PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934770

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934770

Asia-Pacific REIT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

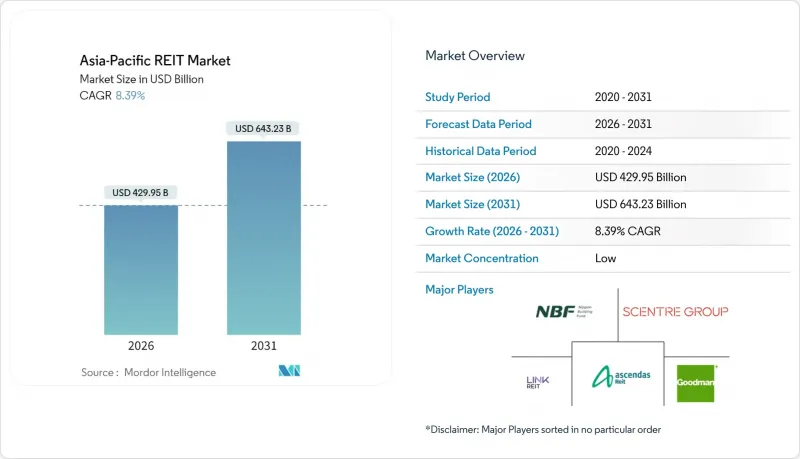

The Asia-Pacific REIT market was valued at USD 396.67 billion in 2025 and estimated to grow from USD 429.95 billion in 2026 to reach USD 643.23 billion by 2031, at a CAGR of 8.39% during the forecast period (2026-2031).

Strong capital reallocation by sovereign wealth funds, favorable regulatory tweaks that expand gearing headroom, and an accelerating shift toward digital infrastructure all underpin this growth trajectory. Cross-border investment flows into listed trusts rebounded on the back of widening yield spreads over government bonds, while accommodative monetary settings in Japan and selective easing cycles elsewhere tempered refinancing risk in early 2025. Policymakers across Singapore, India, and China continued to refine tax pass-through rules and listing frameworks, creating scalable entry points for both domestic and foreign sponsors. At the same time, ESG index inclusion requirements prompted sizable green-bond issuance and retrofit programs, reinforcing asset quality and broadening the investor base. Market participants also cited the privatization pipeline for data centers and telecom towers as a multi-year acquisition engine that should help sustain distribution growth despite pockets of interest-rate volatility.

Asia-Pacific REIT Market Trends and Insights

Rising Institutional Allocations to APAC REITs

Sovereign wealth funds and pension systems are systematically increasing APAC REIT allocations as part of broader portfolio diversification mandates. Cross-regional investment flows into Asia-Pacific surged 221% year-over-year in H2 2024, with institutional investors attracted by yield spreads averaging 130-133 basis points above risk-free rates. Singapore's Government Investment Corporation and Malaysia's Employees Provident Fund have expanded REIT exposure through both direct holdings and co-investment vehicles, while Australian superannuation funds allocated USD 2.82 billion (AUD 4.4 billion) to regional property securities in 2024. This institutional capital influx provides stable funding sources for REIT expansion and acquisition activity, particularly benefiting large-cap vehicles with established track records and diversified asset portfolios.

Supportive REIT-Enabling Regulations & Tax Incentives

Regulatory harmonization across APAC jurisdictions is reducing structural barriers to REIT formation and cross-border investment. Singapore's Monetary Authority introduced enhanced leverage flexibility for REITs in 2024, allowing temporary increases to 50% debt-to-assets for strategic acquisitions, while maintaining prudential oversight through quarterly reporting requirements. India's Securities and Exchange Board implemented Small and Medium REIT regulations, enabling smaller property portfolios to access public markets, with Knowledge Realty Trust's USD 576 million IPO demonstrating investor appetite for Grade A office exposure. Japan's revised J-REIT taxation framework provides additional depreciation allowances for energy-efficient retrofits, supporting portfolio modernization initiatives across the sector.

Rising institutional allocations to listed property

Interest-rate volatility poses a significant restraint on the Asia-Pacific REIT market by inflating the overall cost of capital, making it more expensive for REITs to finance acquisitions, developments, or refinancing activities. As regional central banks adjust monetary policy in response to global inflationary pressures and geopolitical uncertainty, frequent and unpredictable rate shifts create challenges for long-term financial planning and capital allocation. Elevated borrowing costs can deter REITs from pursuing growth strategies, such as expanding their portfolios or undertaking value-enhancing redevelopment projects, due to thinner spreads and lower return prospects. Moreover, volatility in rates undermines investor confidence, as rising yields on government bonds and other fixed-income instruments erode the relative attractiveness of REIT dividend distributions. This dynamic often results in capital outflows, valuation pressures, and reduced liquidity across the REIT sector.

Other drivers and restraints analyzed in the detailed report include:

- Surging E-commerce & Urban Logistics Demand

- Portfolio-Diversification Hunger Among Pension & SWF Investors

- Supportive tax and REIT-enabling regulation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial logistics retained leadership with 27.08% share of the Asia-Pacific REIT market size in 2025, reflecting the structural need for cross-border e-commerce fulfillment capacity. Data-center REITs, although still a smaller slice of the pie, are projected to log the fastest 13.95% CAGR through 2031 as artificial-intelligence workloads fuel hyperscale leasing demand. The Asia-Pacific REIT market benefits from the region's distinct scarcity of institutional-grade server farms, with power and land permits acting as entry barriers. Retail malls remained the largest absolute contributor at 29.18% but saw muted rent reversions compared with logistics. Office landlords continued to pivot toward flexible-floor plates and wellness retrofits to defend occupancy above 90% in CBD corridors, whereas healthcare trusts drew support from aging demographics and government spending. Diversified vehicles used internal capital recycling to tilt portfolios toward sectors with stronger NOI growth, cushioning distribution yields against cyclical headwinds.

Longer-dated power purchase agreements in data-center portfolios offer quasi-infra cash flow that commands premium valuations. Industrial warehouse landlords such as Goodman Group are embedding solar generation on-site, forging a natural ESG hedge. Retail REITs concentrated in essential-services sub-regional centers have outperformed discretionary mall peers on footfall recovery. Healthcare assets-particularly acute-care hospitals and stabilized nursing homes-carry yield spreads above 250 basis points to comparable office stock, making them attractive to yield-oriented investors. The multi-track nature of sector performance underscores why diversified strategies inside the Asia-Pacific REIT market can mitigate single-asset-class volatility.

The Asia-Pacific REIT Market Report is Segmented by Sector of Exposure (Retail, Industrial, Office, Residential, and More), Market Capitalization (Large-Cap >= USD 10 Billion, Mid-Cap USD 2-10 Billion, Small-Cap < USD 2 Billion), and Geography (India, China, Japan, Australia, South Korea, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Link REIT

- Goodman Group

- Ascendas REIT

- Nippon Building Fund

- Scentre Group

- CapitaLand Integrated Commercial Trust

- Mapletree Logistics Trust

- Dexus

- Vicinity Centres

- Keppel DC REIT

- Stockland

- Mirvac Group

- GIC?sponsored REITs

- ESR REIT

- Nomura Real Estate Master Fund

- Daiwa House REIT

- Japan Retail Fund

- Frasers Logistics & Commercial Trust

- Cromwell European REIT (APAC exposure)

- GLP J-REIT

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising institutional allocations to APAC REITs

- 4.2.2 Supportive REIT?enabling regulations & tax incentives

- 4.2.3 Surging e-commerce & urban logistics demand

- 4.2.4 Portfolio-diversification hunger among pension & SWF investors

- 4.2.5 ESG index inclusion funneling new capital (under-the-radar)

- 4.2.6 Digital-infrastructure privatization pipeline (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 Interest-rate volatility inflates cost of capital

- 4.3.2 Foreign-ownership caps in select jurisdictions

- 4.3.3 Transition-risk CAPEX for aging, non-green assets (under-the-radar)

- 4.3.4 FX-mismatch risk in cross-border portfolios (under-the-radar)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, 2021-2030)

- 5.1 By Sector of Exposure

- 5.1.1 Retail

- 5.1.2 Industrial

- 5.1.3 Office

- 5.1.4 Residential

- 5.1.5 Diversified

- 5.1.6 Other Sectors

- 5.1.7 Data Centers

- 5.1.8 Healthcare

- 5.2 By Market Capitalization

- 5.2.1 Large-Cap (more than USD 10 billion)

- 5.2.2 Mid-Cap (USD 2-10 billion)

- 5.2.3 Small-Cap (less than USD 2 billion)

- 5.3 By Geography

- 5.3.1 India

- 5.3.2 China

- 5.3.3 Japan

- 5.3.4 Australia

- 5.3.5 South Korea

- 5.3.6 South-East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

- 5.3.7 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Link REIT

- 6.4.2 Goodman Group

- 6.4.3 Ascendas REIT

- 6.4.4 Nippon Building Fund

- 6.4.5 Scentre Group

- 6.4.6 CapitaLand Integrated Commercial Trust

- 6.4.7 Mapletree Logistics Trust

- 6.4.8 Dexus

- 6.4.9 Vicinity Centres

- 6.4.10 Keppel DC REIT

- 6.4.11 Stockland

- 6.4.12 Mirvac Group

- 6.4.13 GIC?sponsored REITs

- 6.4.14 ESR REIT

- 6.4.15 Nomura Real Estate Master Fund

- 6.4.16 Daiwa House REIT

- 6.4.17 Japan Retail Fund

- 6.4.18 Frasers Logistics & Commercial Trust

- 6.4.19 Cromwell European REIT (APAC exposure)

- 6.4.20 GLP J-REIT

7 Market Opportunities & Future Outlook

- 7.1 Green-certified office redevelopment financing

- 7.2 Healthcare & senior-living REIT expansion