PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934749

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934749

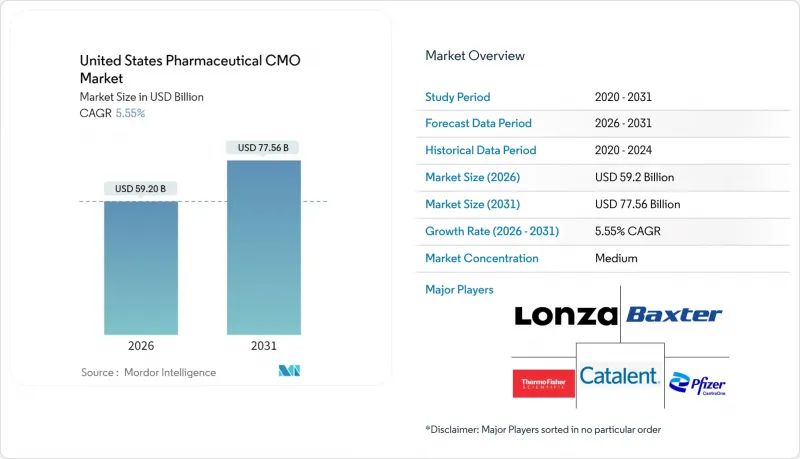

United States Pharmaceutical CMO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States pharmaceutical contract manufacturing market is expected to grow from USD 56.09 billion in 2025 to USD 59.2 billion in 2026 and is forecast to reach USD 77.56 billion by 2031 at 5.55% CAGR over 2026-2031.

This upward trajectory reflects a decisive shift toward specialized outsourcing as innovators optimize capital allocation and tap external expertise for complex chemistries and biologics. Supply-chain security legislation, sterile-facility bottlenecks, and the fast-moving biologics pipeline remain the structural growth drivers. Investment activity continues in high-potency API suites and continuous-manufacturing lines, while near-shoring programs triggered by the BIOSECURE Act are pulling production back to trusted locations. Competitive dynamics favor CDMOs that pair technical depth with regulatory reliability, as pharmaceutical sponsors elevate quality and redundancy over headline pricing. M&A intensity remains high, with vertical integration deals reshaping service breadth and geographic reach.

United States Pharmaceutical CMO Market Trends and Insights

Shift Toward Outsourcing to Reduce CapEx

Pharmaceutical sponsors continue to trade fixed-asset burdens for variable-cost partnerships. Multiyear capacity leases, once typical for blockbuster portfolios, have given way to flexible master service agreements that accommodate changing modality mixes. The strategy frees cash for R&D, presses CDMOs to modernize, and aligns with investor pressure for asset-light operating models. Emerging biotech companies-often pipeline-rich yet capital-constrained-rely almost exclusively on outsourced current-Good-Manufacturing-Practice (cGMP) capability, a reliance that the United States pharmaceutical contract manufacturing market readily monetizes.

Growing Pipeline of Biologics and Advanced Therapies

Monoclonal antibodies, cell therapies, and gene-editing constructs fuel long-dated manufacturing demand that few originators can meet internally. The precise environmental controls and single-use bioreactors required for biologics raise technical barriers and amplify the appeal of expert CDMOs. Oncology and rare-disease sponsors prefer end-to-end biologics partners capable of small batch runs, real-time analytics, and regulatory engagement. These priorities cement biologics as the fastest-growing revenue stream within the United States pharmaceutical contract manufacturing market.

Lower-Cost CDMOs in Asia-Pacific and Latin America

Standardized small-molecule processes still migrate offshore when pricing eclipses regulatory-risk tolerance. Asian CMOs quote 30-50% discounts versus U.S. peers, a spread that widens for commoditized APIs. Domestic providers counter by emphasizing quality records, cyber-resilience, and logistics reliability-attributes increasingly scrutinized after pandemic bottlenecks.

Other drivers and restraints analyzed in the detailed report include:

- Capacity Shortages Among U.S. Sterile Facilities

- Rising Demand for High-Potency API Suites

- Regulatory Complexities and Serialization Mandates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

API manufacturing contributed 41.78% of 2025 revenues, underscoring its foundational role in the United States pharmaceutical contract manufacturing market size. Growth at a 6.41% trajectory reflects sustained demand for complex chemistries, high-potency containment, and stereoselective syntheses. CDMOs with kilogram-scale reactors and zero-liquid-discharge utilities secure long-term supply agreements, particularly for oncology pipelines requiring potent payloads.

Downstream, finished-dosage manufacture encompasses solid, liquid, and injectable routes, each with distinct compliance regimes. Sterile fill-finish lines confront capacity scarcity, supporting higher margins despite fragmented ownership. Packaging and labeling services, though smaller, gain relevance under DSCSA serialization. The United States pharmaceutical contract manufacturing market share in packaging tilts toward facilities offering late-stage customization and cold-chain kitting.

Small molecules retained a 56.74% share in 2025, benefiting from entrenched process know-how and global demand for oral solids. Yet advanced therapies-cell, gene, and RNA-based products-post a leading 7.05% CAGR to 2031. Sponsors favor CDMOs equipped with Grade B cleanrooms, viral-vector suites, and closed-system isolators.

Biologics continue to scale as antibody and fusion-protein platforms mature. Batch variability and stringent glycosylation profiles spur outsourcing to biologics specialists with single-use bioreactor fleets and high-capacity chromatography skids. The United States pharmaceutical contract manufacturing market size for advanced therapies remains capacity-constrained, incentivizing greenfield builds and targeted acquisitions.

The United States Pharmaceutical CMO Market Report is Segmented by Service Type (API Manufacturing, Secondary Packaging, and More), Drug Molecule Type (Small Molecule, Biologics, and More), Scale of Operation (Clinical-Phase Manufacturing, Commercial-Scale Manufacturing), End User (Big Pharma, Generic Pharma, and More), Therapeutic Area (Oncology, Cardiovascular, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Catalent Inc.

- Thermo Fisher Scientific Inc. (Patheon)

- Lonza Group AG

- Pfizer CentreOne (Pfizer Inc.)

- Baxter International Inc. (BioPharma Solutions)

- AbbVie Contract Manufacturing (AbbVie Inc.)

- Recipharm AB

- Jubilant Pharmova Limited

- Boehringer Ingelheim BioXcellence

- Aenova Group GmbH

- Siegfried Holding AG

- Samsung Biologics Co., Ltd.

- FUJIFILM Diosynth Biotechnologies USA Inc.

- Cambrex Corporation

- Alcami Corporation Inc.

- PCI Pharma Services

- Ajinomoto Bio-Pharma Services

- Emergent BioSolutions Inc.

- Vetter Pharma-Fertigung GmbH & Co. KG

- Grand River Aseptic Manufacturing Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift toward outsourcing to reduce CapEx

- 4.2.2 Growing pipeline of biologics and advanced therapies

- 4.2.3 Capacity shortages among U.S. sterile facilities

- 4.2.4 Rising demand for high-potency API (HPAPI) suites

- 4.2.5 Near-shoring driven by supply-chain security Acts

- 4.2.6 Adoption of continuous manufacturing technologies

- 4.3 Market Restraints

- 4.3.1 Lower-cost CDMOs in Asia-Pacific and Latin America

- 4.3.2 Regulatory complexities and serialization mandates

- 4.3.3 Talent shortages in biologics manufacturing

- 4.3.4 Inflation-linked input-cost volatility

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Impact of Macroeconomic Factors on the Market

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 API Manufacturing

- 5.1.1.1 Small Molecule

- 5.1.1.2 Large Molecule

- 5.1.1.3 High-Potency API (HPAPI)

- 5.1.2 FDF Development and Manufacturing

- 5.1.2.1 Solid Dose

- 5.1.2.2 Liquid Dose

- 5.1.2.3 Injectable Dose

- 5.1.3 Secondary Packaging

- 5.1.1 API Manufacturing

- 5.2 By Drug Molecule Type

- 5.2.1 Small Molecule

- 5.2.2 Biologics

- 5.2.3 Advanced Therapies (Cell and Gene)

- 5.3 By Scale of Operation

- 5.3.1 Clinical-Phase Manufacturing

- 5.3.2 Commercial-Scale Manufacturing

- 5.4 By End User

- 5.4.1 Big Pharma

- 5.4.2 Generic Pharma

- 5.4.3 Emerging / Virtual Biotech

- 5.4.4 Specialty Pharma

- 5.5 By Therapeutic Area

- 5.5.1 Oncology

- 5.5.2 Cardiovascular

- 5.5.3 Central Nervous System (CNS)

- 5.5.4 Infectious Disease

- 5.5.5 Other Therapeutic Areas

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Relative Positioning Analysis

- 6.4 Market Share Analysis

- 6.5 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.5.1 Catalent Inc.

- 6.5.2 Thermo Fisher Scientific Inc. (Patheon)

- 6.5.3 Lonza Group AG

- 6.5.4 Pfizer CentreOne (Pfizer Inc.)

- 6.5.5 Baxter International Inc. (BioPharma Solutions)

- 6.5.6 AbbVie Contract Manufacturing (AbbVie Inc.)

- 6.5.7 Recipharm AB

- 6.5.8 Jubilant Pharmova Limited

- 6.5.9 Boehringer Ingelheim BioXcellence

- 6.5.10 Aenova Group GmbH

- 6.5.11 Siegfried Holding AG

- 6.5.12 Samsung Biologics Co., Ltd.

- 6.5.13 FUJIFILM Diosynth Biotechnologies USA Inc.

- 6.5.14 Cambrex Corporation

- 6.5.15 Alcami Corporation Inc.

- 6.5.16 PCI Pharma Services

- 6.5.17 Ajinomoto Bio-Pharma Services

- 6.5.18 Emergent BioSolutions Inc.

- 6.5.19 Vetter Pharma-Fertigung GmbH & Co. KG

- 6.5.20 Grand River Aseptic Manufacturing Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment