PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934681

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934681

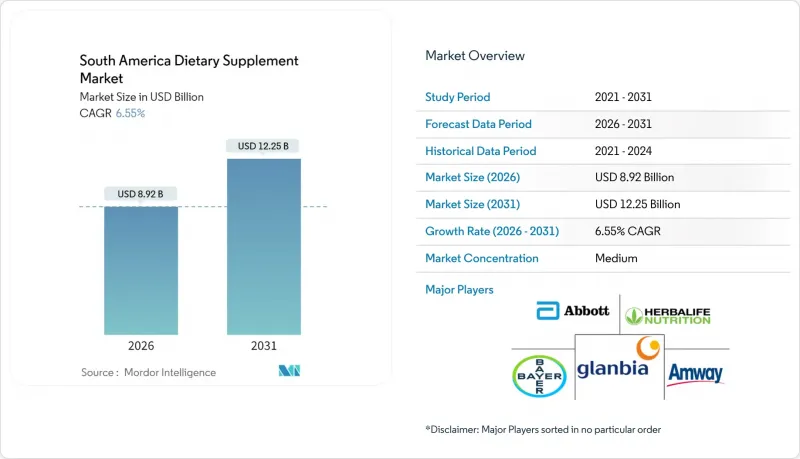

South America Dietary Supplement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The South America dietary supplement market is expected to grow from USD 8.37 billion in 2025 to USD 8.92 billion in 2026 and is forecast to reach USD 12.25 billion by 2031 at 6.55% CAGR over 2026-2031.

As health awareness rises and disposable incomes increase, South America's dietary supplements market is booming. Brazil, with its robust domestic manufacturing and a mature regulatory framework under ANVISA, stands at the forefront of this growth. Data from the Brazilian Association of the Food Industry for Special Purposes and Related Products (ABIA) reveals an 8.1% uptick in dietary and vitamin supplement consumption in Brazil from January to September 2023, compared to the same stretch in 2022 . Colombia, buoyed by a burgeoning middle class and proactive government measures against nutritional deficiencies, is also witnessing a surge. Vitamins and minerals dominate the product landscape, with brands like One A Day (Bayer) and Ensure (Abbott Laboratories) meeting the high consumer demand. Probiotics, highlighted by brands such as Align (Procter & Gamble) and LactoSpore (Sabinsa), are the fastest-growing segment, reflecting a heightened consumer emphasis on gut health. While capsules and softgels lead in popularity, gummies are swiftly capturing attention, particularly among children, owing to offerings from Nutrilite (Amway) and Omnilife that are both sugar-free and functional. Women, influenced by trends in prenatal health and beauty, form a pivotal consumer segment. Given the shifting consumer preferences, innovative product formats, and a conducive regulatory environment, the market's growth trajectory appears promising.

South America Dietary Supplement Market Trends and Insights

Increased Focus on Preventive Healthcare

In South America, a heightened focus on preventive healthcare is reshaping consumer habits in the dietary supplements arena. Instead of waiting for ailments to strike, consumers are now actively seeking out supplements to bolster their health, enhance immunity, and rectify nutritional gaps. This shift is underscored by the surging demand for vitamin C, D, and zinc, with brands such as Garden of Life and Nutrilite broadening their immune-boosting product ranges. The backdrop to this trend is the escalating incidence of chronic diseases: as of 2024, around 16.6 million adults in Brazil grappled with diabetes , and hypertension affected 20 to 40% of the regional populace, per the Brazilian Journal of Nephrology . Dietary supplements are increasingly viewed as allies in managing these ailments, aiding in blood glucose regulation, boosting insulin sensitivity, and potentially lowering blood pressure. As a result, there's a noticeable pivot towards formulations emphasizing metabolic health, glycemic control, and heart health, spurring innovation among companies. The omnipresence of over-the-counter supplements in health stores, combined with the rise of online retail, makes it easier than ever for consumers to weave preventive health into their daily routines. This evolution is not just a market trend but a reflection of a broader cultural shift towards self-care and wellness, propelling the dietary supplements market's growth in South America.

Supplements Targeting Women Consumers Fueling Growth

In South America, the dietary supplements market is increasingly shaped by a heightened focus on women's health. Brazil stands out with a pronounced demand for supplements tailored to women's health concerns, spanning fertility, pregnancy, hormonal balance, and beauty trends. Responding to this demand, brands are rolling out specialized products. Notable examples include phytoestrogen supplements aimed at menopausal support and hormonal balance, alongside Nestle's 2024 launches: Materna Pre and Materna Nausea, targeting fertility and early pregnancy discomforts. The market is also pivoting towards personalized and convenient formats, with liquid supplements rising in popularity for their ease of consumption and rapid absorption, catering to today's fast-paced lifestyles. Across the continent, companies are innovating with vitamins, minerals, and women-centric formulations, driving robust growth in the dietary supplements sector. This emphasis on women's health is not just influencing product development but also reshaping distribution strategies, underscoring the region's burgeoning wellness culture. For instance, Unilever's Olly brand has rolled out 'Period Hero', a product tailored for women's hormonal balance. By honing in on women's distinct health needs, these offerings are not only boosting consumer engagement but also amplifying demand across various supplement categories, propelling the overall growth of South America's dietary supplements market.

Presence of Counterfeit Products Hampering Growth

Counterfeit dietary supplements are stifling market growth across South America. These fraudulent products, often laced with subpar or even harmful ingredients, not only jeopardize health but also undermine trust in legitimate brands. A case in point: In 2024, Brazilian authorities intercepted counterfeit Motility (Digexin) capsules, a plant-based digestive aid, being sold online. This incident underscores that even trusted herbal and functional supplements aren't immune to counterfeiting. The rampant spread of these fakes poses a dual threat: endangering public health and skewing the competitive landscape for genuine manufacturers, thereby diminishing brand credibility. The rise of e-commerce has only exacerbated the issue, blurring the lines for consumers trying to discern real supplements from counterfeit ones. In certain areas, lax regulatory enforcement has emboldened counterfeiters, dissuading potential investors and stunting market growth. The economic impact of counterfeit supplements is also significant, as it disrupts revenue streams for legitimate businesses. To combat this challenge, the region needs tighter regulations, better consumer awareness, and vigilant monitoring to rein in counterfeit distribution, safeguard public health, and rejuvenate trust in the dietary supplements market.

Other drivers and restraints analyzed in the detailed report include:

- Growing Preference for Clean-label, Plant-based and Vegan Formulas

- Healthy-ageing Focus Accelerating Multivitamin Uptake Among Consumers

- Tighter Regulations on Dietary supplement market and Borderline Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In South America, vitamins and minerals dominate the dietary supplements market, holding a 26.74% share, underscoring their pivotal role in combating nutritional deficiencies. For example, in Brazil, consumers gravitate towards vitamin D and multivitamins, with urban pharmacies and wellness stores prominently featuring brands like Centrum (Pfizer) and Supradyn (Bayer). Leveraging the region's rich botanical heritage, companies are infusing ingredients like maqui and guarana into herbal wellness formulations, catering to both local and international markets.

Probiotics are leading the charge as the fastest-growing segment, boasting a CAGR of 9.35%. This surge is largely attributed to heightened consumer awareness surrounding gut health and its integral role in overall wellness. Brands like LactoSpore (Sabinsa) and Align (Procter & Gamble) are at the forefront, championing the digestive and immune health benefits of their products through focused marketing and clinically-backed formulations. Meanwhile, other segments, such as fatty acids and enzyme supplements, are witnessing consistent demand. Notably, omega-3 products from Omnilife are becoming a go-to for cardiovascular and infant nutrition, and enzyme-based digestive solutions are being customized for older consumers. Furthermore, the rising popularity of functional ingredients like adaptogens and nootropics signals a shift in consumer focus towards enhanced wellness, prompting manufacturers to diversify and innovate their offerings.

In 2025, traditional capsules and softgels, favored for their dosing precision and ingredient stability, dominate South America's dietary supplements market with a 37.61% share. Brands like Centrum (Pfizer) and Supradyn (Bayer) utilize these formats for vitamins and minerals, while Omnilife opts for them in herbal and specialty supplements. These formats remain popular due to their long shelf life and ease of mass production, making them a reliable choice for manufacturers and consumers alike.

Gummies, with a robust CAGR of 12.31%, are rapidly emerging as the preferred choice, transforming supplement intake into a delightful wellness ritual. Funtrition has ramped up gummy production, harnessing proprietary technologies like GummyGels and Layer-G. Meanwhile, Spanish-Chilean brands cater to the health-conscious, offering sugar-free and allergen-free functional gummies. Other formats like liquid drops, exemplified by Omix's 2024 debut, and powders are also on the rise, lauded for their convenience and enhanced bioavailability. This diversification in formats not only fuels market growth but also sparks innovation in product design and manufacturing.

The South America Dietary Supplement Market Report is Segmented by Type (Vitamins and Minerals, Herbal Supplements, Fatty Acids, Probiotics, Enzymes, Other Product Types), Form (Tablets, Capsules and Softgels, and More, Consumer Group (Men, Women, Kids/Children)), Distribution Channel (Supermarkets/Hypermarkets, and More), and Geography (Brazil, Argentina, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Tecnoquimicas S.A.

- Grupo Omnilife

- Eurofarma Laboratorios S.A.

- Sabinsa Corporation

- Bayer AG

- Abbott Laboratories

- Amway Corporation

- Herbalife Nutrition Ltd.

- Nestle S.A.

- Pfizer Inc.

- Glanbia PLC

- Sanofi S.A.

- Procter & Gamble Co.

- GNC Holdings, LLC

- NOW Foods

- Nature's Bounty, Inc.

- Blackmores Limited

- Kemin Industries, Inc.

- Shaklee Corporation

- Higher Ground Supplements

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Focus on Preventive Healthcare

- 4.2.2 Supplements Targeting Women Consumers Fueling Growth

- 4.2.3 Growing Preference for Clean-label, Plant-based and Vegan Formulas

- 4.2.4 Healthy-ageing Focus Accelerating Multivitamin Uptake Among Consumers

- 4.2.5 E-commerce Growth Enhances Supplement Accessibility and Market Reach

- 4.2.6 Research and Development Investments Drive Innovative Product Development and Targeted Solution

- 4.3 Market Restraints

- 4.3.1 Presence of Counterfeit Products Hampering the Growth

- 4.3.2 Rising Consumer Scepticism Toward Synthetic Additives and Mega-dose Safety Concerns

- 4.3.3 Tighter Regulations on Dietary Supplements and Borderline Products

- 4.3.4 Price Wars from Local Producers Reduce Profit Margins

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Vitamins and Minerals

- 5.1.2 Herbal Supplements

- 5.1.3 Fatty Acids

- 5.1.4 Probiotics

- 5.1.5 Enzymes

- 5.1.6 Other Product Types

- 5.1.7 Others

- 5.2 By Form

- 5.2.1 Tablets

- 5.2.2 Capsules and Softgels

- 5.2.3 Powders

- 5.2.4 Gummies

- 5.2.5 Liquids

- 5.2.6 Others

- 5.3 By Consumer Group

- 5.3.1 Men

- 5.3.2 Women

- 5.3.3 Kids/Children

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Health and Wellness Stores

- 5.4.3 Online Retail Channels

- 5.4.4 Other Distribution Channels

- 5.5 By Country

- 5.5.1 Brazil

- 5.5.2 Argentina

- 5.5.3 Chile

- 5.5.4 Colombia

- 5.5.5 Peru

- 5.5.6 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Tecnoquimicas S.A.

- 6.4.2 Grupo Omnilife

- 6.4.3 Eurofarma Laboratorios S.A.

- 6.4.4 Sabinsa Corporation

- 6.4.5 Bayer AG

- 6.4.6 Abbott Laboratories

- 6.4.7 Amway Corporation

- 6.4.8 Herbalife Nutrition Ltd.

- 6.4.9 Nestle S.A.

- 6.4.10 Pfizer Inc.

- 6.4.11 Glanbia PLC

- 6.4.12 Sanofi S.A.

- 6.4.13 Procter & Gamble Co.

- 6.4.14 GNC Holdings, LLC

- 6.4.15 NOW Foods

- 6.4.16 Nature's Bounty, Inc.

- 6.4.17 Blackmores Limited

- 6.4.18 Kemin Industries, Inc.

- 6.4.19 Shaklee Corporation

- 6.4.20 Higher Ground Supplements

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK