PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934803

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934803

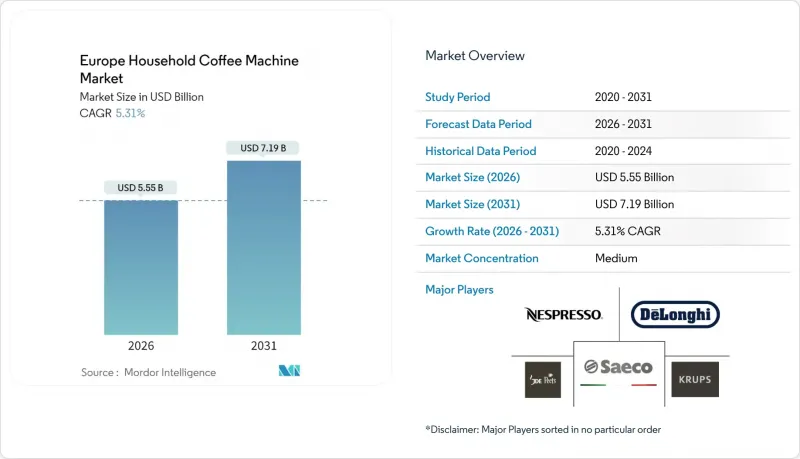

Europe Household Coffee Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe household coffee machine market was valued at USD 5.27 billion in 2025 and estimated to grow from USD 5.55 billion in 2026 to reach USD 7.19 billion by 2031, at a CAGR of 5.31% during the forecast period (2026-2031).

Replacement demand fueled by the EU's energy-efficiency labeling, the surge in premium at-home consumption, and rapid adoption of connected appliances underpin this growth trajectory. Subscription-linked machine placement models pioneered by leading roasters reshape competitive dynamics by converting one-time hardware sales into recurring revenue. Simultaneously, regulatory initiatives such as the Right-to-Repair Directive expand after-sales service opportunities, while supply-chain risks linked to semiconductor shortages and green-coffee price volatility temper near-term momentum. Together, these factors create a nuanced outlook in which technological innovation, sustainability compliance, and consumer lifestyle shifts converge to expand the Europe household coffee machine market.

Europe Household Coffee Machine Market Trends and Insights

Rise in At-Home Premium Coffee Consumption

Lockdowns in 2024 entrenched cafe-quality expectations inside the home, pushing specialty coffee retail spend to USD 20.6 billion and spurring upgrades toward precision bean-to-cup units . Younger consumers value sustainability, favor direct-trade beans, and prefer equipment with ceramic grinders and advanced temperature control. Roasters answer with single-origin offerings that require high-performance extraction, enabling manufacturers to justify premium price points. The Europe household coffee machine market benefits from this trading-up trend as margins expand beyond pure unit growth. Producers that master flavor profiling and durable design see heightened brand loyalty across key Western European economies.

Growth of Single-Serve Capsule Systems

Capsule platforms continue to place hardware in homes and lock in recurring pod sales. In Italy, capsules exceed 50% of retail coffee value, with Lavazza's single-serve segment rising 15.3% in 2024. Convenience resonates with urban dual-income households, reinforcing revenue visibility for brands with subscription models. Environmental critique, however, pressures manufacturers toward compostable pods; Wageningen University studies show 100% circularity for correctly composted capsules versus sub-50% for plastic alternatives. Firms that reconcile ease-of-use with end-of-life stewardship will set the pace in the Europe household coffee machine market.

High Upfront Cost of Fully-Automatic Machines

Price differentials above EUR 1,000 between entry-level drip makers and premium super-automatics deter value-conscious buyers, especially in emerging Eastern European markets. Inflationary pressure in 2024-2025 further stretched household budgets, prolonging replacement cycles. Manufacturers counter with financing plans, trade-ins, and machine-plus-coffee subscriptions, yet those tactics compress margins and require sophisticated logistics. Until disposable incomes converge, price sensitivity will cap premium penetration in portions of the European household coffee machine market.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Smart and Connected Appliances Ecosystem

- EU Energy-Efficiency Labeling Driving Replacements

- Environmental Backlash Against Single-Use Capsules

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Drip machines secured 42.74% of Europe household coffee machine market share in 2025, underlining their affordability and batch brewing appeal. Bean-to-cup units, however, will deliver the fastest 8.34% CAGR as consumers bring cafe-quality espresso home. Capsule, manual pour-over, and traditional espresso models maintain niche loyal followings, while smart versions add IoT convenience to existing formats.

Manufacturers pursue precision grinders, dual-boiler heating, and automatic milk texturing to elevate the user experience. Philips' Series 5500, featuring 20 customizable recipes via the HomeID app, typifies the convergence of digital control and artisanal extraction. Collaborative design launches such as Groupe SEB's Krups EVIDENCE by WILMOTTE reinforce premium cues that lift pricing power across the European household coffee machine market.

Europe Household Coffee Machine Market is Segmented by Product Type (Drip or Filter Coffee Machine, Capsule or Pod Coffee Machine, and More), by Distribution Channel ( Multi-Brand Electrical and Appliance Stores, Specialty Coffee and Kitchenware Stores, and More), by Automation Level (Manual and Semi-Automatic, Fully Automatic), by Geography (UK, Germany, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Other Distribution Channels

- Nestle Nespresso SA

- De'Longhi Group

- JDE Peet's N.V.

- Groupe SEB (Krups)

- Philips Domestic Appliances (Saeco)

- Melitta Group

- Lavazza Group

- Illycaffe S.p.A.

- Breville Group Ltd.

- Siemens Home Appliances (BSH)

- Smeg S.p.A.

- Electrolux AB

- WMF GmbH (SEB)

- Miele & Cie. KG

- Gaggia Milano (Cimbali)

- Jura Elektroapparate AG

- Bosch Home Appliances

- Russell Hobbs (Spectrum Brands)

- Sage Appliances

- Beko (Arcelik)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in at-home premium coffee consumption

- 4.2.2 Growth of single-serve capsule systems

- 4.2.3 Expansion of smart and connected appliances ecosystem

- 4.2.4 EU energy-efficiency labelling driving replacements

- 4.2.5 Subscription-linked machine placement by roasters

- 4.3 Market Restraints

- 4.3.1 High upfront cost of fully-automatic machines

- 4.3.2 Environmental backlash against single-use capsules

- 4.3.3 EU Right-to-Repair rules elevating service costs

- 4.3.4 IoT-chip shortages delaying smart launches

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Drip / Filter Coffee Machines

- 5.1.2 Capsule / Pod Coffee Machines

- 5.1.3 Traditional Espresso Machines

- 5.1.4 Bean-to-Cup Coffee Machine

- 5.1.5 Pour-Over and Manual Specialty Machines

- 5.1.6 Smart / Connected Coffee Machines

- 5.2 By Distribution Channel

- 5.2.1 Multi-Brand Electrical and Appliance Stores

- 5.2.2 Specialty Coffee and Kitchenware Stores

- 5.2.3 Online Pure-Play Retailers

- 5.2.4 Direct-to-Consumer Webshops

- 5.2.5 Mass Merchandisers and Hypermarkets

- 5.3 By Automation Level

- 5.3.1 Manual and Semi-Automatic Machines

- 5.3.2 Fully Automatic Machines

- 5.4 By Geography

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Spain

- 5.4.5 Italy

- 5.4.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.4.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.4.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.1.1 Home Centers

- 6.2 Strategic Moves

- 6.2.1 Specialty Furniture Stores

- 6.3 Market Share Analysis

- 6.3.1 Online

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Other Distribution Channels

- 6.4.2 Nestle Nespresso SA

- 6.4.3 De'Longhi Group

- 6.4.4 JDE Peet's N.V.

- 6.4.5 Groupe SEB (Krups)

- 6.4.6 Philips Domestic Appliances (Saeco)

- 6.4.7 Melitta Group

- 6.4.8 Lavazza Group

- 6.4.9 Illycaffe S.p.A.

- 6.4.10 Breville Group Ltd.

- 6.4.11 Siemens Home Appliances (BSH)

- 6.4.12 Smeg S.p.A.

- 6.4.13 Electrolux AB

- 6.4.14 WMF GmbH (SEB)

- 6.4.15 Miele & Cie. KG

- 6.4.16 Gaggia Milano (Cimbali)

- 6.4.17 Jura Elektroapparate AG

- 6.4.18 Bosch Home Appliances

- 6.4.19 Russell Hobbs (Spectrum Brands)

- 6.4.20 Sage Appliances

- 6.4.21 Beko (Arcelik)

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment