PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934748

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934748

Upper Limb Prosthetics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

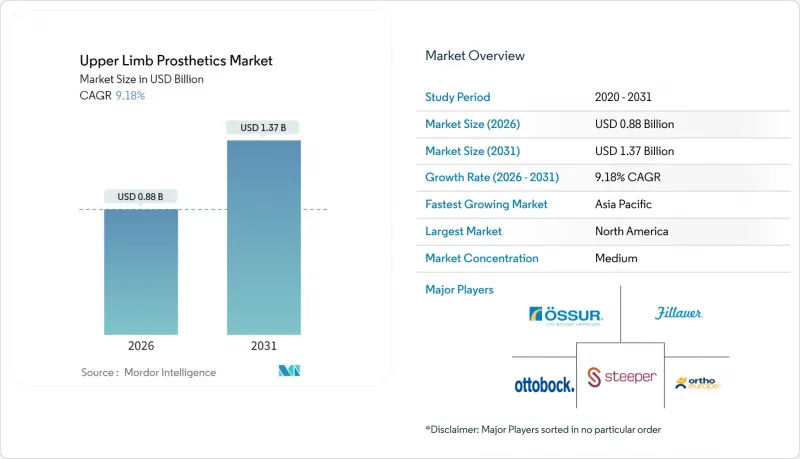

The upper limb prosthetics market was valued at USD 0.81 billion in 2025 and estimated to grow from USD 0.88 billion in 2026 to reach USD 1.37 billion by 2031, at a CAGR of 9.18% during the forecast period (2026-2031).

Rapid advances in brain-computer interfaces, broader reimbursement in high-income economies, and the steady transfer of military research to civilian products underpin growth. Rising diabetes-related amputations and trauma cases increase patient pools, while myoelectric systems enriched with artificial intelligence improve functionality and user acceptance. Robust venture funding accelerates product pipelines, yet supply-chain volatility and high device costs temper adoption, particularly in developing regions.

Global Upper Limb Prosthetics Market Trends and Insights

Growing Incidence of Traumatic & Diabetes-Related Amputations

Amputation epidemiology now shows diabetes as a central cause of limb loss, and trauma from conflict or accidents remains significant. Survivors often need adaptable devices as health conditions shift, driving demand for intuitive solutions that minimize cognitive load. Artificial-intelligence controllers learn residual muscle signals and adjust to fluctuating stump volume, increasing day-to-day wear time. Providers also report rising referrals for complex bilateral fittings, spurring interest in neurally-integrated limbs perceived as part of the body. Taken together, epidemiology and innovation lift the upper limb prosthetics market by widening addressable populations and improving quality-of-life outcomes.

Rapid Adoption of Myoelectric & Bionic Technologies

Myoelectric hands once limited to basic grasp now deliver individual finger control and touch feedback through targeted nerve stimulation. Brain-computer interfaces enable localized tactile sensations, letting users feel object edges and motion. Medicare's new L6700 code covers pattern-recognition modules, reducing patient co-pay barriers and shortening training times. FDA clearance of the Altius direct nerve-stimulation system for phantom-pain relief further motivates device uptake. Collectively, these milestones accelerate the upper limb prosthetics market by replacing mechanical switches with neural intent.

High Device & Maintenance Costs

Advanced bionic arms routinely list above USD 100,000 and require battery changes, software upgrades, and periodic recalibration that add thousands in annual upkeep. Reimbursement gaps in middle-income economies force many patients to settle for cosmetic devices, depressing the penetration of smart systems. France's tariff cuts have already triggered warnings of product withdrawal, revealing how cost containment can backfire on access. Veterans Affairs coverage of osseointegration implants shows selective generosity that does not extend to all amputees. High total cost of ownership therefore drags on the upper limb prosthetics market, particularly where national insurance schemes face budget pressure.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Reimbursement Frameworks in High-Income Economies

- Industrial 3D-Printing Supply Chains Enable Mass-Custom Sockets

- Limited Clinical Capacity & User Training in Developing Regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Myoelectric systems held a 25.40% share of the upper limb prosthetics market in 2025, while 3D-printed modular alternatives are growing at a 9.94% CAGR to 2031. Myoelectric control interprets residual muscle signals to deliver proportional grip force and individual finger motion, a leap from binary body-powered hooks. Universities demonstrated 97% accuracy in predicting hand movements by combining electromyography with force myography, paving the way for seamless intent recognition. Hybrid solutions that blend cable and electronic control give users a fallback option when power is scarce, helping expand the upper limb prosthetics industry in remote areas.

The rise of distributed manufacturing further fuels the upper limb prosthetics market: open-source platforms let clinics fabricate modular hands on desktop printers and swap parts without factory wait times. Medicare coverage for pattern-recognition controllers under code L6700 reduces the total cost of ownership for U.S. users. Extended-reality simulators shorten training from months to weeks, addressing a historic barrier to myoelectric uptake. Collectively, these advances ensure that myoelectric leadership will persist even as low-cost printed devices capture price-sensitive segments, reinforcing premium and value tiers within the upper limb prosthetics market.

Hand and wrist units contributed 20.75% of the upper limb prosthetics market size in 2025 and are set to grow at a 9.28% CAGR through 2031. The focus on end-effector performance stems from daily living needs such as eating, dressing, and typing. Hybrid soft-rigid hands from Johns Hopkins allow delicate tasks without crushing objects, using real-time sensory feedback through targeted nerve stimulation.

Spinal-reflex stimulation research adds involuntary grip control, reducing mental effort during repetitive tasks. Shoulder and elbow components improve with microprocessors that auto-adapt to reach trajectory and load, yet remain costlier and less widely reimbursed. Class II device classification for multi-degree hands gives manufacturers a predictable regulatory route, encouraging incremental upgrades. As user expectations escalate, suppliers bundle modular wrists, quick-change tools, and haptic skins, expanding the share of wallets inside the upper limb prosthetics market.

The Upper Limb Prosthetics Market is Segmented by Device Type (Body-Powered, Passive, and More), Component (Prosthetic Shoulder, Arm, Elbow, and More), End User (Hospitals, Prosthetic Clinics and More), Amputation Level (Transradial, Transhumeral, and More), Technology (Cable-Operated, and More), and Geography (North America, Europe, Asia Pacific, and More). The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 40.05% of 2025 revenue thanks to progressive reimbursement and concentrated R&D funding. DARPA's USD 107 million Revolutionizing Prosthetics initiative seeded many civilian spin-offs, while Canada's universal insurance ensures consistent demand. The region nevertheless felt COVID-era supply shortages that led FDA to monitor prosthetic component inventories more closely, exposing pediatric vulnerability to niche part scarcity. Continued integration of pattern-recognition codes and veteran-focused osseointegration coverage sustains North American leadership inside the upper limb prosthetics market.

Asia Pacific is projected to post an 8.31% CAGR from 2026-2031, driven by rising healthcare expenditure, aging populations and policy support in Japan, China and India. Japan's medtech imports remain strong, and its robotics culture hastens acceptance of bionic arms. China's domestic manufacturers scale cost-optimized myoelectric hands, although complex approval pathways and regional insurance disparities segment the opportunity. India's Ayushman Bharat scheme pushes affordability, creating space for 3D-printed devices. Digital infrastructure gaps and clinician shortages temper progress, yet overall momentum elevates the upper limb prosthetics market across Asia Pacific.

Europe shows mixed signals. Germany and the UK innovate aggressively, backed by firms like Ottobock that export worldwide. However, France's 25% reimbursement cut starting 2025 highlights fiscal austerity that may limit advanced fittings. The EU's stringent MDR regulation raises compliance costs but also boosts global credibility. Cross-border acquisitions see foreign investors controlling 60% of local orthopaedic firms, sparking debate over domestic value retention. Despite headwinds, Europe remains a premium technology crucible, reinforcing its strategic importance to the upper limb prosthetics market.

- Ottobock

- Ossur hf

- Blatchford Group

- Fillauer

- Steeper Group

- Willow Wood Global

- Coapt

- Open Bionics

- Psyonic Inc.

- Unlimited Tomorrow Inc.

- Integrum AB

- Mobius Bionics LLC

- Prensilia Srl

- Naked Prosthetics

- Esper Bionics

- Point Designs LLC

- Protunix

- Aether Biomedical

- Human In Motion Robotics

- Hy5 Pro

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Incidence Of Traumatic & Diabetes-Related Amputations

- 4.2.2 Rapid Adoption Of Myoelectric & Bionic Technologies

- 4.2.3 Expanding Reimbursement Frameworks In High-Income Economies

- 4.2.4 Industrial 3D-Printing Supply Chains Enable Mass-Custom Sockets

- 4.2.5 Military R&D Spill-Over Into Civilian Upper-Limb Solutions

- 4.2.6 Emergence Of AI-Based Sensory Feedback Systems Enhancing User Acceptance

- 4.3 Market Restraints

- 4.3.1 High Device & Maintenance Costs

- 4.3.2 Limited Clinical Capacity & User-Training In Developing Regions

- 4.3.3 Rare-Earth Magnet Supply Volatility For Micro-Motors

- 4.3.4 High Long-Term Abandonment Rates Due To Comfort / Weight Issues

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Device Type

- 5.1.1 Body-Powered

- 5.1.2 Passive/Cosmetic

- 5.1.3 Hybrid

- 5.1.4 Myoelectric/Bionic

- 5.2 By Component

- 5.2.1 Prosthetic Shoulder

- 5.2.2 Prosthetic Arm

- 5.2.3 Prosthetic Elbow

- 5.2.4 Prosthetic Wrist/Hand

- 5.2.5 Other Components

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Prosthetic Clinics & Rehab Centres

- 5.3.3 Home-care & Other End Users

- 5.4 By Amputation Level

- 5.4.1 Transradial

- 5.4.2 Transhumeral

- 5.4.3 Shoulder Disarticulation

- 5.4.4 Partial Hand/Finger

- 5.5 By Technology

- 5.5.1 Cable-Operated

- 5.5.2 Microprocessor-Controlled

- 5.5.3 3D-Printed Modular

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Ottobock SE & Co. KGaA

- 6.3.2 Ossur hf

- 6.3.3 Blatchford Group

- 6.3.4 Fillauer LLC

- 6.3.5 Steeper Group

- 6.3.6 WillowWood Global LLC

- 6.3.7 COAPT LLC

- 6.3.8 Open Bionics Ltd

- 6.3.9 Psyonic Inc.

- 6.3.10 Unlimited Tomorrow Inc.

- 6.3.11 Integrum AB

- 6.3.12 Mobius Bionics LLC

- 6.3.13 Prensilia Srl

- 6.3.14 Naked Prosthetics

- 6.3.15 Esper Bionics

- 6.3.16 Point Designs LLC

- 6.3.17 Protunix

- 6.3.18 Aether Biomedical

- 6.3.19 Human In Motion Robotics

- 6.3.20 Hy5 Pro

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment