PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934790

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934790

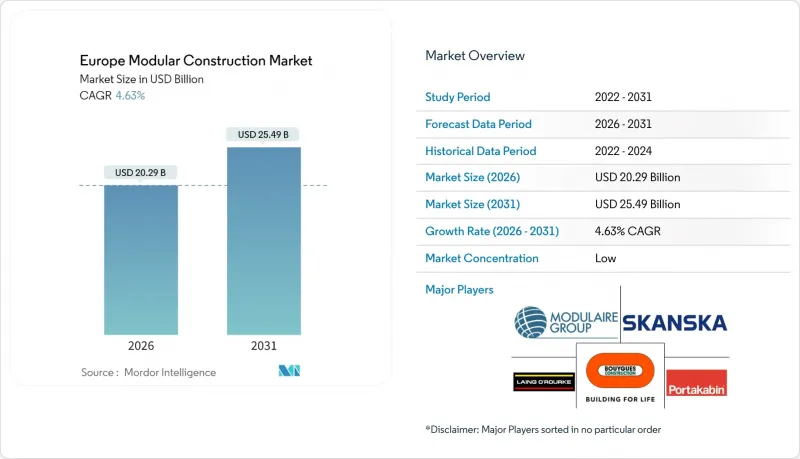

Europe Modular Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe Modular Construction Market size in 2026 is estimated at USD 20.29 billion, growing from 2025 value of USD 19.39 billion with 2031 projections showing USD 25.49 billion, growing at 4.63% CAGR over 2026-2031.

Modular construction in Europe is gaining momentum due to its ability to accelerate delivery schedules and support housing programs, with resilient order books despite a slowdown in broader construction output. Investors view the sector as a structural growth opportunity, driving investments in factory capacity and design innovation. Medium-sized manufacturers face pressure to scale quickly to compete with large incumbents and niche players. While steel dominates the current market, opportunities for concrete and hybrid systems indicate a future with diverse material solutions. Key markets like the UK, Germany, the Nordics, and Eastern European hubs benefit from policy incentives, sustainability goals, and skills shortages. The UK, holding a 22% market share in 2024, is poised for further growth with digital permitting tools and updated safety regulations. The shift toward permanent modular buildings in social housing and healthcare, coupled with revised risk models by insurers and lenders, is reducing financing costs and driving supply-chain investments toward vertically integrated models to meet multi-country demand.

Europe Modular Construction Market Trends and Insights

Supportive Government Initiatives for Modular Construction

Policy support is steadily converting into real contracts across core markets. The UK Future Homes Standard consultation, completed in 2024, establishes energy-performance thresholds that modular systems meet with less cost, and that incentivize developers to specify off-site solutions. Germany's KfW climate-friendly new-build program channels state-subsidized loans toward low-carbon units, indirectly favoring factory precision that reduces thermal bridging. A clear inference here is that governments are linking financial support to measurable environmental outcomes, thereby rewarding manufacturers able to document carbon savings.

Rising Demand for Temporary/Portable Structures

Businesses now view relocatable modules as strategic assets that solve space volatility without locking in long lease liabilities. Rental fleets for education, health care, and light industrial uses are being redeployed more frequently, signaling that the value proposition has shifted from cost saving to operational agility. Providers such as Algeco have widened product height limits to four storeys, which means a broader set of applications can be served without bespoke engineering. The takeaway is that higher utilization rates quietly improve capital returns in the European Modular Construction market.

Fragmented Country-Level Certification Slowing Cross-Border Supply

Different national approvals-BBA in the UK, Avis Technique in France, and ETA for non-standard products-force suppliers to navigate multiple testing regimes, adding time and cost. Dual CE and UKCA marking services offered by organizations such as Bureau Veritas mitigate the issue but still require duplicated paperwork. Smaller firms often restrict themselves to domestic markets, which unintentionally limits economies of scale across Europe. An immediate inference is that companies mastering regulatory complexity gain a competitive moat in export opportunities.

Other drivers and restraints analyzed in the detailed report include:

- Significantly Reduced Project Timelines

- Focus on Sustainability and Reduced Carbon Emissions

- Design Limitations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Permanent modular buildings account for 64.60% of Europe Modular Construction market size in 2025 and are projected to expand at a 5.17% CAGR to 2031, outpacing the industry average. Demand stems from the growing conviction that factory-built homes, schools, and clinics deliver enduring performance equal to traditional structures. Developers recognise that bank valuations now increasingly accept permanent modules at full parity with masonry, which removes a historic financing barrier. The segment's ascent implies factories will need to switch from short production runs to continuous flow manufacturing to meet volume expectations.

A related observation is that product innovation focuses on hybrid steel-and-timber frames that merge strength with lower embodied carbon, signaling more diverse material palettes ahead. As councils and housing associations chase energy-efficiency targets, permanent modular solutions become the default for achieving tight thermal envelopes within cost caps. The inference is that planners may soon reference volumetric typologies directly in zoning guidance, further mainstreaming the approach.

Steel modules hold 47.70% Europe Modular Construction market share in 2025 and demonstrate the fastest expansion at 5.54% CAGR through 2031. Superior strength-to-weight ratios permit larger column-free interiors, supporting open-plan offices and adaptable healthcare bays. Pioneering fossil-free steel referenced earlier suggests that emissions associated with steel frames could fall significantly, enhancing the material's sustainability narrative. An immediate inference is that manufacturers able to secure low-carbon steel billets early will gain preferred-supplier status on green projects.

Concrete remains an essential contender for high-rise modular towers where mass aids acoustic and fire performance, while innovations in alkali-activated binder mixes point toward lower CO2 pathways. Plastic-composite elements, though the smallest slice, carve out niche use cases in corrosion-prone environments like coastal data centers. Collectively, this material diversity reduces supply risk and allows architects to tailor specifications to site constraints, hinting at expanded design flexibility across the industry.

The European Modular Construction Report is Segmented by Construction Type (Permanent Modular and Relocatable Modular), Material (Steel, Concrete, Wood, and Plastic), End-User Sector (Residential, Commercial, and Industrial/Institutional), Service Stage (New Construction and After-Sales Maintenance and Refurbishment (Renovation)), and Geography (Germany, United Kingdom, France, Italy, Nordics, Spain, and Rest of Europe).

List of Companies Covered in this Report:

- Balfour Beatty

- Bouygues Construction

- Elements Europe

- FORTA PRO (SIA)

- Ilke Homes

- JM AB

- KLEUSBERG GmbH & Co. KG

- Laing O'Rourke

- Lindbacks Bygg AB

- Metsa Group

- Modulaire Group

- Polcom Modular

- Portakabin Ltd

- Sigolki Sp. z o.o.

- Skanska

- Steico SE

- TopHat Industries

- VBC Europe

- Vision Modular Systems

- Wernick Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Supportive Government Initiatives for Modular Construction

- 4.2.2 Rising Demand for Temporary/Portable Structures

- 4.2.3 Significantly Reduced Project Timelines

- 4.2.4 Off-Site Labour Solutions Offsetting Ageing Workforce in Europe

- 4.2.5 Focus on Sustainability and Reduced Carbon Emissions

- 4.3 Market Restraints

- 4.3.1 Fragmented Country-Level Certification (BBA, Avis Technique, ETA) Slowing Cross-Border Supply

- 4.3.2 High Initial Investment

- 4.3.3 Design Limitations

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Construction Type

- 5.1.1 Permanent Modular

- 5.1.2 Relocatable Modular

- 5.2 By Material

- 5.2.1 Steel

- 5.2.2 Concrete

- 5.2.3 Wood

- 5.2.4 Plastic

- 5.3 By End-user Sector

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial/Institutional

- 5.4 By Service Stage

- 5.4.1 New Construction

- 5.4.2 After-sales Maintenance and Refurbishment (Renovation)

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Nordics

- 5.5.6 Spain

- 5.5.7 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Balfour Beatty

- 6.4.2 Bouygues Construction

- 6.4.3 Elements Europe

- 6.4.4 FORTA PRO (SIA)

- 6.4.5 Ilke Homes

- 6.4.6 JM AB

- 6.4.7 KLEUSBERG GmbH & Co. KG

- 6.4.8 Laing O'Rourke

- 6.4.9 Lindbacks Bygg AB

- 6.4.10 Metsa Group

- 6.4.11 Modulaire Group

- 6.4.12 Polcom Modular

- 6.4.13 Portakabin Ltd

- 6.4.14 Sigolki Sp. z o.o.

- 6.4.15 Skanska

- 6.4.16 Steico SE

- 6.4.17 TopHat Industries

- 6.4.18 VBC Europe

- 6.4.19 Vision Modular Systems

- 6.4.20 Wernick Group

7 Market Opportunities and Future Outlook

- 7.1 Integration with Smart and Green Building Technologies

- 7.2 White-space and Unmet-need Assessment