PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934733

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934733

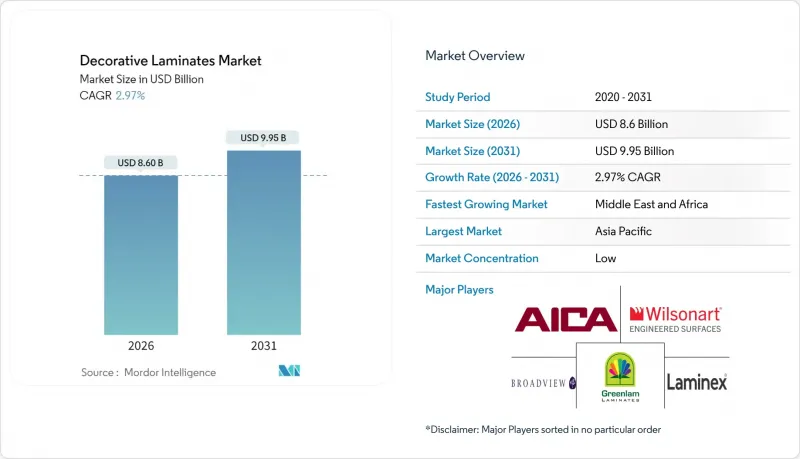

Decorative Laminates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Decorative Laminates market is expected to grow from USD 8.35 billion in 2025 to USD 8.6 billion in 2026 and is forecast to reach USD 9.95 billion by 2031 at 2.97% CAGR over 2026-2031.

This growth reflects stable demand for cost-effective finishes in residential and commercial interior projects, even as construction cycles in developed regions cool. Rapid Asia-Pacific urbanization, sizable public housing targets in India, and China's steady infrastructure pipeline underpin global consumption of high-pressure and compact laminates. Parallel expansion in Middle East and Africa construction activity and the shift toward modular furniture formats sustain momentum, while technology-driven surface innovations allow producers to secure price premiums and defend share against substitute materials. Consolidation pressure is mounting as compliance costs for low-formaldehyde chemistry and wood-traceability rules reward vertically integrated firms with robust research and development (R&D) capabilities.

Global Decorative Laminates Market Trends and Insights

Rapid Urbanization and Modular-furniture Boom

Emerging-market cities absorb millions of new residents each year, and compact living spaces require modular furnishings that rely on lightweight panels finished with decorative laminates. India expects its urban population to swell by 416 million people by 2050, spurring demand for flat-pack furniture that cuts shipping weight by 40% compared with solid wood. Digital printing lets producers roll out hundreds of new decors in small batches, a strategy showcased by EGGER's 2024+ lineup featuring more than 300 design-texture pairings. Overlay consumption rises in tandem because premium embossed films replicate stone and oak grains while resisting scratches and fingerprints. This dual push from urban density and modular design keeps the decorative laminates market expanding independently of cyclical new-build activity.

Residential Construction Surge in Asia-Pacific

Government-led housing programs across India, Vietnam, and Thailand inject sustained spending into mid-price apartments that favor laminates over natural stone or hardwood. India alone targets USD 1 trillion in construction outlays by 2030 to close a 100 million-unit deficit. Vietnam's construction sector reached USD 95.8 billion in 2024 and continues to grow at 7% annually. Localized laminate manufacturing, such as CFL Flooring's USD 150 million Vietnam plant, shortens lead times and holds prices in price-sensitive markets. The region's policy emphasis on affordable housing locks in long-cycle demand that offsets softer Western new-build volumes.

Volatile Prices of Phenolic and Melamine Resins

Phenolic and melamine account for roughly one-fifth of laminate bill-of-materials, and 18-25% price spikes in 2024 squeezed margins as producers could not immediately pass costs to OEM furniture accounts. Because five multinational suppliers dominate specialty resins, regional fabricators lack bargaining leverage and face stock-outs during outages, delaying deliveries and eroding customer trust.

Other drivers and restraints analyzed in the detailed report include:

- Cost-effective Aesthetics Driving Renovation Demand

- Advances in Digital Printing and Emboss-in-register Tech

- Substitution by Engineered Stone, LVT and Thermofoils

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic resin retained a 40.92% share of the decorative laminates market in 2025, reflecting its indispensability for bonding decorative papers to core materials. Yet overlays are set to grow fastest at a 3.39% CAGR as digital printing requires clear, textured films that do not yellow under UV exposure. The decorative laminates market size for overlays is projected to climb steadily as anti-fingerprint and soft-touch finishes command premium spreads. Wood-traceability rules and a 0.062 mg/m3 formaldehyde ceiling under Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) are steering investment into bio-based resins and aldehyde-free systems that raise input costs but unlock Leadership in Energy and Environmental Design (LEED) points for end-users. Adhesives also benefit as low-VOC (Volatile Organic Compound) chemistries gain traction.

Second-tier inputs such as decorative foils and protective films gain strategic value because they enable differentiation without major line overhauls. Producers who master in-line coating of antimicrobial layers or scratch-repair microcapsules can charge more while meeting healthcare project specifications. Consequently, raw-material innovation is expected to tilt bargaining power toward suppliers that offer integrated chemistry packages and technical support.

The Decorative Laminates Market Report is Segmented by Raw Material (Plastic Resin, Adhesives, Wood Substrate, and Other Raw Materials), Application (Furniture, Cabinets, Flooring, and Other Applications), End-User Industry (Residential, Non-Residential, and Transportation), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 38.20% of global revenue in 2025 and will stay dominant through 2031 as India's USD 1 trillion housing drive and China's infrastructure commitments underpin volume. New Vietnamese and Thai capacity shortens regional lead times and buffers currency risk, while Japan and South Korea provide steady replacement demand in aging condominiums. Therefore, the decorative laminates market size in Asia-Pacific combines high-growth greenfield projects with stable refurbishment cycles.

The Middle East and Africa are the fastest-growing regions at a 3.45% CAGR, reflecting 7.4% expansion in the United Arab Emirates (UAE) construction and Saudi Arabia's Vision 2030 megaprojects. Large hospitality builds in Riyadh and Dubai specify premium laminates for wall panelling and case goods, boosting demand for fire-rated and moisture-resistant grades. Localization initiatives in Saudi industrial zones will likely draw investments in lamination lines to skirt import duties.

North America faces constrained new-build activity due to labor shortages and mortgage costs, yet ongoing professional remodeling supports countertop and plank-floor demand. Prefab single-family modules with pre-installed laminated walls mitigate labor deficits and spur steady panel offtake. Europe is navigating cost inflation and stringent emission rules that force mills to re-engineer resin systems. Nevertheless, renovation subsidies tied to energy-efficient retrofits keep spending on interior upgrades afloat, and low-formaldehyde laminate earns specification points in public tenders.

South America delivers mid-single-digit growth as Brazilian residential spending recovers and Mercosur tariff alignment lowers cross-border supply friction. Local veneer shortages also push converters toward imported decor papers and resin, driving value rather than volume.

- Abet Laminati

- Aica Kogyo Co., Ltd.

- Airolam Decorative Laminates

- Archidply

- Bell Laminates

- Broadview Holding

- Durianlam

- Egger

- Greenlam Industries Limited

- Kronoplus Limited

- Laminex

- Merino Industries Limited

- Rushil Decor Limited

- Sonae Arauco

- Stylam

- The Diller Corporation

- Wilsonart LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Urbanisation and Modular-furniture Boom

- 4.2.2 Residential Construction Surge in Asia-Pacific

- 4.2.3 Cost-effective Aesthetics Driving Renovation Demand

- 4.2.4 Advances in Digital Printing and Emboss-in-register Tech

- 4.2.5 Prefab Single-family Housing with Laminate-integrated Panels

- 4.3 Market Restraints

- 4.3.1 Volatile Prices of Phenolic and Melamine Resins

- 4.3.2 Substitution by Engineered Stone, LVT and Thermofoils

- 4.3.3 Supply-chain Traceability Costs for Wood Substrates

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Raw Material

- 5.1.1 Plastic Resin

- 5.1.2 Overlays

- 5.1.3 Adhesives

- 5.1.4 Wood Substrate

- 5.1.5 Other Raw Materials

- 5.2 By Application

- 5.2.1 Furniture

- 5.2.2 Cabinets

- 5.2.3 Flooring

- 5.2.4 Wall Panels

- 5.2.5 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Non-residential

- 5.3.3 Transportation

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Abet Laminati

- 6.4.2 Aica Kogyo Co., Ltd.

- 6.4.3 Airolam Decorative Laminates

- 6.4.4 Archidply

- 6.4.5 Bell Laminates

- 6.4.6 Broadview Holding

- 6.4.7 Durianlam

- 6.4.8 Egger

- 6.4.9 Greenlam Industries Limited

- 6.4.10 Kronoplus Limited

- 6.4.11 Laminex

- 6.4.12 Merino Industries Limited

- 6.4.13 Rushil Decor Limited

- 6.4.14 Sonae Arauco

- 6.4.15 Stylam

- 6.4.16 The Diller Corporation

- 6.4.17 Wilsonart LLC

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment