PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934788

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934788

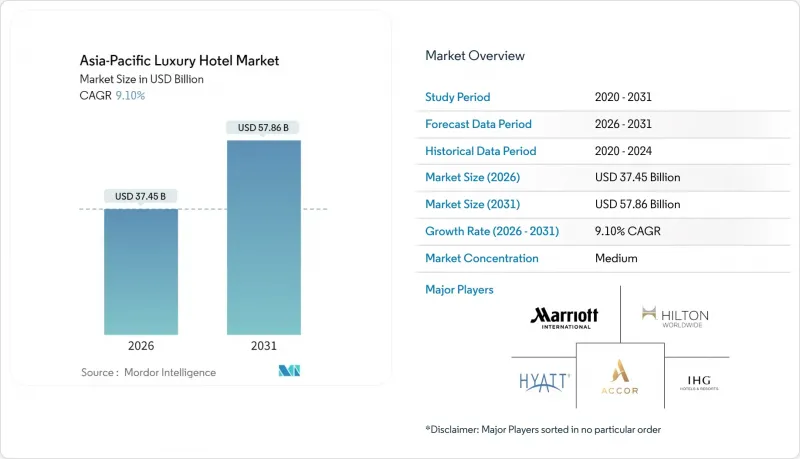

Asia-Pacific Luxury Hotel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Asia-Pacific Luxury Hotel Market market size in 2026 is estimated at USD 37.45 billion, growing from 2025 value of USD 34.33 billion with 2031 projections showing USD 57.86 billion, growing at 9.1% CAGR over 2026-2031.

Rising household wealth, post-pandemic mobility normalization, and guests' appetite for immersive experiences are amplifying average daily rates and length of stay. Leading operators continue to command pricing power despite higher labour expenses because supply growth in prime destinations remains contained. Government visa reforms and large-scale airport, cruise, and rail projects funnel additional long-haul and intra-regional traffic into luxury corridors. At the same time, digital loyalty ecosystems and AI-driven personalization accelerate direct customer engagement, lifting margins while creating first-party data advantages. Private equity and sovereign wealth funds channel capital toward conversion opportunities and branded residences, underscoring confidence in premium positioning over the medium term.

Asia-Pacific Luxury Hotel Market Trends and Insights

Rising Affluent Middle-Class & HNWIs Drive Unprecedented Demand

India's middle-income demographic is projected to constitute a substantial share of the population by 2030, reflecting the country's evolving economic landscape. Additionally, the millionaire population in India is forecast to reach 1.5 million by 2027. This growth in affluent consumer segments is expected to drive significant increases in spending on premium travel, highlighting a shift in consumer preferences and discretionary expenditure patterns. Indian outbound tourism spending climbed to USD 17 billion in 2024, up 17% year on year. Chinese high-net-worth travellers take extended vacations and spend an average RMB225,000 (USD 31,000) per leisure trip, funnelling substantial discretionary income into luxury lodging. Culinary tourism now represents 37.8% of global experiential travel and underpins high-margin food-and-beverage revenue streams in the region's flagship assets. Mass-affluent Asians maintain a clear preference for 4- and 5-star products, allocating 23% of their annual income to travel.

Post-Pandemic Infrastructure Investment Accelerates Market Recovery

Singapore's Tourism 2040 roadmap targets SGD 50 billion (USD 36.81 billion) in receipts and includes Changi Terminal 5 and cruise-terminal upgrades that directly lift luxury room demand. During the first half of 2024, Thailand recorded tourism receipts amounting to THB 825 billion (USD 34 billion), driven by the implementation of new transport corridors and visa policy reforms. According to projections by PATA, visitor arrivals in the Asia-Pacific region are expected to reach 813.7 million by 2027, significantly exceeding pre-pandemic levels. In Vietnam, the government's strategic overhaul of visa regulations, designed to attract long-term and high-spending tourists, is accelerating the announcement of luxury development projects in key locations such as Ho Chi Minh City and prominent resort destinations.

Macroeconomic Volatility and Currency Fluctuations Create Operational Challenges

In 2024, declining consumer confidence in mainland China led to reductions in room rates, while disruptions in India's aviation sector resulted in localized pricing pressures. Currency fluctuations further complicated yield management strategies for operators managing transactions in multiple currencies, while also impacting the discretionary travel budgets of international travellers. Despite persistently high borrowing costs, investors actively pursued rebranding opportunities in key markets such as Japan, Australia, and China, where the potential for long-term growth outweighed short-term financial pressures. To address uneven demand patterns across diverse and dynamic markets, operators increasingly adopted advanced real-time analytics and agile pricing strategies, enabling them to optimize revenue and adapt to market volatility effectively.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Chinese and Indian Outbound Travelers Reshapes Regional Flows

- Government Tourism Incentives Create Competitive Advantages

- High CAPEX and Land-Acquisition Costs in Prime Areas

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Suites captured 36.68% of 2025 revenues, underscoring entrenched demand for spacious layouts that support multi-generational and leisure-business blended trips. Villas and bungalows, although on a smaller base, are expanding at 9.13% CAGR, well ahead of the Asia-Pacific luxury hotel market, reflecting a flight to privacy and the influence of high-end vacation-rental benchmarks. Standard rooms face modest cannibalization as properties elevate categories to defend rate integrity. Penthouses and presidential suites, the smallest cohort, underpin brand halo effects and yield per square foot premiums exceeding property averages by triple digits.

The pivot toward standalone accommodations aligns with post-pandemic health considerations and preference for outdoor amenities such as private pools and gardens. Mandarin Oriental Bali's forthcoming 110-key mix of suites and villas and Capella Kenting's private onsen villas illustrate operator responses to this structural shift. By 2031, villas are projected to contribute a materially higher share of the Asia-Pacific luxury hotel market size, supporting ancillary revenues from in-villa dining, spa, and butler services.

The Asia-Pacific Luxury Hotel Market Report Segments the Industry Into by Room Type (Standard Luxury Room, Suites, and More), by Booking Channel (Direct Booking (Brand Website, Call Center), Online Travel Agencies (OTA), and More), by Service Type (Business Hotels, Airport Hotels, and More), and by Geography (India, China, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Marriott International

- Hilton Worldwide Holdings

- Hyatt Hotels Corporation

- Accor S.A.

- InterContinental Hotels Group (IHG)

- Shangri-La Hotels and Resorts

- Mandarin Oriental Hotel Group

- The Peninsula Hotels (HSH)

- Banyan Tree Holdings

- Rosewood Hotel Group

- Six Senses Hotels Resorts Spas

- Taj Hotels (IHCL)

- Oberoi Group (EIH Ltd.)

- Aman Resorts

- Capella Hotel Group

- Minor Hotels (Anantara, Tivoli)

- Pan Pacific Hotels Group

- Dusit International

- Lotte Hotels & Resorts

- Langham Hospitality Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising affluent middle-class & HNWIs in APAC

- 4.2.2 Post-pandemic travel rebound & tourism infrastructure investment

- 4.2.3 Expansion of Chinese & Indian outbound travellers within region

- 4.2.4 Government incentives for luxury tourism (visa relaxations, tax breaks)

- 4.2.5 Emergence of ultra-luxury branded residences attached to hotels

- 4.2.6 Growth of long-stay "workcation" packages for remote executives

- 4.3 Market Restraints

- 4.3.1 Macroeconomic volatility & currency fluctuations

- 4.3.2 High CAPEX & land-acquisition costs in prime areas

- 4.3.3 Heightened ESG compliance costs for luxury properties

- 4.3.4 Competition from ultra-luxury short-term rental platforms

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Room Type

- 5.1.1 Standard Luxury Room

- 5.1.2 Suites

- 5.1.3 Villas / Bungalows

- 5.1.4 Penthouses & Presidential Suites

- 5.2 By Booking Channel

- 5.2.1 Direct Booking (Brand Website, Call Center)

- 5.2.2 Online Travel Agencies (OTA)

- 5.2.3 Travel Agents / Tour Operators

- 5.2.4 Corporate Contracts

- 5.3 By Service Type

- 5.3.1 Business Hotels

- 5.3.2 Airport Hotels

- 5.3.3 Suite Hotels

- 5.3.4 Resorts

- 5.3.5 Other Service Types

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 India

- 5.4.1.2 China

- 5.4.1.3 Japan

- 5.4.1.4 Australia

- 5.4.1.5 South Korea

- 5.4.1.6 South East Asia

- 5.4.1.6.1 Singapore

- 5.4.1.6.2 Malaysia

- 5.4.1.6.3 Thailand

- 5.4.1.6.4 Indonesia

- 5.4.1.6.5 Vietnam

- 5.4.1.6.6 Philippines

- 5.4.1.7 Rest of Asia-Pacific

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Marriott International

- 6.4.2 Hilton Worldwide Holdings

- 6.4.3 Hyatt Hotels Corporation

- 6.4.4 Accor S.A.

- 6.4.5 InterContinental Hotels Group (IHG)

- 6.4.6 Shangri-La Hotels and Resorts

- 6.4.7 Mandarin Oriental Hotel Group

- 6.4.8 The Peninsula Hotels (HSH)

- 6.4.9 Banyan Tree Holdings

- 6.4.10 Rosewood Hotel Group

- 6.4.11 Six Senses Hotels Resorts Spas

- 6.4.12 Taj Hotels (IHCL)

- 6.4.13 Oberoi Group (EIH Ltd.)

- 6.4.14 Aman Resorts

- 6.4.15 Capella Hotel Group

- 6.4.16 Minor Hotels (Anantara, Tivoli)

- 6.4.17 Pan Pacific Hotels Group

- 6.4.18 Dusit International

- 6.4.19 Lotte Hotels & Resorts

- 6.4.20 Langham Hospitality Group

7 Market Opportunities & Future Outlook

- 7.1 Integration of ultra-luxury branded residences within hotel complexes

- 7.2 AI-driven hyper-personalised guest-experience platforms for UHNW travellers