PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934684

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934684

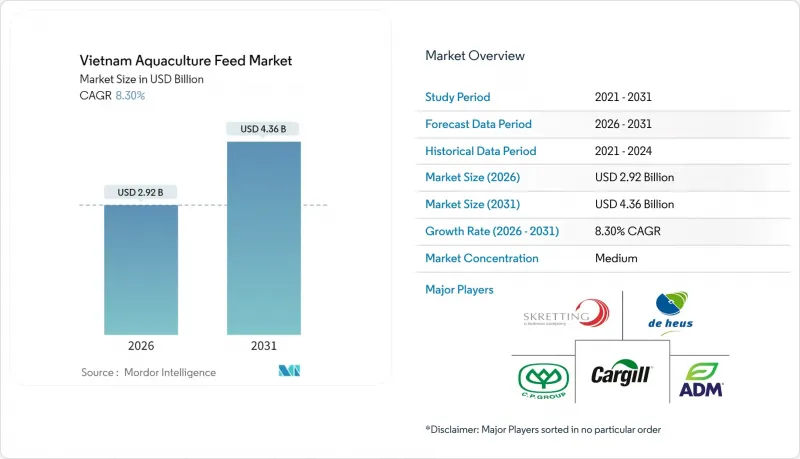

Vietnam Aquaculture Feed - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Vietnam aquaculture feed market size in 2026 is estimated at USD 2.92 billion, growing from 2025 value of USD 2.7 billion with 2031 projections showing USD 4.36 billion, growing at 8.3% CAGR over 2026-2031.

Rising export revenues, surging intensive aquaculture investments, and technology-driven feed efficiency collectively fuel this expansion. Feed accounts for roughly 50-60% of production costs, so farmers prioritize formulations that improve conversion ratios and lower waste . Expanding recirculating aquaculture systems (RAS) accelerate demand for high-performance pellets and extruded products. Government incentives for alternative proteins, along with venture-capital spending on insect-meal facilities, strengthen domestic ingredient supply and reduce volatility tied to imported fishmeal. Multinational feed manufacturers continue to scale up local plants, intensifying competition with agile Vietnamese firms that emphasize regional specialization and functional feed innovation.

Vietnam Aquaculture Feed Market Trends and Insights

Robust expansion of domestic RAS facilities

Vietnam's recirculating aquaculture systems adoption accelerated dramatically in 2024, with super-intensive shrimp farming achieving stocking densities of 800-1,200 post-larvae per square meter compared to traditional extensive systems at 10-15 per square meter. RAS facilities require specialized feed formulations with higher protein content and enhanced digestibility, creating premium pricing opportunities for feed manufacturers. The technology shift enables year-round production cycles and reduces disease risks, driving consistent feed demand growth. Tepbac's IoT solutions now monitor over 1,500 shrimp farms, enabling precision feeding that optimizes feed conversion ratios and reduces waste.

Rising consumer demand for antibiotic-free seafood

The European Union's continued yellow card warning regarding Vietnam's fisheries governance creates additional pressure for clean production methods, while US importers prioritize suppliers with verified antibiotic-free certifications. Feed makers respond with probiotic and prebiotic additives that replace prophylactic drugs; Cargill's new premix plant supplies customized functional blends, and GreenFeed invests in fermentation for native probiotic strains. Premium antibiotic-free feeds are priced 15-20% above standard diets, elevating manufacturer margins and rewarding farms that adopt certification schemes such as VietGAP.

Volatile fishmeal prices

Global fishmeal price volatility significantly impacts Vietnamese feed manufacturers' cost structures and profitability, with prices fluctuating annually based on anchovy catches and competing demand from livestock feed applications. Vietnam's dependence on imported fishmeal creates exposure to international supply disruptions, particularly from Peru and Chile, where El Nino weather patterns affect catch volumes. The volatility particularly affects premium feed segments targeting carnivorous species like grouper and snapper, where fishmeal inclusion rates remain high due to nutritional requirements.

Other drivers and restraints analyzed in the detailed report include:

- Mainstream growth of functional feeds

- Increasing integration of AI for precision feeding

- Stringent EPA discharge regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pelleted feed maintains commanding market leadership with 46.25% of the Vietnam aquaculture feed market share in 2025, reflecting Vietnamese farmers' preference for cost-effective, standardized nutrition solutions that offer reliable performance across diverse aquaculture systems. The segment's dominance stems from pelleted feed's superior storage characteristics, reduced waste during feeding, and compatibility with existing farm infrastructure, particularly in traditional pond systems that represent the majority of Vietnam's aquaculture operations. Moist feed applications remain specialized, primarily serving hatchery operations and high-value species production, while micro feed demand grows alongside marine aquaculture expansion targeting juvenile fish and shellfish.

Extruded products are growing 8.05% annually, led by RAS shrimp complexes that pay premiums for water-stable, high-energy formulas. Growing environmental scrutiny favors extruded formats because they cut leaching losses. Skretting's Lotus II upgrade targets this demand with specialized shrimp diets that achieve feed conversion ratios below 1.3:1 in intensive tanks. As automation spreads, formulation tweaks such as oil-coating profiles and crumble strength create new service niches for nutritionists.

The Vietnam Aquaculture Feed Market Report is Segmented by Feed Type (Extruded Feed, Pelleted Feed, Moist Feed, Micro Feed), by Ingredient Source (Fish Meal and Fish Oil, Plant Protein, Animal By-Products, Algal and Alternative Proteins), and by Species (White-Leg Shrimp, Giant Tiger Prawn, Pangasius, Carp, Catfish, Tilapia, Other Species). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cargill Inc.

- De Heus Animal Nutrition B.V.

- Skretting (Nutreco NV)

- Archer-Daniels-Midland Company

- Charoen Pokphand Group

- Skretting Vietnam (Nutreco N.V.)

- Grobest Industrial Co. Ltd. (Grobest Group)

- Tongwei Co. Ltd.

- Alltech Inc.

- Lallemand Inc.

- INVE Aquaculture Inc. (Benchmark Holdings Plc)

- Aller Aqua Vietnam (Aller Aqua A/S)

- GreenFeed Vietnam Corp.

- Uni-President Vietnam Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Robust expansion of domestic RAS facilities

- 4.2.2 Rising consumer demand for antibiotic-free seafood

- 4.2.3 Mainstream growth of functional feeds

- 4.2.4 Increasing integration of AI for precision feeding

- 4.2.5 Federal incentives for alternative-protein ingredients

- 4.2.6 Venture-capital funding in insect-meal start-ups

- 4.3 Market Restraints

- 4.3.1 Volatile fish-meal prices

- 4.3.2 Stringent EPA discharge regulations

- 4.3.3 Supply-chain bottlenecks for specialty additives

- 4.3.4 Producer hesitancy toward novel GMO protein inputs

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Feed Type

- 5.1.1 Extruded Feed

- 5.1.2 Pelleted Feed

- 5.1.3 Moist Feed

- 5.1.4 Micro Feed

- 5.2 By Ingredient Source

- 5.2.1 Fish Meal and Fish Oil

- 5.2.2 Plant Protein

- 5.2.3 Animal By-products

- 5.2.4 Algal and Alternative Proteins

- 5.3 By Species

- 5.3.1 White-leg Shrimp (Litopenaeus vannamei)

- 5.3.2 Giant Tiger Prawn (Penaeus monodon)

- 5.3.3 Pangasius

- 5.3.4 Carp

- 5.3.5 Catfish

- 5.3.6 Tilapia

- 5.3.7 Other Species

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, Recent Developments)

- 6.4.1 Cargill Inc.

- 6.4.2 De Heus Animal Nutrition B.V.

- 6.4.3 Skretting (Nutreco NV)

- 6.4.4 Archer-Daniels-Midland Company

- 6.4.5 Charoen Pokphand Group

- 6.4.6 Skretting Vietnam (Nutreco N.V.)

- 6.4.7 Grobest Industrial Co. Ltd. (Grobest Group)

- 6.4.8 Tongwei Co. Ltd.

- 6.4.9 Alltech Inc.

- 6.4.10 Lallemand Inc.

- 6.4.11 INVE Aquaculture Inc. (Benchmark Holdings Plc)

- 6.4.12 Aller Aqua Vietnam (Aller Aqua A/S)

- 6.4.13 GreenFeed Vietnam Corp.

- 6.4.14 Uni-President Vietnam Co. Ltd.

7 Market Opportunities and Future Outlook