PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934730

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934730

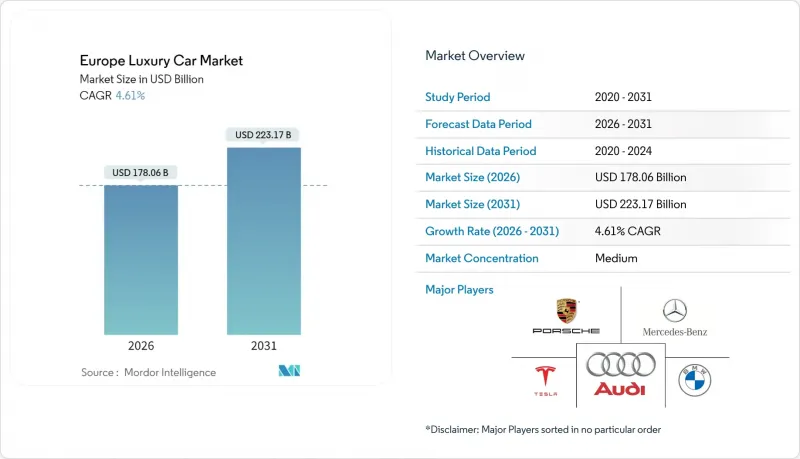

Europe Luxury Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The European luxury car market was valued at USD 170.21 billion in 2025 and estimated to grow from USD 178.06 billion in 2026 to reach USD 223.17 billion by 2031, at a CAGR of 4.61% during the forecast period (2026-2031).

Demand resilience stems from sustained wealth creation among affluent households, robust brand equity built by long-established manufacturers, and supportive policy frameworks accelerating electrified model launches. Sport utility vehicles (SUVs) continue to draw the largest customer base, while rising interest in coupe and convertible body styles reveals a renewed appetite for experiential driving. The transition toward battery-electric powertrains is gaining momentum, yet internal-combustion vehicles still dominate volumes, forcing producers to balance scale economics with regulatory compliance. Subscription and other flexible access models are expanding fastest, reflecting a generational shift toward service-based mobility and creating fresh revenue avenues tied to in-car digital features.

Europe Luxury Car Market Trends and Insights

Rising Population of UHNWIs and HNWIs

Affluent Europeans continue to accumulate financial assets, underpinning the addressable pool of potential luxury-car buyers. Despite broader macroeconomic uncertainty, wealth surveys show steady growth in ultra-high-net-worth cohorts, especially in Switzerland and Germany. These consumers seek exclusive personalization, state-of-the-art technology, and branded heritage, reinforcing demand even when mass-market segments soften. Manufacturers benefit from higher gross margins on bespoke trims that this clientele favors. As economic power concentrates further in the top income brackets, the purchasing buffer shields premium automakers from cyclical downturns and supports pricing power.

Rapid Electrification of Luxury Segment

Euro 7 emissions limits, effective in November 2026, compel producers to phase out high-emitting engines and accelerate battery-electric launches. Luxury customers, often early adopters of advanced technology, are increasingly open to driving electric vehicles, provided performance benchmarks remain intact. Carmakers invest heavily in dedicated EV platforms, solid-state battery research, and pan-European charging alliances. The regulatory tailwind combines with municipal zero-emission zones to elevate electric models within showroom mixes. Over time, electrification is expected to reshape the competitive hierarchy by rewarding firms that master battery supply chains and software-defined architectures.

Macroeconomic Uncertainty and Inflation

Persistent inflation erodes real purchasing power, while geopolitical tensions and supply-chain disruptions unsettle consumer sentiment. Even high-income households delay discretionary outlays when headlines signal recession risk or stock-market turbulence. Manufacturers also contend with higher input costs-ranging from battery minerals to semiconductors-that squeeze margins or require sticker-price adjustments. Premium car demand may progress unevenly across quarters until monetary policy stabilizes and inflation expectations anchor.

Other drivers and restraints analyzed in the detailed report include:

- Digitally Enabled In-Car Experience Demand

- Micro-Market-Specific BEV Purchase Incentives

- Luxury-EV Residual-Value Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SUVs represented 52.05% of the European luxury car market share in 2025, reflecting an enduring appeal for elevated seating, flexible cargo capacity, and all-weather confidence that resonates with affluent families and executives. Coupe and convertible nameplates, although smaller in volume, are enrolling a 6.09% CAGR to 2031 as leisure travel rebounds and consumers seek more emotive driving experiences. Growth in these expressive segments underscores that demand at the top encompasses practicality and lifestyle identity. Manufacturers expand portfolio breadth, pairing flagship SUVs with limited-run sports models that reinforce brand desirability. Design cues and technology debuted on halo coupes frequently cascade to high-volume crossovers, strengthening coherence across lineups and sustaining pricing power.

The sedan's archetypal luxury status endures yet faces incremental share pressure as buyers migrate toward sport-utility practicality. Automakers respond by injecting sedans with advanced driver assistance and immersive infotainment to preserve relevance. Multi-purpose vehicles remain a niche, mostly confined to chauffeur-driven use in select metropolitan areas where interior space overrides exterior presence. Although uncommon in this echelon, Hatchbacks find pockets of demand in congested cities that restrict parking footprints. Vehicle-type diversification ensures that the European luxury car market meets heterogeneous lifestyle needs while safeguarding margins through differentiated body styles.

Internal-combustion engines account for 75.62% of deliveries today, illustrating the inertia of legacy production capacity and consumer familiarity. However, battery-electric vehicles are pacing at a 9.87% CAGR through 2031 as infrastructure expands and regulatory deadlines near. Plug-in hybrids serve as a bridge technology, giving buyers an electric driving mode without range anxiety-especially valuable for rural long-distance commuters. Automakers hedge investments by deriving multi-energy platforms that spread R&D costs across gasoline, hybrid, and full-electric variants.

The European luxury car market size attributable to BEVs grows each year as high-capacity charging corridors become ubiquitous and luxury marques introduce grand-touring EVs boasting 600 km real-world range. Software-adjustable chassis settings allow electric flagships to replicate the dynamic character traditionally delivered by bespoke V-8 engines. Nevertheless, some connoisseurs still cherish the aural and tactile feedback of performance combustion powertrains, ensuring a prolonged coexistence until emission bans fully materialize. This twin-track strategy affords manufacturers time to amortize ICE assets while funding next-generation battery programs.

The European Luxury Car Market Report is Segmented by Vehicle Type (Hatchback, Sedan, and More), Powertrain Type (ICE, and More), Price Range (USD 45, 000-100, 000, USD 100, 001-200, 000, and Above USD 200, 000), Ownership Model (Outright Purchase, Finance/Lease, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Mercedes-Benz Group AG

- BMW AG

- Audi AG

- Porsche AG

- Tesla Inc.

- Volvo Car AB

- Jaguar Land Rover Automotive plc

- Bentley Motors Ltd

- Rolls-Royce Motor Cars Ltd

- Aston Martin Lagonda Global Holdings plc

- Ferrari N.V.

- Automobili Lamborghini S.p.A.

- Maserati S.p.A.

- Lucid Group Inc.

- Polestar Automotive Holding UK plc

- Genesis Motor Europe (Hyundai)

- Rivian Automotive Inc.

- BYD Auto Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Population of UHNWIS and HNWIS

- 4.2.2 Rapid Electrification of Luxury Segment

- 4.2.3 Digitally Enabled In-Car Experience Demand

- 4.2.4 Micro market-Specific BEV Purchase Incentives

- 4.2.5 Monetization of Connected-Vehicle Data Streams

- 4.2.6 Subscription and Fractional-Ownership Models

- 4.3 Market Restraints

- 4.3.1 High Purchase Cost and Tightening Credit

- 4.3.2 Macroeconomic Uncertainty and Inflation

- 4.3.3 Luxury-EV Residual-Value Volatility

- 4.3.4 Carbon-Intensity Taxes Targeting

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Hatchback

- 5.1.2 Sedan

- 5.1.3 Sport Utility Vehicle (SUV)

- 5.1.4 Multi-purpose Vehicle (MPV)

- 5.1.5 Coupe and Convertible

- 5.2 By Powertrain Type

- 5.2.1 Internal-Combustion Engine

- 5.2.2 Hybrid Electric Vehicle (HEV)

- 5.2.3 Plug-in Hybrid Electric Vehicle (PHEV)

- 5.2.4 Battery Electric Vehicle (BEV)

- 5.3 By Price Range

- 5.3.1 USD 45,000 - USD 100,000

- 5.3.2 USD 100,001 - USD 200,000

- 5.3.3 Above USD 200,000

- 5.4 By Ownership Model

- 5.4.1 Outright Purchase

- 5.4.2 Finance/Lease

- 5.4.3 Subscription

- 5.4.4 Fractional and Club Ownership

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Sweden

- 5.5.8 Denmark

- 5.5.9 Belgium

- 5.5.10 Switzerland

- 5.5.11 Austria

- 5.5.12 Norway

- 5.5.13 Russia

- 5.5.14 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 Mercedes-Benz Group AG

- 6.4.2 BMW AG

- 6.4.3 Audi AG

- 6.4.4 Porsche AG

- 6.4.5 Tesla Inc.

- 6.4.6 Volvo Car AB

- 6.4.7 Jaguar Land Rover Automotive plc

- 6.4.8 Bentley Motors Ltd

- 6.4.9 Rolls-Royce Motor Cars Ltd

- 6.4.10 Aston Martin Lagonda Global Holdings plc

- 6.4.11 Ferrari N.V.

- 6.4.12 Automobili Lamborghini S.p.A.

- 6.4.13 Maserati S.p.A.

- 6.4.14 Lucid Group Inc.

- 6.4.15 Polestar Automotive Holding UK plc

- 6.4.16 Genesis Motor Europe (Hyundai)

- 6.4.17 Rivian Automotive Inc.

- 6.4.18 BYD Auto Co., Ltd.

7 Market Opportunities & Future Outlook