PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934738

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934738

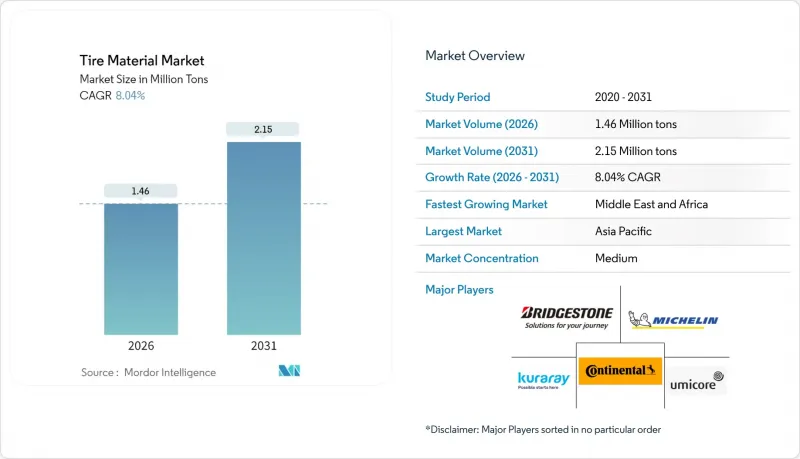

Tire Material - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The tire material market size in 2026 is estimated at 1.46 million tons, growing from 2025 value of 1.35 million tons with 2031 projections showing 2.15 million tons, growing at 8.04% CAGR over 2026-2031.

Higher vehicle weight from electric-vehicle battery packs, tighter Euro 7 tire-abrasion limits, and accelerated replacement cycles in e-commerce fleets are shifting demand toward synthetic elastomers and high-silica filler systems. Integrated tire makers are investing in recovered carbon black and bio-based silica, signaling that supply-chain security now outweighs spot-price considerations. The Asia-Pacific region dominates the global volume, while sovereign diversification programs in the Middle East are unlocking greenfield capacity that will reshape regional trade flows. Headline risks center on crude oil volatility, pending PFAS restrictions, and lingering OEM inventory destocking that together shorten planning horizons and elevate the value of circular feedstocks.

Global Tire Material Market Trends and Insights

Global Ramp-Up of EV and Hybrid Vehicle Production

Electric trucks sold 54,000 units in 2023, 35% higher than in 2022, marking the first time the category outpaced electric buses. Battery packs weighing 300-500 kg place additional load on tire contact patches, cutting traditional compound life in half. Tire makers now test synthetic blends, such as liquid farnesene rubber, to meet lower rolling-resistance targets without increasing heat buildup. The International Rubber Study Group expects natural-rubber demand to hit 16.9 million tons by 2030, yet EV platforms are decoupling volume growth from historical elastomer ratios. Suppliers Kuraray and JSR are racing to commercialize bio-based polymers that match the performance of solution S-SBR at a lower carbon intensity, reinforcing why the tire material market is shifting toward specialty elastomers.

OEM Shift Toward Low Rolling Resistance Compounds

Euro 7 rules, effective mid-2026, cap tire abrasion at 7 mg/km for passenger cars and 11 mg/km for light commercial vehicles, which limits the use of high-carbon-black compounds OEMs now specify silica-silane systems that cut rolling resistance by up to 20% while meeting wet-grip targets. Evonik's ULTRASIL 9100 GR, produced from bio-ethanol, delivers a 60% CO2 reduction without compromising surface-area requirements. PPG's AGILON silica attains similar traction benefits but emphasizes lower mixing energy, a priority as European electricity costs rise. North American truck OEMs still prefer carbon-black-rich recipes that resist heat above 80 °C, fragmenting filler demand and obliging suppliers to maintain dual production lines.

Volatile Crude Oil and Carbon-Black Pricing

European carbon-black prices rose 18% in June 2024, following the ban on imports from Russia, which forced tire makers to source higher-priced material from Turkey and Egypt. Feedstocks, such as FCC tar, track Brent crude with a three-month lag, resulting in margin compression when oil rallies outpace contract renegotiations. Cabot's Q4 2024 reinforcement volumes fell 7% as customers delayed restocking amid price uncertainty. Natural-rubber futures also remain volatile, dropping 2.1% week-over-week in March 2025 as Thai and Indonesian output expanded, prompting tire makers to hold 60-90 days of safety stock, which ties up working capital.

Other drivers and restraints analyzed in the detailed report include:

- Surge in E-Commerce Activities and Replacement Tire Miles

- Re-Industrialization of Southeast Asia Creating New Local Tire Plants

- Looming EU PFAS Ban Limiting Fluorinated Additives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Elastomers accounted for 42.88% of the tire material market size in 2025 and will expand at a 5.43% CAGR through 2031 as synthetic blends displace pure natural rubber in EV applications. Natural rubber still dominates passenger tires due to its superior tear strength, yet low-rolling-resistance mandates are accelerating the switch to solution S-SBR, polybutadiene, and bio-based liquid farnesene rubber. Kuraray reports lifecycle CO2 cuts of 30% and a 10% reduction in rolling resistance in Michelin pilot programs, illustrating how premium OEM specifications reward novel polymers. Reinforcing fillers, which occupy approximately one-third of the total compound volume, are witnessing a rise in silica's share as Euro 7 abrasion limits force higher-silica tread recipes. Bio-ethanol silica grades from Evonik and PPG are closing the historical cost gap with carbon black, a shift that further diversifies supplier bases within the tire material market.

