PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934797

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934797

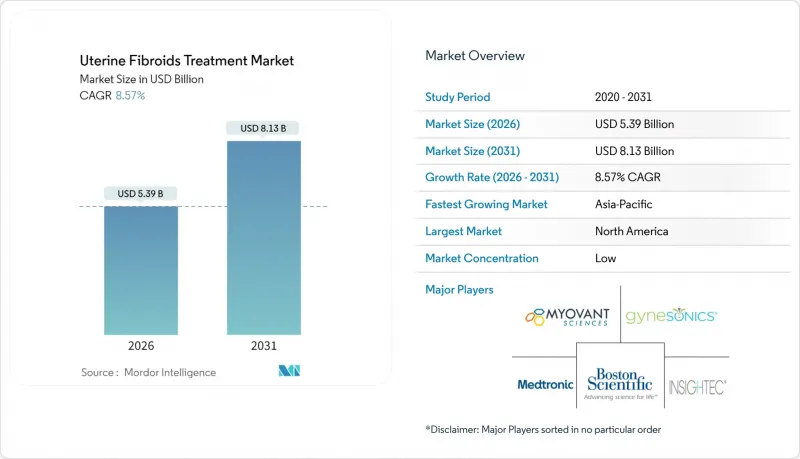

Uterine Fibroids Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Uterine Fibroids Treatment Market was valued at USD 4.96 billion in 2025 and estimated to grow from USD 5.39 billion in 2026 to reach USD 8.13 billion by 2031, at a CAGR of 8.57% during the forecast period (2026-2031).

Demand accelerates as symptomatic fibroids affect up to 80% of women by age 50, with elevated prevalence and earlier onset among Black women. Adoption of minimally invasive and non-invasive options gains pace as patients seek fertility preservation and shorter recovery. Robust reimbursement in high-income nations, paired with faster approvals for oral GnRH antagonists, widens therapeutic choice and expands the uterine fibroids treatment market. Device makers secure growth by integrating artificial intelligence (AI) into procedure planning, while pharmaceutical sponsors extend product life cycles through combination regimens and add-back therapy. Supply-chain resilience around rare-earth embolization particles and HIFU components remains pivotal for uninterrupted procedure volumes.

Global Uterine Fibroids Treatment Market Trends and Insights

Rising Prevalence of Symptomatic Fibroids

Clinical studies confirm that Black women experience three-fold higher fibroid prevalence and earlier onset than other groups, driving concentrated demand in health systems serving diverse populations. Broader use of high-resolution ultrasound and MRI enables earlier detection, swelling the addressable pool beyond those with severe symptoms. Heightened awareness of fertility impairment linked to untreated fibroids encourages earlier consultation, channeling patients toward uterus-sparing solutions. Together, these factors create durable demand that underpins the uterine fibroids treatment market.

Shift Toward Minimally & Non-Invasive Procedures

Incision-free options such as transcervical radiofrequency ablation treated more than 10,000 patients by August 2024, evidencing rapid adoption. Comparative research shows radiofrequency ablation generated 72.2% live-birth rates without uterine rupture, outperforming conventional myomectomy. Category 1 CPT codes introduced in 2024 removed reimbursement ambiguity and lowered administrative hurdles. High-intensity focused ultrasound records a 9.33% complication rate in overweight patients, less than half that of laparoscopic surgery. Collectively, these clinical and economic benefits tilt physician and patient preference toward uterine-preserving modalities, expanding the uterine fibroids treatment market.

High Cost of Advanced Devices & Procedures

Developing and commercializing next-generation fibroid technologies carries significant capital needs; Hologic's USD 350 million purchase of Gynesonics underscores these investment levels. Limited local manufacturing in emerging economies inflates import costs, placing premium procedures out of reach for uninsured patients. Pandemic-era device shortages highlighted how supply shocks amplify price pressures, especially for rural facilities. Even in high-income markets, out-of-pocket patient costs can exceed USD 25,000 across a treatment journey, prompting delayed care and limiting the uterine fibroids treatment market.

Other drivers and restraints analyzed in the detailed report include:

- Favorable Reimbursement in High-Income Nations

- Launch of Oral GnRH Antagonists

- Shortage of Skilled IR Specialists in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Surgical procedures accounted for 42.88% of the uterine fibroids treatment market share in 2025, reflecting their entrenched clinical role. However, non-invasive options are forecast to grow at a 8.88% CAGR, adding USD 1.33 billion to the uterine fibroids treatment market size by 2031. Long-term follow-up of MR-guided focused ultrasound reveals a 33.1% re-intervention rate over seven years, with women over 44 years of age requiring fewer repeat procedures. Radiofrequency ablation expands indications for overweight patients, meeting an unmet need with lower complication risk.

Pharmacological therapy advances complement device growth. Oral GnRH antagonists provide durable, reversible symptom relief, allowing patients to postpone or avoid surgery. Reimbursement clarity boosts minimally invasive volumes; the Category 1 CPT designation for transcervical ablation is a notable catalyst for this increase. AI planning software accelerates the MR-gFUS workflow, with autonomous agents achieving very high levels of expert acceptance. Collectively, these clinical, economic, and technological elements reinforce momentum toward minimally invasive and non-invasive care, reshaping the uterine fibroids treatment market.

The Uterine Fibroids Treatment Market Report is Segmented by Type (Subserosal Fibroids, Intramural Fibroids, Submucosal Fibroids, Pedunculated Fibroids), Treatment (Drugs, and Surgical Techniques), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Report Offers the Value (USD Million) for the Above Segments.

Geography Analysis

North America accounted for 41.86% uterine fibroids treatment market share in 2025, underpinned by consistent reimbursement, high diagnostic awareness, and proximity to device innovators. FDA breakthrough device pathways expedite commercialization cycles, enabling rapid clinical adoption. Medicare's fixed payment for uterine artery embolization secures predictable margins, while commercial insurers expand coverage for transcervical and MR-guided techniques. Nonetheless, procedure availability varies, as rural hospitals struggle to maintain interventional radiology staff, prompting regional disparities that temper overall growth.

Asia-Pacific is projected to record the highest 9.94% CAGR through 2031, propelled by healthcare infrastructure upgrades and rising disposable income. China's status as a leading medical-device manufacturing hub lowers procurement costs and accelerates domestic adoption. Japan and South Korea lead in MR-guided focused ultrasound deployment, reflecting mature imaging capabilities and aging demographics. India's large addressable population positions it as a future volume driver, contingent on specialist training and public-private investment in women's health.

Europe demonstrates steady expansion, supported by cohesive regulatory frameworks and widespread insurance coverage. Harmonized clinical guidelines facilitate cross-border referral for complex cases, while rigorous evidence standards ensure consistent quality across treatment centers. Recent reimbursement approvals for oral GnRH antagonists improve medical-therapy utilization patterns, offering alternatives to surgery for symptomatic women. Regional growth, however, remains sensitive to national budget constraints and the pace of workforce development.

- Abbvie

- Pfizer

- Bayer

- Sumitomo Pharma Co., Ltd. (Myovant)

- Hologic

- Boston Scientific

- Merit Medical Systems

- Terumo Corp.

- Insightec Ltd.

- EDAP TMS SA

- Intuitive Surgical

- Cook Group

- Varian Medical Systems (Siemens Healthineers)

- 8Spheres Medical Co.

- Gynesonics Inc.

- ObsEva SA

- Profound Medical

- LiNA Medical ApS

- AngioDynamics

- Cook Siemens Partnership (TGA)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of symptomatic fibroids

- 4.2.2 Shift toward minimally & non-invasive procedures

- 4.2.3 Favorable reimbursement in high-income nations

- 4.2.4 Launch of oral GnRH antagonists

- 4.2.5 AI-enabled imaging & robotics adoption (under-reported)

- 4.2.6 Biomarker-driven precision medicine (under-reported)

- 4.3 Market Restraints

- 4.3.1 High cost of advanced devices & procedures

- 4.3.2 Shortage of skilled IR specialists in emerging markets

- 4.3.3 Rare-earth supply risk for embolization/HIFU parts (under-reported)

- 4.3.4 Limited long-term fertility data for new ablation tech (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, 2025-2030)

- 5.1 By Treatment Method

- 5.1.1 Pharmacological Therapy

- 5.1.1.1 Hormonal (GnRH antagonists, SPRMs, COCs)

- 5.1.1.2 Non-hormonal (NSAIDs, Tranexamic Acid)

- 5.1.2 Surgical Procedures

- 5.1.2.1 Hysterectomy

- 5.1.2.2 Myomectomy (Hysteroscopic * Laparoscopic * Open)

- 5.1.3 Minimally-Invasive Procedures

- 5.1.3.1 Uterine Artery Embolization

- 5.1.3.2 Radiofrequency Ablation (e.g., Acessa)

- 5.1.4 Non-Invasive Procedures

- 5.1.4.1 MR-guided HIFU

- 5.1.4.2 Transcervical Fibroid Ablation (Sonata)

- 5.1.1 Pharmacological Therapy

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Ambulatory Surgical Centers

- 5.2.3 Specialty Gynecology Clinics

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 GCC

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 AbbVie Inc.

- 6.3.2 Pfizer Inc.

- 6.3.3 Bayer AG

- 6.3.4 Sumitomo Pharma Co., Ltd. (Myovant)

- 6.3.5 Hologic Inc.

- 6.3.6 Boston Scientific Corp.

- 6.3.7 Merit Medical Systems Inc.

- 6.3.8 Terumo Corp.

- 6.3.9 Insightec Ltd.

- 6.3.10 EDAP TMS SA

- 6.3.11 Intuitive Surgical Inc.

- 6.3.12 Cook Medical LLC

- 6.3.13 Varian Medical Systems (Siemens Healthineers)

- 6.3.14 8Spheres Medical Co.

- 6.3.15 Gynesonics Inc.

- 6.3.16 ObsEva SA

- 6.3.17 Profound Medical Corp.

- 6.3.18 LiNA Medical ApS

- 6.3.19 AngioDynamics Inc.

- 6.3.20 Cook Siemens Partnership (TGA)

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment