PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934741

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934741

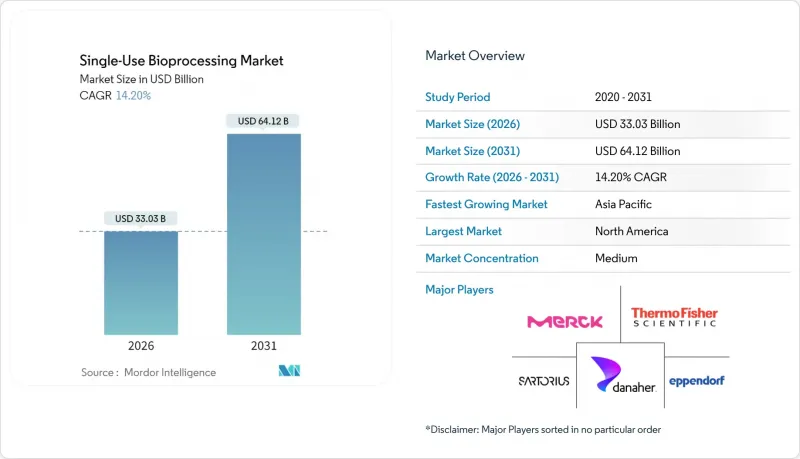

Single-Use Bioprocessing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Single-use bioprocessing market size in 2026 is estimated at USD 33.03 billion, growing from 2025 value of USD 28.92 billion with 2031 projections showing USD 64.12 billion, growing at 14.2% CAGR over 2026-2031.

Consistent demand for flexible mRNA vaccine capacity, personalized therapy production, and capital-light facility models continues to pull investment toward disposable technologies. North American and European manufacturers replace fixed stainless-steel assets with modular single-use lines that reduce start-up timelines by up to 24 months, while Asia-Pacific greenfield projects use single-use systems to bypass the high utility requirements of conventional plants. Cost avoidance, faster changeovers, and lower contamination risk remain the dominant purchasing criteria, and sustainability mandates now influence vendor selection as firms seek water-saving solutions. Competitive activity centers on larger bioreactors, polymer security of supply, and integrated sensor packages that can support continuous and hybrid processing flows.

Global Single-Use Bioprocessing Market Trends and Insights

Cost & CAPEX Avoidance Versus Stainless-Steel Facilities

Single-use systems eliminate USD 50-100 million of capital that stainless-steel facilities typically require, enabling companies to allocate funds to R&D instead of piping, clean-steam, and water-for-injection networks. GSK's USD 120 million Pennsylvania plant uses 2,000 L disposable bioreactors and cut commissioning time by up to two years while removing cleaning-validation labor . Smaller biotech firms and CDMOs benefit most, as single-use lines allow distributed regional production strategies without scale penalties. Ongoing savings stem from 80% lower water consumption and reduced autoclave energy, which improve facility operating margins across product life cycles.

Rising Biologics & Biosimilar Manufacturing Demand

Global biologics expansion pushes manufacturers toward equipment sets that minimize cross-contamination risk and accommodate multiple molecules in rapid succession. Biosimilar producers gain particular advantage because single-use changeovers do not require prolonged cleaning verification that adds to regulatory complexity. India's biologics CDMO revenue is projected to climb from USD 13.58 billion in 2023 to USD 24.77 billion by 2028, with single-use platforms removing the large sunk costs that once limited domestic capacity growth. ATMP developers equally prefer disposable lines for enclosed, sterile handling of cell and gene therapies, reinforcing steady demand into the next decade.

Leachables & Extractables Compliance Risks

Regulators escalate scrutiny through USP (665) and USP (87), replacing legacy USP (88) Class VI testing by May 2026 to protect patients from polymer leachates. System suppliers now fund extensive chemistry characterization for each film, connector, and gasket, raising qualification budgets and elongating project timelines. Pharma license applications must include multi-modal analytical data, which favors incumbents with sophisticated labs and may slow smaller vendors' entry.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Scale-Up Needs for mRNA Vaccines & Personalized Therapies

- Increasing Sustainability Mandates

- Plastic-Waste Disposal & Upcoming ESG Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Media bags and containers delivered USD 9.84 billion revenue in 2025, equal to 34.02% of the single-use bioprocessing market share. Their universal role in raw-material handling, seed-culture storage, and harvest collection keeps volume demand high across every scale. Technology advances in 3-layer films improve gas permeability and solvent compatibility, reinforcing their dominance in both mammalian and microbial applications. The single-use bioreactor category grows at a 14.75% CAGR through 2031 as 3,000 L-5,000 L formats prove commercially viable. Magnetic mixing, probe redundancy, and integrated optical sensors mitigate shear and scale-up worries that once limited adoption. The single-use bioprocessing market size for bioreactors is projected to more than double by 2031 on the back of commercial install programs in Asia-Pacific pilot plants.

Filtration assemblies rank second in revenue as downstream bottlenecks become acute when high-density perfusion cultures feed purification trains. Hybrid depth-filter and membrane designs now reach throughputs that support production bioreactors larger than 2,000 L, expanding disposable penetration. Tubing, aseptic connectors, and sampling valves register steady growth because larger-volume continuous lines require high-integrity fluid paths that withstand repeated pressure cycles. Single-use analytical probes also post brisk uptake as Process Analytical Technology expectations rise, giving operators real-time control without fouling concerns inside stainless-steel housings.

Upstream processing held 46.60% of 2025 revenue owing to widespread confidence in single-use bioreactors for mammalian cell culture. Productivity boosts from high-intensity perfusion make disposable reactors attractive for commercial antibody manufacturing. However, downstream systems advance at 15.05% CAGR, narrowing the gap as resin-free chromatography, membrane adsorbers, and single-pass tangential-flow filters overcome earlier performance limits. The single-use bioprocessing market size allocated to downstream operations is expected to exceed USD 22 billion by 2031 as fully disposable trains roll out for viral vectors and next-generation vaccines.

Continuous processing momentum accelerates this downstream shift. Integrated perfusion-chromatography skids can reduce facility footprints by more than 40%, an enticing proposition for high-value products where equipment utilization matters more than volumetric output. Regulatory familiarity with disposable purification systems grows as successful dossiers accumulate, encouraging adopters to eliminate hybrid layouts that once paired single-use upstream with stainless downstream gear. The result is a move toward end-to-end disposable plants that advance agility and reduce cross-contamination risk.

The Single-Use Bioprocessing Market Report is Segmented by Product (Single-Use Bioreactors, Filtration Assemblies, and More), Workflow Stage (Upstream Processing, Downstream Processing, Other Operations), End User (Biopharmaceutical Companies, and More), Scale (Clinical Scale, Commercial Scale), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 41.75% of 2025 revenue, anchored by early-mover companies such as Genentech and Amgen that set regulatory precedent for disposable lines. A mature CDMO ecosystem and clear FDA guidance streamline adoption cycles, while state capital grants encourage local vaccine capacity after pandemic supply shortages. Knowledge clusters in Boston-Cambridge and the San Francisco Bay Area ensure ready access to experienced operators who can run single-use facilities at high utilization.

Asia-Pacific records a 15.25% CAGR through 2031, the fastest worldwide trajectory. China's industrial policy subsidizes new biologics campuses, and local builders prefer disposable systems to avoid high-purity piping costs and long commissioning schedules. BioNTech's acquisition of a facility with ten 2,000 L single-use lines highlights confidence in regional regulatory acceptance. India's CDMO market leans on single-use to bridge power and water constraints, and South Korea's government-backed Cytiva factory secures consumable supply closer to key customers.

Europe shows steady but slower growth as many plants have already transitioned core upstream steps. EU climate law accelerates further adoption because disposable reactors save water and energy, yet landfill regulations force companies to invest in recycling alliances. Sanofi's new insulin site still favors stainless for ultrahigh-throughput products, demonstrating that very large commodity biologics may remain metal-based for cost reasons. Latin America, the Middle East, and Africa remain nascent but attractive for greenfield builds where infrastructure gaps make stainless less practical. Multilateral vaccine initiatives could catalyze first-wave sales in those regions, supporting long-term volume upside for the single-use bioprocessing market.

- Sartorius

- Thermo Fisher Scientific

- Danaher Corp. (Cytiva & Pall)

- Merck KGaA (MilliporeSigma)

- Avantor Inc.

- Solventum

- Eppendorf

- Repligen

- Saint-Gobain Life Sciences

- Parker Hannifin (Domnick Hunter)

- Entegris Inc.

- GEA Group

- ABEC

- PBS Biotech Inc.

- CESCO Bioengineering Co.

- Celltainer Biotech

- Distek Inc.

- OmniBRx Biotechnologies

- Meissner Filtration Products

- Cellexus

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cost & CAPEX Avoidance Versus Stainless-Steel Facilities

- 4.2.2 Rising Biologics & Biosimilar Manufacturing Demand

- 4.2.3 Rapid Scale-Up Needs for mRNA Vaccines & Personalized Therapies

- 4.2.4 Increasing Sustainability Mandates

- 4.2.5 Advances In Single-Use Fermentors for Microbial Processes

- 4.2.6 Expansion Of Continuous & Hybrid Bioprocessing Lines

- 4.3 Market Restraints

- 4.3.1 Leachables & Extractables Compliance Risks

- 4.3.2 Plastic-Waste Disposal & Upcoming ESG Regulations

- 4.3.3 Performance Limits in High-Volume Downstream Steps

- 4.3.4 Supply-Chain Tightness for Medical-Grade Polymers

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Single-use Bioreactors

- 5.1.2 Filtration Assemblies

- 5.1.3 Media Bags and Containers

- 5.1.4 Mixers & Blenders

- 5.1.5 Tubing & Connectors

- 5.1.6 Single-use Sensors & Analytics

- 5.1.7 Chromatography & Purification Columns

- 5.1.8 Sampling & Aseptic Transfer Systems

- 5.1.9 Others

- 5.2 By Workflow Stage

- 5.2.1 Upstream Processing

- 5.2.2 Downstream Processing

- 5.2.3 Other Operations

- 5.3 By End User

- 5.3.1 Biopharmaceutical Companies

- 5.3.2 Academic and Research Institutes

- 5.3.3 Others

- 5.4 By Scale

- 5.4.1 Clinical Scale

- 5.4.2 Commercial Scale

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Sartorius AG

- 6.3.2 Thermo Fisher Scientific Inc.

- 6.3.3 Danaher Corp. (Cytiva & Pall)

- 6.3.4 Merck KGaA (MilliporeSigma)

- 6.3.5 Avantor Inc.

- 6.3.6 Solventum

- 6.3.7 Eppendorf AG

- 6.3.8 Repligen Corporation

- 6.3.9 Saint-Gobain Life Sciences

- 6.3.10 Parker Hannifin (Domnick Hunter)

- 6.3.11 Entegris Inc.

- 6.3.12 GEA Group

- 6.3.13 ABEC Inc.

- 6.3.14 PBS Biotech Inc.

- 6.3.15 CESCO Bioengineering Co.

- 6.3.16 Celltainer Biotech BV

- 6.3.17 Distek Inc.

- 6.3.18 OmniBRx Biotechnologies

- 6.3.19 Meissner Filtration Products

- 6.3.20 Cellexus

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment