PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934782

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934782

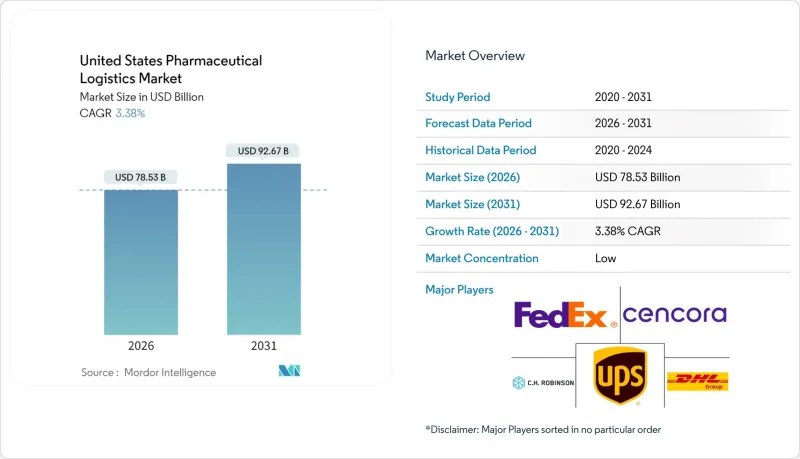

United States Pharmaceutical Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States Pharmaceutical Logistics Market was valued at USD 75.96 billion in 2025 and estimated to grow from USD 78.53 billion in 2026 to reach USD 92.67 billion by 2031, at a CAGR of 3.38% during the forecast period (2026-2031).

The United States pharmaceutical logistics market size projection underscores how compliance deadlines and biologics demand are reshaping cost structures and service design. A tightening Drug Supply Chain Security Act (DSCSA) timetable, expiring in August 2025, forces serialization investments that only well-capitalized providers can execute, granting them premium pricing latitude. Surging GLP-1 weight-management therapies, the steady rise of cell and gene treatments, and direct-to-patient (DTP) fulfillment further enlarge the United States pharmaceutical logistics market, pressing operators to expand temperature-controlled capacity at speed. Manufacturers are simultaneously formulating ambient-stable versions of existing drugs to curb rising freight costs, tempering the relative growth of non-cold-chain flows yet creating new packaging and labeling work for value-added service (VAS) providers. Regional network redesign is underway, with the Midwest gaining share as a national hub while capacity additions in the South ease congestion on coastal corridors.

United States Pharmaceutical Logistics Market Trends and Insights

Expansion of Specialty Biologics Requiring Strict Temperature Control

Temperature-controlled transport costs three to five times more than ambient freight, and 80% of therapies shipped in developed markets now need 2°-8 °C custody, elevating cold-chain complexity. UPS moved early by paying USD 1.6 billion for Andlauer Healthcare Group in April 2025, adding 1.7 million ft2 of GDP-certified storage and extending its -80 °C freezer network. Biologics also shorten order-to-delivery cycles, driving demand for high-frequency replenishment lanes rather than bulk shipments. Smaller carriers struggle to finance the continuous monitoring systems the FDA now audits for excursion logs, accelerating consolidation. As cold-chain nodes multiply in secondary markets, operators gain geographic flexibility but must coordinate inventory at added hand-off points, intensifying the need for AI-driven route visibility.

DSCSA Serialization Deadline Boosting Trace-and-Trace Investments

The FDA requires full unit-level traceability on prescription medicines by August 2025, splitting the United States pharmaceutical logistics market between serialization-ready providers and those facing restricted access. Implementation complexity is evident in TraceLink's B2N network, which processed 6 million EPCIS events in 90 days yet logged a 30% data-error rate that could trigger daily product quarantines. Up-front system costs, estimated at USD 0.06 per saleable unit, invite pooling solutions run by third-party logistics specialists. Providers that embed DSCSA compliance into VAS packages not only lock in retainer fees but also deepen buyer dependence on their digital ecosystems for recall management, shortage mitigation, and contract manufacturing oversight.

Fuel-Price Volatility Inflating Distribution Costs

WTI spot prices swung 23% in 2024-2025, leaving pharma carriers with unmatched fuel-surcharge formulas that lag cost spikes by weeks. Temperature-controlled trucks burn 12% more diesel to power reefers, amplifying exposure. While LNG and electric tractor pilots show promise, range limits and sparse charging networks curtail adoption on coast-to-coast lanes. Route-optimization software and multi-stop milk-run models reduce empty miles, but product-integrity rules still cap load consolidation.

Other drivers and restraints analyzed in the detailed report include:

- Surge in GLP-1 Obesity/Diabetes Drug Volumes Stressing Cold-Chain Capacity

- Growth of Direct-to-Patient Distribution Models

- Generic-Drug Price Erosion Squeezing Logistics Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transportation still anchors revenue, yet the United States pharmaceutical logistics market shows a clear migration toward bundled solutions. In 2025, transportation delivered 70.45% of turnover, but value-added services are expected to outpace at a 4.75% CAGR (2026-2031) as clients seek serialization, relabeling, and kitting alongside freight. Road freight's share remains resilient due to final-mile and rural clinic deliveries, with sensors and dual-compartment trailers adding compliance. Air freight, while costly, preserves its niche for cell therapy and compassionate-use shipments that tolerate no delay. Ocean carriage gains as shippers divert stable formulation APIs to controlled-atmosphere reefers on Asia-to-US lanes, aligning with ESG goals and securing uplift during air-capacity crunches.

Rail remains marginal, hindered by limited GDP-certified hand-off nodes. Warehouse & storage demand tightens as DSCSA elevates traceability, turning depots into digital serialization hubs where 2D data-matrix codes are verified before release. This pushes automation projects-vision-system scanners and autonomous pallet movers-to squeeze latency out of compliance checks. The fastest growth occurs in VAS, including pallet reconfiguration, late-stage customization, and documentation for import-export variance.

The United States Pharmaceutical Logistics Market Report is Segmented by Service Type (Transportation, Warehousing & Storage, and Value-Added Services & Others), Mode of Operation (Cold-Chain Logistics and Non-Cold-Chain Logistics), Product Type (Prescription Drugs, Biologics & Biosimilars, Veterinary Medicine, and More), Region (Northeast, Midwest, South, and West). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- DHL Supply Chain & Global Forwarding

- FedEx

- UPS

- Cencora

- C.H. Robinson

- XPO Logistics

- Ryder System

- Penske Logistics

- Expeditors International

- SEKO Logistics

- LifeScience Logistics

- MD Logistics

- DSV

- Kuehne + Nagel

- Hub Group

- Nippon Express

- CEVA Logistics

- GXO Logistics

- KRC Logistics

- Langham Logistics

- Crown LSP Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of specialty biologics requiring strict temperature control

- 4.2.2 DSCSA serialization deadline boosting trace-and-trace investments

- 4.2.3 Surge in GLP-1 obesity/diabetes drug volumes stressing cold-chain capacity

- 4.2.4 Sustainability-driven modal shift from air to sea freight

- 4.2.5 Growth of direct-to-patient distribution models

- 4.2.6 AI-enabled "control-tower" routing and predictive spoilage analytics reducing lead times

- 4.3 Market Restraints

- 4.3.1 Fuel-price volatility inflating distribution costs

- 4.3.2 Generic-drug price erosion squeezing logistics margins

- 4.3.3 Shortage of ultra-low-temperature technicians & drivers

- 4.3.4 Cyber-attacks on IoT cold-chain infrastructure

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Type

- 5.1.1 Transportation

- 5.1.1.1 Road Freight

- 5.1.1.2 Air Freight

- 5.1.1.3 Sea Freight

- 5.1.1.4 Rail Freight

- 5.1.2 Warehousing & Storage

- 5.1.3 Value-added Services and Others

- 5.1.1 Transportation

- 5.2 By Mode of Operation

- 5.2.1 Cold-Chain Logistics

- 5.2.2 Non-Cold-Chain Logistics

- 5.3 By Product Type

- 5.3.1 Prescription Drugs

- 5.3.2 OTC Drugs

- 5.3.3 Biologics & Biosimilars

- 5.3.4 Vaccines & Blood Products

- 5.3.5 Clinical Trail Materials

- 5.3.6 Cell & Gene Therapies

- 5.3.7 Medical Devices & Diagnostics

- 5.3.8 Veterinary Medicine

- 5.3.9 Others

- 5.4 By Region (United States)

- 5.4.1 Northeast

- 5.4.2 Midwest

- 5.4.3 South

- 5.4.4 West

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 DHL Supply Chain & Global Forwarding

- 6.4.2 FedEx

- 6.4.3 UPS

- 6.4.4 Cencora

- 6.4.5 C.H. Robinson

- 6.4.6 XPO Logistics

- 6.4.7 Ryder System

- 6.4.8 Penske Logistics

- 6.4.9 Expeditors International

- 6.4.10 SEKO Logistics

- 6.4.11 LifeScience Logistics

- 6.4.12 MD Logistics

- 6.4.13 DSV

- 6.4.14 Kuehne + Nagel

- 6.4.15 Hub Group

- 6.4.16 Nippon Express

- 6.4.17 CEVA Logistics

- 6.4.18 GXO Logistics

- 6.4.19 KRC Logistics

- 6.4.20 Langham Logistics

- 6.4.21 Crown LSP Group

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment