PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934755

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934755

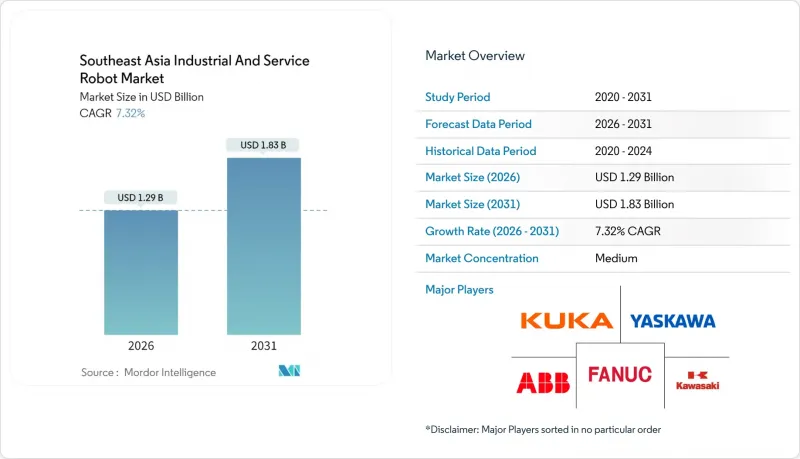

Southeast Asia Industrial And Service Robot - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Southeast Asia industrial and service robot market is expected to grow from USD 1.20 billion in 2025 to USD 1.29 billion in 2026 and is forecast to reach USD 1.83 billion by 2031 at 7.32% CAGR over 2026-2031.

Rising labor scarcity in mature manufacturing hubs, aggressive "China-plus-one" supply-chain shifts, and a surge of government Industry 4.0 subsidies combine to accelerate uptake of both industrial and service robots. Thailand leads today's demand thanks to Eastern Economic Corridor incentives, while Vietnam's fast-growing electronics sector turns it into the region's automation hotspot. Collaborative cobots gain traction among SMEs seeking flexible, low-footprint solutions, even as heavy-duty articulated units remain core to automotive and electronics lines. The Southeast Asia industrial and service robot market is becoming a pivotal enabler of near-shoring strategies for global manufacturers that want geographic diversity and cost competitiveness.

Southeast Asia Industrial And Service Robot Market Trends and Insights

ASEAN Industry 4.0 Subsidy Programmes Accelerating Robot Uptake

Massive fiscal incentives across ASEAN are lowering capital hurdles for manufacturers to trial and scale automation. Thailand's Eastern Economic Corridor earmarked USD 45 billion for high-tech industry upgrades, with robotics highlighted as a priority. Singapore has invested SGD 60 million since 2016 into more than 40 robotics projects, enabling startups such as Lionsbot to boost production of autonomous cleaning units. Thailand's Board of Investment further facilitated robotics projects worth 15 billion baht, aiming for 10,000 new systems annually. These programs include training grants and testbeds, closing skill gaps and creating a self-reinforcing ecosystem that supports SMEs as well as multinationals. Malaysia's Industry4WRD and Indonesia's Making Indonesia 4.0 push similar agendas, extending the subsidy tailwind across the entire Southeast Asia industrial and service robot market.

Rising Labor Scarcity in Singapore and Thailand Boosting Automation ROI

Tighter foreign-worker quotas in Singapore and demographic shifts in Thailand are stoking wage inflation that narrows the cost gap between robots and humans. Singapore's government earmarked SGD 450 million (USD 353.36 million) over three years to accelerate workplace automation as companies struggle to hire. In healthcare, Bangkok's Mongkutwattana General Hospital deployed medication-dispensing robots to offset nursing shortages. Successful early projects demonstrate quick payback, reinforcing boardroom confidence and triggering wider adoption across manufacturing, hospitality, and logistics.

High Capex Versus Low Migrant-Labour Costs Limits ROI in Indonesia and Vietnam

Cheap migrant labour still undercuts robot hourly costs for many repetitive tasks, restraining uptake in labour-abundant industries. Indonesian factories often achieve faster payback through manual processes, delaying automation except in quality-critical operations. Vietnamese SMEs confront similar arithmetic even as electronics giants automate clean-room lines. Rising minimum wages and demonstration projects such as Pegatron's 5G-enabled smart factory illustrate the tipping point where premium throughput offsets initial capex.

Other drivers and restraints analyzed in the detailed report include:

- China-Plus-One Electronics Migration to Vietnam/Malaysia Lifting Precision-Assembly Demand

- E-Commerce Fulfilment Boom in Indonesia and Philippines Driving Logistics Robots

- Shortage of Advanced Robotics Talent Outside Singapore Slows Commissioning and Service

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial robots generated 71.30% of the Southeast Asia industrial and service robot market size in 2025, anchored in electronics SMT lines, automotive welding cells, and general material-handling tasks. Articulated, SCARA, and cartesian models deliver high repeatability for end-users that prioritise speed and accuracy. Meanwhile, cobots record the fastest 18.70% CAGR as SMEs adopt plug-and-play units for machine tending and packaging. Universal Robots has shipped more than 100,000 cobots worldwide and enlarged its Philippine channel to tap untapped demand. The retrofit-friendly nature of cobots sidesteps costly safety fencing and shortens payback periods, expanding reach across plastic moulding, PCB assembly, and food processing. Over the forecast horizon, hybrid lines mixing large industrial arms with auxiliary cobots will characterise factories across Vietnam and Thailand, cementing the Southeast Asia industrial and service robot market as a heterogeneous blend of form factors.

Second-generation delta and parallel robots address ultra-high-speed pick-and-place needs in food packaging, while heavy-duty 1,000 kg-plus payload units such as Kawasaki's MG series enable shipbuilding and construction handling. Service robots remain a smaller revenue slice but exhibit strong potential in healthcare, hospitality, and public-space cleaning. Combined, these patterns point to sustained hardware diversification and continual software enhancements that enrich the Southeast Asia industrial and service robot market.

Greenfield factories absorb the bulk of units as multinationals erect state-of-the-art lines in Vietnam, Malaysia, and Indonesia. AutoStore's new modular-robot factory in Thailand exemplifies the build-out of local capacity to meet global demand while cutting lead times. The Southeast Asia industrial and service robot market size for retrofit projects is also rising, representing near-term opportunities because 65% of AutoStore goods-to-person systems have been installed in brownfield sites. Retrofit momentum helps SMEs modernise legacy lines without full plant overhauls.

Hybrid strategies blend new automated cells with existing manual workstations, allowing gradual scaling. The shift towards subscription-based "robots-as-a-service" further reduces financial risk, pulling in first-time buyers and broadening the Southeast Asia industrial and service robot industry's adoption funnel.

Southeast Asia Industrial and Service Robot Market Report is Segmented by Robot Type (Industrial Robots, Service Robots), Payload Capacity (Up To 15 Kg, 16-60 Kg, and More), Component (Hardware, and More), Application (Assembly, and More), End-User Industry (Automotive, and More), Installation Type (New Installations, and More), Enterprise Size (Large Enterprises, Smes). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- FANUC Corporation

- Yaskawa Electric Corporation

- ABB Ltd

- KUKA AG

- Mitsubishi Electric Corporation

- Kawasaki Heavy Industries Ltd

- Omron Corporation

- Denso Corporation

- Nachi-Fujikoshi Corp.

- Seiko Epson Corporation

- Universal Robots A/S

- Techman Robot Inc.

- Staubli International AG

- Comau S.p.A.

- Hanwha Robotics

- Delta Electronics Inc.

- Hyundai Robotics

- PBA Robotics (Singapore) Pte Ltd

- Siasun Robot and Automation Co.

- Shibaura Machine Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 ASEAN "Industry 4.0" subsidy programmes accelerating robot uptake

- 4.2.2 Rising labour scarcity in Singapore and Thailand boosting automation ROI

- 4.2.3 China-plus-one electronics migration to Vietnam/Malaysia lifting precision-assembly demand

- 4.2.4 E-commerce fulfilment boom in Indonesia and Philippines driving logistics robots

- 4.2.5 Smart-hospital capex in Thailand and Singapore expanding service-robot adoption

- 4.2.6 Growth of regional system-integrator ecosystem (PBA, SYS-MAC) reducing deployment barriers for SMEs

- 4.3 Market Restraints

- 4.3.1 High capex versus low migrant-labour costs limits ROI in Indonesia and Vietnam

- 4.3.2 Fragmented factory utilities and floor conditions complicate integration

- 4.3.3 Import tariffs/lead-times for robot components due to weak local supply base

- 4.3.4 Shortage of advanced robotics talent outside Singapore slows commissioning and service

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Robot Type

- 5.1.1 Industrial Robots

- 5.1.1.1 Articulated Robots

- 5.1.1.2 SCARA Robots

- 5.1.1.3 Cartesian / Gantry Robots

- 5.1.1.4 Parallel / Delta Robots

- 5.1.1.5 Collaborative Robots (Cobots)

- 5.1.1.6 Other Industrial Robot Types

- 5.1.2 Service Robots

- 5.1.2.1 Professional Service Robots

- 5.1.2.1.1 Logistics and Warehousing

- 5.1.2.1.2 Medical and Healthcare

- 5.1.2.1.3 Agriculture and Field

- 5.1.2.1.4 Inspection and Maintenance

- 5.1.2.1.5 Hospitality

- 5.1.2.2 Domestic Service Robots

- 5.1.2.2.1 Cleaning

- 5.1.2.2.2 Companion and Elder-care

- 5.1.2.2.3 Lawn and Pool

- 5.1.2.2.4 Other Domestic Robot Types

- 5.1.2.1 Professional Service Robots

- 5.1.1 Industrial Robots

- 5.2 By Payload Capacity (Industrial)

- 5.2.1 Up to 15 kg

- 5.2.2 16 - 60 kg

- 5.2.3 61 - 225 kg

- 5.2.4 Above 225 kg

- 5.3 By Component

- 5.3.1 Hardware

- 5.3.1.1 Manipulator

- 5.3.1.2 Controller

- 5.3.1.3 Drives

- 5.3.1.4 Sensors

- 5.3.1.5 End-Effectors

- 5.3.2 Software

- 5.3.3 Services

- 5.3.3.1 Integration and Deployment

- 5.3.3.2 Training and Support

- 5.3.3.3 Maintenance

- 5.3.1 Hardware

- 5.4 By Application

- 5.4.1 Material Handling and Pick-and-Place

- 5.4.2 Welding and Soldering

- 5.4.3 Assembly

- 5.4.4 Painting and Dispensing

- 5.4.5 Packaging and Palletising

- 5.4.6 Inspection and Quality Control

- 5.4.7 Cutting and Processing

- 5.4.8 Other Applications

- 5.5 By End-user Industry

- 5.5.1 Automotive

- 5.5.2 Electronics and Semiconductor

- 5.5.3 Metals and Machinery

- 5.5.4 Plastics and Chemicals

- 5.5.5 Food and Beverage

- 5.5.6 Logistics and Warehousing

- 5.5.7 Healthcare

- 5.5.8 Retail and Hospitality

- 5.5.9 Others (Agriculture, Construction)

- 5.6 By Installation Type

- 5.6.1 New Installations

- 5.6.2 Retrofit and Upgrades

- 5.7 By Enterprise Size

- 5.7.1 Large Enterprises

- 5.7.2 Small and Medium Enterprises

- 5.8 By Country

- 5.8.1 Indonesia

- 5.8.2 Malaysia

- 5.8.3 Singapore

- 5.8.4 Thailand

- 5.8.5 Vietnam

- 5.8.6 Philippines

- 5.8.7 Rest of Southeast Asia

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global?level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 FANUC Corporation

- 6.4.2 Yaskawa Electric Corporation

- 6.4.3 ABB Ltd

- 6.4.4 KUKA AG

- 6.4.5 Mitsubishi Electric Corporation

- 6.4.6 Kawasaki Heavy Industries Ltd

- 6.4.7 Omron Corporation

- 6.4.8 Denso Corporation

- 6.4.9 Nachi-Fujikoshi Corp.

- 6.4.10 Seiko Epson Corporation

- 6.4.11 Universal Robots A/S

- 6.4.12 Techman Robot Inc.

- 6.4.13 Staubli International AG

- 6.4.14 Comau S.p.A.

- 6.4.15 Hanwha Robotics

- 6.4.16 Delta Electronics Inc.

- 6.4.17 Hyundai Robotics

- 6.4.18 PBA Robotics (Singapore) Pte Ltd

- 6.4.19 Siasun Robot and Automation Co.

- 6.4.20 Shibaura Machine Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment