PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937274

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937274

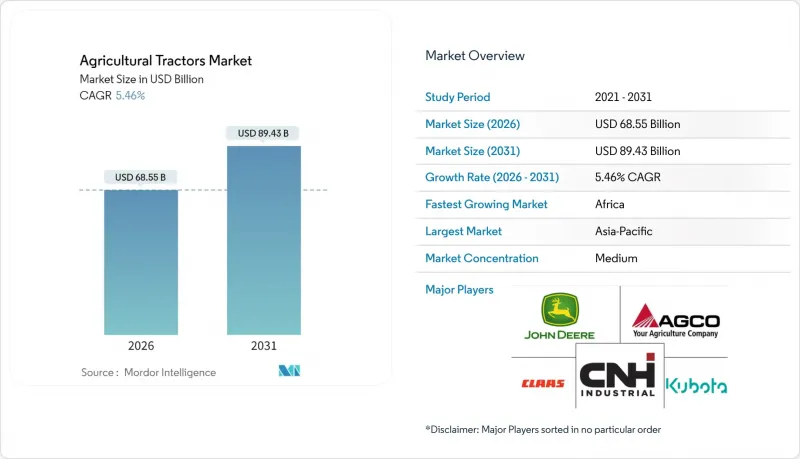

Agricultural Tractors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The agricultural tractors market is expected to grow from USD 65 billion in 2025 to USD 68.55 billion in 2026 and is forecast to reach USD 89.43 billion by 2031 at 5.46% CAGR over 2026-2031.

Current growth is underpinned by continuing mechanization in emerging economies, rapid precision-agriculture retrofit activity in developed regions, and early commercialization of electric and autonomous tractor platforms. Asia-Pacific sustains the strongest regional momentum, as expansive subsidy programs in India and China's farm-modernization push stimulate replacement demand, while Africa posts the fastest growth as CAADP 2.0 sets minimum mechanization targets and unlocks concessional financing. The 40-100 HP segment reflects optimal power-to-cost ratios for mid-scale farming operations, while 2-wheel drive configurations maintain dominance due to lower acquisition costs and maintenance simplicity. Utility tractors serve diverse agricultural applications from tillage to material handling. However, autonomous tractors are experiencing explosive growth as grain majors pilot driverless systems to address labor shortages and optimize field operations. Consolidation among global vendors remains moderate; yet regional brands continue to grow through focused cost-optimized product lines and locally aligned distribution. Supply chain volatility in Tier 4 F engines and rising interest rates affecting dealer floor-plan financing present near-term headwinds, yet precision agriculture retrofit demand and electrification initiatives continue driving long-term growth momentum.

Global Agricultural Tractors Market Trends and Insights

Subsidy Renewals in India and Brazil

India extended subsidized credit lines under the Kisan Credit Card scheme to fiscal 2029, allocating INR 1.68 trillion (USD 20.2 billion) for farm mechanization, with tractors capturing roughly 15% of disbursements . Brazil's Programa Nacional de Fortalecimento da Agricultura Familiar offers 3% interest financing, improving affordability for 40-100 HP models . As manual labor costs have risen 40-60% since 2022, tractors have become financially viable for holdings above 5 ha, accelerating agricultural tractor market adoption.

Electrification of Utility Tractors below 60 HP

Electric tractors under 60 HP gain traction in orchards and greenhouses where zero-tailpipe emissions reduce ventilation costs and meet local regulations. Fendt's e100 Vario delivers up to six operating hours, the European Union's Green Deal provides up to 40% purchase subsidies for electric agricultural equipment, and California's Air Resources Board mandates zero-emission standards for utility vehicles by 2030, creating regulatory tailwinds for electrification initiatives. Battery packs still cost USD 400-600 per kWh, yet the International Energy Agency projects a 40% cost decline by 2030, bringing parity within reach .

High battery pack cost for electric models

Electric tractor adoption faces significant headwinds from battery pack costs that remain 2-3 times higher than automotive applications, limiting market penetration despite growing environmental regulations. Agricultural lithium-ion packs cost USD 400-600 per kWh, roughly triple light-duty automotive levels. The total cost of ownership for electric tractors exceeds diesel equivalents by 20-40% over five-year periods, even accounting for lower operating costs and government incentives. Battery degradation in agricultural applications, where tractors operate in dusty, high-vibration conditions with irregular charging cycles, reduces effective capacity by 15-25% annually, further impacting economic viability for commercial farming operations.

Other drivers and restraints analyzed in the detailed report include:

- Rising Replacement Demand in the U.S. Corn Belt

- Precision-ag Retrofit Boom in Mid-Horsepower Fleet

- Bank liquidity crunch in Sub-Saharan credit lines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 40-100 HP segment captured 42.94% of the agricultural tractors market share in 2025, reflecting optimal power-to-cost ratios for diverse farming operations from row-crop cultivation to material handling applications. This segment benefits from versatility across multiple agricultural tasks, enabling farmers to justify higher capital investments through year-round utilization rather than seasonal deployment. The sub-40 HP category maintains its share by primarily serving specialty crops, vineyard operations, and smallholder agriculture in emerging markets where compact size and maneuverability outweigh raw power requirements.

High-horsepower segments above 200 HP demonstrate 7.49% CAGR growth, driven by large-scale farming operations seeking to maximize field efficiency through wider implement compatibility and reduced operating hours per acre.The 101-200 HP segment faces headwinds from supply chain constraints affecting Tier 4 Final engines, yet precision agriculture retrofits are driving demand for ISOBUS-compatible models that support variable-rate application and autonomous guidance systems.

Two-wheel configurations delivered a 71.80% share of the agricultural tractor market size in 2025, favored for lower acquisition cost and simpler upkeep. The typical 40-100 HP 2WD tractor is USD 8,000-15,000 cheaper than its 4WD counterpart, an important gap in price-sensitive economies. Four-wheel drive demand is projected to expand 7.62% annually as conservation tillage and wetter planting windows raise traction needs.

The shift toward 4WD systems reflects changing farming practices that prioritize field efficiency and soil conservation over initial equipment costs. Modern 4WD tractors incorporate electronic traction management systems that automatically engage front-wheel assist based on slip detection, optimizing fuel efficiency while maintaining traction advantages. Regulatory influence from soil conservation programs in the United States and European Union encourages 4WD adoption through reduced soil compaction and improved field trafficability during wet conditions, supporting sustainable farming practices while maintaining productivity levels.

The Agricultural Tractors Market Report is Segmented by Power Output (less Than 40 HP, and More), by Drive Type ( 2-Wheel Drive, and 4-Wheel Drive ), by Engine Type (Diesel and More), by Tractor Type (Utility, Row-Crop and More), and by Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Report Offers Market Size and Forecasts in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominates the global agricultural tractors market with a 38.60% share, driven by India's mechanization initiatives, China's agricultural modernization programs, and Japan's precision agriculture adoption. India anchors regional demand through 25-50% purchase subsidies on tractors below 35 HP, while China seeks 75% mechanization by 2030 versus 52% in 2024, spurring mid-range tractor uptake. Japan's technology leadership in autonomous systems positions the country as a testing ground for the global rollout of robotized equipment.

Africa is the fastest-growing region. The agricultural tractors market in Africa is projected to advance 7.62% annually, with government procurement and concessionary financing targeting 40% mechanization under CAADP 2.0. Nigeria imported 8,500 tractors in 2024, a 15% rise year on year, while Kenya and Ghana collectively secured USD 480 million in multilateral credit lines to fund cooperative machinery pools

North America exhibits mature replacement dynamics. High-horsepower purchases dominate in the Corn Belt as farms averaging 600 ha seek wider implements and labor productivity gains. The United States accounts for the majority share of regional value, while Canada invests in electric compact units for dairy and greenhouse operations. Europe follows, driven by Stage V emissions compliance and the European Green Deal target to cut agricultural emissions 25% by 2030, accelerating the diesel-to-electric transition in specialty applications. Germany and France remain early adopters of 4WD and autosteer platforms and jointly represent 42% of European shipments in 2025.

- Deere and Company

- CNH Industrial

- AGCO Corporation

- Kubota Corporation

- Mahindra and Mahindra

- CLAAS KGaA

- SDF Group

- Yanmar Holdings Co., Ltd.

- Argo Tractors S.p.A.

- Weichai Lovol Intelligent Agricultural Technology CO., LTD

- LS Mtron Ltd

- Kioti Tractor (Daedong Corporation)

- International Tractors Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Subsidy Renewals in India and Brazil

- 4.2.2 Precision-ag Retrofit Boom among Mid-Horsepower Tractors

- 4.2.3 Electrification of Utility Tractors (<60 HP)

- 4.2.4 Rising Replacement Demand in U.S. Corn Belt

- 4.2.5 Mandated Mechanization under Africa's CAADP 2.0

- 4.2.6 Autonomous Pilot Programs by Global Grain Majors

- 4.3 Market Restraints

- 4.3.1 High Battery Pack Cost for Electric Models

- 4.3.2 Bank Liquidity Crunch in Sub-Saharan Credit Lines

- 4.3.3 Supply-chain Volatility in Powertrains (Tier 4 F engines)

- 4.3.4 Rising Interest Rates Affecting Dealer Floorplan Financing

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Power Output

- 5.1.1 Less than 40 HP

- 5.1.2 40-100 HP

- 5.1.3 101-200 HP

- 5.1.4 More than 200 HP

- 5.2 By Drive Type

- 5.2.1 2-Wheel Drive

- 5.2.2 4-Wheel Drive

- 5.3 By Engine Type

- 5.3.1 Diesel

- 5.3.2 Electric

- 5.3.3 Hybrid

- 5.4 By Tractor Type

- 5.4.1 Utility

- 5.4.2 Row-Crop

- 5.4.3 Orchard and Vineyard

- 5.4.4 Autonomous

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 Russia

- 5.5.3.4 United Kingdom

- 5.5.3.5 Italy

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 Turkey

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Egypt

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Deere and Company

- 6.4.2 CNH Industrial

- 6.4.3 AGCO Corporation

- 6.4.4 Kubota Corporation

- 6.4.5 Mahindra and Mahindra

- 6.4.6 CLAAS KGaA

- 6.4.7 SDF Group

- 6.4.8 Yanmar Holdings Co., Ltd.

- 6.4.9 Argo Tractors S.p.A.

- 6.4.10 Weichai Lovol Intelligent Agricultural Technology CO., LTD

- 6.4.11 LS Mtron Ltd

- 6.4.12 Kioti Tractor (Daedong Corporation)

- 6.4.13 International Tractors Limited

7 Market Opportunities and Future Outlook