Lightweight plasticizers face stricter REACH limits on aromatic content, prompting a shift toward treated distillate extracts and tall-oil derivatives, even though they add USD 0.10-0.15 per kilogram to compound cost. Nano-zinc-oxide grades cut heavy-metal loading by 40%, easing recycling, while Bekaert steel cord with 50% scrap content lowers compound CO2 by half. These incremental advances position material suppliers for premium pricing as OEMs chase cradle-to-grave sustainability metrics.

The Tire Material Market Report is Segmented by Material Type (Elastomers, Reinforcing Fillers, Plasticizers, Chemicals, Metal Reinforcements, and Textile Reinforcements), Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Trucks, Buses), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific held 52.05% of the tire material market share in 2025, underpinned by China's 30.5-million-unit light-vehicle output and the region's 62% share of global natural-rubber supply. Chinese tire makers, such as Sailun and Linglong, reported net profit growth exceeding 70% in 2024 and are expanding capacity both domestically and internationally, indicating sustained demand for upstream materials. Japan's Bridgestone, Sumitomo, and Yokohama raised their combined capital expenditure by 10.6% for FY 2025, directing funds toward high-value EV components and overseas plants. Southeast Asia's cost advantage and access to raw rubber encourage new entrants, while EU-aligned tire labeling standards prompt local producers to adopt low-rolling-resistance recipes, creating export-ready demand for advanced fillers.

The Middle East and Africa region is the fastest-growing geography, registering a 5.82% CAGR through 2031, as Saudi Arabia and the UAE deploy industrial diversification strategies. Projects such as the USD 550 million Pirelli-PIF plant and Egypt's USD 1.8 billion capacity pipeline promise to build a self-sufficient cluster that will need local carbon black, silica, and synthetic rubber supply. Europe and North America remain innovation hubs because regulatory pressure accelerates the adoption of bio-based silica, recovered carbon black, and stringent traceability standards, lessons that later cascade to emerging markets. South America's growth is at 3-4%, tempered by currency volatility and slower capacity additions; however, Brazil's 70 million vehicle parc offers a resilient aftermarket base that still imports specialty fillers.

- Bekaert

- Birla Carbon

- Bridgestone Corporation

- Cabot Corporation

- Continental AG

- Evonik

- Exxon Mobil Corporation

- JSR Corporation

- Kuraray Co., Ltd.

- LANXESS

- Linglong Tire

- Michelin

- Orion

- Sailun Group Co., Ltd.

- Sumitomo Rubber Industries, Ltd.

- Umicore

- Zhongce Rubber Group Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Global ramp-up of EV and hybrid vehicle production

- 4.2.2 OEM shift toward low-rolling-resistance compounds

- 4.2.3 Surge in e-commerce activities and the corresponding rise in replacement tire miles

- 4.2.4 Re-industrialisation of Southeast Asia creating new local tire plants

- 4.2.5 Cold-in-place recycling enabling circular feedstocks

- 4.3 Market Restraints

- 4.3.1 Volatile crude-oil and carbon-black pricing

- 4.3.2 OEM inventory destocking in 2024-25

- 4.3.3 Looming EU PFAS ban limiting fluorinated additives

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Material Type

- 5.1.1 Elastomers

- 5.1.1.1 Natural Rubber

- 5.1.1.2 Synthetic Rubber

- 5.1.2 Reinforcing Fillers

- 5.1.2.1 Carbon Black

- 5.1.2.2 Silica

- 5.1.3 Plasticizers

- 5.1.3.1 Paraffinic Oil

- 5.1.3.2 Naphthenic Oil

- 5.1.3.3 Aromatic Oil

- 5.1.4 Chemicals

- 5.1.4.1 Sulfur

- 5.1.4.2 Zinc Oxide

- 5.1.4.3 Stearic Acid

- 5.1.5 Metal Reinforcements

- 5.1.5.1 Steel Cord

- 5.1.5.2 Bead Wire

- 5.1.6 Textile Reinforcements

- 5.1.6.1 Nylon

- 5.1.6.2 Polyester

- 5.1.6.3 Others

- 5.1.1 Elastomers

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles (LCV)

- 5.2.3 Heavy Trucks

- 5.2.4 Buses

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 Japan

- 5.3.1.3 India

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bekaert

- 6.4.2 Birla Carbon

- 6.4.3 Bridgestone Corporation

- 6.4.4 Cabot Corporation

- 6.4.5 Continental AG

- 6.4.6 Evonik

- 6.4.7 Exxon Mobil Corporation

- 6.4.8 JSR Corporation

- 6.4.9 Kuraray Co., Ltd.

- 6.4.10 LANXESS

- 6.4.11 Linglong Tire

- 6.4.12 Michelin

- 6.4.13 Orion

- 6.4.14 Sailun Group Co., Ltd.

- 6.4.15 Sumitomo Rubber Industries, Ltd.

- 6.4.16 Umicore

- 6.4.17 Zhongce Rubber Group Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment