PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934690

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934690

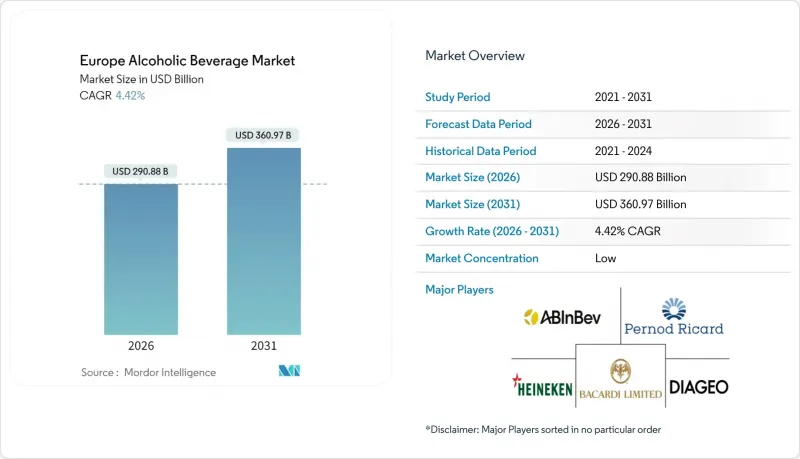

Europe Alcoholic Beverage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe alcohol beverage market size in 2026 is estimated at USD 290.88 billion, growing from 2025 value of USD 278.56 billion with 2031 projections showing USD 360.97 billion, growing at 4.42% CAGR over 2026-2031.

This growth in value is largely attributed to the recovery of tourism, the shift toward premium products, and the rapid adoption of e-commerce. However, volume growth remains limited in mature categories like mainstream beer. Consumers are increasingly favoring premium spirits, low-alcohol beers, and ready-to-drink (RTD) cocktails, driven by a preference for quality, authenticity, and convenience. A rising female consumer base, the normalization of at-home drinking occasions, and increased digital engagement are transforming distribution and marketing strategies. Additionally, digital platforms and influencer marketing are playing a significant role in influencing product discovery and consumer preferences. On the regulatory side, there is growing momentum toward sustainability, particularly in reducing packaging waste and implementing health labeling. This shift is directing investments toward low-carbon packaging solutions and innovations in non-alcoholic products.

Europe Alcoholic Beverage Market Trends and Insights

Surge in demand for premium alcoholic beverages

In key European markets, demographic changes and increasing disposable incomes are driving premium alcohol consumption patterns, emphasizing quality over quantity. The premiumization trend has accelerated post-pandemic, with consumers showing a greater willingness to spend on artisanal and heritage brands. As European consumers develop more refined tastes, they are seeking unique, high-quality beverages characterized by authentic flavors and craftsmanship. This shift towards premiumization not only highlights evolving consumer preferences but also significantly contributes to market expansion, with a preference for artisanal, small-batch, and craft products over mass-produced alternatives. Although LVMH's Wines and Spirits segment experienced a 4% organic decline in 2023, champagne sales, particularly in Europe and Japan, demonstrated growth, reflecting selective premium consumption. This shift towards premium products is especially notable in the spirits category, where consumers are attracted to authentic experiences and craftsmanship narratives that justify higher price points.

Low/no-alcohol product uptake

European consumption patterns are experiencing a notable transformation, with the low and no-alcohol segment leading the change. This evolution is primarily driven by increasing health awareness and shifting generational preferences. Across all demographics, there is a clear cultural movement toward moderating alcohol consumption, which has significantly boosted the demand for low and no-alcohol options. Younger consumers are at the forefront of this trend, often motivated by goals to reduce calorie intake or avoid intoxication. In 2024, alcohol consumption is associated with one in every 11 deaths in the WHO European Region. Addressing these concerns, the EU has introduced a new classification system for no and low-alcohol wines. This system defines terms such as 'alcohol-free' (<=0.5% ABV) and '0.0%' (<=0.05% ABV), providing regulatory clarity and fostering market growth. Leading beverage companies like Anheuser-Busch InBev, Heineken, Carlsberg, and Diageo are actively driving innovation and expanding their low and no-alcohol product portfolios, thereby enhancing consumer trust and increasing product availability.

Stringent excise taxes and regulation

Excise taxation policies in Europe are exerting significant pressure, restricting volume growth and limiting market accessibility. In February 2025, the UK introduced a major reform to its alcohol duty system, transitioning to a per-liter-of-alcohol model. This change resulted in a slight 0.5% increase in duty receipts, totaling GBP 12.646 billion for the 2024-2025 fiscal year. The complexity of the new system has imposed additional administrative challenges on producers and distributors, while the expected rise in public revenue has not materialized. According to WHO data, only 28 out of 53 European member states currently impose excise taxes on wine, indicating room for potential tax expansions that could further restrict market growth. Furthermore, the European Commission reports that, as of January 2024, key European markets are facing increased pricing pressures due to VAT rate adjustments. Luxembourg raised its VAT from 16% to 17%, the Czech Republic consolidated its rate to 12%, and Estonia increased its VAT from 20% to 22%.

Other drivers and restraints analyzed in the detailed report include:

- Growth in craft and small-batch production

- Growing tourism and hospitality impact positive growth

- Rising health consciousness

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Beer maintains its dominant position with 45.32% market share in 2025, reflecting its cultural significance and accessibility across European markets. This enduring popularity is attributed to its affordability and the strong tradition of beer consumption in the region. Within the beer category, the low-alcohol beer segment demonstrates remarkable growth potential. Alcohol-free beer, in particular, is projected to become the second-largest beer category globally, driven by increasing health consciousness and changing consumer lifestyles. In contrast, the wine market faces significant challenges due to climate change, which has adversely impacted European wine production in 2024. Additionally, wine consumption has also declined, reflecting shifting consumer preferences and external pressures.

On the other hand, spirits emerge as the fastest-growing segment, achieving a robust 5.12% CAGR through 2031. This growth is primarily driven by the increasing demand for premium products and the expanding cocktail culture, which appeals to younger demographics and urban consumers. The spirits category also benefits from the recovery of tourism and the revitalization of on-trade channels, as consumers show a growing willingness to pay premium prices for authentic and high-quality experiences. Spirits are also capitalizing on innovation in the ready-to-drink (RTD) segment. Meanwhile, wine producers are adapting to new EU labeling regulations that took effect in December 2023. These regulations mandate the inclusion of detailed nutritional information and ingredient lists on wine labels. While this compliance requirement increases operational costs for producers, it enhances transparency and fosters greater trust among consumers.

Male consumers represent 62.10% market share in 2025, maintaining their traditional dominance in alcohol consumption patterns.The World Health Organization states that men in the region consumed nearly four times more alcohol than women in 2024, with men averaging 14.9 liters annually compared to women's 4.0 liters. However, female consumers are experiencing significant growth, with a 5.88% CAGR projected through 2031. This growth reflects evolving social norms and targeted marketing efforts. This trend is particularly evident in the premium spirits and wine categories, where brands are creating products and experiences tailored to female preferences. The rise in female consumption aligns with broader lifestyle trends that emphasize social experiences and a focus on quality over quantity.

Generational trends indicate distinct preferences within both segments. Gen Z and Millennial consumers are driving demand for low-alcohol alternatives and authentic brand experiences. Diageo's research identifies a 'zebra striping' trend, where consumers alternate between alcoholic and non-alcoholic beverages during the same occasion, reflecting changing consumption behaviors across genders. Marketing strategies are increasingly adopting inclusive messaging and experience-driven positioning, moving away from traditional gender-specific approaches.

The Europe Alcohol Beverage Market Report is Segmented by Product Type (Beer, Wine, Spirits, Others), End User (Male, Female), Packaging Type (Bottles, Cans, Others), Distribution Channel (On-Trade, Off-Trade), and Geography (United Kingdom, Germany, France, Italy, Spain, Russia, Sweden, Belgium, Poland, Netherlands, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Liter).

List of Companies Covered in this Report:

- Anheuser-Busch InBev SA/NV

- Heineken Holding NV

- Diageo PLC

- Pernod Ricard SA

- Carlsberg Breweries A/S

- Molson Coors Beverage Company

- Bacardi Limited

- LVMH Moet Hennessy Louis Vuitton SE

- E and J Gallo Winery

- Campari Group

- Remy Cointreau SA

- Asahi Group Holdings, Ltd.

- Brown-Forman Corporation

- Beam Suntory, Inc.

- Constellation Brands, Inc.

- Treasury Wine Estates

- Groupe Castel

- William Grant and Sons Ltd.

- Bronco Wine Company

- Suntory Holdings Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in demand for premium alcoholic beverages

- 4.2.2 Low/no-alcohol product uptake

- 4.2.3 Growth in craft and small-batch production

- 4.2.4 Growing tourism and hospitality impact positive growth

- 4.2.5 Growth of online alcohol sales

- 4.2.6 Digital and social media influence

- 4.3 Market Restraints

- 4.3.1 Stringent excise taxes and regulation

- 4.3.2 Rising health consciousness

- 4.3.3 High competition from non-alcoholic alternatives

- 4.3.4 CO? supply shortages for brewing

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Beer

- 5.1.1.1 Ale Beer

- 5.1.1.2 Lager

- 5.1.1.3 Low-Alcohol Beer

- 5.1.1.4 Other Beer Types

- 5.1.2 Wine

- 5.1.2.1 Fortified Wine

- 5.1.2.2 Still Wine

- 5.1.2.3 Sparkling Wine

- 5.1.2.4 Others Wine Types

- 5.1.3 Spirits

- 5.1.3.1 Brandy and Cognac

- 5.1.3.2 Liquer

- 5.1.3.3 Tequilla and Mezcel

- 5.1.3.4 Rum

- 5.1.3.5 Whisky

- 5.1.3.6 Other Spirit Types

- 5.1.4 Others

- 5.1.1 Beer

- 5.2 By End User

- 5.2.1 Male

- 5.2.2 Female

- 5.3 By Packaging Type

- 5.3.1 Bottles

- 5.3.2 Cans

- 5.3.3 Others (Tetra Pack)

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.2 Off-Trade

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Russia

- 5.5.7 Sweden

- 5.5.8 Belgium

- 5.5.9 Poland

- 5.5.10 Netherlands

- 5.5.11 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Anheuser-Busch InBev SA/NV

- 6.4.2 Heineken Holding NV

- 6.4.3 Diageo PLC

- 6.4.4 Pernod Ricard SA

- 6.4.5 Carlsberg Breweries A/S

- 6.4.6 Molson Coors Beverage Company

- 6.4.7 Bacardi Limited

- 6.4.8 LVMH Moet Hennessy Louis Vuitton SE

- 6.4.9 E and J Gallo Winery

- 6.4.10 Campari Group

- 6.4.11 Remy Cointreau SA

- 6.4.12 Asahi Group Holdings, Ltd.

- 6.4.13 Brown-Forman Corporation

- 6.4.14 Beam Suntory, Inc.

- 6.4.15 Constellation Brands, Inc.

- 6.4.16 Treasury Wine Estates

- 6.4.17 Groupe Castel

- 6.4.18 William Grant and Sons Ltd.

- 6.4.19 Bronco Wine Company

- 6.4.20 Suntory Holdings Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK