PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934757

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934757

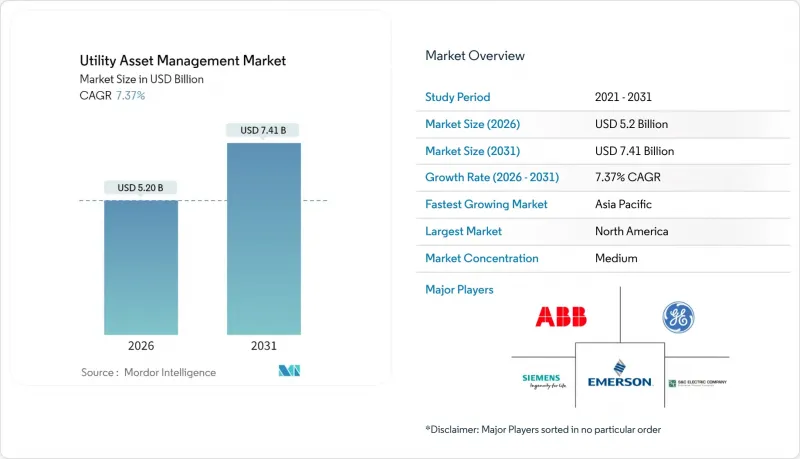

Utility Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Utility Asset Management market size in 2026 is estimated at USD 5.2 billion, growing from 2025 value of USD 4.84 billion with 2031 projections showing USD 7.41 billion, growing at 7.37% CAGR over 2026-2031.

Growth stems from parallel infrastructure replacement cycles and the rapid digitalization of grid operations, both of which elevate spending on predictive analytics, intelligent sensors, and cloud platforms. Regulatory bodies are tightening reliability standards, while utilities are expanding their renewable portfolios, which demand finer visibility into asset health. Cloud-enabled tools now shorten outage restoration times, and Infrastructure-as-a-Service contracts help mid-tier operators overcome capital constraints. Meanwhile, cybersecurity frameworks are becoming a prerequisite rather than an add-on for any new asset management deployment.

Global Utility Asset Management Market Trends and Insights

Aging Grid Infrastructure Replacement & Modernization

More than 70% of North American transmission lines are nearing the end of their life, while European substations typically average over 40 years of service, compelling utilities to replace assets and add digital controls simultaneously. The European Commission pegs investment needs at EUR 730 billion for distribution and EUR 477 billion for transmission grids by 2040. Large electric firms such as E.ON have dedicated USD 46 billion to five-year upgrade programs, complemented by Iberdrola's EUR 41 billion electrification roadmap. Climate-related outages escalate the urgency, pushing operators to prioritize climate-resilient designs and predictive maintenance. Consequently, the utility asset management market is witnessing a surge in orders for smart transformers, hardened conductors, and advanced maintenance analytics.

Integration of IoT Sensors for Real-Time Condition Monitoring

Utilities are outfitting transformers, breakers, and conductors with IEC 61850-compliant sensors that continuously stream temperature, vibration, and oil-quality data. Early fault indications surface weeks ahead of failure, cutting maintenance outages by up to 30% and boosting asset utilization. Interoperable IEDs reduce vendor lock-in and lower integration costs. Edge gateways stationed in substations now process data locally to meet millisecond protection requirements, while cloud platforms run longer-horizon analytics for capital planning. The utility asset management market benefits as operators treat sensor networks as strategic infrastructure rather than discretionary add-ons.

Cyber-Security Vulnerabilities in Connected Assets

Expanding sensor footprints multiply potential attack vectors. Recent incidents targeting industrial control systems underscore weaknesses in legacy relay protocols and unsecured serial links. Full mitigation entails encryption, network segmentation, and continuous threat hunting, which can add 15-25% to deployment budgets. Utilities also face skills shortages in operational technology security, which forces them to outsource to specialist firms. Heightened risk perceptions can delay or down-scope digital projects, curbing immediate demand in the utility asset management market.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Mandates for Reliability & Outage Reduction

- Rising Renewable-Energy Penetration Requiring Advanced Asset Analytics

- Ageing Workforce & Knowledge Attrition Slow Digital Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware contributions totaled USD 2.14 billion in 2025, accounting for 44.30% of the utility asset management market share. Expenditure covered substation IEDs, vibration sensors, high-speed switches, and satellite-enabled communication gateways. Procurement favors modular, IEC-61850-ready devices to future-proof investments. Despite this dominance, the software category is outpacing physical assets at a 10.36% CAGR as utilities unlock higher returns from analytics.

Software revenues stem from fault prediction engines, digital twin platforms, and mobile workforce management suites that converge operational and information technology silos. As service-life extension overtakes outright replacement strategies, executives reallocate budgets toward algorithms that defer capital outlays. The services segment complements the stack, offering integration, change management, and outsourced maintenance. Jacobs underscores this relevance by operating and maintaining water and power assets for over 15 million people daily. The tight intertwining of equipment, code, and consulting sustains expansion across the utility asset management market.

Cloud-hosted solutions accounted for nearly half of the utility asset management market size, reaching USD 2.32 billion in 2025, and are projected to grow at a 12.41% CAGR through 2031. Pay-as-you-go models appeal to mid-tier utilities that lack the scale for redundant data centers and 24/7 cybersecurity teams. NRG Energy's partnership with Google Cloud to orchestrate a 1 GW virtual power plant demonstrates the versatility of the cloud for both asset monitoring and distributed energy coordination.

On-premise installations persist where data-sovereignty statutes or latency-critical protections prevail, especially among transmission operators. Hybrid topologies are now emerging, placing edge servers in substations for microsecond trip commands, while relegating long-term analytics to the cloud. Microgrid managers in Southeast Asia illustrate this mix by running real-time power-quality algorithms on-site and sending historical feeds to regional cloud hubs for asset health trending.

The Utility Asset Management Market Report is Segmented by Component (Hardware, Software, and Services), Deployment Mode (Cloud, On-Premise, and Hybrid/Edge), Utility Type (Public Utilities and Private Utilities), Application (Transformers, Sub-Stations, Transmission and Distribution Network, and Generation Assets), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

North America commanded USD 1.83 billion in 2025, driven by strengthened FERC and NERC regulations, as well as multi-billion-dollar grid hardening commitments from FirstEnergy and National Grid. The region exhibits mature cloud adoption, fostering integrated dashboards that blend asset condition, weather models, and line-rating algorithms. State regulators now permit conditional cost recovery for proven outage-reduction technologies, boosting near-term demand across the utility asset management market.

The Asia-Pacific is the fastest mover, advancing at a 11.52% CAGR, driven by India's USD 30 billion smart-meter rollout and China's accelerated substation digitalization campaigns. Governments treat digital asset governance as core to their energy-transition roadmaps, and the region's USD 1.7 trillion infrastructure pipeline maintains high visibility. Vendors localize platforms to handle multilingual interfaces and variable grid codes, broadening acceptance among distribution companies.

Europe balances aging equipment with ambitious decarbonization targets. Distribution operators must integrate rooftop solar and EV chargers while replacing forty-year-old switchgear. Anticipatory investment guidelines from Brussels encourage utilities to model 2035-level demand and build ahead of need, redirecting significant budget to forecasting software and sensor densification. Major players, including E.ON, Iberdrola, and Vattenfall, have together pledged over EUR 250 billion for network upgrades by 2030, reinforcing a robust outlook for the utility asset management market.

- ABB Ltd.

- Siemens AG

- General Electric Co.

- IBM Corporation

- Hitachi Energy

- Schneider Electric SE

- Emerson Electric Co.

- Oracle Corp.

- Cisco Systems Inc.

- S&C Electric Company

- Sentient Energy Inc.

- Aclara Technologies LLC

- Enetics Inc.

- Lindsey Manufacturing Co.

- Netcontrol Oy

- KloudGin Inc.

- Projetech Inc. (IBM Maximo aaS)

- Brightly Software

- Aspen Technology Inc.

- AVEVA Group

- Honeywell International Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Aging grid infrastructure replacement & modernization

- 4.2.2 Integration of IoT sensors for real-time condition monitoring

- 4.2.3 Regulatory mandates for reliability & outage reduction

- 4.2.4 Rising renewable-energy penetration requiring advanced asset analytics

- 4.2.5 AI-powered digital twins slash unplanned transformer downtime

- 4.2.6 Infrastructure-as-a-Service financing for mid-tier utilities

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX for monitoring hardware & software

- 4.3.2 Cyber-security vulnerabilities in connected assets

- 4.3.3 Ageing workforce & knowledge attrition slow digital adoption

- 4.3.4 Lengthy public-utility procurement cycles

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.2.3 Hybrid/Edge

- 5.3 By Utility Type

- 5.3.1 Public Utilities

- 5.3.2 Private Utilities

- 5.4 By Application

- 5.4.1 Transformers

- 5.4.2 Sub-stations

- 5.4.3 Transmission and Distribution Network

- 5.4.4 Generation Assets

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 NORDIC Countries

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 ASEAN Countries

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Siemens AG

- 6.4.3 General Electric Co.

- 6.4.4 IBM Corporation

- 6.4.5 Hitachi Energy

- 6.4.6 Schneider Electric SE

- 6.4.7 Emerson Electric Co.

- 6.4.8 Oracle Corp.

- 6.4.9 Cisco Systems Inc.

- 6.4.10 S&C Electric Company

- 6.4.11 Sentient Energy Inc.

- 6.4.12 Aclara Technologies LLC

- 6.4.13 Enetics Inc.

- 6.4.14 Lindsey Manufacturing Co.

- 6.4.15 Netcontrol Oy

- 6.4.16 KloudGin Inc.

- 6.4.17 Projetech Inc. (IBM Maximo aaS)

- 6.4.18 Brightly Software

- 6.4.19 Aspen Technology Inc.

- 6.4.20 AVEVA Group

- 6.4.21 Honeywell International Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment