PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934734

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934734

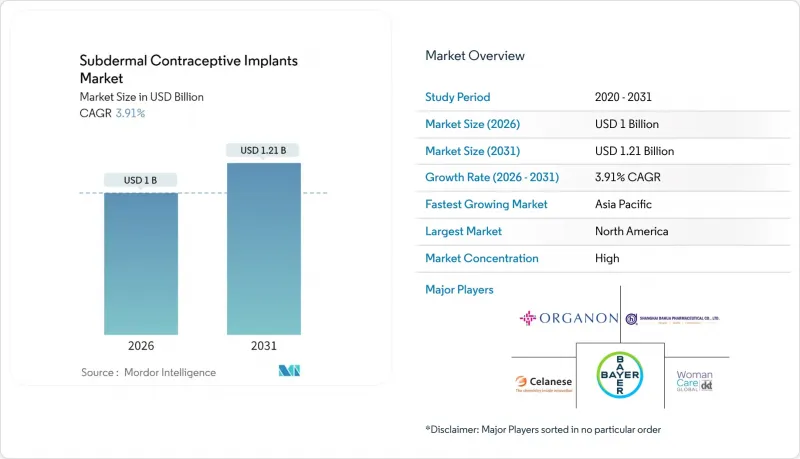

Subdermal Contraceptive Implants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Subdermal Contraceptive Implants market size in 2026 is estimated at USD 1.0 billion, growing from 2025 value of USD 0.96 billion with 2031 projections showing USD 1.21 billion, growing at 3.91% CAGR over 2026-2031.

This moderate expansion reflects the transition of long-acting reversible contraception from a niche alternative to a mainstream family-planning staple as public purchasers, insurers, and donors raise implant budgets. Government allocations such as the USAID family-planning envelope of USD 607.5 million in 2024, with implants accounting for 34% of the contraceptive value delivered, have established predictable demand pipelines that enable manufacturers to optimize output and pricing. Accelerated adoption further aligns with a sustained uptick in unintended pregnancies, policy-driven reimbursement gains, and telehealth-enabled provider networks that widen consumer reach. Competitive strategies have shifted from pure product differentiation toward ecosystem building that couples device supply with training, counseling, and digital follow-up, favoring firms capable of forging multi-level partnerships with health ministries and NGOs. At the same time, emerging biodegradable polymer designs aim to remove the cost and anxiety associated with implant removal, opening incremental addressable volumes among low-resource clinics.

Global Subdermal Contraceptive Implants Market Trends and Insights

Government-Led Family-Planning Funding Spikes Post-2025

Escalating public budgets continue to reshape the subdermal contraceptive implants market as national and donor programs expand multi-year purchasing agreements. USAID sustained a USD 607.5 million allocation for global family planning in 2024 and implants represented 34% of the value delivered, cementing a stable volume foundation. Bill C-64 in Canada introduces universal contraceptive coverage that includes implants, signaling the convergence of donor and domestic funding models. UNFPA, already the largest global distributor of donated contraceptives, leverages these public budgets through established supply networks that prioritize implants for underserved women. As fiscal commitments lengthen, suppliers gain clarity to scale production lines, reduce per-unit costs, and negotiate long-term framework contracts. This evolution positions government procurement mastery as a decisive competitive edge over pure manufacturing prowess.

Climbing Global Rate of Unplanned Pregnancies

A persistent surge in unintended pregnancies sustains baseline demand irrespective of macro cycles and local income trends. The Guttmacher Institute estimates that expanded contraception funding can prevent 17.1 million unintended pregnancies every year while returning up to USD 6 in health savings for each dollar spent. India records nearly half of its 48 million annual pregnancies as unintended, reinforcing the region's untapped potential for long-acting solutions. Outcomes from Access to Medicines Initiative pilots in Nigeria showed a 90% rise in implant uptake that paralleled measurable drops in unintended pregnancies, underscoring direct impact pathways. These metrics elevate implants from optional interventions to cost-saving necessities in public health budgeting and frame the subdermal contraceptive implants market as structurally defensive.

Adverse Effects & Safety Misconceptions

Misinformation about side effects spreads rapidly through digital channels and suppresses demand despite favorable clinical evidence. A Ghana survey found fear of side effects rising from 18% to 26% as the leading deterrent. The International Planned Parenthood Federation counters myths around fertility loss and insertion pain yet struggles to match the viral traction of anecdotal social posts. Qualitative studies in Australia show negative peer narratives can overrule clinician advice, even among women who acknowledge implant efficacy. Biodegradable formats address removal fears but add new educational burdens about dissolution timelines. Sustained multi-stakeholder communication remains essential to reverse perception headwinds.

Other drivers and restraints analyzed in the detailed report include:

- Preference Shift Toward Long-Acting Reversible Contraception

- Expanded Reimbursement for Contraceptive Counseling & Devices

- High Upfront Cost in Low-Income Settings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Etonogestrel devices dominated the subdermal contraceptive implants market with 68.43% revenue share in 2025, thanks to long-standing safety data, consistent supply and embedded clinical protocols. This entrenched base protects cash flows but also heightens vulnerability to patent cliffs anticipated after 2027. Biodegradable candidates are accelerating at a 5.72% CAGR to 2031, and their ability to dissolve in situ directly addresses removal fatigue among both patients and providers. Casea S, currently in Phase I evaluation, applies a degradable poly(ε-caprolactone) backbone that triggers a predictable breakdown sequence after 18-24 months while sustaining therapeutic release .

Development of radiopaque poly(ε-caprolactone) additives solves imaging visibility gaps and supports clinician confidence during insertion verification, though it introduces new regulatory documentation requirements. Shanghai Dahua showcased the scaling potential of cost-efficient levonorgestrel variants by distributing over 6 million WHO-qualified implants to 30 nations in two years. Over the forecast horizon, first movers that master biodegradable chemistry and secure prequalification are likely to capture a disproportionate share of incremental procurement lots, gradually eroding the current etonogestrel advantage.

The Subdermal Contraceptive Implants Market Report is Segmented by Product Type (Etonogestrel Implants, Levonorgestrel Implants, Biodegradable Next-Gen Implants), End User (Hospitals, Specialty & Family-Planning Clinics, Community Health Centers, NGO & Government Programs), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 37.50% of global revenue in 2025, anchored by mature reimbursement systems, well-trained providers and steady public health funding. Market expansion now relies on addressing contraceptive deserts that persist in rural counties. Canada's impending universal coverage law is expected to rebalance pay-out-of-pocket disparities and stimulate higher volume procurement. The United States continues to pilot telehealth and mobile outreach grants under Organon's "Her Plan is Her Power" program, a direct response to persistent access gaps in high-need communities. Mexico's integration into North American pharmaceutical supply chains creates lower-cost contract manufacturing options that can dampen regional price inflation.

Asia-Pacific is the fastest-growing territory at 6.55% CAGR to 2031, powered by demographic pressure and policy momentum. China hosts large-scale implant fabrication hubs led by Shanghai Dahua, exporting millions of units while meeting rising urban domestic demand. India's high unintended pregnancy incidence and favorable cost-utility findings underpin new government tenders that are poised to expand implant coverage beyond urban centers. Australia and Japan operate at near-parity with Western Europe in clinical standards and thus serve as early adopter test beds for biodegradable prototypes. Rapid infrastructure modernisation in Indonesia, Vietnam, and the Philippines will add layered procurement demand, making supply agility critical.

Europe presents a stable outlook, underpinned by European Medicines Agency harmonization that simplifies multi-country rollout. The EMA confirmed that Implanon's benefit-risk profile remains positive, tempering safety concerns and sustaining inclusion in national formularies. Germany leverages statutory health insurance to reimburse both device and counseling, sustaining predictable provider revenue. The United Kingdom's refreshed Faculty of Sexual and Reproductive Healthcare guidelines standardize technique and follow-up, streamlining training resources for manufacturers. Southern European nations continue to close LARC penetration gaps through regional public health drives that favor cost-efficient levonorgestrel products.

The Middle East and Africa region intertwines donor funds, NGO outreach, and emerging government budgets. Nigeria's Access to Medicines Initiative pilot showcases dramatic adoption once distribution is coupled with demand generation. South Africa explores results-based financing to widen implant choice among adolescents. Francophone West Africa leans on UNFPA and Marie Stopes for commodity supply, yet exhibits rising domestic procurement interest as economic growth improves fiscal space.

South America remains a secondary yet rising market, with Brazil and Argentina expanding insurance coverage for implants in public health networks. Chile's digital health agenda highlights tele-counseling and remote follow-up, creating precedents that neighboring countries may replicate.

- Organon

- Bayer

- Shanghai Dahua Pharmaceutical

- Tapemark Inc.

- Celanese

- Lubrizol Life Science

- Gedeon Richter Plc

- DKT WomanCare Global

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government-Led Family-Planning Funding Spikes Post-2025

- 4.2.2 Climbing Global Rate of Unplanned Pregnancies

- 4.2.3 Preference Shift Toward Long-Acting Reversible Contraception (LARC)

- 4.2.4 Expanded Reimbursement for Contraceptive Counseling & Devices

- 4.2.5 Telehealth-Bundled Insertion-Training Programs

- 4.2.6 Emergence of Biodegradable Polymer Implants Easing Removals

- 4.3 Market Restraints

- 4.3.1 Adverse Effects & Safety Misconceptions

- 4.3.2 High Upfront Cost in Low-Income Settings

- 4.3.3 Supply-Chain Risk from Radiopacity Additive Regulation

- 4.3.4 Social-Media-Driven Natural-Family-Planning Movements

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Etonogestrel Implants

- 5.1.2 Levonorgestrel Implants

- 5.1.3 Biodegradable Next-Gen Implants

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Specialty & Family-planning Clinics

- 5.2.3 Community Health Centers

- 5.2.4 NGO & Government Programs

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East & Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.3.1 Organon & Co.

- 6.3.2 Bayer AG

- 6.3.3 Shanghai Dahua Pharmaceutical Co., Ltd.

- 6.3.4 Tapemark Inc.

- 6.3.5 Celanese

- 6.3.6 Lubrizol Life Science

- 6.3.7 Gedeon Richter Plc

- 6.3.8 DKT WomanCare Global

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment