PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934747

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934747

China Mattress - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

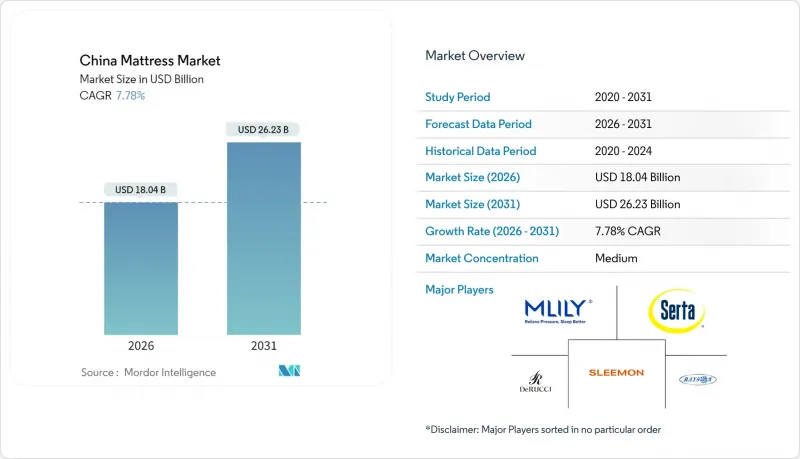

The China mattress market is expected to grow from USD 16.74 billion in 2025 to USD 18.04 billion in 2026 and is forecast to reach USD 26.23 billion by 2031 at 7.78% CAGR over 2026-2031.

Urbanization, higher disposable incomes among millennials, and a stronger focus on sleep quality underpin the expansion of the China mattress market. Consumers increasingly perceive sleep as a wellness investment, an outlook reinforced by the Healthy China 2030 program that popularizes health-oriented lifestyles. The China mattress market is also gaining from e-commerce maturity, where bed-in-a-box offerings shorten delivery lead times and reduce logistics costs. Competitive differentiation is tilting toward premium materials, IoT-enabled features, and eco-certified inputs that speak to rising health and sustainability

China Mattress Market Trends and Insights

Rising Disposable Incomes Among Urban Millennials

Higher salaries and stable employment in first- and second-tier cities are fueling premium mattress upgrades across the China mattress market. Millennials often research online and favor brands that disclose material sources and certification credentials, encouraging product transparency. Certifications such as CertiPUR-US and OEKO-TEX Standard 100 resonate with this demographic, allowing manufacturers to capture premium price points. Housing ownership remains a catalyst, as newly purchased or renovated homes spur mattress replacement cycles. The widening urban middle class, therefore, ensures a steady pipeline of consumers willing to invest in advanced sleep technologies.

Rapid Expansion of E-Commerce and Social-Commerce Bed-in-a-Box Brands

China's sophisticated logistics networks enable bed-in-a-box vendors to ship compressed mattresses nationwide within days. Digital marketplaces such as Tmall and JD.com reduce reliance on legacy retail, supporting the fastest growth channel in the China mattress market. Social-commerce integrations allow influencer-led content and customer reviews to drive purchasing decisions, further lowering customer acquisition costs. The model's capital-light store footprint lets new entrants scale quickly across regions. Lower warehousing and transportation expenses generate savings that brands either pass on to consumers or reinvest in R&D, reinforcing a virtuous growth cycle.

Volatile Polyurethane Foam Prices Linked to Crude-Oil Swings

Raw materials constitute up to half of production costs, and price spikes in foam undermine profitability for value-tier models. Plants in Guangdong and Zhejiang, which house the majority of foam processors, experience cost swings that can delay product launches or trigger price revisions. Some manufacturers hedge volatility by vertically integrating or diversifying suppliers across regions. Others experiment with plant-based foams to reduce petroleum dependence and align with sustainability trends. Persistent fluctuations encourage strategic inventory management and selective contract renegotiations with retailers.

Other drivers and restraints analyzed in the detailed report include:

- Healthy China 2030 Initiative Boosting Sleep-Health Awareness

- Growth of Mid-Scale Domestic Hotel Chains Requiring Standardized Bedding

- Intensifying Anti-Dumping Actions in Key Export Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Innerspring units retained 65.92% of China mattress market share in 2025 due to cost efficiency and consumer familiarity. Conversely, foam products, including memory foam, are projected to grow at a 8.72% CAGR, outpacing the overall China mattress market. The upside comes from superior pressure relief, motion isolation, and easy compression for e-commerce shipping. Manufacturers innovate with open-cell structures and gel infusions that improve breathability, addressing concerns about heat retention. Hybrid configurations mix foam comfort layers with pocketed coils, offering a balanced value proposition that widens appeal across price points.

Foam innovation also dovetails with smart-bed demand, as embedded sensors integrate more seamlessly into homogeneous foam layers. CertiPUR-US compliance further enhances export viability, especially to markets mandating stringent emissions standards. As more consumers equate premium sleep with foam technology, innerspring suppliers respond by upgrading coil counts, adding pillow-tops, or bundling toppers. Over the long term, competitive parity will depend on proprietary formulations and sustainable inputs such as plant-based polyols. The China mattress market size for foam lines is therefore positioned to capture incremental dollars that shift upward on the value chain.

King-size models commanded 39.85% of revenue in 2025, underscoring their status appeal among high-income households. Nevertheless, queen-size units are forecast to register an 8.55% CAGR, the fastest within the China mattress market. Urban families living in apartments gravitate toward queen-size formats that maximize comfort without overwhelming floor space. Hotels also standardize guest rooms around queen-size bed frames to optimize occupancy and turnover, adding commercial momentum. Single-size and double-size mattresses serve price-conscious segments and smaller living spaces, maintaining steady demand in student housing, rental properties, and budget-conscious households.

Versatility crowns the queen-size as the sweet spot for e-commerce, since compressed packaging is easier to handle for shippers and end consumers. Manufacturers offering multiple firmness options under a single queen-size SKU reduce inventory complexity while catering to varied sleep preferences. King-size growth still benefits from rising disposable incomes and larger home sizes in high-tier cities, but land-use constraints temper its trajectory. Single and double sizes maintain demand in dormitories and rental markets, yet their growth remains slower than the segment average. The compressed packaging advantages of bed-in-a-box models apply particularly well to queen-size mattresses, enabling cost-effective shipping and storage that supports e-commerce expansion.

The China Mattress Market Report is Segmented by Product Type (Innerspring/Coil, Foam, Latex, Hybrid, Other Types), Mattress Size (Single, Double, Queen, King, Custom), End User (Residential, Commercial), Distribution Channel (B2C Retail, B2B Project), and Geography (East, Southwestern, North, South Central, Northeast, Northwestern China). Market Forecasts are Provided in Value (USD).

List of Companies Covered in this Report:

- Airland

- Airweave

- Comfort-Sleep

- DeRucci (Musi)

- Goodnight (Daziran)

- Hengyuanxiang Bedding

- Hilding Anders China

- IKEA (China Bedding Division)

- King Koil China

- Kuka Home

- Mlily (Mengbaihe)

- Rayson Mattress

- RichMat

- Sealy China

- Serta China

- Simmons Bedding

- Sinomax

- Sleemon (Xilinmen)

- Swissflex

- Suibao Mattress

- Therapedic China

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Disposable Incomes Among China's Urban Millennials

- 4.2.2 Rapid Expansion of E-Commerce And Social-Commerce Bed-In-A-Box Brands

- 4.2.3 Government "Healthy China 2030" Initiative Boosting Sleep-Health Awareness

- 4.2.4 Growth Of Mid-Scale Domestic Hotel Chains Requiring Standardized Bedding

- 4.2.5 Adoption of Smart/IOT-Enabled Mattresses Integrated With Health Apps

- 4.2.6 Emerging Demand for Certified Eco-Friendly Latex Sourced From Hainan

- 4.3 Market Restraints

- 4.3.1 Volatile Polyurethane Foam Prices Linked to Crude-Oil Swings

- 4.3.2 Intensifying Anti-Dumping Actions in Key Export Markets

- 4.3.3 Rising Labor Costs in Coastal Provinces Shifting Production Inland

- 4.3.4 Counterfeit / Grey-Channel Products Eroding Branded Pricing Power

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

- 4.8 Insights on Consumer Behavior Analysis and Preferences in the Market (key motivational factors, preferred sales channel, demographics, key influencers and decision-makers)

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Innerspring / Coil

- 5.1.2 Foam (including memory foam)

- 5.1.3 Latex

- 5.1.4 Hybrid

- 5.1.5 Other Mattress Types

- 5.2 By Mattress Size

- 5.2.1 Single-size Mattress

- 5.2.2 Double-size Mattress

- 5.2.3 Queen-size Mattress

- 5.2.4 King-size Mattress

- 5.2.5 Custom & Specialty Sizes

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Distribution Channel

- 5.4.1 B2C/Retail

- 5.4.1.1 Mass Merchandisers

- 5.4.1.2 Specialty Mattress Stores (including exclusive brand outlets)

- 5.4.1.3 Online

- 5.4.1.4 Other Distribution Channels

- 5.4.2 B2B/Project

- 5.4.1 B2C/Retail

- 5.5 By Geography

- 5.5.1 East China

- 5.5.2 Southwestern China

- 5.5.3 North China

- 5.5.4 South Central China

- 5.5.5 Northeast China

- 5.5.6 Northwestern China

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Airland

- 6.4.2 Airweave

- 6.4.3 Comfort-Sleep

- 6.4.4 DeRucci (Musi)

- 6.4.5 Goodnight (Daziran)

- 6.4.6 Hengyuanxiang Bedding

- 6.4.7 Hilding Anders China

- 6.4.8 IKEA (China Bedding Division)

- 6.4.9 King Koil China

- 6.4.10 Kuka Home

- 6.4.11 Mlily (Mengbaihe)

- 6.4.12 Rayson Mattress

- 6.4.13 RichMat

- 6.4.14 Sealy China

- 6.4.15 Serta China

- 6.4.16 Simmons Bedding

- 6.4.17 Sinomax

- 6.4.18 Sleemon (Xilinmen)

- 6.4.19 Swissflex

- 6.4.20 Suibao Mattress

- 6.4.21 Therapedic China

7 Market Opportunities & Future Outlook

- 7.1 Affordable Smart-Bed Packages For Gen-Z Renters

- 7.2 Eco-Certified Latex Sourcing Partnerships In Hainan

- 7.3 Modular Mattresses For Fluctuating Apartment Sizes