PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934682

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934682

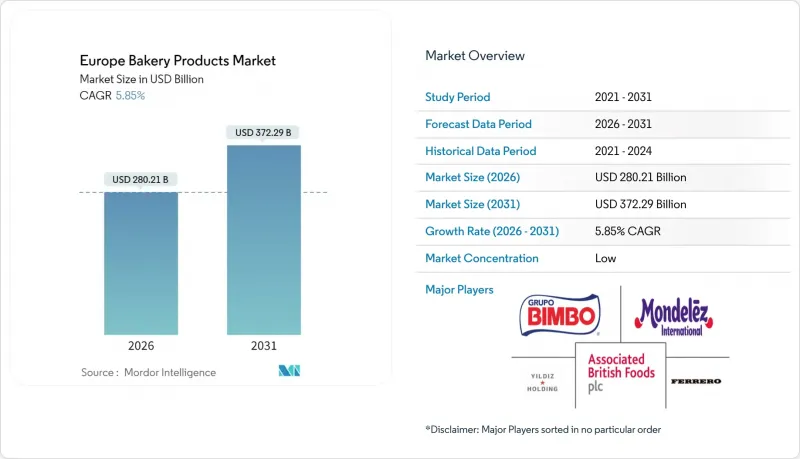

Europe Bakery Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The European bakery products market was valued at USD 264.72 billion in 2025 and estimated to grow from USD 280.21 billion in 2026 to reach USD 372.29 billion by 2031, at a CAGR of 5.85% during the forecast period (2026-2031).

This upward trajectory highlights the market's resilience as consumers increasingly gravitate towards healthier, sustainable, and convenient baked goods. For example, data from the Department for Environment, Food and Rural Affairs reveals that in 2022/23, UK consumers favored unfrozen cakes and pastries, averaging 105 grams per person weekly. Buns, scones, and teacakes followed closely at 59 grams. The market is buoyed by a rising demand for clean-label products, a digital retail transformation, and an increasing preference for frozen items. These trends are expanding the market's reach for both major manufacturers and niche specialists. Furthermore, the market is witnessing a premiumization trend, allowing companies to elevate average prices without dampening demand, even amidst volatile commodity costs. To counter regulatory challenges and maintain both margins and credibility, firms are channeling investments into automation, traceability, and eco-friendly packaging.

Europe Bakery Products Market Trends and Insights

Health and Wellness Trends

European consumers are increasingly favoring functional and nutritionally enhanced bakery products, with protein-enriched and fiber-fortified options gaining traction. In Germany, demand for high-protein snacks and gut-friendly bakery items is rising, while plant-based and flexitarian preferences are reshaping formulations across Europe. According to the German Frozen Food Institute, in 2024, food retailers sold 114,684 tons of frozen cakes, and out-of-home markets sold 91,136 tons. Manufacturers like CSM Ingredients are innovating with technologies such as SlimBake, which reduces fat content by up to 30% without compromising taste or texture. Generation Z is driving demand for personalized nutrition and snack alternatives, while Italian consumers are seeking sustainable bakery goods with health benefits. EFSA's updated guidance on novel foods is enabling the use of innovative ingredients like fermented green lentils as egg replacers, reducing production costs by 30% and meeting clean-label standards.

Product Innovation and Premiumization

European bakers are racing to innovate, pouring resources into automation and unique products to tap into premium markets. Take Grupo Bimbo: in July 2025, the company funneled a whopping USD 2 billion into automation and sustainability across its European branches, underscoring the industry's push for tech-savvy and efficient operations. Sourdough isn't just for traditional loaves anymore; it's set to make waves in various baked goods, thanks to a surge in consumer interest. And as social media and tech fuel flavor experimentation, culinary fusion concepts are on the rise. French bakeries, blending age-old techniques with today's demand for convenience and quality, are leading a renaissance in the artisanal segment, showcasing the evident premiumization trend. On another front, the embrace of Industry 4.0 technologies, from robotics to blockchain traceability, is not only transforming production but also meeting the modern consumer's call for transparency and quality assurance.

Competition from Artisanal and Specialty Bakeries

Across Europe, the rise of artisanal and specialty bakeries is putting intense pressure on industrial bakery producers, especially in premium segments where consumers prioritize authenticity and craftsmanship. In France, artisan bakeries are witnessing a revival, with a resurgence in traditional bakeries after years of decline. This comeback is bolstered by innovations that seamlessly merge age-old techniques with contemporary conveniences. Furthermore, the Real Bread Campaign's triumph over major UK supermarkets, challenging their "freshly baked" claims, underscores a heightened consumer awareness. This awareness leans heavily towards authentic bakery products, distancing from mass-produced options. Artisanal bakeries, with their inherent flexibility, are quick to adapt to local tastes and dietary trends, often rolling out innovative products months ahead of their industrial counterparts. Highlighting the industry's sentiment, the German Baker's Confederation, which represents over 9,200 bakeries, underscores the dual focus on skilled craftsmanship and energy-efficient technologies as key competitive advantages over mass-market producers. In response to this evolving landscape, industrial producers are channeling significant investments into product differentiation and premium positioning, all while striving to retain their foothold in value-centric market segments.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for Clean Label and Natural Ingredients

- Sustainability and Packaging Innovation

- Ingredient Costs and Supply Chain Disruptions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, cakes and pastries dominate the market with a 27.32% share, underscoring European consumers' penchant for these indulgent treats, whether for daily enjoyment or special occasions. Meanwhile, biscuits and cookies are on the rise, boasting a projected CAGR of 6.03% through 2031, thanks to their convenience and health-oriented adaptations. Bread, a staple in traditional diets, is grappling with shifting dietary trends and stiff competition from alternative carbs. Urban markets are witnessing a surge in demand for 'morning goods', as busy consumers hunt for nutritious yet portable breakfast options.

Mondelez International's keen interest in the global cakes and pastries arena, highlighted by its acquisition of Chipita Global SA, underscores the segment's robust growth potential, especially in Central and Eastern Europe. Retailers are increasingly adopting in-store bakery models that employ freeze-and-thaw techniques for cakes and pastries, a move that's slashing labor costs and waste while upholding product quality. As Europe's demographics diversify, there's a rising appetite for specialty and ethnic bakery products, with consumers eager for genuine international flavors. Furthermore, the infusion of functional ingredients across product lines is not only setting manufacturers apart but also catering to the health-conscious demand for enhanced nutritional value.

In 2025, fresh bakery products dominate the market with a 71.10% share, underscoring consumer preferences for the quality, taste, and texture of freshly baked goods. Meanwhile, the frozen segment, though currently smaller, is on a growth trajectory, boasting a 6.12% CAGR through 2031. This surge is attributed to benefits like supply chain efficiency, extended shelf life, and advanced freezing technologies that uphold product quality. Such growth signals the sector's alignment with modern retail demands and a consumer shift towards convenience without sacrificing taste.

Technological advancements in blast freezing and packaging bolster the frozen segment's growth, ensuring product integrity during storage and distribution. This not only broadens manufacturers' geographic reach but also curtails food waste. European retailers are increasingly turning to frozen bakery solutions, streamlining inventory management and cutting down labor costs tied to in-store baking. While fresh products enjoy premium pricing and steadfast consumer loyalty, especially in artisanal and specialty segments where immediate consumption is key, the market sees a clear segmentation. Fresh goods dominate planned purchases and special occasions, whereas frozen options cater to impulse buys and convenience, highlighting the coexistence of both segments.

The European Bakery Products Market is Segmented by Product Type (Bread, Cakes and Pastries, Biscuits and Cookies, Morning Goods, and More), by Form (Fresh and Frozen), by Category (Conventional, Organic, and Functional), by Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Bakeries/Specialty Stores, Online Retail Stores, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Grupo Bimbo

- Associated British Foods

- Mondelez International

- Y?ld?z Holding

- Ferrero International SpA

- Eti Gida San ve Tic AS

- Barilla G. e R. Fratelli S.p.A

- August Storck KG

- Manner & Comp AG

- Lotus Bakeries NV

- Galletas Gullon SA

- Griesson - de Beukelaer GmbH & Co. KG

- Galbusera SpA

- Adam Foods, S.L.

- Hovis Ltd

- Balocco SpA

- Harry Brot GmbH

- Warburtons Ltd

- Brioche Pasquier

- Pagengruppen AB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Health and wellness trends

- 4.2.2 Product innovation and premiumization

- 4.2.3 Growing demand for clean label and natural ingredients

- 4.2.4 Sustainability and packaging innovation

- 4.2.5 Consumer desire for freshness and shelf-life extension

- 4.2.6 Growth in out-of-home and on-the-go consumption

- 4.3 Market Restraints

- 4.3.1 Competition from artisanal and specialty bakeries

- 4.3.2 Consumer skepticism and label scrutiny

- 4.3.3 Environmental and sustainability demands

- 4.3.4 Ingredient costs and supply chain disruptions

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Product Type

- 5.1.1 Bread

- 5.1.2 Cakes and Pastries

- 5.1.3 Biscuits and Cookies

- 5.1.4 Morning Goods

- 5.1.5 Other Bakery Products

- 5.2 By Form

- 5.2.1 Fresh

- 5.2.2 Frozen

- 5.3 By Category

- 5.3.1 Conventional

- 5.3.2 Organic/Clean Label

- 5.3.3 Protein/Functional

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets and Hypermarkets

- 5.4.2 Convenience Stores

- 5.4.3 Bakeries/Specialty Stores

- 5.4.4 Online Retail Stores

- 5.4.5 Other Retail Channels

- 5.5 By Geography

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Russia

- 5.5.7 Sweden

- 5.5.8 Belgium

- 5.5.9 Poland

- 5.5.10 Netherlands

- 5.5.11 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Grupo Bimbo

- 6.4.2 Associated British Foods

- 6.4.3 Mondelez International

- 6.4.4 Y?ld?z Holding

- 6.4.5 Ferrero International SpA

- 6.4.6 Eti Gida San ve Tic AS

- 6.4.7 Barilla G. e R. Fratelli S.p.A

- 6.4.8 August Storck KG

- 6.4.9 Manner & Comp AG

- 6.4.10 Lotus Bakeries NV

- 6.4.11 Galletas Gullon SA

- 6.4.12 Griesson - de Beukelaer GmbH & Co. KG

- 6.4.13 Galbusera SpA

- 6.4.14 Adam Foods, S.L.

- 6.4.15 Hovis Ltd

- 6.4.16 Balocco SpA

- 6.4.17 Harry Brot GmbH

- 6.4.18 Warburtons Ltd

- 6.4.19 Brioche Pasquier

- 6.4.20 Pagengruppen AB

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK