindra

- 6.4.5 Kubota Corporation

- 6.4.6 Tractors and Farm Equipment Ltd (Amalgamations Group)

- 6.4.7 Yanmar Holdings Co., Ltd.

- 6.4.8 International Tractors Ltd -Sonalika

- 6.4.9 CLAAS KGaA mbH

- 6.4.10 Weichai Lovol Intelligent Agriculture (Weichai Group)

- 6.4.11 LS Mtron Ltd (LS Group)

- 6.4.12 SDF Group - Same Deutz-Fahr

- 6.4.13 Tumosan Motor ve Traktor Sanayi A.S.

- 6.4.14 Dongfeng Agricultural Machinery Group

- 6.4.15 Zetor Tractors a.s. (HTC Holding)

7 Market Opportunities and Future Outlook