PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934785

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934785

Vietnam Online Travel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

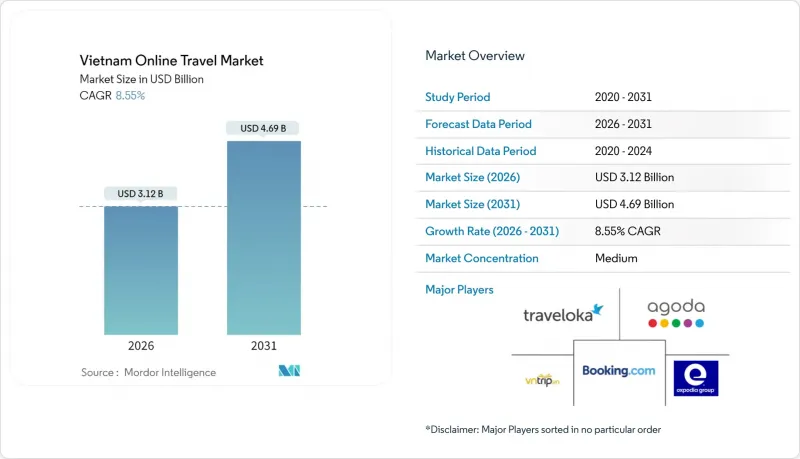

The Vietnam Online Travel Market was valued at USD 2.87 billion in 2025 and estimated to grow from USD 3.12 billion in 2026 to reach USD 4.69 billion by 2031, at a CAGR of 8.55% during the forecast period (2026-2031).

Accelerating digital-transformation policies, 78.8% internet penetration, and 87% smartphone usage keep transaction volumes high, while tourism's rebound brings 17.6 million foreign visitors and 110 million domestic trips back into the pipeline. Mobile bookings dominate as digital-wallet users jump to 50 million and QR payments touch 62% penetration, removing friction from checkout flows. Expanded air routes by low-cost carriers lift seat capacity, and rail upgrades draw leisure travelers seeking greener journeys. The Vietnam online travel booking market faces price competition from foreign OTAs, yet domestic players exploit local language service and wallet partnerships to stay relevant.

Vietnam Online Travel Market Trends and Insights

Rising internet and smartphone penetration

Mobile connections stand at 127 million, equal to 126% of the population, and median download speeds of 75.72 Mbps keep booking apps responsive. Government 5G targets cover half of the current 4G sites by 2025 and 99% of the population by 2030, paving the way for AI itinerary builders and VR previews . Higher connectivity also spurs spontaneous bookings for flash deals. The Vietnam online travel booking market, therefore, benefits from an ever-expanding digital audience, especially among Gen Z travelers who rely on super-apps for daily transactions.

Government smart-tourism and digital-transformation push

Decision 749/QD-TTg prioritizes tourism in the national digital-economy agenda and chases a 30% GDP share by 2030. Hanoi's stimulus plan earmarks VND 130 trillion for 2025 revenue via AI-powered promotion and real-time visitor dashboards. The obliges restaurants and attractions to accept e-payments, tightening links between physical experiences and online channels. These policies institutionalize digital habits, reinforcing the Vietnam online travel booking market across all age groups.

Foreign OTA dominance squeezing local margins

Booking.com, Agoda, and Traveloka collectively secure roughly 80% of digital travel turnover, leaving little headroom for local brands. Deep marketing budgets, global hotel inventory, and AI chatbots widen the gap. Domestic OTAs counter with Vietnamese interfaces and wallet tie-ups, yet still face a higher cost-per-acquisition. Margin pressure forces a shift toward niche products, rail passes, cultural tours, and B2B management to stay profitable in the Vietnam online travel booking market.

Other drivers and restraints analyzed in the detailed report include:

- Low-cost carriers and expanded air connectivity

- Surge in digital-wallet use enabling instant travel payments

- Language and cultural barriers among older / rural users

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Air ticketing generated 47.62% of 2025 revenue for the Vietnam online travel booking market. Expansion by national and private airlines, coupled with app-only fare deals, keeps the segment dominant. Yet, railway ticketing posts a 12.48% CAGR outlook as the government upgrades tracks and coaches. Environmental messaging resonates with younger tourists seeking low-carbon trips, and rail API feeds now sync with major OTAs, allowing live seat selection. Hotels and packaged holidays hold the second-largest slice, boosted by chain upgrades such as TTC Hospitality's asset rise to VND 4,544 billion. Bus and activity bookings contribute incremental sales and smooth seasonal swings. The Vietnam online travel booking market size for rail is therefore set to outstrip its modest base while air retains scale advantages.

Mobile produced 72.77% of 2025 transactions, reflecting Vietnam's 87% smartphone reach. Booking.com's Trip Planner and Agoda's AI coding tools personalize offers in Vietnamese, and Vietnam Airlines grants 10% app discounts on international legs. Voice search and vernacular chat reduce typing, appealing to first-time users. Desktop remains relevant for multi-stop corporate itineraries, yet its share slides each year. Wallet SDKs embedded in apps cut checkout to seconds, raising user stickiness. With 5G coverage targets approaching, the Vietnam online travel booking market will see mobile exceed three-quarters of gross bookings well before 2031.

Vietnam Online Travel Market Report is Segmented by Booking Type (Air Ticketing, Hotels and Packages, and More), by Platform (Desktop, Mobile), by Traveler Origin (Domestic Travelers, International Travelers), by Payment Method (Digital Wallets, Cards, and More), and by Geography (Northern Vietnam, Central Vietnam, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Booking.com

- Agoda

- Traveloka

- Expedia Group

- TripAdvisor

- Skyscanner

- Trivago

- VNTrip.vn

- Mytour Vietnam

- Vietravel

- Gotadi

- Tugo

- Kayak

- Trip.com (Ctrip)

- Tripi

- Luxstay

- BestPrice Travel

- Alotrip

- Baolau

- MoMo Travel Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising internet and smartphone penetration

- 4.2.2 Government smart-tourism and digital-transformation push

- 4.2.3 Low-cost carriers and expanded air connectivity

- 4.2.4 Surge in digital-wallet use enabling instant travel payments

- 4.2.5 Viral short-form video marketing of Vietnamese destinations

- 4.2.6 Super-app ecosystems bundling travel services

- 4.3 Market Restraints

- 4.3.1 Foreign OTA dominance squeezing local margins

- 4.3.2 Language and cultural barriers among older / rural users

- 4.3.3 High international airfares limiting inbound demand

- 4.3.4 Data-privacy and cyber-fraud concerns in mobile payments

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers / Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Consumer Buying-Behavior Insights

5 Market Size and Growth Forecasts (Value)

- 5.1 By Booking Type

- 5.1.1 Air Ticketing

- 5.1.2 Hotels and Packages

- 5.1.3 Bus Ticketing

- 5.1.4 Railway Ticketing

- 5.1.5 Other Booking Types

- 5.2 By Platform

- 5.2.1 Desktop

- 5.2.2 Mobile

- 5.3 By Traveler Origin

- 5.3.1 Domestic Travelers

- 5.3.2 International Travelers

- 5.4 By Payment Method

- 5.4.1 Digital Wallets

- 5.4.2 Cards

- 5.4.3 Bank Transfer

- 5.4.4 Cash on Delivery / Office Pay

- 5.5 By Geography

- 5.5.1 Northern Vietnam

- 5.5.2 Central Vietnam

- 5.5.3 Southern Vietnam

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Booking.com

- 6.4.2 Agoda

- 6.4.3 Traveloka

- 6.4.4 Expedia Group

- 6.4.5 TripAdvisor

- 6.4.6 Skyscanner

- 6.4.7 Trivago

- 6.4.8 VNTrip.vn

- 6.4.9 Mytour Vietnam

- 6.4.10 Vietravel

- 6.4.11 Gotadi

- 6.4.12 Tugo

- 6.4.13 Kayak

- 6.4.14 Trip.com (Ctrip)

- 6.4.15 Tripi

- 6.4.16 Luxstay

- 6.4.17 BestPrice Travel

- 6.4.18 Alotrip

- 6.4.19 Baolau

- 6.4.20 MoMo Travel Services

7 Market Opportunities and Future Outlook

- 7.1 White-Space & Unmet-Need Assessment