PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934679

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934679

Shampoo - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

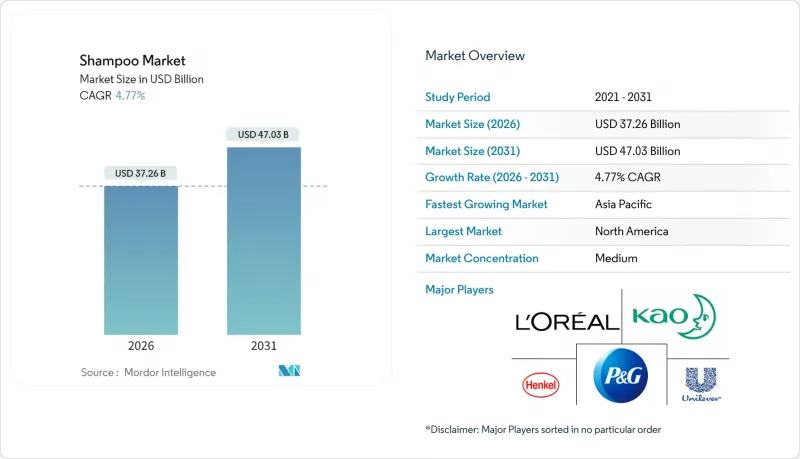

The global shampoo market was valued at USD 35.6 billion in 2025 and estimated to grow from USD 37.26 billion in 2026 to reach USD 47.03 billion by 2031, at a CAGR of 4.77% during the forecast period (2026-2031).

The global hair shampoo market is on a steady rise, driven by changing consumer behaviors in retail. Today's shoppers prioritize ingredient transparency, wellness benefits, and ethical sourcing. This shift has bolstered the popularity of natural and organic shampoos, with brands like Garnier Whole Blends and Herbal Essences Bio: Renew leading the charge. The trend of premiumization is evident, as consumers opt for higher-end products like Kerastase Nutritive and Olaplex Bond Maintenance, signaling their readiness to invest in home-use solutions that deliver visible results. While mass-market giants like Head & Shoulders and Dove maintain their shelf dominance, younger consumers are turning to direct-to-consumer and niche brands. Personalized offerings, such as those from Function of Beauty and Prose, let buyers tailor formulations to their unique hair types and lifestyles. The online marketplace is further propelling this trend, granting consumers easy access to emerging brands and customized solutions. The Asia-Pacific region is at the forefront of this global growth, buoyed by rising incomes and a surge in digital commerce, leading to frequent product trials and brand-switching. Meanwhile, North America and Europe are leaning towards eco-conscious packaging and variants that are sulfate-free and vegan. In essence, the demand for shampoos is evolving, emphasizing premium efficacy, personalization, and sustainability, with consumers redefining value beyond mere pricing.

Global Shampoo Market Trends and Insights

Growing preference for organic and herbal shampoos

As consumers increasingly seek gentler, cleaner alternatives that resonate with their wellness values, the retail haircare market witnesses a surge in demand for organic and herbal shampoos. A March 2025 study by NSF revealed that 74% of consumers now prioritize organic ingredients in personal care, underscoring a significant pivot towards clean beauty . This shift is spurring product innovations, exemplified by Herbal Essences' "Pure Plants" range, crafted with aloe and camellia oil, and designed for eco-conscious consumers with its transparent ingredient list and sustainable packaging. In India, brands like Forest Essentials, Lotus Herbals, Biotique, Pilgrim, Jovees, and Khadi Natural are spearheading the growth of retail herbal shampoos. These brands are infusing botanicals such as shikakai, amla, neem, hibiscus, and bhringraj into their offerings. Marketed to address issues like dandruff, hair fall, and scalp health, these shampoos leverage digital-first campaigns, influencer collaborations, and platforms like Nykaa to connect with a younger, ingredient-savvy audience. In 2024, Beyonce's Cecred line debuted, spotlighting bioactive natural ingredients like fermented rice water, showcasing the swift consumer embrace of plant-powered claims. Ultimately, as shoppers emphasize authenticity, efficacy, and sustainability, organic and herbal shampoos are evolving from niche options to pivotal players in the global retail shampoo market.

Influence of social media and digital marketing

Social media and digital marketing are reshaping consumer engagement and purchasing decisions in the shampoo market, with online influence emerging as a pivotal driver of retail growth. A 2024 survey from the University of Portsmouth revealed that 60% of consumers place their trust in influencer recommendations . Furthermore, nearly half of all purchase decisions are swayed by these endorsements, highlighting the significant impact of digital voices on consumer behavior. Celebrity-led product launches underscore this trend: Beyonce's Cecred line swiftly gained traction on TikTok and Instagram, while Blake Lively's beauty brand debut in 2024 showcased the power of cultural icons in generating immediate awareness and driving retail demand. Established brands are also capitalizing on this trend. Olaplex remains at the forefront of digital haircare discussions, due to influencer-led tutorials. In India, brands like Biotique and Pilgrim are leveraging Instagram Reels and micro-influencers to promote natural shampoos, addressing local concerns such as dandruff and hair fall. Retail platforms are not to be outdone; Nykaa, with its ambassadors Sharvari and Rasha Thadani, has transformed its shampoo and haircare portfolio into a leading sales category, owing to aspirational campaigns that seamlessly merge beauty with lifestyle. These concerted efforts underscore the evolution of shampoo purchases: once a routine necessity, it's now a lifestyle choice, driven by social media engagement, peer validation, and celebrity endorsement. This shift is not only accelerating the adoption of premium products but also expanding the reach of both established and emerging retail brands.

High competition and market saturation

Oversaturation is posing significant challenges to the global shampoo market, as an influx of competing products across all segments makes it hard for brands to distinguish themselves. Mass-market players, like Tresemme with its Pro Pure collection and Sunsilk's new herbal infusions, are consistently broadening their offerings. Concurrently, natural-centric brands such as Lotus Herbals and Pilgrim are introducing overlapping variants, emphasizing botanicals like aloe, hibiscus, and onion extract. Premium brands, including Aveda and Redken, are expanding their retail footprint with treatment-focused shampoos, merging the realms of salon-quality and mass-market products. Celebrity-backed launches, from Jisoo's beauty line in Korea to Beyonce's Cecred, have heightened competition, shifting consumer focus from brand loyalty to novelty. E-commerce giants like Amazon and Nykaa showcase numerous similar dandruff and hair-fall shampoos, pushing brands to resort to heavy discounts for visibility. This plethora of options is muddying consumer choices, diluting long-term loyalty, and compelling both established and new brands to invest heavily in marketing for relevance. Retailers, with limited shelf space, are curtailing product duplication by streamlining their assortments, often at the expense of smaller brands. Consequently, the market is becoming increasingly crowded, making differentiation a challenge, squeezing profitability, and stunting overall growth, even with a steady stream of new product launches.

Other drivers and restraints analyzed in the detailed report include:

- Increasing demand for men's segment shampoos

- Rise of multifunctional shampoos with innovative active ingredients

- Availability of counterfeit shampoos

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Standard shampoos, with a commanding 91.10% share, dominate the global hair shampoo market, due to their widespread consumer familiarity and established distribution networks. Brands such as Head & Shoulders, Dove, and Pantene leverage strong brand recognition and consistent product performance to maintain their leadership on retail shelves worldwide. These brands, benefiting from economies of scale, enjoy extensive availability across supermarkets, hypermarkets, and e-commerce platforms, making them the go-to choice for consumers seeking reliable, everyday hair care solutions.

Natural, organic, and medicated shampoos are emerging as the fastest-growing segment, with a notable growth rate of approximately 6.92% CAGR. This surge reflects a shift in consumer preferences towards ingredient transparency, wellness-focused formulations, and pronounced hair health benefits. Brands like Sienna Naturals, Prose, Ceremonia, Ursa Major, and Attitude are carving a niche by offering botanical, organic, and sustainably sourced ingredients, appealing to eco-conscious and ingredient-savvy consumers. Furthermore, medicated variants, such as targeted dandruff or hair-fall solutions, are witnessing heightened acceptance, bolstered by mainstream distribution through retail and e-commerce channels. This accessibility not only diminishes the premium barrier but also propels the overall market expansion in the natural and organic segment.

In 2025, specific-purpose shampoos seized a commanding 55.10% share of the global hair shampoo market, projected to grow at a steady 4.83% CAGR through 2031. This trend underscores a growing consumer preference for products tailored to individual hair concerns. Leading the retail channels, anti-dandruff and scalp-health products, such as Head & Shoulders Clinical Strength and Neutrogena T/Gel, boast clinically validated efficacy. Meanwhile, volumizing and thickening shampoos, like Living Proof Full Shampoo and Olaplex Volume Shampoo, focus on enhancing root-level hair density and manageability. Strengthening and repair-centric products, such as Prose Repair Shampoo and Ceremonia Hair Repair, cater to consumers prioritizing preventive haircare. Furthermore, natural and plant-based alternatives, including Sienna Naturals Anti-Dandruff and Ursa Major Fortifying Shampoo, are carving a niche by merging performance with eco-friendly formulations.

General and multi-purpose shampoos, designed for family convenience, continue to thrive due to their everyday usability and widespread retail presence. Brands like Dove Daily Moisture and Pantene Daily Care cater to consumers desiring dependable, all-in-one solutions, even without specialized claims. While these familiar products enjoy broad accessibility, they're increasingly challenged by specific-purpose variants that, despite their premium pricing, entice consumers to seek targeted solutions for issues like dandruff, hair fall, and repair. Additionally, as consumer awareness evolves, emerging concerns such as pollution protection and blue-light defense are being addressed by brands like Attitude Protect & Repair Shampoo, gradually broadening the spectrum of multi-purpose offerings.

The Global Shampoo Market Report is Segmented by Product Type (Standard Shampoo, Natural/Organic/Medicated Shampoo), Hair Concern (General/Multi-purpose, Specific Purpose), Category (Mass, Luxury/Premium), Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, and Others), and Geography (North America, Europe, Asia-Pacific, and Others). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominates the global hair shampoo market, commanding a 47.10% share and expanding at a 5.52% CAGR. A robust retail infrastructure, heightened consumer demand, and a swift embrace of premium and specialty products fuel this growth. Countries such as China and India underscore this regional supremacy. With vast supermarket chains, contemporary trade formats, and a booming e-commerce landscape, brands are effectively reaching diverse consumer segments. In India, brands like Sunsilk, Dove, and Patanjali adeptly navigate both offline and online avenues to serve both mainstream and niche audiences. Meanwhile, in China, luxury haircare brands like L'Oreal Professionnel and Kerastase are gaining momentum, due to digital campaigns aimed at the younger, tech-savvy demographic.

North America and Europe are witnessing growth, driven by innovation, a push for premium products, and shifting consumer preferences. In North America, regulatory shifts, exemplified by initiatives like MoCRA, are steering the market. These changes favor established manufacturers with the resources for product development, especially as consumers demand transparency, sustainability, and high-performance formulations. This trend has amplified the appetite for luxury and specialized shampoos. Meanwhile, Europe's growth is underpinned by stringent regulations, a commitment to sustainability, and a heightened consumer focus on ethical sourcing. This environment has allowed premium and artisanal brands to flourish, especially through specialty beauty retailers and online platforms.

South America and the Middle East and Africa are witnessing gradual growth, influenced by local regulations and emerging retail landscapes. In Brazil, while economic improvements and heightened brand awareness present opportunities for both global and local players, challenges loom in the form of political instability, currency volatility, and counterfeit products. These regions are leaning heavily on modern retail growth and e-commerce, though traditional channels still play a pivotal role in rural and price-sensitive markets, leading to more tempered growth compared to their more established counterparts.

- Procter & Gamble Company

- Unilever PLC

- L'Oreal S.A.

- Kenvue Inc.

- Henkel AG & Co. KGaA

- Kao Corporation

- Shiseido Company, Limited

- Amorepacific Corporation

- LG Household & Health Care Ltd.

- Colgate-Palmolive Company

- Beiersdorf AG

- Revlon, Inc.

- Natura &Co

- O Boticario S.A. (Grupo Boticario)

- Dabur India Limited

- Patanjali Ayurved Limited

- Emami Limited

- Marico Limited

- The Himalaya Drug Company (Himalaya Wellness Company)

- Godrej Consumer Products Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing preference for organic and herbal shampoos

- 4.2.2 Influence of social media and digital marketing

- 4.2.3 Increasing demand for men's segment shampoos

- 4.2.4 Rise of multifunctional shampoos with innovative active ingredients

- 4.2.5 Sustainability and eco-friendly packaging

- 4.2.6 Growing demand for AI-personalized and custom shampoos

- 4.3 Market Restraints

- 4.3.1 Regulatory challenges

- 4.3.2 High competition and market saturation

- 4.3.3 Supply chain disruptions

- 4.3.4 Availability of counterfeit shampoos

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Standard Shampoo

- 5.1.2 Natural/Organic/Medicated Shampoo

- 5.2 By HairConcern

- 5.2.1 General/Multi-purpose

- 5.2.2 Specific Purpose

- 5.2.2.1 Anti-Dandruff and Scalp Health

- 5.2.2.2 Volumizing and Thickening

- 5.2.2.3 Strengthening and Repair

- 5.2.2.4 Hair Regrowth and Hair Repair

- 5.2.2.5 Others

- 5.3 By Category

- 5.3.1 Mass

- 5.3.2 Luxury/Premium

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Convenience/Grocery Stores

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Procter & Gamble Company

- 6.4.2 Unilever PLC

- 6.4.3 L'Oreal S.A.

- 6.4.4 Kenvue Inc.

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Kao Corporation

- 6.4.7 Shiseido Company, Limited

- 6.4.8 Amorepacific Corporation

- 6.4.9 LG Household & Health Care Ltd.

- 6.4.10 Colgate-Palmolive Company

- 6.4.11 Beiersdorf AG

- 6.4.12 Revlon, Inc.

- 6.4.13 Natura &Co

- 6.4.14 O Boticario S.A. (Grupo Boticario)

- 6.4.15 Dabur India Limited

- 6.4.16 Patanjali Ayurved Limited

- 6.4.17 Emami Limited

- 6.4.18 Marico Limited

- 6.4.19 The Himalaya Drug Company (Himalaya Wellness Company)

- 6.4.20 Godrej Consumer Products Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK